As global markets navigate geopolitical tensions and economic uncertainties, investors are keenly observing the shifting tides in various sectors. Penny stocks, often associated with smaller or newer companies, continue to capture attention for their potential to offer growth at accessible price points. Despite being an outdated term, penny stocks remain relevant as they can present unique opportunities when backed by strong financials and solid fundamentals. In this context, we explore three promising penny stocks that stand out for their financial strength and potential for long-term success.

Top 10 Penny Stocks

| Name | Share Price | Market Cap | Financial Health Rating |

| DXN Holdings Bhd (KLSE:DXN) | MYR0.525 | MYR2.61B | ★★★★★★ |

| Bosideng International Holdings (SEHK:3998) | HK$3.88 | HK$44.54B | ★★★★★★ |

| Datasonic Group Berhad (KLSE:DSONIC) | MYR0.305 | MYR848.56M | ★★★★★★ |

| Angler Gaming (NGM:ANGL) | SEK3.94 | SEK307.44M | ★★★★★★ |

| T.A.C. Consumer (SET:TACC) | THB4.16 | THB2.5B | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.95 | £323.15M | ★★★★★★ |

| Hil Industries Berhad (KLSE:HIL) | MYR0.855 | MYR283.81M | ★★★★★★ |

| Foresight Group Holdings (LSE:FSG) | £3.95 | £455.98M | ★★★★★★ |

| Embark Early Education (ASX:EVO) | A$0.79 | A$144.95M | ★★★★☆☆ |

| Next 15 Group (AIM:NFG) | £3.05 | £316.77M | ★★★★☆☆ |

Click here to see the full list of 5,700 stocks from our Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Quanzhou Huixin Micro-credit (SEHK:1577)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Quanzhou Huixin Micro-credit Co., Ltd. is a microfinance company offering short-term financing solutions to entrepreneurs and small to medium-sized enterprises in China, with a market cap of HK$578 million.

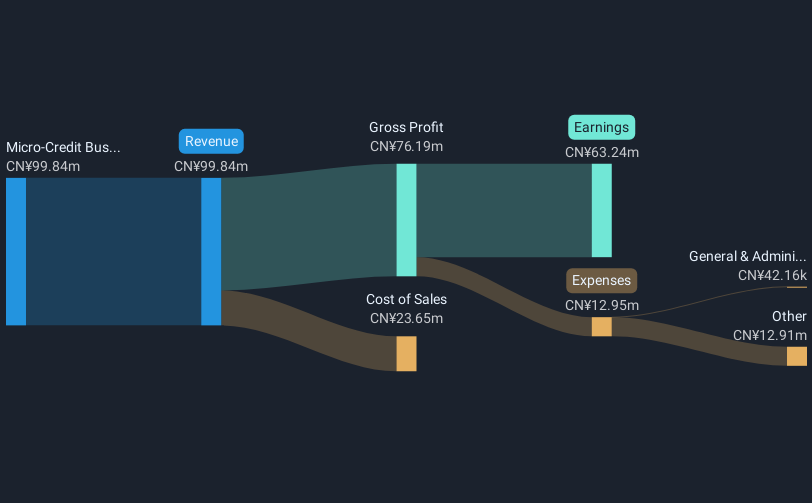

Operations: The company's revenue segment consists solely of its Micro-Credit Business, generating CN¥99.84 million.

Market Cap: HK$578M

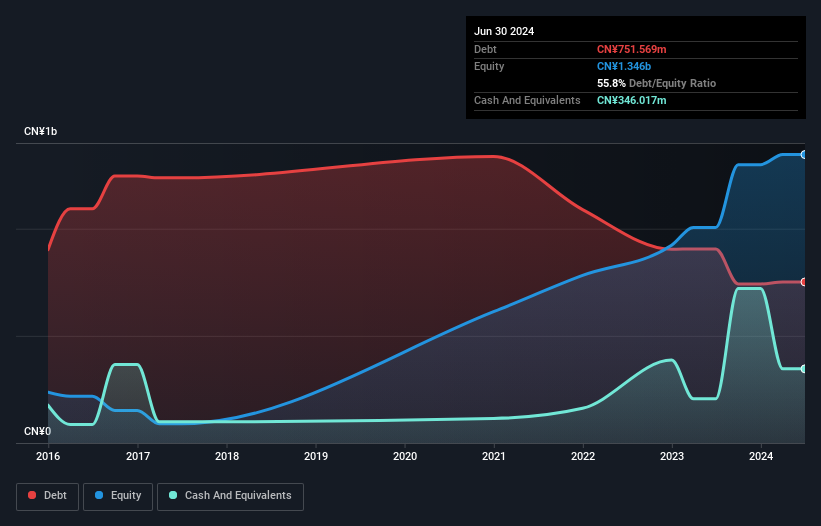

Quanzhou Huixin Micro-credit's financial position is robust, with short-term assets (CN¥1.2 billion) exceeding both its short-term (CN¥47.4 million) and long-term liabilities (CN¥3.9 million). The company has more cash than total debt, and its debt-to-equity ratio has significantly decreased over five years, indicating prudent financial management. Despite a high net profit margin of 63.3%, recent earnings growth is negative, contrasting with a modest 5-year growth rate of 2% annually. The stock trades slightly below estimated fair value but remains highly volatile compared to most Hong Kong stocks, which could affect investor sentiment in the penny stock market segment.

- Click here and access our complete financial health analysis report to understand the dynamics of Quanzhou Huixin Micro-credit.

- Review our historical performance report to gain insights into Quanzhou Huixin Micro-credit's track record.

Wise Living Technology (SEHK:2481)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Wise Living Technology Co., Ltd. offers heat services in the People’s Republic of China and has a market cap of HK$868.61 million.

Operations: The company generates CN¥1.66 billion from its heat supply and related services segment.

Market Cap: HK$868.61M

Wise Living Technology Co., Ltd. has demonstrated stable weekly volatility over the past year and improved its debt-to-equity ratio significantly, now at a satisfactory 30.1%. The company's earnings have grown by 27.7% in the past year, outpacing industry averages and showing accelerated profit growth compared to its five-year trend. However, short-term assets (CN¥1.1 billion) fall short of covering both short-term (CN¥1.5 billion) and long-term liabilities (CN¥2.7 billion), which could pose liquidity challenges despite strong operating cash flow coverage of debt at 65.6%. Recent board changes reflect ongoing corporate governance adjustments amidst evolving business operations in China.

- Jump into the full analysis health report here for a deeper understanding of Wise Living Technology.

- Learn about Wise Living Technology's historical performance here.

Logory Logistics Technology (SEHK:2482)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Logory Logistics Technology Co., Ltd. offers digital freight transportation services and solutions to logistics companies, cargo owners, shippers, and truck drivers in China, with a market cap of HK$1.07 billion.

Operations: The company's revenue is primarily generated from its digital freight businesses and related services, amounting to CN¥6.26 billion.

Market Cap: HK$1.07B

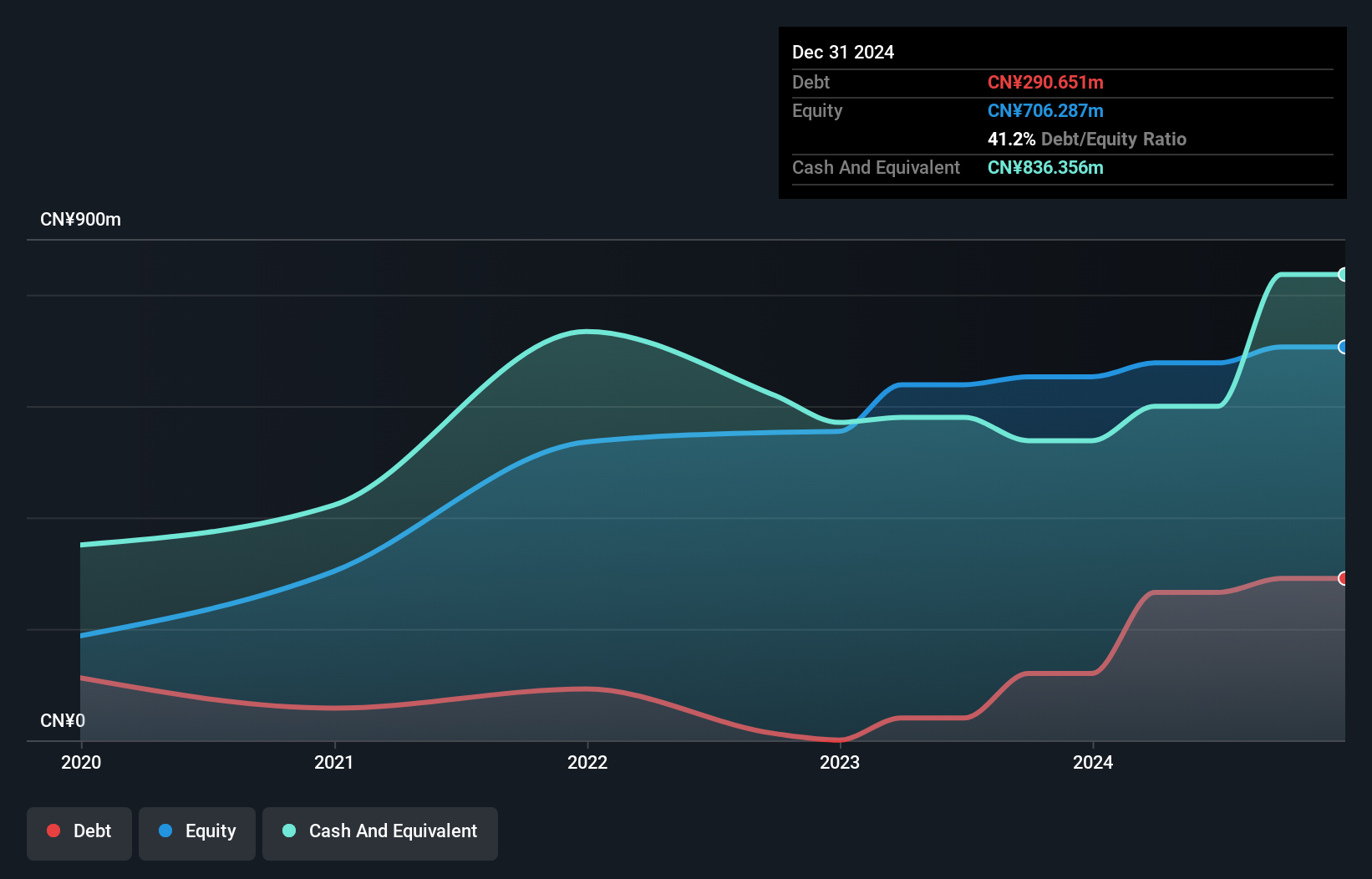

Logory Logistics Technology Co., Ltd. has transitioned to profitability recently, with short-term assets of CN¥2.5 billion exceeding both short-term and long-term liabilities, suggesting a solid liquidity position. The company maintains more cash than total debt, although operating cash flow remains negative, indicating potential challenges in covering debt obligations through operations alone. Despite a low return on equity at 2.7%, interest payments are well covered by EBIT at 9.6 times coverage. Shareholders have not faced significant dilution over the past year, but the stock's high volatility may concern risk-averse investors despite stable weekly fluctuations compared to peers.

- Click to explore a detailed breakdown of our findings in Logory Logistics Technology's financial health report.

- Examine Logory Logistics Technology's past performance report to understand how it has performed in prior years.

Make It Happen

- Discover the full array of 5,700 Penny Stocks right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:2482

Logory Logistics Technology

Provides digital freight transportation services and solutions to logistics companies, cargo owners, other shippers, and truck drivers in China.

Adequate balance sheet with questionable track record.

Market Insights

Community Narratives