- Hong Kong

- /

- Hospitality

- /

- SEHK:880

Strong week for SJM Holdings (HKG:880) shareholders doesn't alleviate pain of five-year loss

SJM Holdings Limited (HKG:880) shareholders will doubtless be very grateful to see the share price up 34% in the last quarter. But that doesn't change the fact that the returns over the last half decade have been disappointing. The share price has failed to impress anyone , down a sizable 65% during that time. So is the recent increase sufficient to restore confidence in the stock? Not yet. We'd err towards caution given the long term under-performance.

Although the past week has been more reassuring for shareholders, they're still in the red over the last five years, so let's see if the underlying business has been responsible for the decline.

Because SJM Holdings made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last half decade, SJM Holdings saw its revenue increase by 25% per year. That's well above most other pre-profit companies. Unfortunately for shareholders the share price has dropped 11% per year - disappointing considering the growth. This could mean high expectations have been tempered, potentially because investors are looking to the bottom line. If you think the company can keep up its revenue growth, you'd have to consider the possibility that there's an opportunity here.

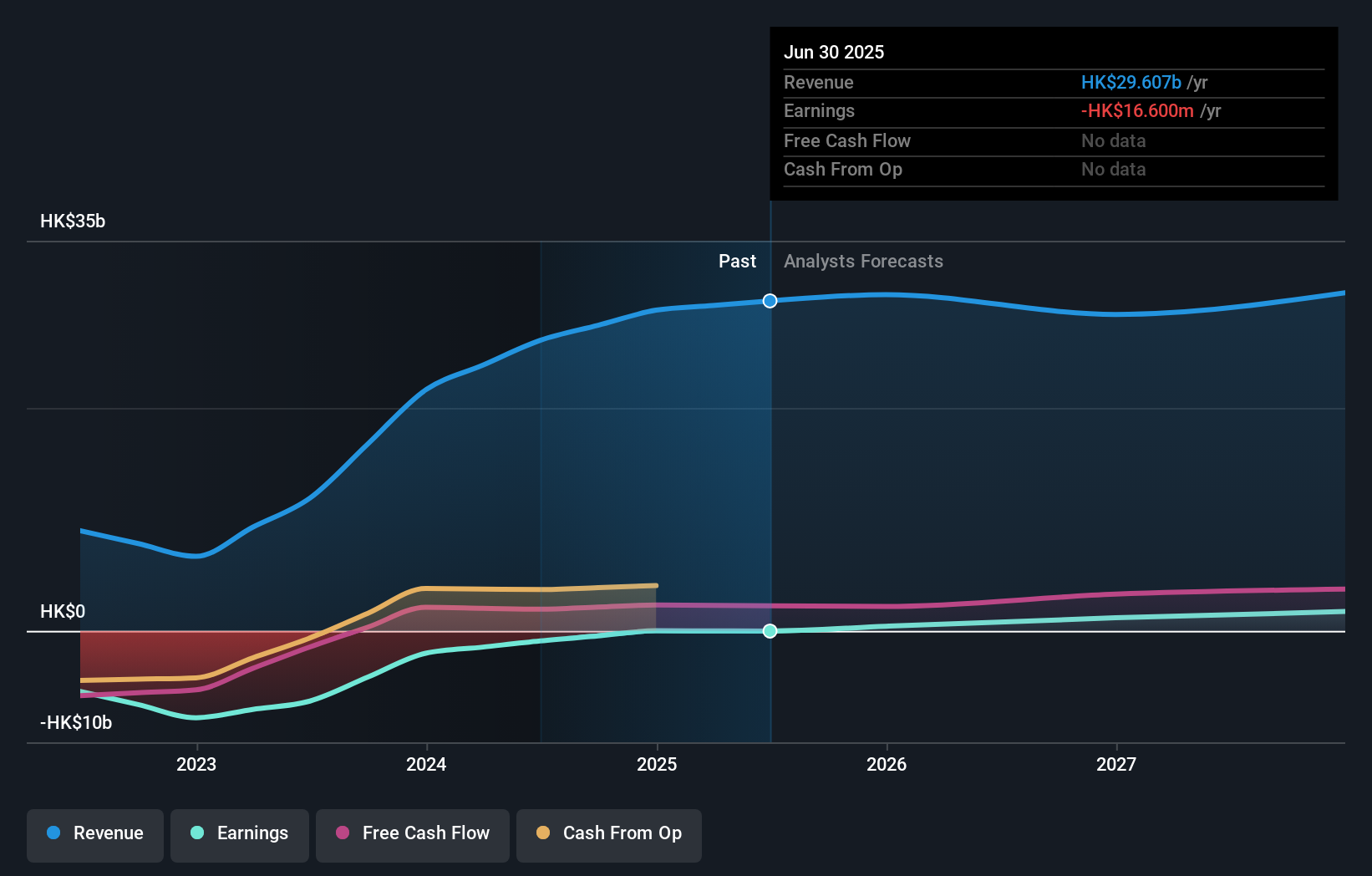

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

SJM Holdings is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So it makes a lot of sense to check out what analysts think SJM Holdings will earn in the future (free analyst consensus estimates)

What About The Total Shareholder Return (TSR)?

We'd be remiss not to mention the difference between SJM Holdings' total shareholder return (TSR) and its share price return. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for SJM Holdings shareholders, and that cash payout explains why its total shareholder loss of 62%, over the last 5 years, isn't as bad as the share price return.

A Different Perspective

SJM Holdings provided a TSR of 27% over the last twelve months. But that return falls short of the market. On the bright side, that's still a gain, and it is certainly better than the yearly loss of about 10% endured over half a decade. So this might be a sign the business has turned its fortunes around. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 1 warning sign with SJM Holdings , and understanding them should be part of your investment process.

Of course SJM Holdings may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Hong Kong exchanges.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:880

SJM Holdings

An investment holding company, owns, develops, and operates casinos and integrated entertainment resorts in Macau.

Undervalued with moderate growth potential.

Similar Companies

Market Insights

Community Narratives