- China

- /

- Basic Materials

- /

- SZSE:002596

3 Promising Asian Penny Stocks With Market Caps Over US$500M

Reviewed by Simply Wall St

Amidst a backdrop of fluctuating global markets, Asian indices have shown resilience, with mainland Chinese stock markets edging higher due to easing U.S.-China trade tensions. For investors willing to explore beyond the well-trodden paths of larger firms, penny stocks—despite their somewhat outdated moniker—remain a compelling area for potential value and growth. This article highlights three such stocks in Asia that stand out for their financial strength and offer promising opportunities for those seeking under-the-radar investments.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.88 | HK$2.34B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.52 | HK$940.15M | ✅ 4 ⚠️ 1 View Analysis > |

| Advice IT Infinite (SET:ADVICE) | THB4.84 | THB3B | ✅ 4 ⚠️ 2 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.57 | HK$2.13B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.16 | SGD470.14M | ✅ 4 ⚠️ 2 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.102 | SGD53.4M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.48 | SGD13.7B | ✅ 5 ⚠️ 1 View Analysis > |

| Anton Oilfield Services Group (SEHK:3337) | HK$1.03 | HK$2.77B | ✅ 4 ⚠️ 1 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.07 | NZ$152.31M | ✅ 2 ⚠️ 5 View Analysis > |

| Rojana Industrial Park (SET:ROJNA) | THB4.38 | THB8.85B | ✅ 3 ⚠️ 3 View Analysis > |

Click here to see the full list of 944 stocks from our Asian Penny Stocks screener.

Let's explore several standout options from the results in the screener.

China Travel International Investment Hong Kong (SEHK:308)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: China Travel International Investment Hong Kong Limited offers travel and tourism services, with a market cap of HK$9.91 billion.

Operations: The company's revenue is primarily derived from Tourist Attraction and Related Operations (HK$2.18 billion), Passenger Transportation Operations (HK$1.07 billion), Hotel Operations (HK$882.15 million), and Travel Document and Related Operations (HK$310.78 million).

Market Cap: HK$9.91B

China Travel International Investment Hong Kong Limited, with a market cap of HK$9.91 billion, faces challenges as it remains unprofitable despite reducing losses over the past five years. The company reported a net loss of HK$86.85 million for H1 2025, reversing from a profit in the previous year. It maintains more cash than total debt and its operating cash flow covers 34.9% of its debt, indicating manageable financial health. Recent board changes and an extraordinary shareholders meeting suggest strategic adjustments are underway amid decreased interim dividends and new financing arrangements with a HKD 500 million revolving loan facility secured in October 2025.

- Navigate through the intricacies of China Travel International Investment Hong Kong with our comprehensive balance sheet health report here.

- Explore China Travel International Investment Hong Kong's analyst forecasts in our growth report.

Hainan RuiZe New Building MaterialLtd (SZSE:002596)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hainan RuiZe New Building Material Co., Ltd operates in China, focusing on the production and sale of commercial concrete and municipal sanitation services, with a market cap of CN¥5.23 billion.

Operations: The company generates revenue of CN¥1.16 billion from its operations within China.

Market Cap: CN¥5.23B

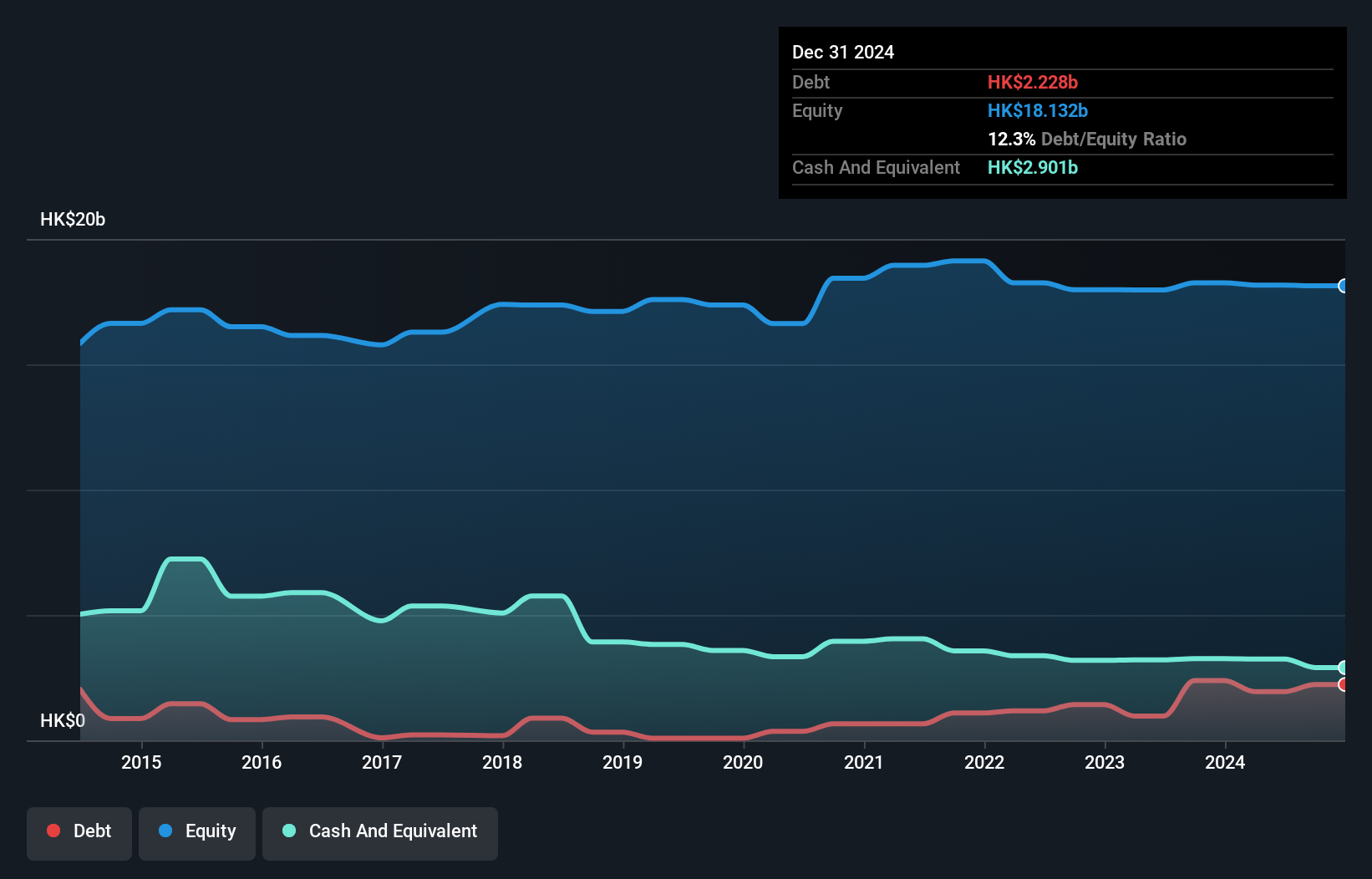

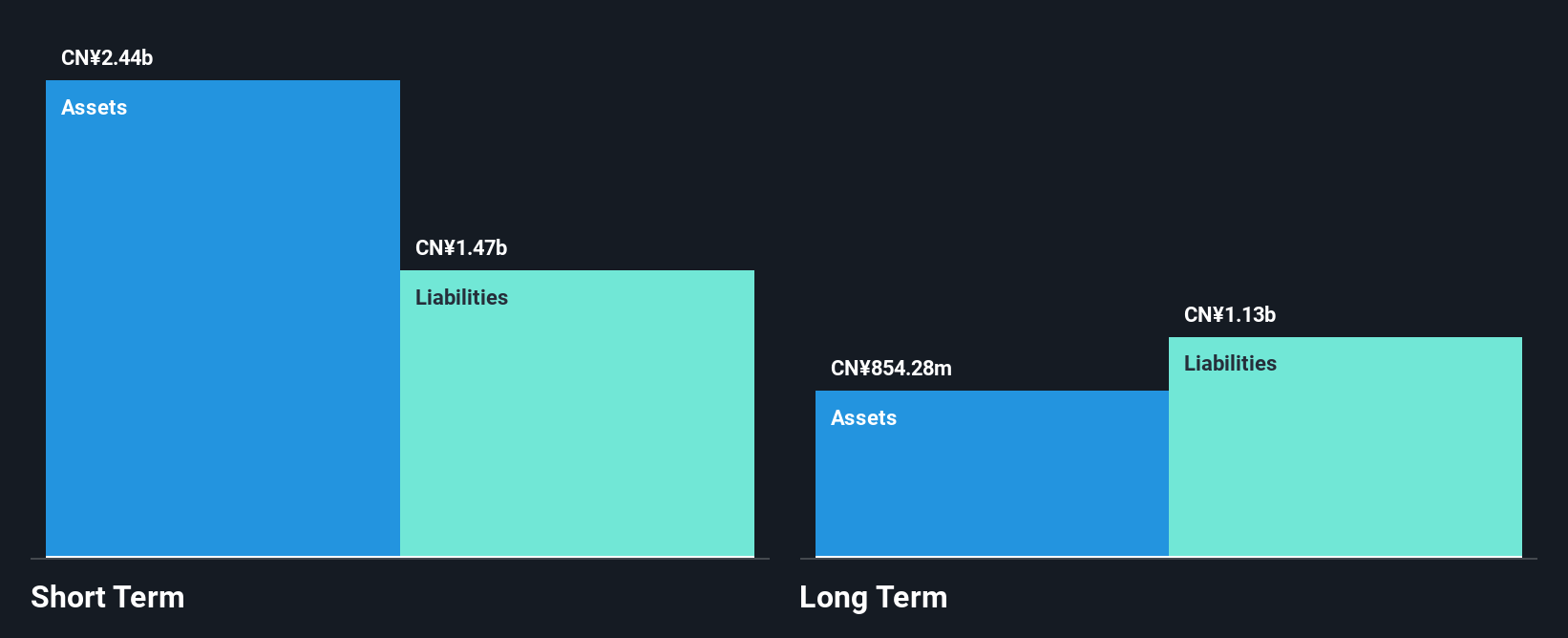

Hainan RuiZe New Building Material Co., Ltd, with a market cap of CN¥5.23 billion, continues to navigate financial challenges as it remains unprofitable. Despite this, the company has managed to reduce its net loss from CN¥87.03 million to CN¥81.2 million over the past year and maintains a positive cash flow sufficient for more than three years if stable. Its short-term assets exceed both short- and long-term liabilities, though its high net debt-to-equity ratio of 193.9% indicates significant leverage concerns. Recent amendments in company bylaws suggest ongoing strategic restructuring efforts amidst declining revenues and earnings performance.

- Click here and access our complete financial health analysis report to understand the dynamics of Hainan RuiZe New Building MaterialLtd.

- Gain insights into Hainan RuiZe New Building MaterialLtd's past trends and performance with our report on the company's historical track record.

Youngy Health (SZSE:300247)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Youngy Health Co., Ltd. is involved in the manufacture, export, and sale of sauna products in China with a market cap of CN¥4.01 billion.

Operations: Youngy Health Co., Ltd. has not reported any specific revenue segments.

Market Cap: CN¥4.01B

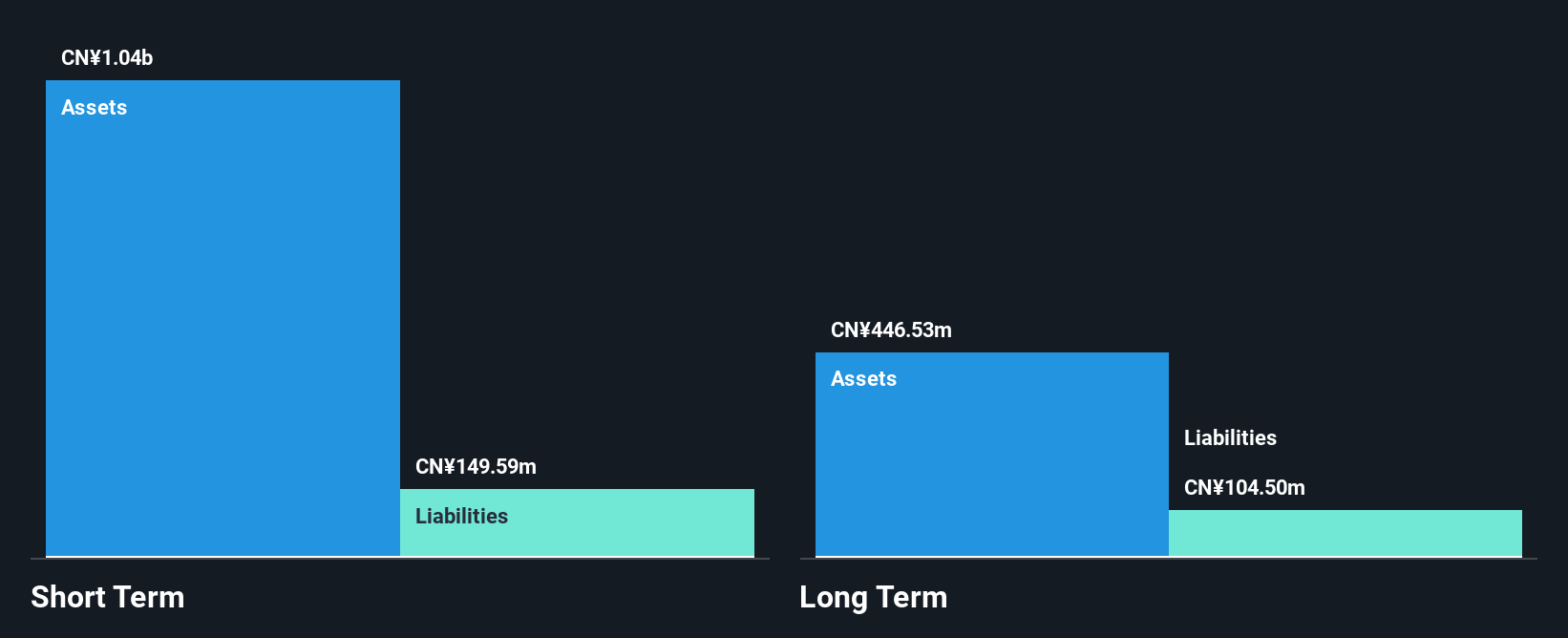

Youngy Health Co., Ltd., with a market cap of CN¥4.01 billion, has demonstrated significant earnings growth, reporting a 106.1% increase over the past year, surpassing its five-year average and industry benchmarks. The company is debt-free and boasts strong short-term asset coverage over liabilities. Recent earnings results for the nine months ended September 2025 show sales increased to CN¥651.9 million from CN¥475.8 million year-on-year, with net income rising to CN¥66.53 million from CN¥36.44 million, reflecting improved profitability and stable financial health despite an inexperienced board of directors averaging 2.9 years in tenure.

- Unlock comprehensive insights into our analysis of Youngy Health stock in this financial health report.

- Learn about Youngy Health's historical performance here.

Make It Happen

- Take a closer look at our Asian Penny Stocks list of 944 companies by clicking here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hainan RuiZe New Building MaterialLtd might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SZSE:002596

Hainan RuiZe New Building MaterialLtd

Engages in the production and sale of commercial concrete and municipal sanitation business in China.

Adequate balance sheet with weak fundamentals.

Market Insights

Community Narratives