- Hong Kong

- /

- Consumer Services

- /

- SEHK:1448

3 Asian Penny Stocks With Market Caps Up To US$4B

Reviewed by Simply Wall St

As global markets show signs of resilience, with U.S. small-cap stocks outperforming their larger counterparts and a rebound in tech shares, investors are increasingly eyeing opportunities beyond traditional market leaders. Penny stocks, though often considered a relic of past market eras, remain relevant due to their potential for growth at accessible price points. In this context, we explore three Asian penny stocks that combine affordability with strong financials, presenting intriguing opportunities for those looking to diversify their investment portfolios.

Top 10 Penny Stocks In Asia

| Name | Share Price | Market Cap | Rewards & Risks |

| JBM (Healthcare) (SEHK:2161) | HK$2.87 | HK$2.35B | ✅ 3 ⚠️ 1 View Analysis > |

| Lever Style (SEHK:1346) | HK$1.53 | HK$946.34M | ✅ 4 ⚠️ 1 View Analysis > |

| TK Group (Holdings) (SEHK:2283) | HK$2.44 | HK$2.02B | ✅ 4 ⚠️ 1 View Analysis > |

| CNMC Goldmine Holdings (Catalist:5TP) | SGD1.11 | SGD449.87M | ✅ 4 ⚠️ 2 View Analysis > |

| T.A.C. Consumer (SET:TACC) | THB4.94 | THB2.96B | ✅ 3 ⚠️ 3 View Analysis > |

| Atlantic Navigation Holdings (Singapore) (Catalist:5UL) | SGD0.098 | SGD51.3M | ✅ 2 ⚠️ 4 View Analysis > |

| Yangzijiang Shipbuilding (Holdings) (SGX:BS6) | SGD3.28 | SGD12.91B | ✅ 5 ⚠️ 1 View Analysis > |

| F & J Prince Holdings (PSE:FJP) | ₱2.20 | ₱859.28M | ✅ 2 ⚠️ 3 View Analysis > |

| Livestock Improvement (NZSE:LIC) | NZ$1.00 | NZ$142.34M | ✅ 2 ⚠️ 5 View Analysis > |

| Lum Chang Holdings (SGX:L19) | SGD0.45 | SGD168.58M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 955 stocks from our Asian Penny Stocks screener.

Let's review some notable picks from our screened stocks.

Fu Shou Yuan International Group (SEHK:1448)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fu Shou Yuan International Group Limited, with a market cap of HK$6.70 billion, operates in the People's Republic of China providing burial and funeral services through its subsidiaries.

Operations: The company's revenue is primarily derived from burial services at CN¥1.28 billion and funeral services at CN¥276.98 million, with additional contributions from other services totaling CN¥37 million.

Market Cap: HK$6.7B

Fu Shou Yuan International Group, with a market cap of HK$6.70 billion, remains unprofitable but is debt-free and has strong short-term asset coverage against liabilities. Recent board appointments may enhance governance with experienced professionals joining the team. The company’s dividend yield of 18.77% is not well-supported by earnings or cash flow, raising sustainability concerns. Analysts expect a 22.3% price increase, although profitability challenges persist as losses have grown by 12% annually over five years. Despite stable volatility and no shareholder dilution recently, its negative return on equity highlights ongoing financial hurdles in the consumer services sector in China.

- Click here and access our complete financial health analysis report to understand the dynamics of Fu Shou Yuan International Group.

- Evaluate Fu Shou Yuan International Group's prospects by accessing our earnings growth report.

Xinyi Solar Holdings (SEHK:968)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Xinyi Solar Holdings Limited is an investment holding company that produces, sells, and trades solar glass products across Mainland China, Asia, North America, Europe, and other international markets with a market cap of HK$29.36 billion.

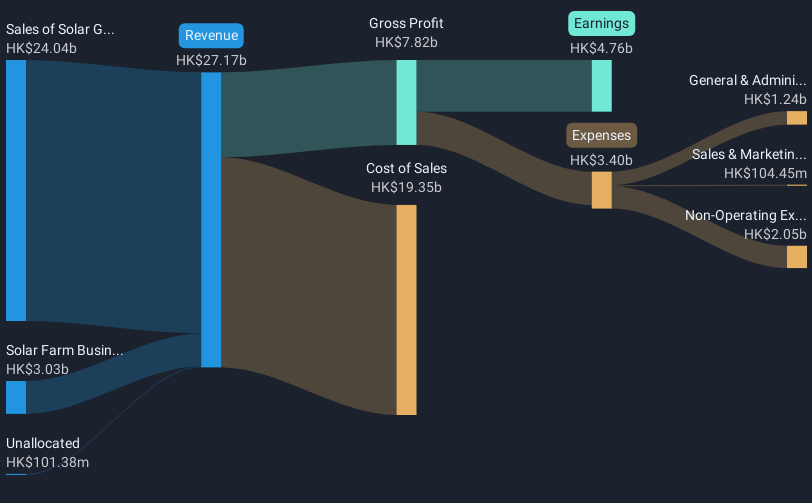

Operations: The company generates revenue primarily from the sale of solar glass, amounting to CN¥18.07 billion, and its solar farm business, including EPC services, which contributes CN¥3.03 billion.

Market Cap: HK$29.36B

Xinyi Solar Holdings, with a market cap of HK$29.36 billion, is unprofitable and faces challenges in the semiconductor industry. Despite this, its financial structure shows resilience with short-term assets of CN¥20 billion exceeding both short-term (CN¥15.3 billion) and long-term liabilities (CN¥7.9 billion). The company's debt-to-equity ratio has improved over five years to 37.2%, indicating prudent financial management, although operating cash flow covers only 12.6% of its debt—less than ideal for comfort levels. While earnings are forecasted to grow significantly at 56.74% annually, past losses have increased by 15.5% per year over five years.

- Click here to discover the nuances of Xinyi Solar Holdings with our detailed analytical financial health report.

- Review our growth performance report to gain insights into Xinyi Solar Holdings' future.

Hunan Mendale HometextileLtd (SZSE:002397)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Hunan Mendale Hometextile Co., Ltd operates in the home textile industry both within China and internationally, with a market capitalization of CN¥3.27 billion.

Operations: The company reported a revenue of -CN¥95.26 million from its textile segment.

Market Cap: CN¥3.27B

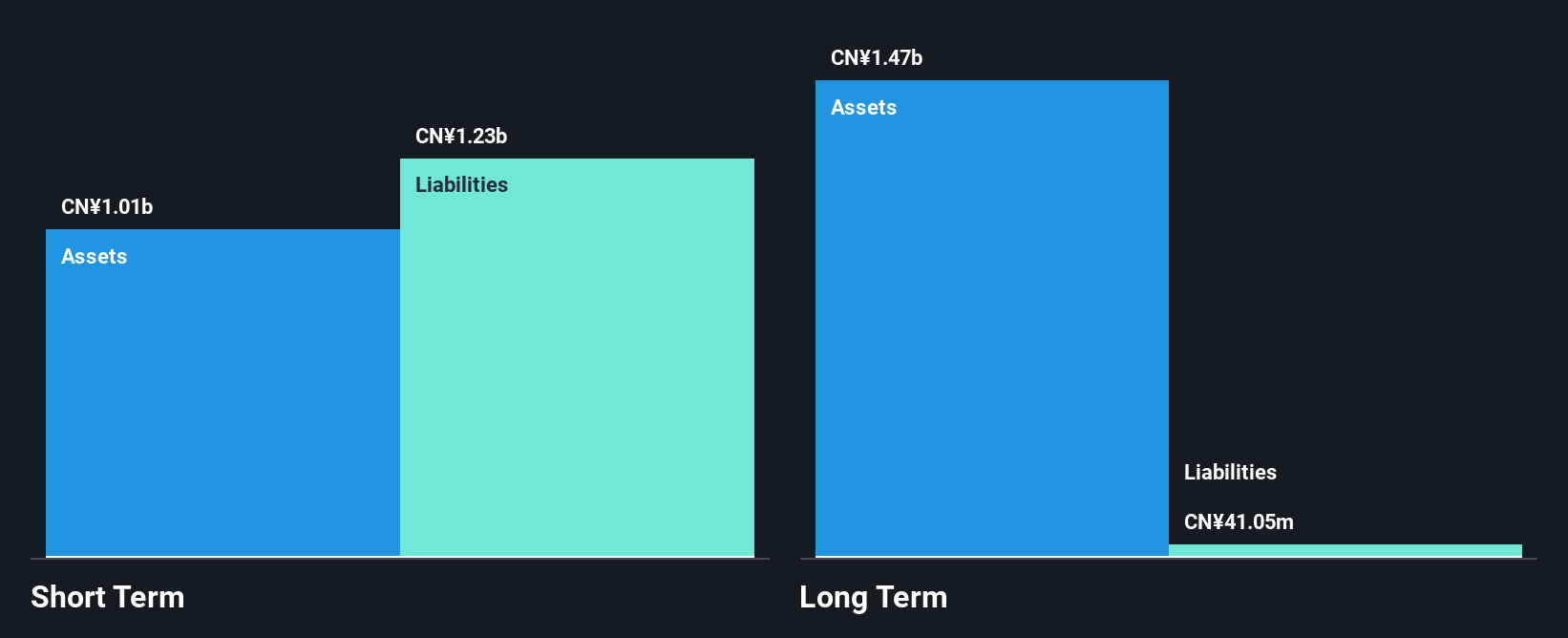

Hunan Mendale Hometextile Co., Ltd, with a market cap of CN¥3.27 billion, has shown significant earnings growth of 161.8% over the past year, surpassing the luxury industry's performance. Despite this growth, its short-term assets (CN¥1 billion) fall short of covering its short-term liabilities (CN¥1.2 billion). The company's net profit margin improved to 1.9%, aided by a one-off gain of CN¥11.6 million. Recent changes in company bylaws and registered capital were approved at an extraordinary general meeting on November 18, 2025, signaling potential strategic shifts as it navigates financial challenges and opportunities in the home textile sector.

- Navigate through the intricacies of Hunan Mendale HometextileLtd with our comprehensive balance sheet health report here.

- Assess Hunan Mendale HometextileLtd's previous results with our detailed historical performance reports.

Turning Ideas Into Actions

- Access the full spectrum of 955 Asian Penny Stocks by clicking on this link.

- Ready For A Different Approach? These 12 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1448

Fu Shou Yuan International Group

Provides burial and funeral services in the People’s Republic of China.

Flawless balance sheet with reasonable growth potential.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026