- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:6808

Should Sun Art Retail Group’s (SEHK:6808) CEO Succession to Li Weiping Spark Investor Reassessment?

Reviewed by Sasha Jovanovic

- Sun Art Retail Group recently announced the resignation of CEO Shen Hui, effective December 1, 2025, with industry veteran Li Weiping appointed as his successor.

- Li Weiping brings over 20 years of retail management experience at major players like Freshippo and Lotte Supermarket, reflecting a clear focus on leadership continuity and sector expertise.

- We’ll explore how Li Weiping’s appointment and her extensive background in retail influence Sun Art’s overall investment appeal.

These 11 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

What Is Sun Art Retail Group's Investment Narrative?

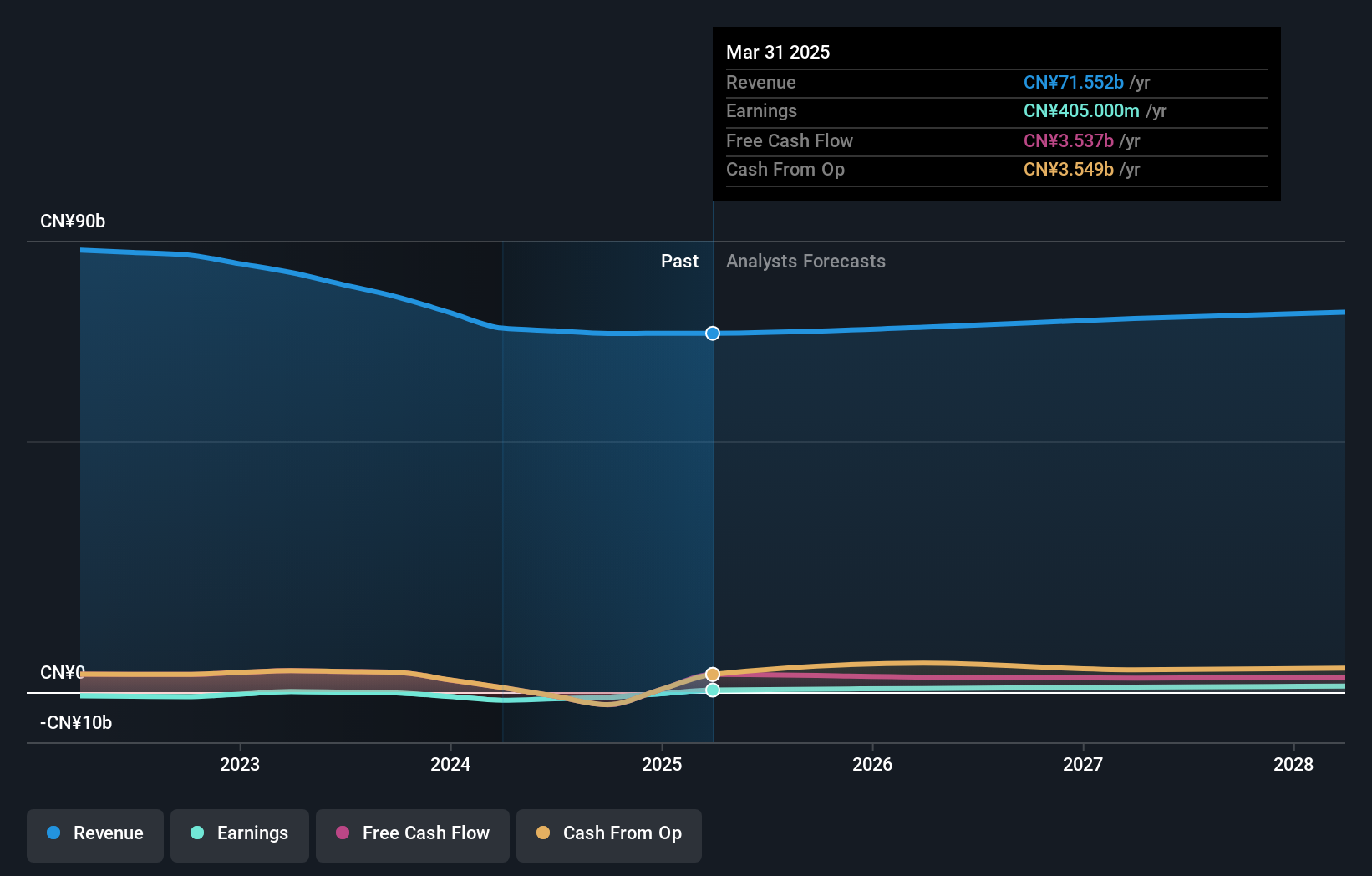

To be a shareholder in Sun Art Retail Group right now, you’d need to believe in the company’s ability to turn around operational weakness in a fiercely competitive, low-margin sector. Recent CEO succession is the big short-term story, as Li Weiping’s appointment comes right after a challenging half-year, net loss, shrinking sales, and suspended dividends have weighed on sentiment. Markets welcomed her arrival, with the share price opening higher as investors saw promise in her extensive retail background. Still, this leadership change doesn’t fundamentally alter the key near-term catalysts: restoring profitability and reviving growth amid rising competition and sluggish consumer demand. The risks remain familiar, but now hinge on whether new management can accelerate turnaround initiatives fast enough, especially given earlier analyst forecasts and lagging returns. The recent CEO transition fits into a series of broader leadership changes, but its immediate impact on the fundamental risks and catalysts appears modest for now. On the flip side, board experience remains limited and may signal growing pains ahead.

Despite retreating, Sun Art Retail Group's shares might still be trading above their fair value and there could be some more downside. Discover how much.Exploring Other Perspectives

Explore another fair value estimate on Sun Art Retail Group - why the stock might be worth just HK$2.07!

Build Your Own Sun Art Retail Group Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Sun Art Retail Group research is our analysis highlighting 4 key rewards and 2 important warning signs that could impact your investment decision.

- Our free Sun Art Retail Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Sun Art Retail Group's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 25 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6808

Sun Art Retail Group

An investment holding company, operates brick-and-mortar stores and online sales channels in the People’s Republic of China.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026