- Hong Kong

- /

- Food and Staples Retail

- /

- SEHK:1797

East Buy Holding (SEHK:1797): Evaluating Valuation After Strategic Cash Deployment with Leading Chinese Banks

Reviewed by Simply Wall St

East Buy Holding (SEHK:1797) recently made headlines by subscribing to wealth management products from China Guangfa Bank and China Merchants Bank. This move highlights their strategic approach to managing surplus cash.

See our latest analysis for East Buy Holding.

Momentum has cooled for East Buy Holding, with a 1-month share price return of -12.62% and a steep 3-month decline. This comes even as investor interest in undervalued Asian stocks grows. Still, shareholders have seen a stellar 1-year total return of nearly 39%, which sets a positive long-term tone despite recent volatility.

If you’re keen to discover other compelling opportunities, now’s an ideal time to broaden your search and explore fast growing stocks with high insider ownership.

With East Buy Holding reportedly trading well below its fair value, investors are left to wonder if this is an overlooked opportunity for long-term growth or if the market has already accounted for everything ahead.

Price-to-Sales Ratio of 4.4x: Is it justified?

East Buy Holding is currently trading at a price-to-sales (P/S) ratio of 4.4x, which stands out compared to its industry peers and market benchmarks.

The price-to-sales ratio compares a company’s market capitalization to its revenue. In the consumer retailing sector, this multiple is often used when earnings are volatile or temporarily depressed. It offers insight into how much investors are willing to pay for each dollar of sales. A higher P/S ratio suggests investors expect future sales growth or improved profitability; however, it could also indicate the stock is overvalued.

Compared to competitors, East Buy Holding’s P/S ratio greatly exceeds the Hong Kong Consumer Retailing industry average of 0.6x and the peer average of 0.9x. Even when measured against the estimated fair P/S ratio of 1.5x, the current valuation appears stretched. This suggests the market may have built in aggressive growth expectations that could be challenging to meet.

Explore the SWS fair ratio for East Buy Holding

Result: Price-to-Sales Ratio of 4.4x (OVERVALUED)

However, slowing revenue growth, along with the stock’s high discount to analyst targets, could signal potential headwinds for East Buy Holding in the near term.

Find out about the key risks to this East Buy Holding narrative.

Another View: What Does the SWS DCF Model Say?

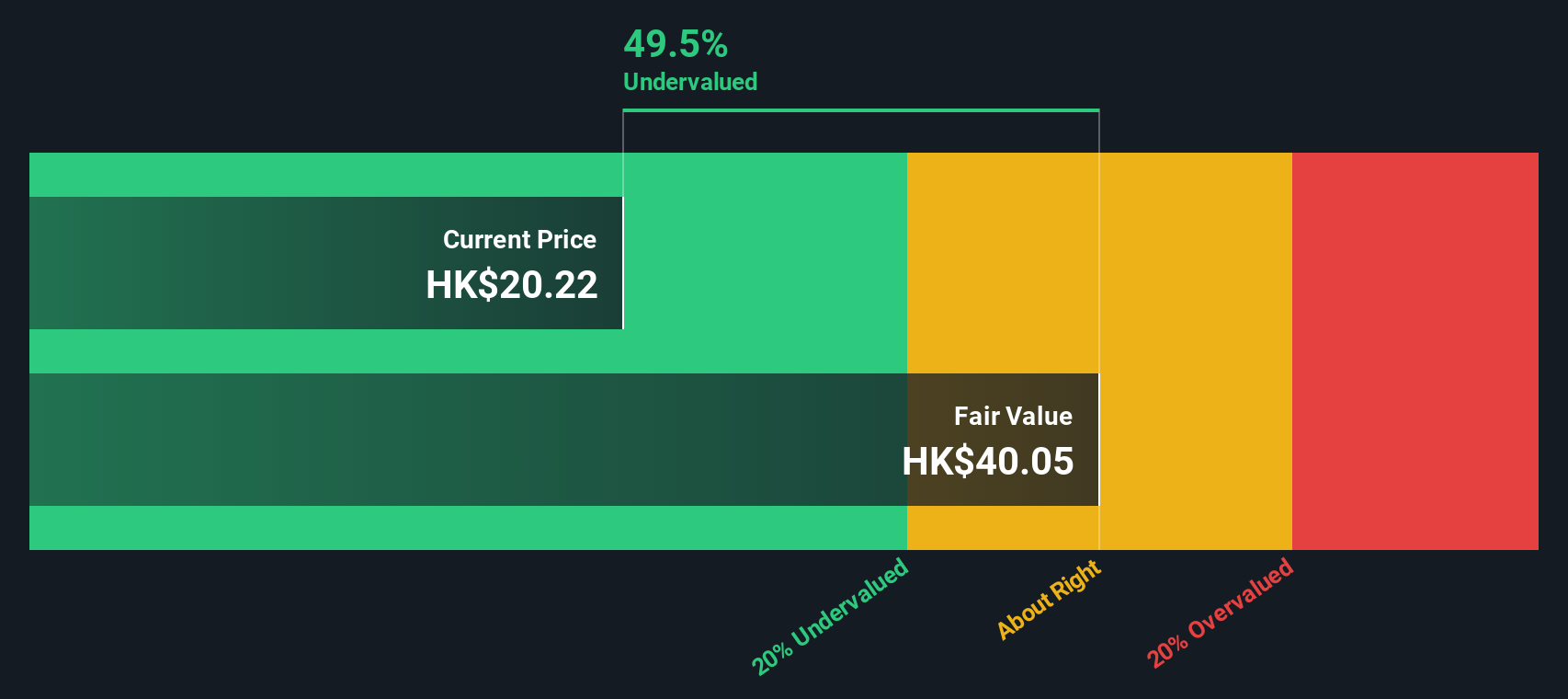

While the price-to-sales ratio suggests East Buy Holding could be overvalued, our DCF model paints a different picture. According to our DCF analysis, the stock is currently trading nearly 50% below its estimated fair value. This signals an undervalued opportunity. However, does the market agree with this long-term projection, or are further risks lurking?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out East Buy Holding for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 875 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own East Buy Holding Narrative

If you have a different perspective or prefer hands-on analysis, you can quickly assemble your own view in just a few minutes. Do it your way.

A great starting point for your East Buy Holding research is our analysis highlighting 2 key rewards and 3 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Smart investors know that the best opportunities don’t wait. Get ahead by using the Simply Wall Street Screener to uncover companies with game-changing potential and strong fundamentals today.

- Unlock the world of strong payouts by checking out these 15 dividend stocks with yields > 3%, which consistently deliver yields greater than 3%.

- Spot the frontier of tomorrow’s healthcare revolution with these 31 healthcare AI stocks, leveraging artificial intelligence to transform medical outcomes.

- Catch early-stage growth with these 3588 penny stocks with strong financials, which combine solid financials and exceptional market upside.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if East Buy Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1797

East Buy Holding

An investment holding company, engages in the livestreaming e-commerce business for sale of private label products in the People's Republic of China.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives