Why Laopu Gold (SEHK:6181) Is Up 7.2% After HSBC Endorses Its Growing Luxury Market Share

Reviewed by Sasha Jovanovic

- Earlier this week, HSBC initiated coverage on Laopu Gold with a Buy rating, recognizing the company's emergence as a competitive force in the Chinese luxury market.

- An interesting aspect is Laopu Gold’s estimated 16% market share in mainland China’s high-end jewelry segment for 2024, reflecting rapid expansion against major international rivals.

- We’ll examine how Laopu Gold’s boutique exclusivity and growing market share shape its investment narrative amid increasing industry competition.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Laopu Gold's Investment Narrative?

To be a shareholder in Laopu Gold, you have to believe the brand can continue to capture attention and demand in China’s increasingly crowded luxury jewelry market. The recent HSBC initiation and the stock’s very large move since IPO have put a spotlight on Laopu as a rising challenger, both amplifying visibility and likely intensifying scrutiny in the short term. With strong recent earnings, index inclusion, and a semi-annual dividend policy proposal, the business has solid near-term catalysts. However, after such a significant price run-up and given a higher-than-average price-to-earnings ratio, investor expectations now look highly ambitious. The biggest risks, which may be magnified by the publicity, include the potential for market share gains to stall, intense competition, and the ongoing need to justify premium valuation levels now that much optimism appears reflected in the price. HSBC’s coverage recognition enhances the investment narrative, but it also raises the bar for ongoing performance.

On the flip side, keep in mind that rising competition could pressure margins and future growth.

Exploring Other Perspectives

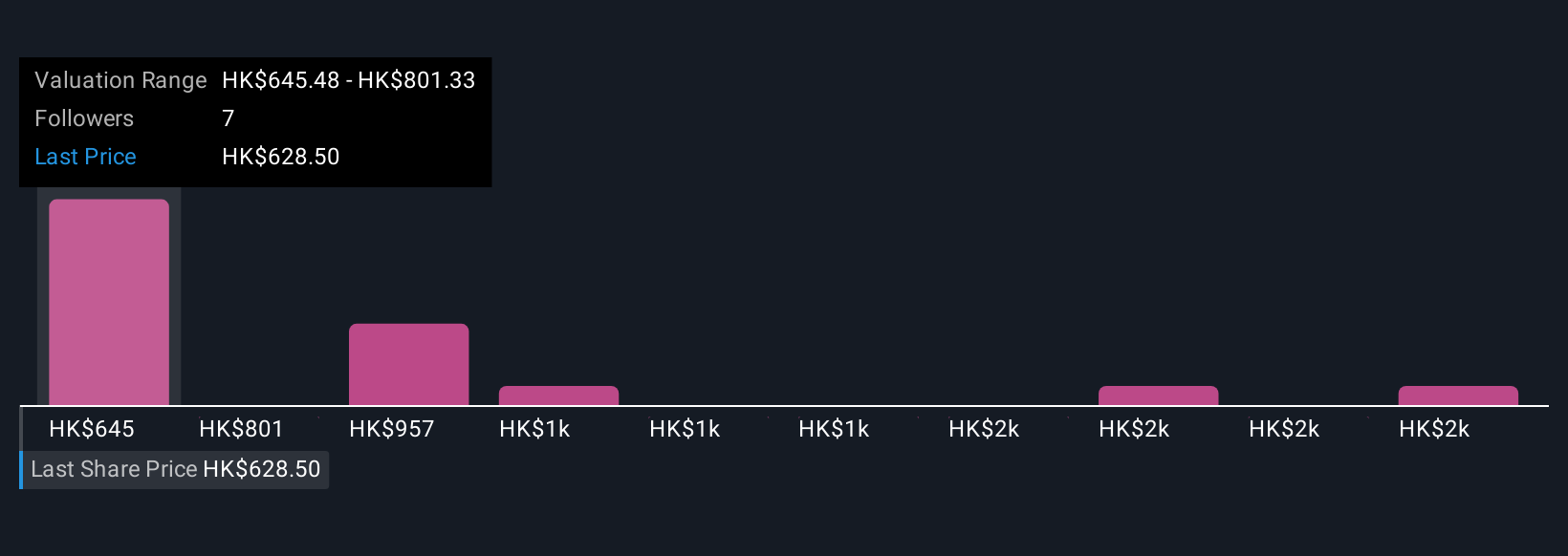

Explore 5 other fair value estimates on Laopu Gold - why the stock might be worth over 3x more than the current price!

Build Your Own Laopu Gold Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Laopu Gold research is our analysis highlighting 3 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Laopu Gold research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Laopu Gold's overall financial health at a glance.

Interested In Other Possibilities?

These stocks are moving-our analysis flagged them today. Act fast before the price catches up:

- Find companies with promising cash flow potential yet trading below their fair value.

- These 15 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- AI is about to change healthcare. These 31 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:6181

Laopu Gold

Designs, manufactures, and sells jewelry products in Mainland China, Hong Kong, and Macau.

Exceptional growth potential with solid track record.

Market Insights

Community Narratives