- Hong Kong

- /

- Construction

- /

- SEHK:750

China Shuifa Singyes Energy Holdings (HKG:750) Has No Shortage Of Debt

The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We can see that China Shuifa Singyes Energy Holdings Limited (HKG:750) does use debt in its business. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt and other liabilities become risky for a business when it cannot easily fulfill those obligations, either with free cash flow or by raising capital at an attractive price. Ultimately, if the company can't fulfill its legal obligations to repay debt, shareholders could walk away with nothing. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. The first step when considering a company's debt levels is to consider its cash and debt together.

What Is China Shuifa Singyes Energy Holdings's Debt?

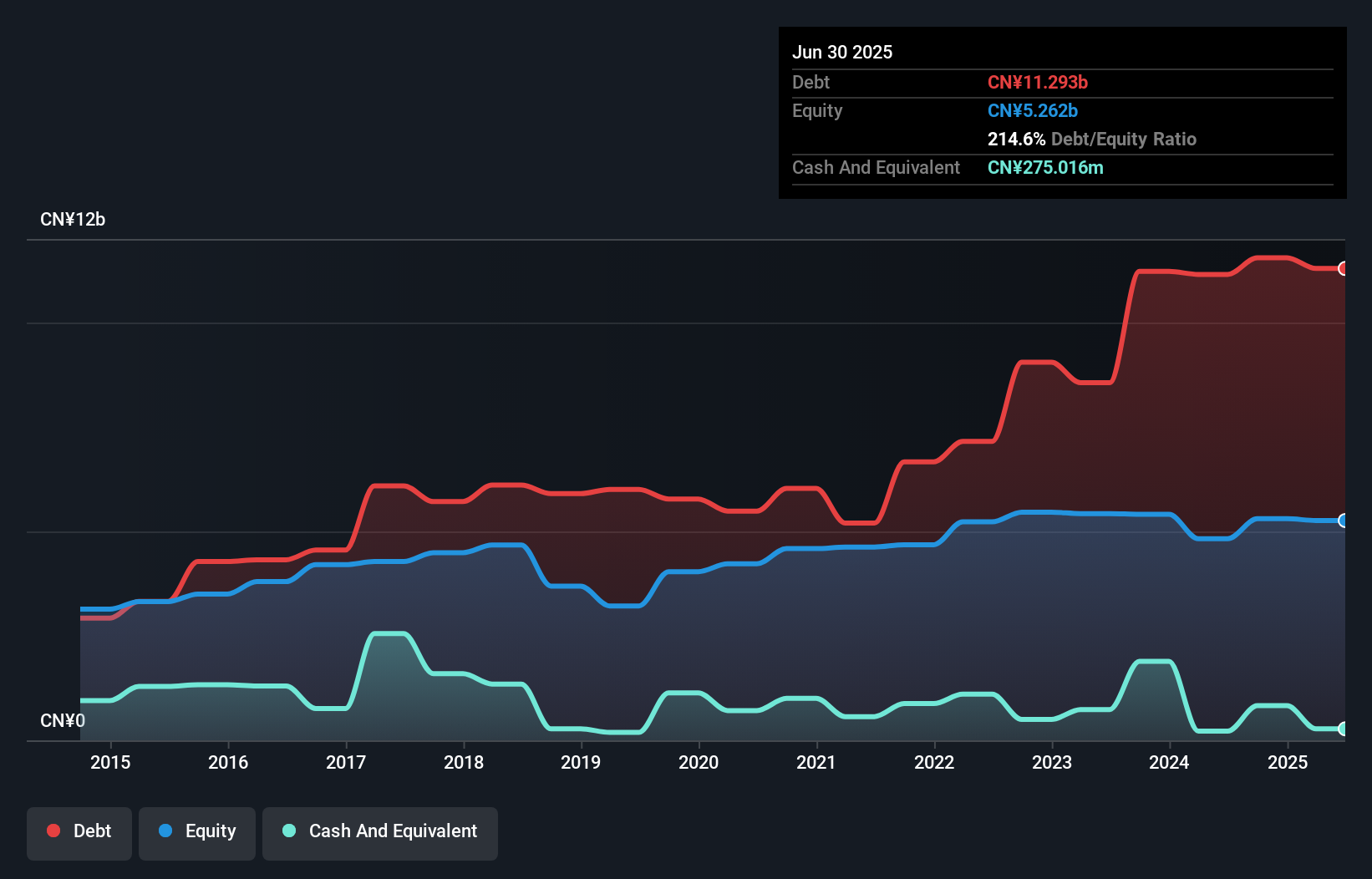

The chart below, which you can click on for greater detail, shows that China Shuifa Singyes Energy Holdings had CN¥11.3b in debt in June 2025; about the same as the year before. However, it does have CN¥275.0m in cash offsetting this, leading to net debt of about CN¥11.0b.

A Look At China Shuifa Singyes Energy Holdings' Liabilities

The latest balance sheet data shows that China Shuifa Singyes Energy Holdings had liabilities of CN¥11.7b due within a year, and liabilities of CN¥5.49b falling due after that. Offsetting these obligations, it had cash of CN¥275.0m as well as receivables valued at CN¥12.4b due within 12 months. So it has liabilities totalling CN¥4.55b more than its cash and near-term receivables, combined.

This deficit casts a shadow over the CN¥715.0m company, like a colossus towering over mere mortals. So we'd watch its balance sheet closely, without a doubt. At the end of the day, China Shuifa Singyes Energy Holdings would probably need a major re-capitalization if its creditors were to demand repayment.

Check out our latest analysis for China Shuifa Singyes Energy Holdings

We use two main ratios to inform us about debt levels relative to earnings. The first is net debt divided by earnings before interest, tax, depreciation, and amortization (EBITDA), while the second is how many times its earnings before interest and tax (EBIT) covers its interest expense (or its interest cover, for short). This way, we consider both the absolute quantum of the debt, as well as the interest rates paid on it.

Weak interest cover of 1.0 times and a disturbingly high net debt to EBITDA ratio of 15.0 hit our confidence in China Shuifa Singyes Energy Holdings like a one-two punch to the gut. The debt burden here is substantial. Even more troubling is the fact that China Shuifa Singyes Energy Holdings actually let its EBIT decrease by 9.4% over the last year. If that earnings trend continues the company will face an uphill battle to pay off its debt. When analysing debt levels, the balance sheet is the obvious place to start. But you can't view debt in total isolation; since China Shuifa Singyes Energy Holdings will need earnings to service that debt. So when considering debt, it's definitely worth looking at the earnings trend. Click here for an interactive snapshot.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. So we always check how much of that EBIT is translated into free cash flow. During the last three years, China Shuifa Singyes Energy Holdings burned a lot of cash. While that may be a result of expenditure for growth, it does make the debt far more risky.

Our View

To be frank both China Shuifa Singyes Energy Holdings's conversion of EBIT to free cash flow and its track record of staying on top of its total liabilities make us rather uncomfortable with its debt levels. And even its net debt to EBITDA fails to inspire much confidence. Considering all the factors previously mentioned, we think that China Shuifa Singyes Energy Holdings really is carrying too much debt. To our minds, that means the stock is rather high risk, and probably one to avoid; but to each their own (investing) style. There's no doubt that we learn most about debt from the balance sheet. But ultimately, every company can contain risks that exist outside of the balance sheet. For instance, we've identified 2 warning signs for China Shuifa Singyes Energy Holdings that you should be aware of.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:750

China Shuifa Singyes Energy Holdings

An investment holding company, designs, manufactures, supplies, and installs conventional curtain walls in the People’s Republic of China.

Good value with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026