Why We're Not Concerned Yet About L.K. Technology Holdings Limited's (HKG:558) 26% Share Price Plunge

The L.K. Technology Holdings Limited (HKG:558) share price has softened a substantial 26% over the previous 30 days, handing back much of the gains the stock has made lately. Longer-term shareholders will rue the drop in the share price, since it's now virtually flat for the year after a promising few quarters.

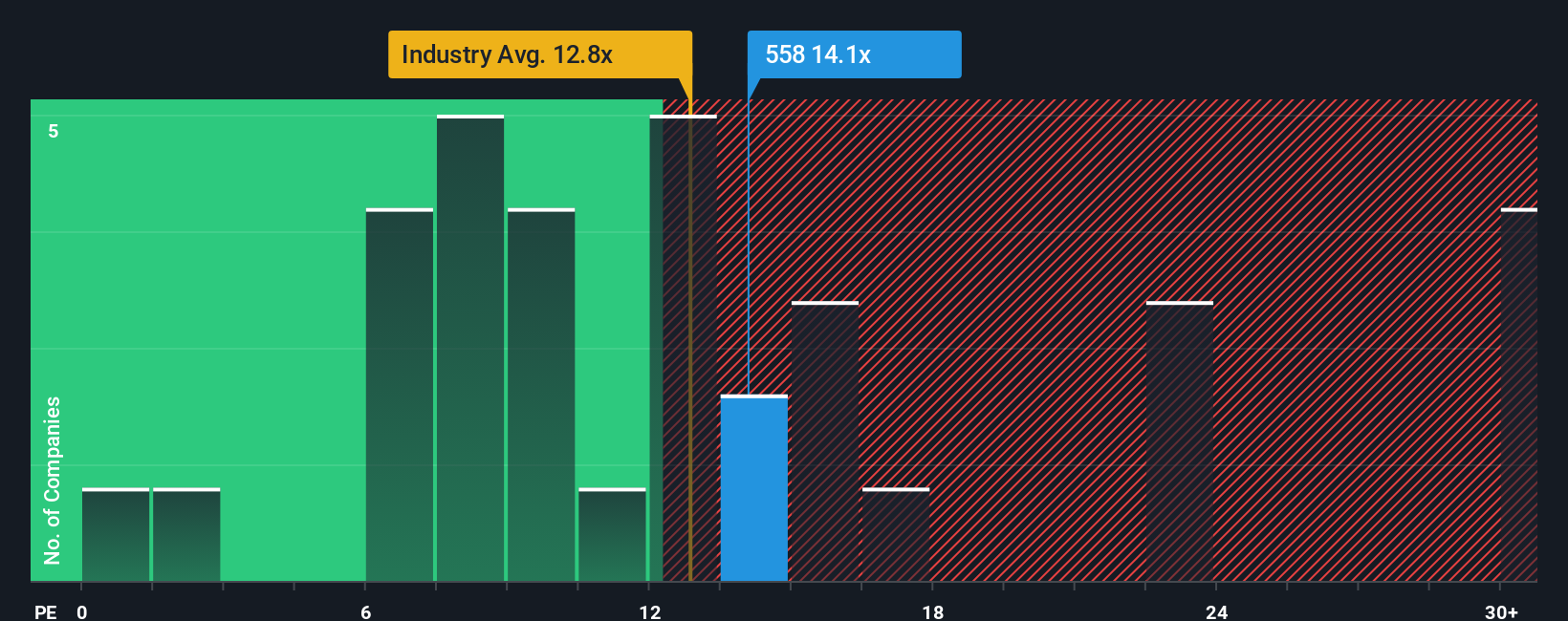

Although its price has dipped substantially, it's still not a stretch to say that L.K. Technology Holdings' price-to-earnings (or "P/E") ratio of 14.1x right now seems quite "middle-of-the-road" compared to the market in Hong Kong, where the median P/E ratio is around 13x. Although, it's not wise to simply ignore the P/E without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

While the market has experienced earnings growth lately, L.K. Technology Holdings' earnings have gone into reverse gear, which is not great. It might be that many expect the dour earnings performance to strengthen positively, which has kept the P/E from falling. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

View our latest analysis for L.K. Technology Holdings

Is There Some Growth For L.K. Technology Holdings?

The only time you'd be comfortable seeing a P/E like L.K. Technology Holdings' is when the company's growth is tracking the market closely.

If we review the last year of earnings, dishearteningly the company's profits fell to the tune of 27%. As a result, earnings from three years ago have also fallen 44% overall. So unfortunately, we have to acknowledge that the company has not done a great job of growing earnings over that time.

Looking ahead now, EPS is anticipated to climb by 15% each year during the coming three years according to the five analysts following the company. That's shaping up to be similar to the 15% per year growth forecast for the broader market.

With this information, we can see why L.K. Technology Holdings is trading at a fairly similar P/E to the market. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Bottom Line On L.K. Technology Holdings' P/E

Following L.K. Technology Holdings' share price tumble, its P/E is now hanging on to the median market P/E. Using the price-to-earnings ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

We've established that L.K. Technology Holdings maintains its moderate P/E off the back of its forecast growth being in line with the wider market, as expected. At this stage investors feel the potential for an improvement or deterioration in earnings isn't great enough to justify a high or low P/E ratio. It's hard to see the share price moving strongly in either direction in the near future under these circumstances.

You always need to take note of risks, for example - L.K. Technology Holdings has 2 warning signs we think you should be aware of.

Of course, you might also be able to find a better stock than L.K. Technology Holdings. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About SEHK:558

L.K. Technology Holdings

An investment holding company, designs, manufactures, and sells machines, machining centres, and related accessories in Mainland China, Europe, North America, Central America, South America, and internationally.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives