First Tractor (SEHK:38) Margin Decline Challenges Bullish Growth Narrative Despite Forecast-Beating Outlook

Reviewed by Simply Wall St

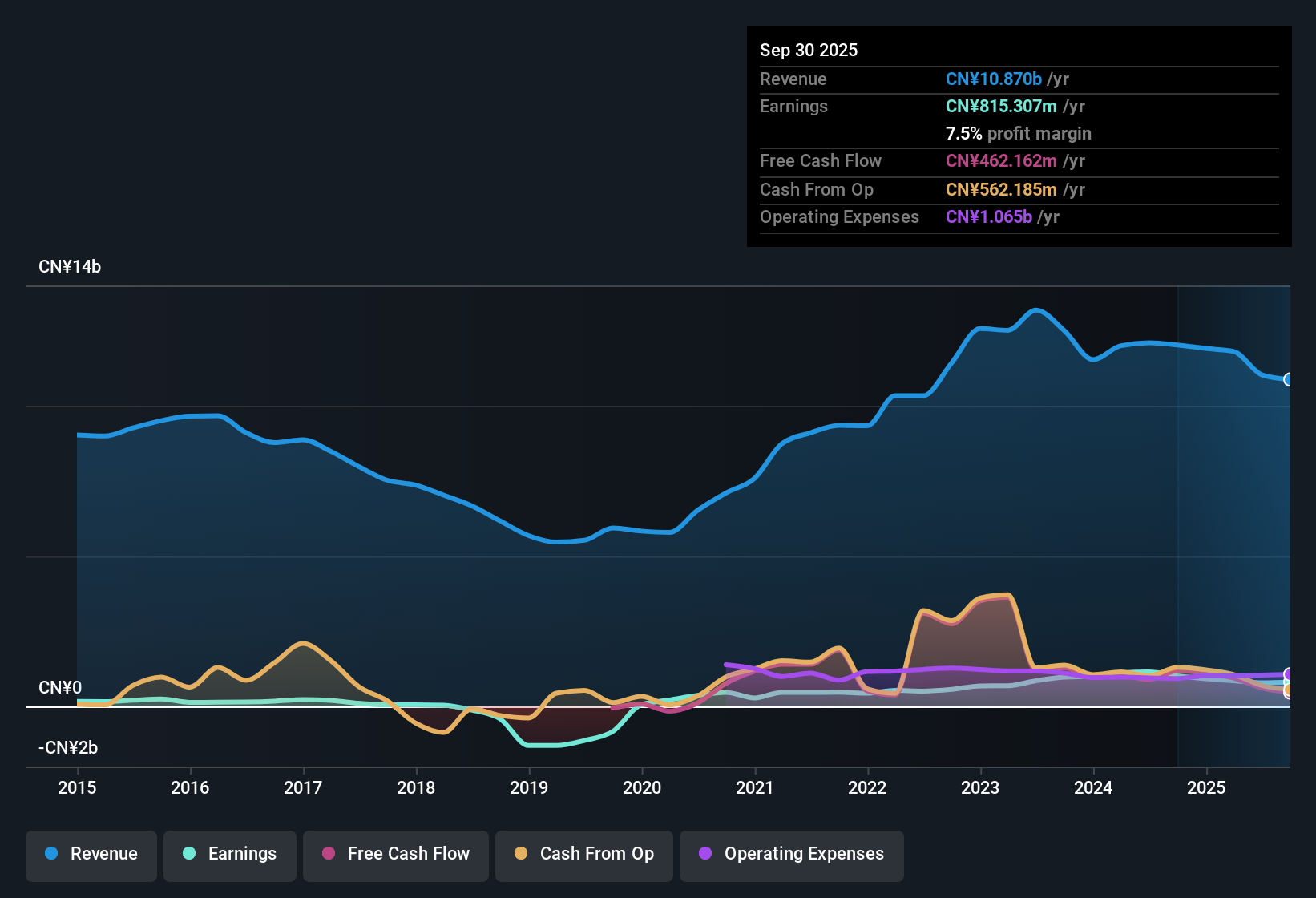

First Tractor (SEHK:38) is expecting earnings to grow 17.6% per year, with revenue projected to expand by 9% annually. Both are outpacing Hong Kong market averages of 12.3% for earnings and 8.6% for revenue. The company’s net profit margin, however, has slipped from 8.4% last year to 7.5%, even as five-year earnings growth averaged a robust 18.7% per year. Despite these longer-term gains, the most recent period saw negative earnings growth, giving investors a mixed short-term view while focusing attention on margin pressure and future prospects.

See our full analysis for First Tractor.The next section breaks down how these numbers stack up against the leading narratives that investors and the Simply Wall St community are following. This reveals which ideas hold up and where expectations may need to shift.

Curious how numbers become stories that shape markets? Explore Community Narratives

Profit Margin Compression Takes Center Stage

- Net profit margin fell from 8.4% to 7.5%, signaling that First Tractor's ability to turn sales into profit is facing headwinds even as overall growth remains healthy.

- What sets the latest margin trend apart is that, while the prevailing market view highlights strong five-year earnings growth of 18.7% per year and robust government support for modernizing agriculture, this margin slippage directly challenges the bullish thesis that policy tailwinds alone are enough to offset profitability pressure.

- Despite the positive backdrop from sector subsidies and modernization policies, recent negative earnings growth shows margins are not immune to rising competition or input costs.

- The 7.5% margin undercuts the optimism that revenue momentum will always translate to stronger bottom-line results in China's machinery sector.

Relative Valuation: Cheaper Than Peers, But Not Than Its DCF

- First Tractor’s price-to-earnings ratio stands at 10x, below the Hong Kong machinery industry average of 12.7x and the peer average of 13.8x. However, its share price of HK$7.94 significantly exceeds its DCF fair value of HK$3.24.

- The prevailing market view often points to a lower P/E multiple as a mark of hidden value, but the share price premium over DCF fair value poses a reality check for investors counting on a deep value discount.

- While trading below peers by P/E, First Tractor’s valuation still appears stretched relative to its modeled intrinsic value. This suggests the market is pricing in additional growth or sentiment that is not fully backed by fundamentals.

- This duality—attractive on one valuation lens, expensive on another—creates tension for those debating whether the stock offers true margin of safety or not.

Dividend Sustainability Remains an Investor Focus

- The balance of risks and rewards in recent filings highlighted sustainability of the dividend as First Tractor’s key risk factor, overtaking short-term earnings volatility as the primary concern for many shareholders.

- The prevailing market view makes clear that, despite solid forecasted growth, investors remain watchful for signals on dividend reliability. Recent touches of margin pressure amplify the risk that payout levels might come under review.

- Ongoing margin compression can impact future free cash flow, which could pressure the board’s ability to maintain or grow the current dividend.

- With growth forecasts still above market averages, all eyes are on whether capital allocation will balance expansion ambitions with steady returns to shareholders.

See how this detailed view fits into the broader story and what other investors are saying in the latest narratives. See what the community is saying about First Tractor

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on First Tractor's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

See What Else Is Out There

First Tractor’s compressed profit margins and premium valuation indicate that sustained earnings growth is not translating into reliable long-term value.

Looking for greater value and stronger fundamentals? Consider these 855 undervalued stocks based on cash flows to target companies where the share price better reflects their real earnings power and future potential.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:38

First Tractor

Engages in the manufacturing and sale of agricultural machinery and power machinery.

Flawless balance sheet average dividend payer.

Market Insights

Community Narratives