- Hong Kong

- /

- Industrials

- /

- SEHK:19

How Investors Are Reacting To Swire Pacific (SEHK:19) Boosting Its Stake in Cathay Pacific

Reviewed by Sasha Jovanovic

- State-owned Qatar Airways has in the past sold its entire US$897 million stake in Cathay Pacific Airways, with Cathay Pacific repurchasing the 9.7 percent holding, marking Qatar Airways' complete exit after eight years.

- This buyback has increased Swire Pacific's ownership in Cathay Pacific to 47.69 percent from 43.12 percent, strengthening its influence and alignment with the airline's future direction and growth initiatives.

- We'll examine how Swire Pacific’s increased stake in Cathay Pacific may impact its investment narrative and long-term strategic outlook.

These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

Swire Pacific Investment Narrative Recap

Being a Swire Pacific shareholder hinges on confidence in the resilience and growth of its core businesses, particularly real estate in Mainland China and the ongoing recovery in aviation through Cathay Pacific. The recent increase in Swire Pacific's stake in Cathay Pacific, following Qatar Airways' exit, further aligns its fortunes with the airline; however, this shift does not materially alter the key short-term catalyst, Asia-Pacific air travel recovery, or the biggest risk: ongoing earnings volatility tied to aviation sector swings.

Among recent announcements, Swire Pacific's ongoing share buyback program stands out, having repurchased more than 11 percent of its shares since late 2023. This is particularly relevant as it underscores management's continued commitment to capital returns, even as aviation sector uncertainty and property market pressures remain central themes for the business.

By contrast, investors should also be alert to how changes in aviation market conditions could affect Swire Pacific's consolidated earnings and...

Read the full narrative on Swire Pacific (it's free!)

Swire Pacific's outlook anticipates revenue of HK$107.5 billion and earnings of HK$13.8 billion by 2028. This scenario is based on a 6.8% annual revenue growth rate and a HK$12.6 billion increase in earnings from current levels of HK$1.2 billion.

Uncover how Swire Pacific's forecasts yield a HK$79.50 fair value, a 19% upside to its current price.

Exploring Other Perspectives

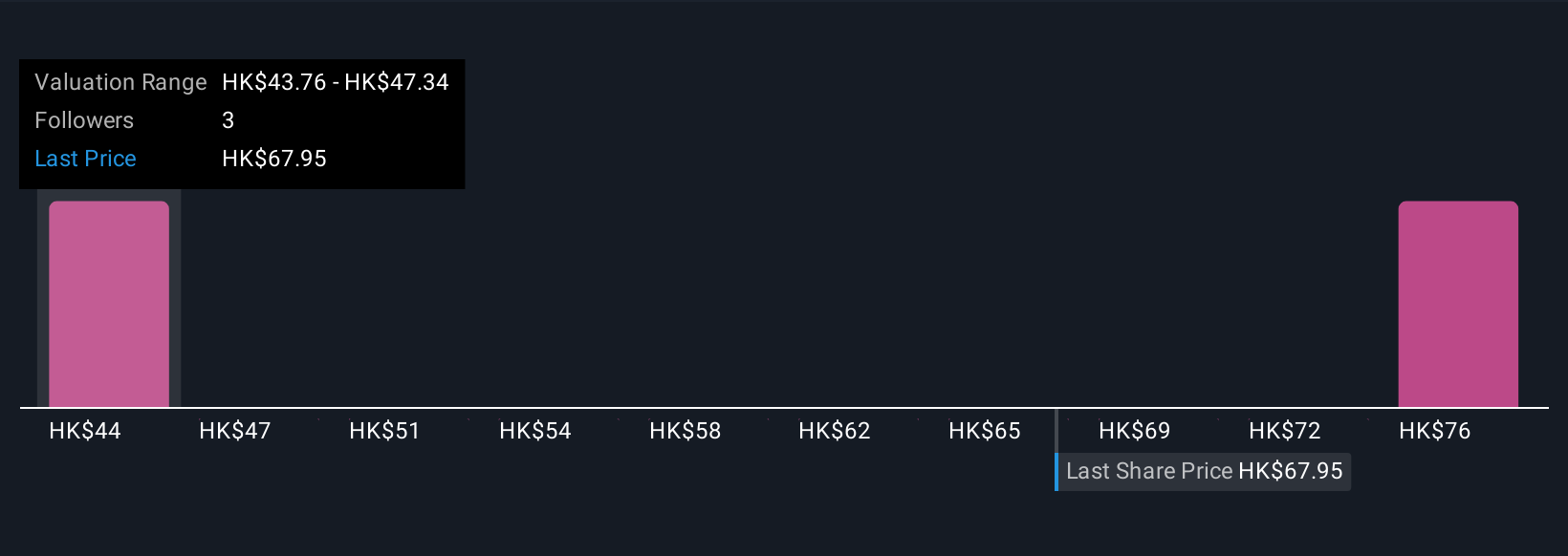

Simply Wall St Community members currently offer two fair value estimates for Swire Pacific, from HK$37.06 to HK$79.50, signaling broad differences in outlook. With aviation sector volatility still a defining risk, exploring a range of viewpoints can help you understand what's most likely to influence results in the year ahead.

Explore 2 other fair value estimates on Swire Pacific - why the stock might be worth 44% less than the current price!

Build Your Own Swire Pacific Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Swire Pacific research is our analysis highlighting 1 key reward and 3 important warning signs that could impact your investment decision.

- Our free Swire Pacific research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Swire Pacific's overall financial health at a glance.

Contemplating Other Strategies?

Right now could be the best entry point. These picks are fresh from our daily scans. Don't delay:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Rare earth metals are the new gold rush. Find out which 35 stocks are leading the charge.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:19

Swire Pacific

Engages in the property, aviation, beverages, marine, and trading and industrial businesses in Hong Kong, Mainland China, Taiwan, rest of Asia, the United States, and internationally.

Moderate growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives