- Hong Kong

- /

- Construction

- /

- SEHK:1800

Is China Communications Construction’s New Dividend Plan Signaling a Strategic Shift for SEHK:1800 Investors?

Reviewed by Sasha Jovanovic

- China Communications Construction Company Limited recently reported earnings for the nine months ended September 30, 2025, with revenue and net income decreasing to CNY 513.92 billion and CNY 13.65 billion respectively compared to the prior year.

- The company announced both an interim dividend and a plan to distribute 20% of its first-half net profit as cash dividends, reinforcing its focus on rewarding shareholders despite lower earnings.

- With a new dividend plan signaling commitment to cash returns, we’ll explore how this shapes China Communications Construction’s investment narrative.

Find companies with promising cash flow potential yet trading below their fair value.

What Is China Communications Construction's Investment Narrative?

For investors considering China Communications Construction, the investment case has always rested on faith in the company’s significant domestic and global infrastructure footprint and its reliable, if unspectacular, cash generation. The recent drop in revenue and earnings renews focus on whether the business can defend its margins and sustain dividends amid competitive and macro pressures. However, management’s commitment to a 20% first-half profit payout as cash, even as earnings declined, suggests a desire to keep investors engaged in the near term. While this does not resolve underlying questions about debt coverage and dividend sustainability highlighted before this news, it may soften some short-term concerns around shareholder returns. The near-term catalysts, better cash flow visibility, ongoing share buybacks, and board changes, remain relevant, though recent numbers subtly shift risk more toward earnings quality and the sustainability of distributions rather than growth acceleration or valuation.

But investors should not overlook how weaker cash flow coverage of debt could affect future payouts. China Communications Construction's shares are on the way up, but could they be overextended? Uncover how much higher they are than fair value.Exploring Other Perspectives

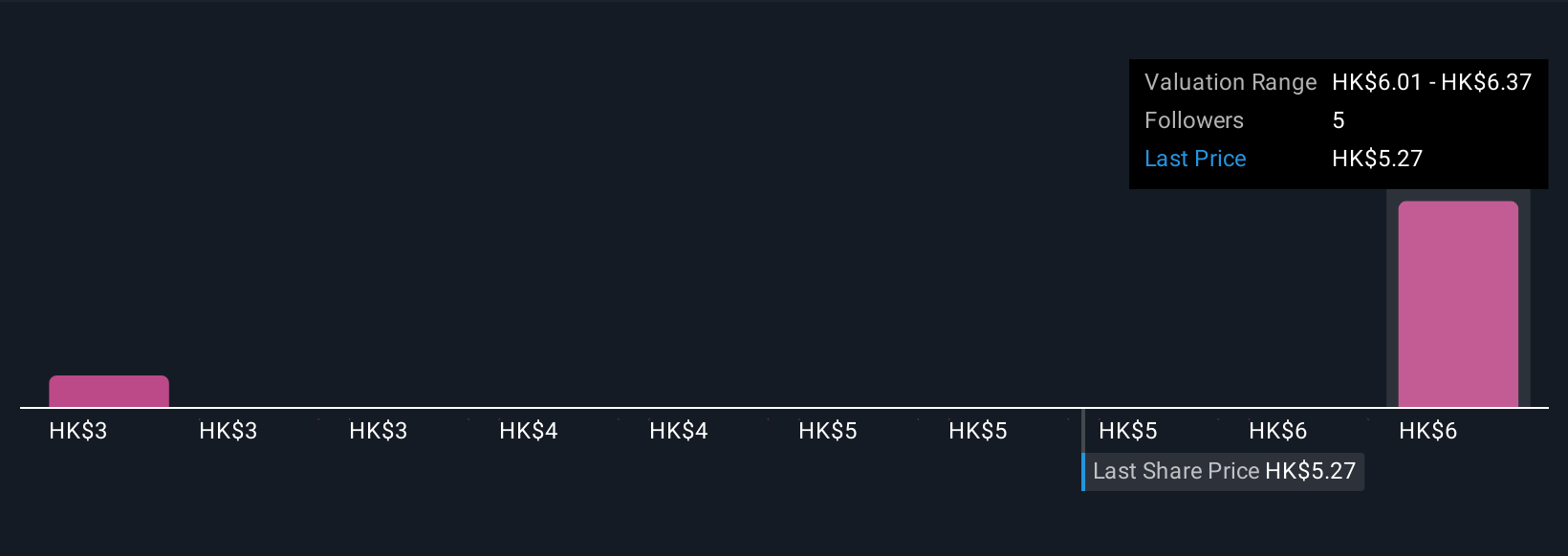

Explore 2 other fair value estimates on China Communications Construction - why the stock might be worth 47% less than the current price!

Build Your Own China Communications Construction Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Communications Construction research is our analysis highlighting 3 key rewards and 2 important warning signs that could impact your investment decision.

- Our free China Communications Construction research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Communications Construction's overall financial health at a glance.

Ready To Venture Into Other Investment Styles?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

- Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

- AI is about to change healthcare. These 32 stocks are working on everything from early diagnostics to drug discovery. The best part - they are all under $10b in market cap - there's still time to get in early.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1800

China Communications Construction

Engages in the infrastructure construction, infrastructure design, and dredging businesses in Mainland China, Australia, Hong Kong, Africa, the Middle East, and Southeast Asia.

Good value second-rate dividend payer.

Similar Companies

Market Insights

Community Narratives