- Hong Kong

- /

- Construction

- /

- SEHK:1662

Yee Hop Holdings (SEHK:1662) Margins Rise to 5.1%, Reinforcing Profitability Narrative

Reviewed by Simply Wall St

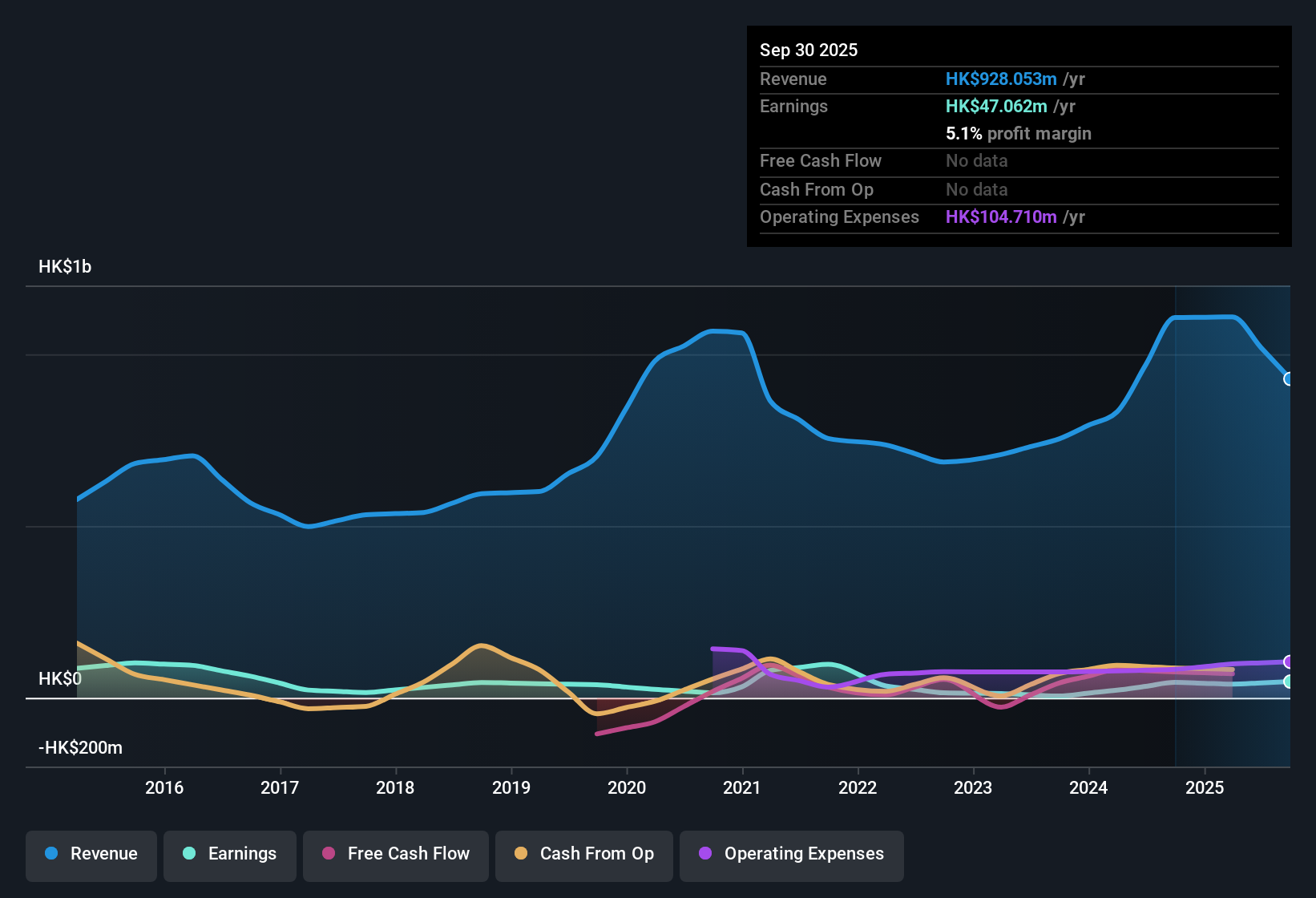

Yee Hop Holdings (SEHK:1662) just published its H1 2026 results, reporting revenue of HK$928.1 million and basic EPS of HK$0.10 for the trailing twelve months. Over recent periods, revenue fell from HK$1,106.6 million in H1 2025 to HK$928.1 million in the latest half, with EPS changing from HK$0.09 to HK$0.10 over the same timeframe. Margins remained a key watchpoint, with profitability moving in the context of these top-line shifts.

See our full analysis for Yee Hop Holdings.Now, let’s dig into how these latest numbers stack up against the popular narratives. Sometimes the consensus gets reinforced, while other times it faces fresh challenges.

Curious how numbers become stories that shape markets? Explore Community Narratives

Margins Hit 5.1% as Profitability Grows

- Net profit margin climbed to 5.1% for the trailing twelve months, improving from last year’s 4% margin.

- Profit margin expansion supports the prevailing narrative that Yee Hop’s operational improvements are material, even as revenue dipped over the period.

- Net income (excluding extra items) reached HK$47.1 million for the latest twelve months, compared to HK$39.8 million in the prior comparable trailing period.

- This uplift comes despite total revenue sliding from HK$1,108.5 million a year ago to HK$928.1 million now. This suggests better cost management or higher project quality drove the margin gain.

Valuation Above Sector While Peer Discount Persists

- The company’s current P/E ratio is 27.4x, below the peer average of 41.6x but well above the broader Hong Kong construction sector at 10.7x.

- Discussion around valuation remains nuanced, as Yee Hop trades at HK$2.50 per share, which is above the DCF fair value of HK$2.20. This suggests the market is assigning a premium for its recent margin gains.

- This premium versus DCF value may reflect confidence in the durability of margin growth. The fact that the stock sits closer to peer averages than the sector norm highlights ongoing debate about fair value for its risk profile.

- Investors weighing in reference both the positive margin shift and longer-term earnings decline of 9.9% per year over five years, keeping valuations in focus as a swing factor for sentiment.

Five-Year Earnings Trajectory Still Negative

- Despite the latest profit uptick, Yee Hop’s five-year earnings per year trend declined 9.9% annually.

- Market opinion notes that this long-term decline tempers enthusiasm around recent gains, with analysts and commentators pointing out that the quality of earnings is currently assessed as high.

- With net income rebounding in the latest twelve months but lagging historic highs, many see the current result as a positive deviation rather than a reversal of the broader downtrend.

- The data suggests positive operational momentum but underscores the importance of consistent future profitability before a sustained rerating is likely.

Next Steps

Don't just look at this quarter; the real story is in the long-term trend. We've done an in-depth analysis on Yee Hop Holdings's growth and its valuation to see if today's price is a bargain. Add the company to your watchlist or portfolio now so you don't miss the next big move.

Explore Alternatives

While Yee Hop’s improving margins are encouraging, its persistent five-year earnings decline and above-sector valuation raise concerns about sustained growth and fair pricing.

If you want to focus on companies trading below their intrinsic worth with more attractive valuation signals, check out these 919 undervalued stocks based on cash flows that may offer better opportunities right now.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1662

Yee Hop Holdings

An investment holding company, provides engineering and construction services in Hong Kong, the People’s Republic of China, and the Philippines.

Flawless balance sheet with proven track record.

Market Insights

Community Narratives

Recently Updated Narratives

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

A case for for IMPACT Silver Corp (TSXV:IPT) to reach USD $4.52 (CAD $6.16) in 2026 (23 bagger in 1 year) and USD $5.76 (CAD $7.89) by 2030

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

The company that turned a verb into a global necessity and basically runs the modern internet, digital ads, smartphones, maps, and AI.