- Hong Kong

- /

- Electrical

- /

- SEHK:1133

Harbin Electric (SEHK:1133) Valuation Check After HSBC’s Bullish Call on Its Clean Power Role

Reviewed by Simply Wall St

HSBC Global Research has just spotlighted Harbin Electric (SEHK:1133), highlighting its role in nuclear and hydropower supply as China wrestles with energy oversupply and fast rising demand from AI driven data centers.

See our latest analysis for Harbin Electric.

The HSBC call lands on a stock that has already been on a tear, with a roughly 66% 3 month share price return and a near fivefold 1 year total shareholder return, suggesting momentum is still very much intact despite only modest recent boardroom changes.

If this shift toward AI hungry infrastructure has your attention, it might be a good time to see what else is setting up for growth among high growth tech and AI stocks.

With shares still trading at a steep discount to HSBC’s target despite explosive recent gains, the key question now is whether Harbin Electric remains undervalued or if the market is already pricing in years of future growth.

Price-to-Earnings of 13.6x: Is it justified?

On a trailing price-to-earnings ratio of 13.6x at the last close of HK$14.8, Harbin Electric screens as undervalued versus peers despite its sharp share price rally.

The price-to-earnings multiple links what investors are willing to pay today with the company’s current level of reported profits, a key gauge for a mature, cash generative industrial such as Harbin Electric.

Harbin Electric’s 13.6x earnings multiple sits well below the peer average of 48.5x and under the estimated fair price-to-earnings ratio of 16.1x, suggesting the market is still assigning a noticeable discount to its profit power even after a year of outsized gains.

Compared with both the wider Asian electrical industry on 31.2x and the more focused electrical peer set on 48.5x, Harbin Electric’s 13.6x multiple looks strikingly conservative, implying investors have yet to fully re-rate the stock toward levels that similar businesses already command and that it could move closer to the fair ratio over time if growth and margins hold up.

Explore the SWS fair ratio for Harbin Electric

Result: Price-to-Earnings of 13.6x (UNDERVALUED)

However, investors still face key risks, including policy shifts on nuclear and hydropower spending, as well as a slowdown in power equipment orders from data center projects.

Find out about the key risks to this Harbin Electric narrative.

Another View: DCF Flags a Richer Price

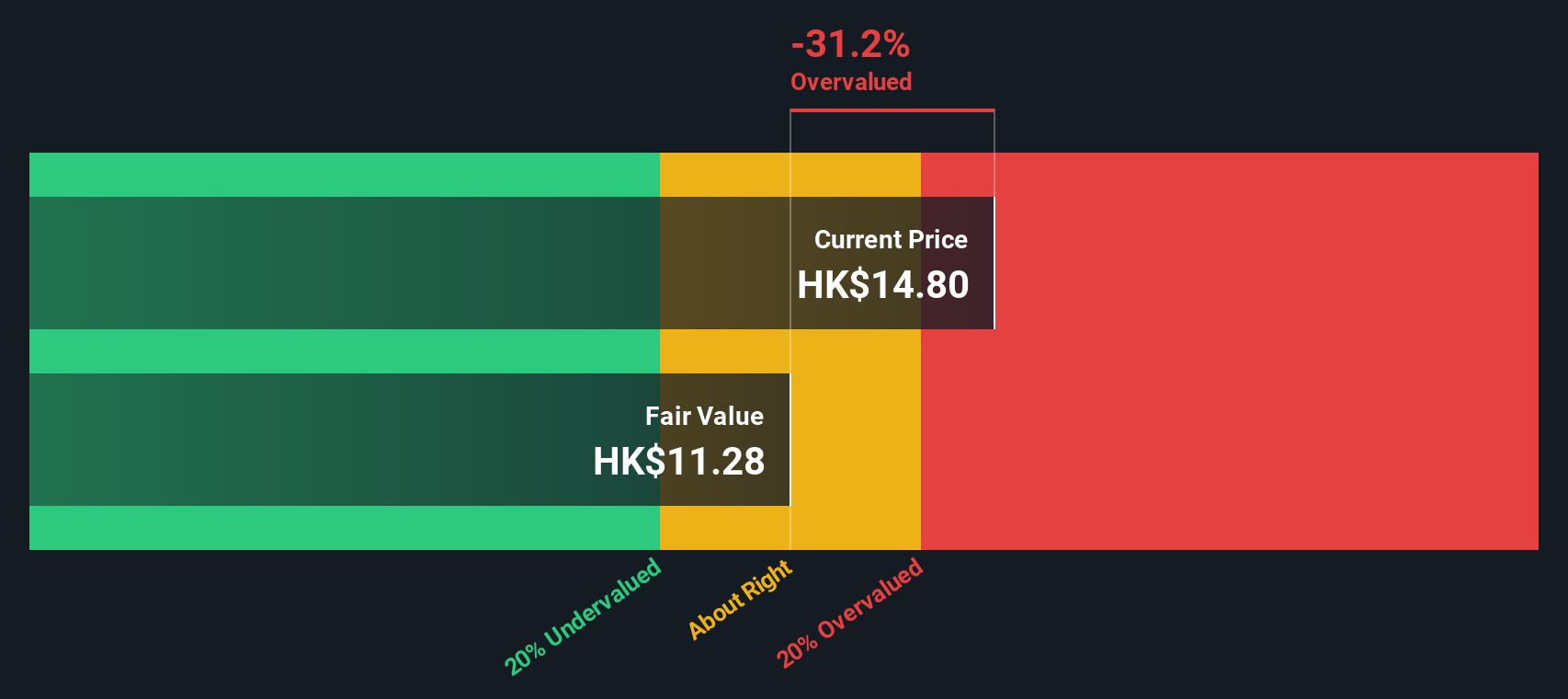

While earnings multiples point to value, our DCF model suggests Harbin Electric is actually trading above fair value, with HK$14.8 versus an SWS DCF fair value of HK$11.28. Is the market overpaying for long term growth or underestimating future cash flows?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Harbin Electric for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 907 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Harbin Electric Narrative

If you see the story differently or want to stress test the numbers yourself, you can build a fresh narrative in just a few minutes: Do it your way

A great starting point for your Harbin Electric research is our analysis highlighting 5 key rewards and 1 important warning sign that could impact your investment decision.

Looking for more investment ideas?

Before markets move on without you, use the Simply Wall St Screener to uncover fresh opportunities that match your style and keep your portfolio ahead of the crowd.

- Capture asymmetrical upside by targeting mispriced opportunities through these 907 undervalued stocks based on cash flows that stand out for strong cash flow potential and solid fundamentals.

- Position yourself at the heart of the AI wave by focusing on companies powering the next tech shift with these 26 AI penny stocks.

- Strengthen your income strategy by locking in cash returns from these 15 dividend stocks with yields > 3% that meet your yield and quality thresholds.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Harbin Electric might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1133

Harbin Electric

Manufactures and sells power plant equipment in the People’s Republic of China, the rest of Asia, Africa, Europe, and the United States.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026