Why China Construction Bank (SEHK:939) Is Up 5.6% After Q3 Profit Rises Despite Margin Pressures

Reviewed by Sasha Jovanovic

- China Construction Bank reported third quarter 2025 results, with net income rising to CNY 95.28 billion, while net interest income edged down, and the bank also approved a preferred share dividend of RMB 2.14 billion with a nominal rate of 3.57% to be distributed in December.

- While overall profit increased, the decline in net interest income signals pressure on lending margins, a trend closely watched by investors in the sector.

- We’ll examine how the improvement in net income alongside softer net interest income impacts China Construction Bank’s investment narrative.

Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

China Construction Bank Investment Narrative Recap

To own China Construction Bank stock, you need to believe in the long-term resilience of China’s consumer and digital banking sector, along with the bank’s ability to generate steady profits despite margin headwinds. The Q3 2025 report, showing growing net income but softer net interest income, does not materially change the near-term catalysts or biggest risk: pressure on lending margins as interest rates remain low and deposit repricing lags. The core narrative, growing fee-based revenue and operational efficiency, remains intact, but margin compression risk is still front and center.

The recent board-approved RMB 2.14 billion preferred share dividend, set for distribution in December at a fixed 3.57% rate, is a relevant signal of the bank’s steady capital return policy. This action shows commitment to rewarding shareholders, even as lending margins narrow, and aligns with the broader catalyst of stable dividends supporting investor confidence during periods of modest profit growth.

However, even as overall profit edges higher, investors should be aware that persistent net interest margin compression could...

Read the full narrative on China Construction Bank (it's free!)

China Construction Bank's outlook anticipates CN¥858.7 billion in revenue and CN¥372.3 billion in earnings by 2028. This projection is based on a 12.8% annual revenue growth rate and a CN¥46.1 billion earnings increase from current earnings of CN¥326.2 billion.

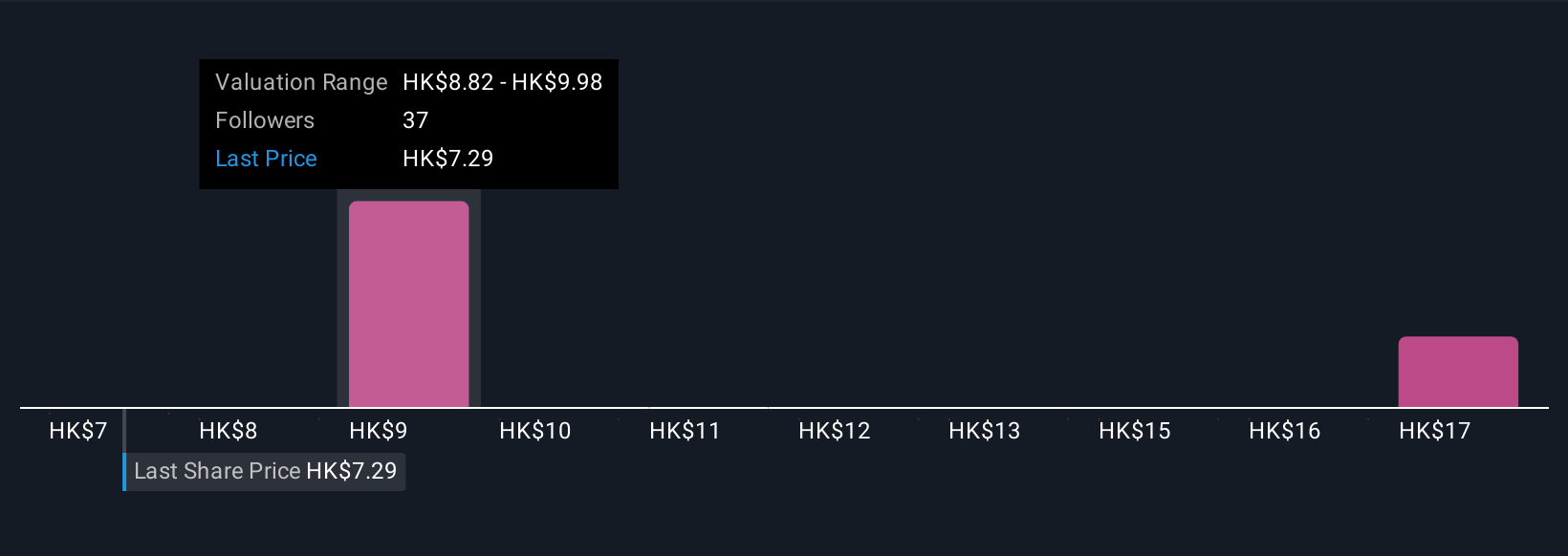

Uncover how China Construction Bank's forecasts yield a HK$9.00 fair value, a 11% upside to its current price.

Exploring Other Perspectives

Fair value views among three Simply Wall St Community members range widely from HK$9.00 to HK$18.36 per share. While profit growth and dividends remain bright spots, the sector’s margin pressure keeps participants watching carefully for changes in revenue quality or risk, so check out multiple viewpoints before deciding.

Explore 3 other fair value estimates on China Construction Bank - why the stock might be worth over 2x more than the current price!

Build Your Own China Construction Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your China Construction Bank research is our analysis highlighting 5 key rewards that could impact your investment decision.

- Our free China Construction Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate China Construction Bank's overall financial health at a glance.

Ready For A Different Approach?

Our top stock finds are flying under the radar-for now. Get in early:

- Rare earth metals are the new gold rush. Find out which 36 stocks are leading the charge.

- We've found 17 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:939

China Construction Bank

Engages in the provision of various banking and related financial services to individuals and corporate customers in the People's Republic of China and internationally.

Flawless balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives