China Construction Bank (SEHK:939) Net Margin Hits 54.7%, Reinforcing Value Narrative Despite Modest Growth

Reviewed by Simply Wall St

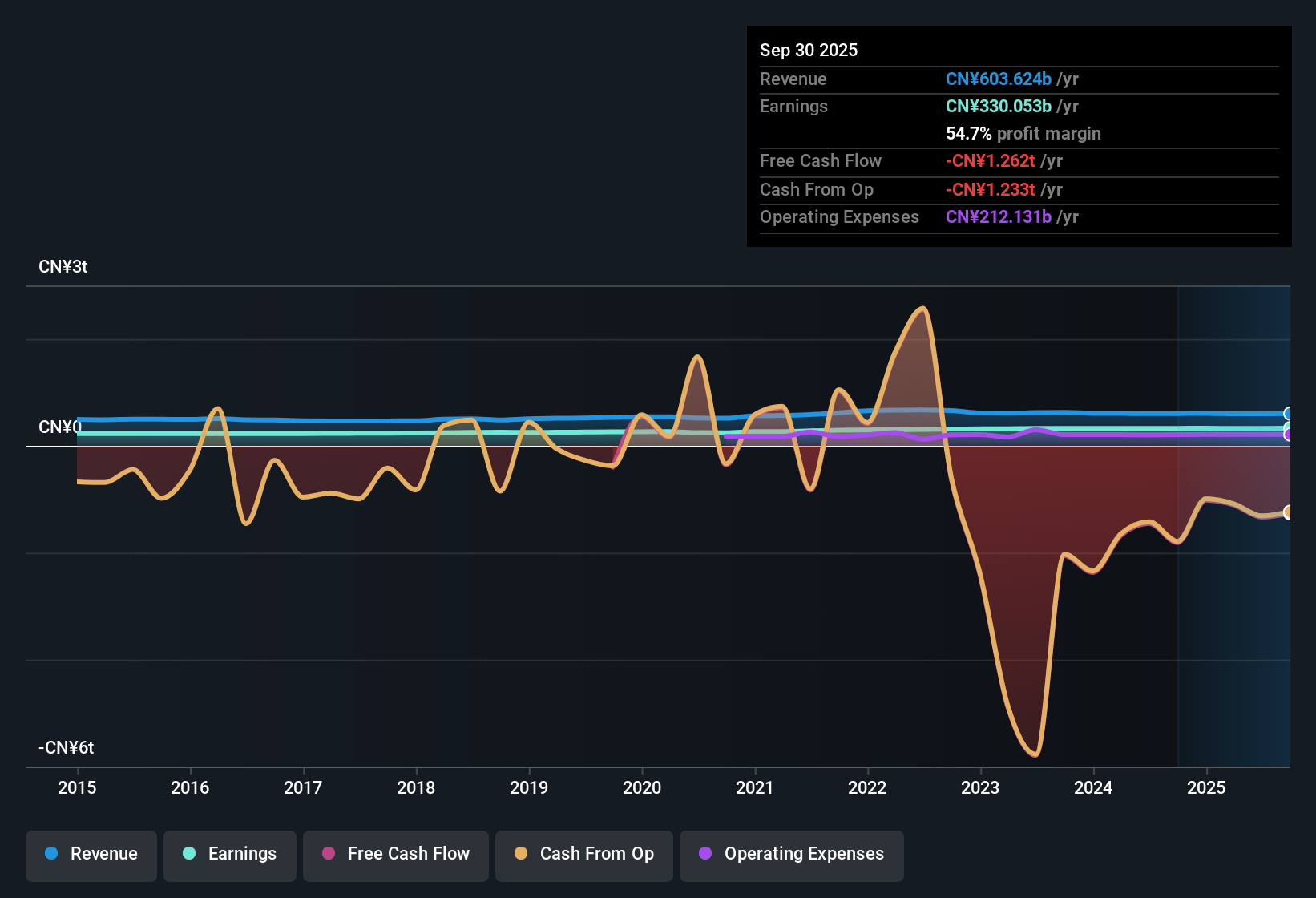

China Construction Bank (SEHK:939) has posted solid results with net profit margins reaching 54.7%, edging up from last year’s 54.2%. While earnings growth over the past year came in at 0.7%, below the five-year average of 4.6% per year, revenue is projected to rise at a robust 10.4% annually, beating the broader Hong Kong market’s 8.7% forecast. The earnings outlook for the next few years is more modest, with growth expected at 3.7% per year, trailing the Hong Kong average of 12.4%.

See our full analysis for China Construction Bank.Next, we will see how these earnings compare to the stories investors tell about China Construction Bank, and whether the numbers back up the prevailing narratives or force a rethink.

See what the community is saying about China Construction Bank

Margin Compression Offset by Diversified Fee Income

- Net interest margin is forecast to shrink from 54.5% to 43.4% over the next three years even as revenue is projected to grow by 12.8% annually. This highlights rising headwinds for profitability.

- According to the analysts' consensus view, digital innovation and a surge in green lending are expected to cushion margin pressure.

- Rising consumer demand for wealth management and digital banking is fueling stable fee income. This helps to offset the margin squeeze from low rates.

- Rapid fintech adoption and nearly 15% growth in green loans are cited as supporting resilient profit growth, despite ongoing policy and sector challenges.

See how analysts think margin trends could shift the story in the 📈 Read the full China Construction Bank Consensus Narrative.

Valuation Strongly Below DCF Fair Value

- Shares trade at HK$7.70, well under the DCF fair value of HK$18.13 and below the Hong Kong banking sector average PE (5.6x vs. 5.9x). This marks a sizable discount by both intrinsic and relative valuation.

- In the analysts' consensus view, this valuation gap is supported by healthy profit margins and a robust dividend, though future earnings growth is expected to trail the broader market.

- Analyst price target of HK$9.09 is 18% above the current share price, suggesting upside if profit holds and margins do not compress faster than expected.

- The narrative notes modest earnings growth but emphasizes the strong value proposition against both industry and peer averages, as well as the fair value gap.

Asset Quality and Risk Controls in Focus

- No material risks were recorded for the period under review, and industry-leading risk management is highlighted by improving NPL ratios and high provision coverage.

- The consensus narrative emphasizes that robust risk controls and targeted lending to growth sectors support long-term returns. However, it also warns that real estate exposure and digital competition remain key concerns.

- Stable or improving asset quality reassures investors, but renewed stress in China's property sector or increased digital competition could quickly impact profitability and net margins.

- The narrative flags demographic headwinds and policy tightening as long-term risks that could restrict flexibility in pricing and limit earnings expansion.

Next Steps

To see how these results tie into long-term growth, risks, and valuation, check out the full range of community narratives for China Construction Bank on Simply Wall St. Add the company to your watchlist or portfolio so you'll be alerted when the story evolves.

Looking at the figures from another angle? Share your perspective and shape your unique take on China Construction Bank in just a few minutes. Do it your way

A good starting point is our analysis highlighting 5 key rewards investors are optimistic about regarding China Construction Bank.

See What Else Is Out There

Despite a robust balance sheet and attractive valuation, China Construction Bank's earnings growth is expected to lag well behind the broader market in the coming years.

If consistent expansion matters most to you, filter for companies with stronger prospects and reliable results using our stable growth stocks screener (2101 results) selection.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:939

China Construction Bank

Engages in the provision of various banking and related financial services to individuals and corporate customers in the People's Republic of China and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives