Does Issuing RMB1 Billion Sci-tech Bonds Recast Chongqing Rural Commercial Bank’s (SEHK:3618) Innovation Strategy?

Reviewed by Sasha Jovanovic

- Chongqing Rural Commercial Bank has recently completed the issuance of RMB1 billion sci-tech innovation bonds in the national inter-bank bond market to channel funding into technology-focused enterprises.

- This bond issue underlines the bank’s growing role as a financial conduit for China’s innovation agenda, aligning its balance sheet more closely with sci-tech lending and investment.

- We’ll now examine how this sci-tech bond issuance shapes Chongqing Rural Commercial Bank’s investment narrative and long-term innovation focus.

We've found 15 US stocks that are forecast to pay a dividend yield of over 6% next year. See the full list for free.

What Is Chongqing Rural Commercial Bank's Investment Narrative?

To own Chongqing Rural Commercial Bank, you really need to believe in a fairly traditional regional bank story that is gradually layering on an innovation angle without losing its core strengths. The bank’s appeal has been its solid profitability, high quality earnings and relatively low valuation multiples, combined with share price and total return performance that has comfortably outpaced both the Hong Kong market and the local banks sector. Short term, investors are watching earnings momentum, dividend consistency and how board turnover settles after several director changes. The new RMB1 billion sci-tech innovation bond issuance fits directly into this, but on its own is unlikely to shift the near term earnings or capital story in a material way. Instead, it slightly tilts the risk mix toward innovation lending, which could matter more over time if that book meaningfully scales.

However, the increased exposure to sci-tech borrowers introduces risks that investors should not overlook. Chongqing Rural Commercial Bank's shares have been on the rise but are still potentially undervalued. Find out how large the opportunity might be.Exploring Other Perspectives

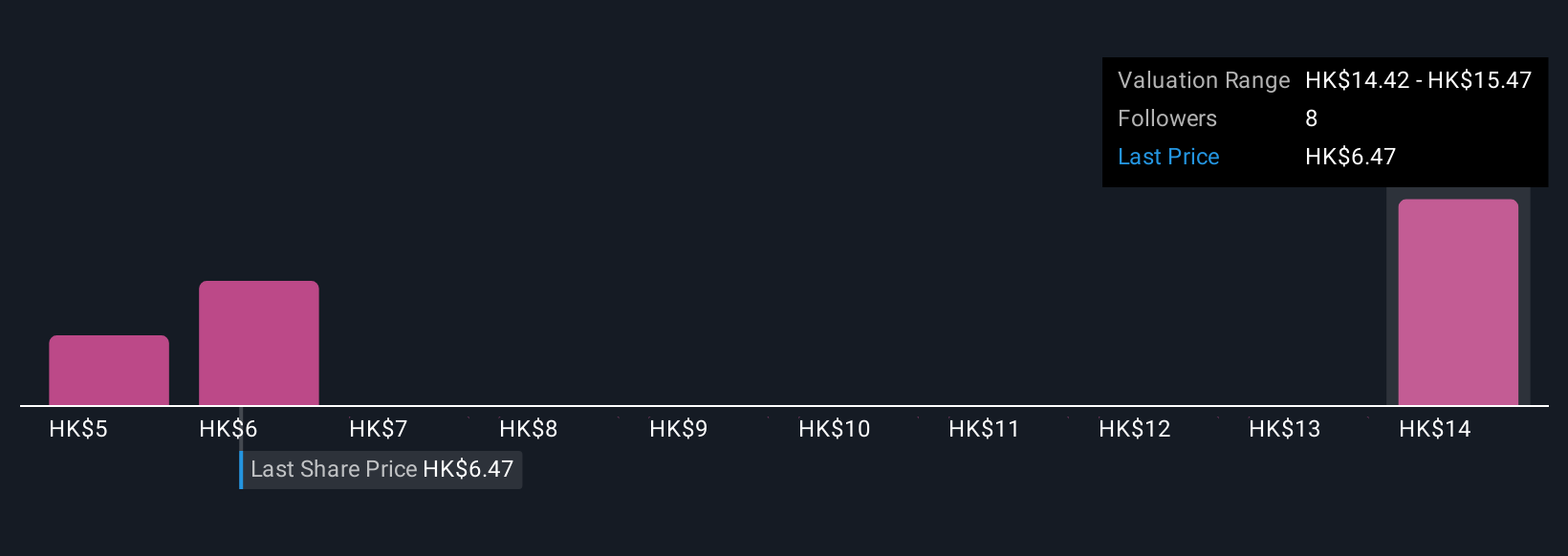

Five fair value views from the Simply Wall St Community span roughly HK$4.96 to HK$15.47, showing how far apart individual investors can be on Chongqing Rural Commercial Bank. Set this against the evolving risk profile from its sci-tech lending push and recent governance changes, and you can see why it pays to weigh multiple perspectives on how resilient future performance might be.

Explore 5 other fair value estimates on Chongqing Rural Commercial Bank - why the stock might be worth over 2x more than the current price!

Build Your Own Chongqing Rural Commercial Bank Narrative

Disagree with this assessment? Create your own narrative in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Chongqing Rural Commercial Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Chongqing Rural Commercial Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Chongqing Rural Commercial Bank's overall financial health at a glance.

No Opportunity In Chongqing Rural Commercial Bank?

Opportunities like this don't last. These are today's most promising picks. Check them out now:

- These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 26 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:3618

Chongqing Rural Commercial Bank

Provides banking services in the People’s Republic of China.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026