A Look at Bank of Chongqing (SEHK:1963) Valuation After Dividend Boost and Governance Update

Reviewed by Simply Wall St

Bank of Chongqing (SEHK:1963) approved a substantial cash dividend for the first three quarters of 2025, giving shareholders enhanced returns and new options for dividend currency. The company also updated its Articles of Association, signaling governance adjustments.

See our latest analysis for Bank of Chongqing.

Shares of Bank of Chongqing have gained notable momentum since the start of the year, with a share price return of 37% year-to-date and a remarkable 1-year total shareholder return of over 55%. While recent news around the substantial dividend and updates to corporate governance likely contributed to positive sentiment, the bank’s three- and five-year total shareholder returns of 169% and 184% respectively highlight a strong long-term trajectory and sustained investor confidence.

If you are looking for discovery opportunities beyond the banking sector, now is the perfect moment to broaden your investing horizons and explore fast growing stocks with high insider ownership

With shares posting outstanding returns and a hefty dividend on the way, investors may wonder if Bank of Chongqing is still trading at a bargain or if the market has already factored in its future growth potential.

Price-to-Earnings of 5.1: Is it justified?

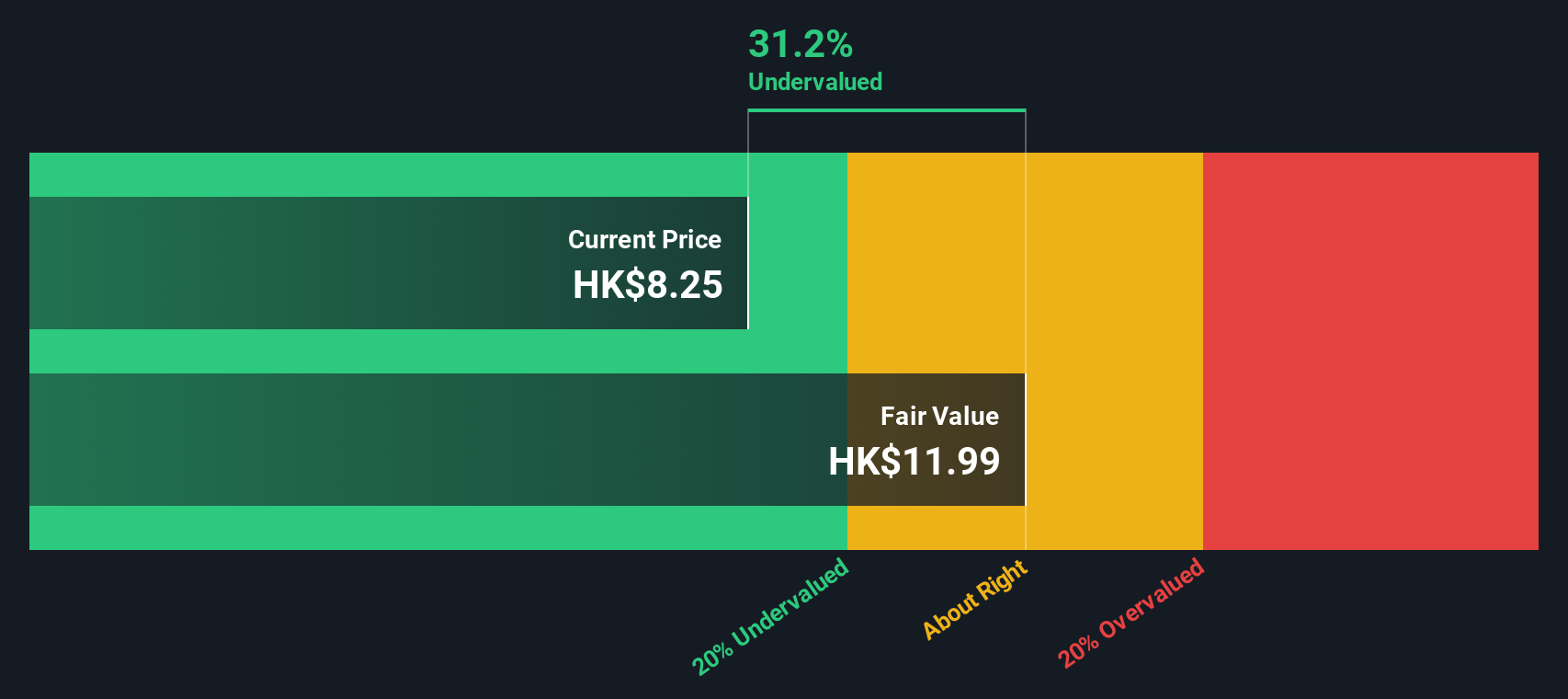

Bank of Chongqing is trading at a price-to-earnings ratio (P/E) of 5.1, which looks attractively valued compared to its peers and the market. With the last close at HK$8.25, investors are currently paying less for the bank's earnings than the sector average. This suggests the market might be underestimating its future potential.

The price-to-earnings ratio measures how much investors are willing to pay for each dollar of earnings. A lower P/E can signal undervaluation, particularly for established banks like Bank of Chongqing that have a track record of profitability.

Notably, Bank of Chongqing's P/E of 5.1 is lower than both its peer group average (5.6) and the Hong Kong Banks industry average (5.9). Compared to our estimated fair price-to-earnings ratio of 6, shares may have room to re-rate upward if the market starts to recognize the bank's consistent earnings growth and high-quality profits.

Explore the SWS fair ratio for Bank of Chongqing

Result: Price-to-Earnings of 5.1 (UNDERVALUED)

However, weaker net income growth or a slip in market sentiment could quickly cause the market to reassess Bank of Chongqing's current valuation.

Find out about the key risks to this Bank of Chongqing narrative.

Another View: SWS DCF Model Signals Deeper Discount

While the price-to-earnings comparison highlights Bank of Chongqing as undervalued, our SWS DCF model provides additional insight. It estimates fair value at HK$11.99, which is significantly above the latest close. This indicates the market may be overlooking further potential, but is it too good to be true?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Bank of Chongqing for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 928 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Bank of Chongqing Narrative

If you have a different perspective or want to test your own ideas using our data, you can easily put together your own analysis in just a few minutes with Do it your way.

A great starting point for your Bank of Chongqing research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Opportunities?

Stay ahead of the curve and avoid missing out. Propel your portfolio forward by targeting high-potential sectors with these exclusive ideas:

- Unlock steady income streams by tapping into these 14 dividend stocks with yields > 3% with yields over 3% and strong fundamentals fueling long-term growth.

- Catch the AI wave early by using these 25 AI penny stocks to access emerging companies driving artificial intelligence innovation and reshaping our digital landscape.

- Position yourself at the forefront of finance’s next evolution by selecting these 81 cryptocurrency and blockchain stocks and joining the momentum of stocks transforming the cryptocurrency and blockchain ecosystem.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bank of Chongqing might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:1963

Bank of Chongqing

Provides various banking and services for corporate and individual customers in the People’s Republic of China.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026