Dongfeng Motor Group (SEHK:489) Valuation Revisited as VOYAH Spin-Off Speculation Builds in Tough China EV Market

Reviewed by Simply Wall St

Dongfeng Motor Group (SEHK:489) is back in focus as investors revisit the value of its 100% owned EV arm VOYAH, with speculation building around a potential Hong Kong spin off amid an intense China EV shakeout.

See our latest analysis for Dongfeng Motor Group.

The speculation around VOYAH comes after a powerful run, with Dongfeng’s share price up roughly 153% year to date and a 1 year total shareholder return near 140%. This suggests momentum is still very much alive despite some recent consolidation.

If this EV story has you thinking more broadly about autos, it might be worth scanning other potential opportunities among auto manufacturers for ideas beyond Dongfeng.

But after such a rapid rerating and growing excitement around a VOYAH spin off, are investors still getting Dongfeng at a discount to its fundamentals, or is the market already pricing in most of the future growth?

Price-to-Sales of 0.6x: Is it justified?

Dongfeng Motor Group trades on a price to sales ratio of 0.6x at last close of HK$9.19, which screens as undervalued versus both peers and a fair value benchmark.

The price to sales multiple compares the market value of the company to the revenue it generates, a useful lens when profits are negative or volatile, as is the case for Dongfeng today.

Here, the market is paying just 0.6 times sales, while our estimated fair price to sales ratio is 1.2x and peer and Asian auto industry averages sit closer to 0.8x and 1x respectively, implying investors may be underpricing the group’s revenue base and its forecast transition back to profitability.

Compared to the broader Asian auto industry, Dongfeng’s 0.6x price to sales looks notably lower, and if the market were to converge toward the 1.2x fair ratio, there could be meaningful upside from current levels.

Explore the SWS fair ratio for Dongfeng Motor Group

Result: Price-to-Sales of 0.6x (UNDERVALUED)

However, sustained losses, intense EV competition, and any setback to a VOYAH spin off could quickly cool sentiment and compress Dongfeng’s valuation.

Find out about the key risks to this Dongfeng Motor Group narrative.

Another View: Our DCF Fair Value Check

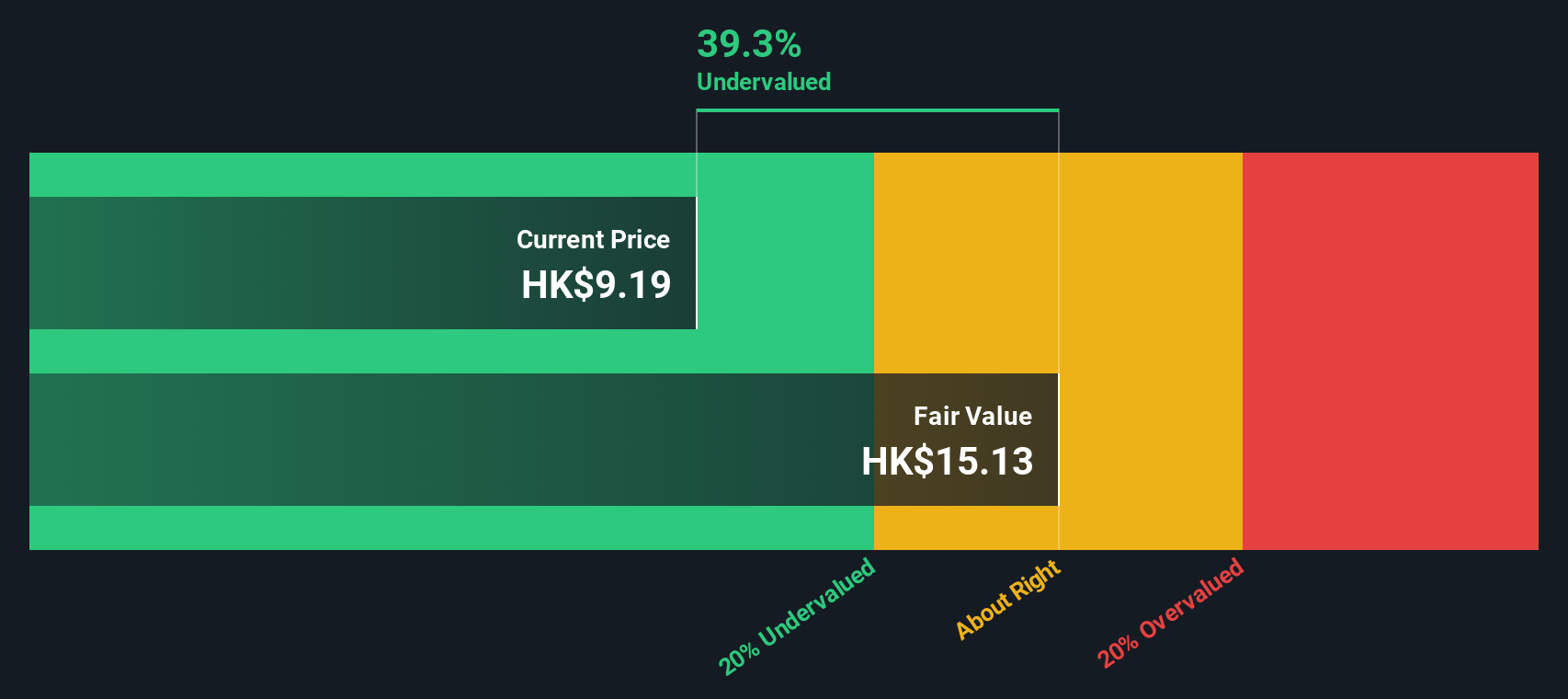

Our DCF model tells a similar story, with Dongfeng trading around 39% below its estimated fair value of HK$15.13. That indicates potential upside if cash flows materialise as expected, but also raises a question: is the market flagging risks the model cannot fully capture?

Look into how the SWS DCF model arrives at its fair value.

Simply Wall St performs a discounted cash flow (DCF) on every stock in the world every day (check out Dongfeng Motor Group for example). We show the entire calculation in full. You can track the result in your watchlist or portfolio and be alerted when this changes, or use our stock screener to discover 906 undervalued stocks based on their cash flows. If you save a screener we even alert you when new companies match - so you never miss a potential opportunity.

Build Your Own Dongfeng Motor Group Narrative

If you see things differently or want to dig into the numbers yourself, you can quickly build a customized view in under three minutes: Do it your way.

A good starting point is our analysis highlighting 3 key rewards investors are optimistic about regarding Dongfeng Motor Group.

Looking for more investment ideas?

Before you move on, put this momentum to work and build a stronger watchlist by targeting specific themes and opportunities across the market.

- Capture high-upside potential in smaller names by scanning these 3576 penny stocks with strong financials with resilient balance sheets and improving fundamentals.

- Focus on these 30 healthcare AI stocks transforming diagnostics, treatment planning, and hospital efficiency worldwide to participate in long-term innovation across the healthcare landscape.

- Strengthen your income strategy with these 15 dividend stocks with yields > 3% that combine reliable payouts with solid financial health.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SEHK:489

Dongfeng Motor Group

Engages in the research, development, manufacture, and sale of commercial and passenger vehicles, engines, and other auto parts in the People’s Republic of China.

Undervalued with excellent balance sheet.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

ADNOC Gas future shines with a 21.4% revenue surge

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026