- United Kingdom

- /

- Hospitality

- /

- LSE:PPH

3 UK Growth Companies With High Insider Ownership To Watch

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index experiencing declines due to weak trade data from China and its impact on commodity-driven companies. As global economic uncertainties persist, investors may find it worthwhile to consider growth companies with high insider ownership, as these firms often demonstrate strong alignment between management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 14.3% | 74.4% |

| Metals Exploration (AIM:MTL) | 10.4% | 88.2% |

| Manolete Partners (AIM:MANO) | 35.6% | 38.1% |

| Kainos Group (LSE:KNOS) | 23.8% | 23% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Energean (LSE:ENOG) | 19% | 21.1% |

| B90 Holdings (AIM:B90) | 21.3% | 157.2% |

| Afentra (AIM:AET) | 37.7% | 38.2% |

| ActiveOps (AIM:AOM) | 19.5% | 102.9% |

We'll examine a selection from our screener results.

Aston Martin Lagonda Global Holdings (LSE:AML)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Aston Martin Lagonda Global Holdings plc is involved in the design, development, manufacture, and marketing of luxury sports cars across various global markets with a market cap of approximately £662.66 million.

Operations: The company generates revenue primarily from its automotive segment, which accounted for £1.33 billion.

Insider Ownership: 16.6%

Aston Martin Lagonda Global Holdings has seen challenges with declining sales and increased net losses, reporting GBP 285.2 million in Q3 2025 sales compared to GBP 391.6 million a year prior. Despite this, the company forecasts significant revenue growth at 14.5% annually, outpacing the UK market average of 4.3%. Insider ownership remains high, indicating potential alignment with shareholder interests but recent financial performance and volatility may pose risks for investors seeking stability in growth stocks.

- Take a closer look at Aston Martin Lagonda Global Holdings' potential here in our earnings growth report.

- The analysis detailed in our Aston Martin Lagonda Global Holdings valuation report hints at an inflated share price compared to its estimated value.

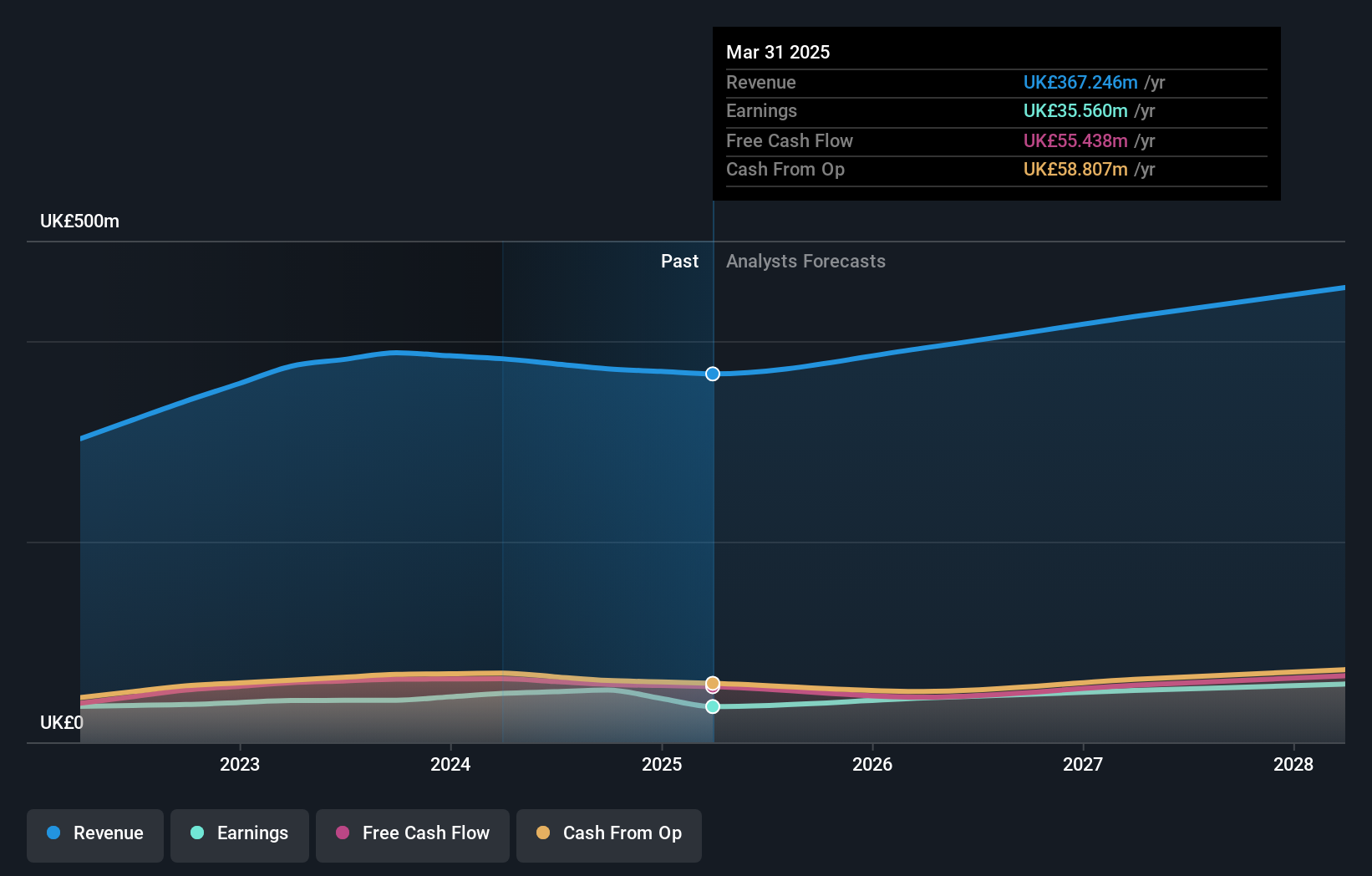

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, the Americas, Central Europe, and internationally with a market cap of £1.29 billion.

Operations: The company's revenue segments include Digital Services (£203.43 million), Workday Products (£76.28 million), and Workday Services (£100.56 million).

Insider Ownership: 23.8%

Kainos Group demonstrates strong growth potential, with insider ownership suggesting alignment with shareholder interests. The company forecasts earnings growth of 23% annually, outpacing the UK market. Recent share repurchase initiatives aim to optimize capital structure, while revenue is expected to grow at 9.3% per year. Despite lower profit margins compared to last year and a dividend not fully covered by earnings, Kainos's return on equity is projected to be very high at 41.6%.

- Click to explore a detailed breakdown of our findings in Kainos Group's earnings growth report.

- Our comprehensive valuation report raises the possibility that Kainos Group is priced higher than what may be justified by its financials.

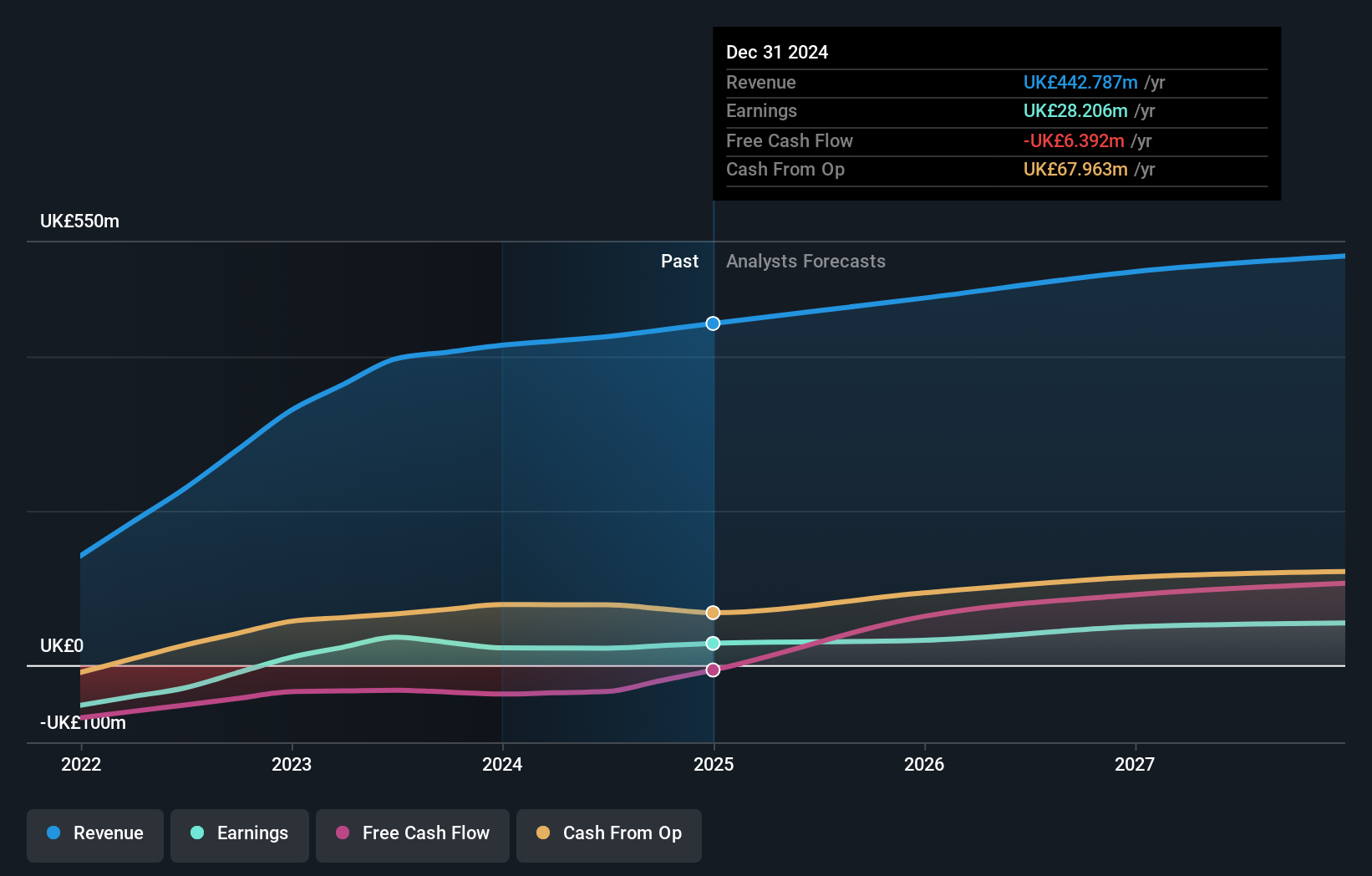

PPHE Hotel Group (LSE:PPH)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: PPHE Hotel Group Limited is involved in owning, co-owning, developing, leasing, operating, and franchising hospitality real estate across several European countries including the Netherlands and the United Kingdom; it has a market cap of £758.44 million.

Operations: The company's revenue segments include Management and Central Services (£56.70 million) and Owned Hotel Operations across Croatia (£85.91 million), Germany (£23.33 million), the United Kingdom (£256.21 million), and the Netherlands (£64.59 million).

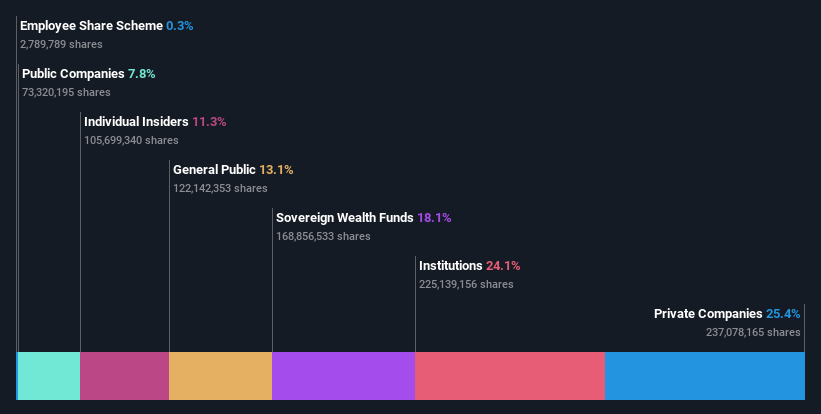

Insider Ownership: 13.1%

PPHE Hotel Group's strategic review, backed by insiders holding 44% of shares, explores growth capital and potential sale options. The company forecasts a robust annual earnings growth of 24.2%, outpacing the UK market. However, revenue growth is modest at 5.9%. Recent refinancing extends debt maturity to 2030 with higher interest rates but no amortization, impacting cash flow positively. While trading below estimated fair value, interest coverage remains a concern due to large one-off items affecting earnings quality.

- Get an in-depth perspective on PPHE Hotel Group's performance by reading our analyst estimates report here.

- In light of our recent valuation report, it seems possible that PPHE Hotel Group is trading beyond its estimated value.

Make It Happen

- Delve into our full catalog of 53 Fast Growing UK Companies With High Insider Ownership here.

- Ready For A Different Approach? Rare earth metals are the new gold rush. Find out which 37 stocks are leading the charge.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PPH

PPHE Hotel Group

Owns, co-owns, develops, leases, operates, and franchises hospitality real estate in the Netherlands, the United Kingdom, Germany, Croatia, Austria, Hungary, Italy, and Serbia.

Reasonable growth potential second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026