- United Kingdom

- /

- Aerospace & Defense

- /

- LSE:QQ.

UK Penny Stocks Worth Watching In December 2025

Reviewed by Simply Wall St

The UK stock market has recently experienced fluctuations, with the FTSE 100 index closing lower due to weak trade data from China, highlighting concerns over global economic recovery. Despite these challenges, investors often find opportunities in lesser-known areas of the market. Penny stocks, although an outdated term, still represent smaller or newer companies that can offer significant value and potential growth for those willing to explore beyond the mainstream indices.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.10 | £467.57M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.07 | £167.23M | ✅ 4 ⚠️ 2 View Analysis > |

| On the Beach Group (LSE:OTB) | £2.15 | £311.55M | ✅ 5 ⚠️ 1 View Analysis > |

| Ingenta (AIM:ING) | £0.875 | £13.21M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.04 | £25.89M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.675 | $392.4M | ✅ 4 ⚠️ 2 View Analysis > |

| Impax Asset Management Group (AIM:IPX) | £1.486 | £182.98M | ✅ 3 ⚠️ 2 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.435 | £69.31M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.52 | £44.82M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.105 | £176.36M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 306 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

accesso Technology Group (AIM:ACSO)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: accesso Technology Group plc develops technology solutions for the attractions and leisure industry and has a market cap of £136.31 million.

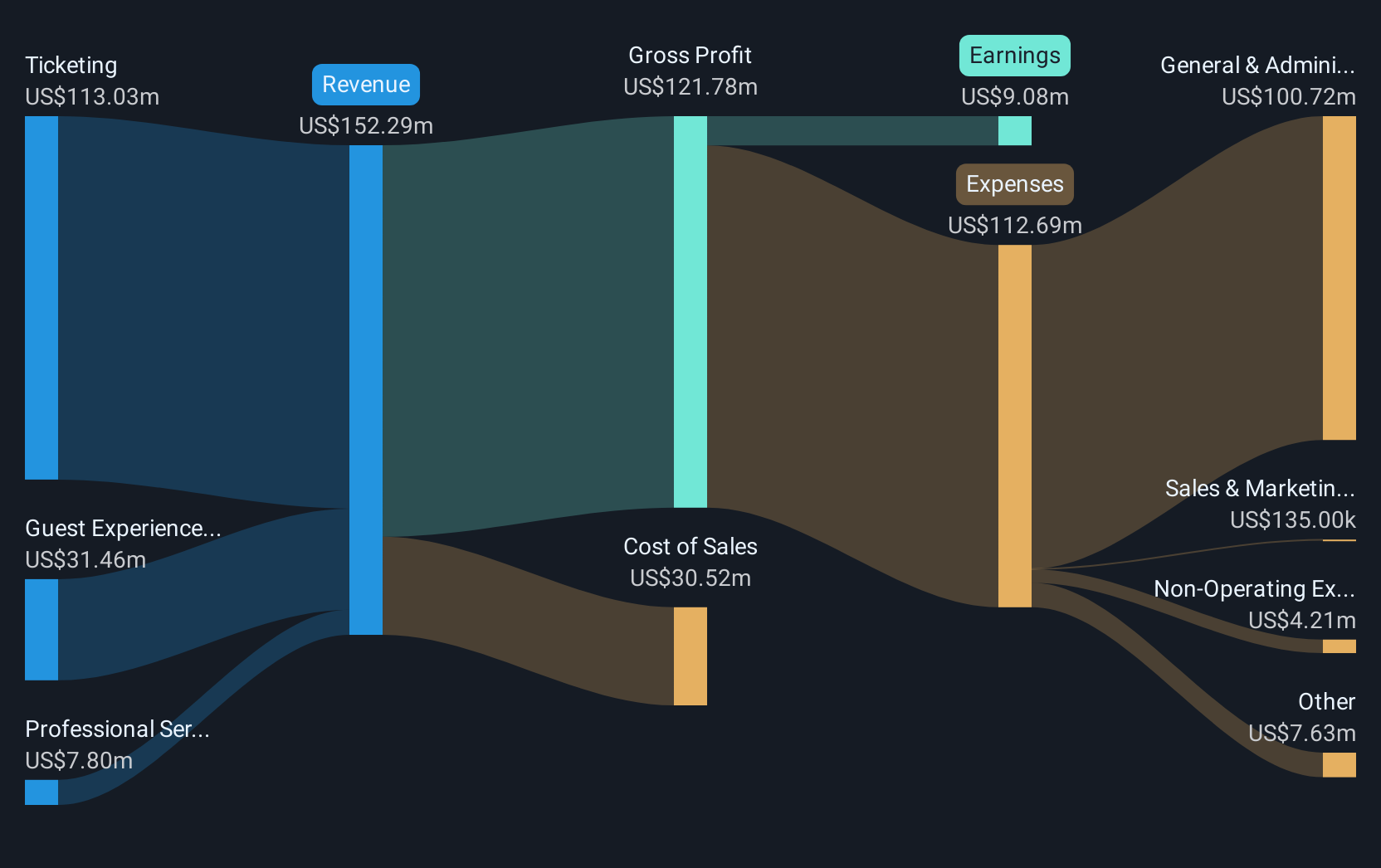

Operations: The company generates revenue through three main segments: Ticketing ($114.34 million), Guest Experience ($28.66 million), and Professional Services ($8.00 million).

Market Cap: £136.31M

accesso Technology Group, with a market cap of £136.31 million, has shown resilience in the penny stock landscape through strategic advancements and financial management. The company recently enhanced its product offerings with AI-driven solutions like accesso Freedom and Scan & Go, aiming to improve guest experiences across attractions globally. Financially, accesso's debt levels have decreased over five years while maintaining profitability growth at 19.9% last year, surpassing industry averages. Despite lowering its revenue guidance for 2025, the company continues to buy back shares and strengthen its board with experienced leaders like new CCO Mike Evenson.

- Dive into the specifics of accesso Technology Group here with our thorough balance sheet health report.

- Gain insights into accesso Technology Group's outlook and expected performance with our report on the company's earnings estimates.

Iofina (AIM:IOF)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Iofina plc, with a market cap of £46.05 million, explores, develops, and produces iodine and halogen-based specialty chemical derivatives from oil and gas operations across North America, Asia, South America, Europe, and internationally.

Operations: The company generates revenue of $57.65 million from its segment focused on halogen derivatives and iodine.

Market Cap: £46.05M

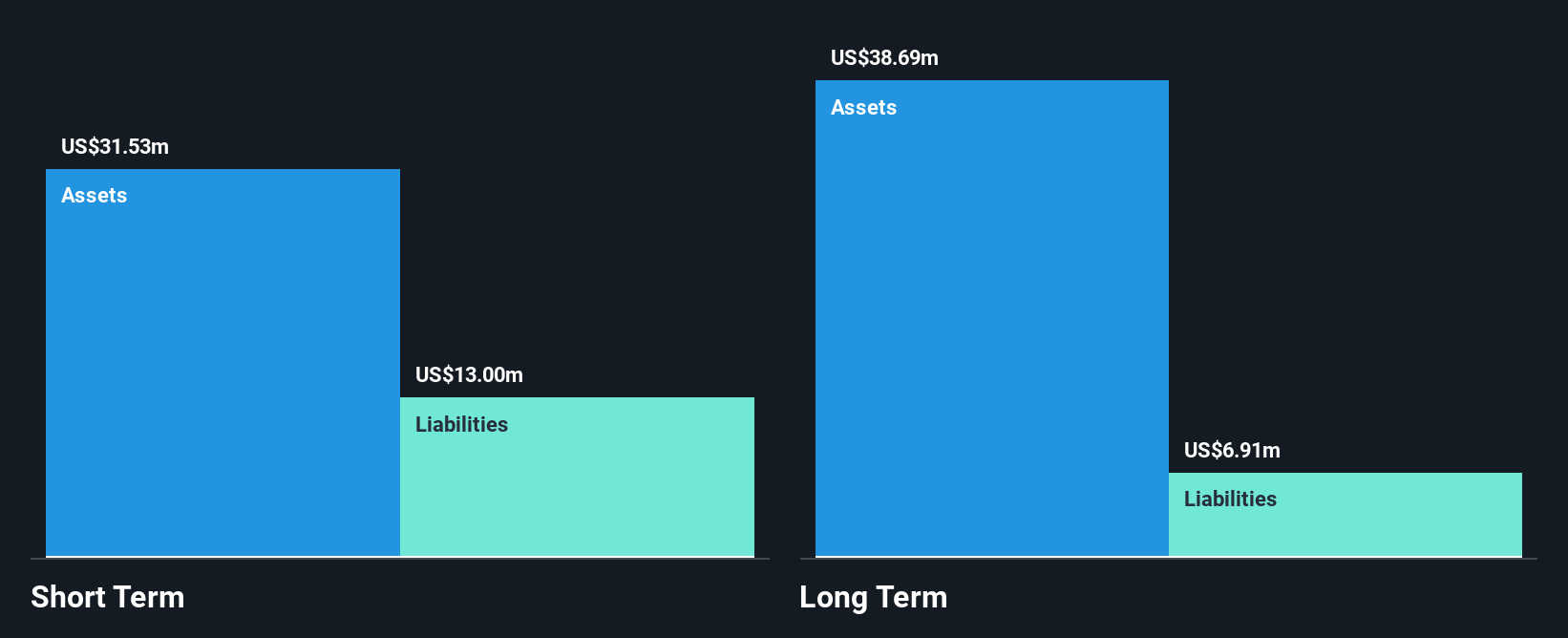

Iofina plc, with a market cap of £46.05 million, has demonstrated significant progress in the penny stock arena through strategic partnerships and financial improvements. The company's debt to equity ratio has impressively decreased from 80% to 14.4% over five years, with short-term assets covering both short- and long-term liabilities effectively. Recent agreements, like the one with Western Midstream Partners for a new IOsorb® plant in the Permian Basin, highlight growth potential by doubling current plant capacity and expanding iodine production capabilities. Despite challenges such as low return on equity at 9.6%, Iofina's earnings have grown significantly by 33.5% over the past year, outpacing industry averages.

- Click here to discover the nuances of Iofina with our detailed analytical financial health report.

- Learn about Iofina's future growth trajectory here.

QinetiQ Group (LSE:QQ.)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: QinetiQ Group plc offers science and technology solutions in the defense, security, and infrastructure sectors across the UK, US, Australia, and internationally with a market cap of £2.22 billion.

Operations: The company's revenue is divided into EMEA Services, generating £1.47 billion, and Global Solutions, contributing £417 million.

Market Cap: £2.22B

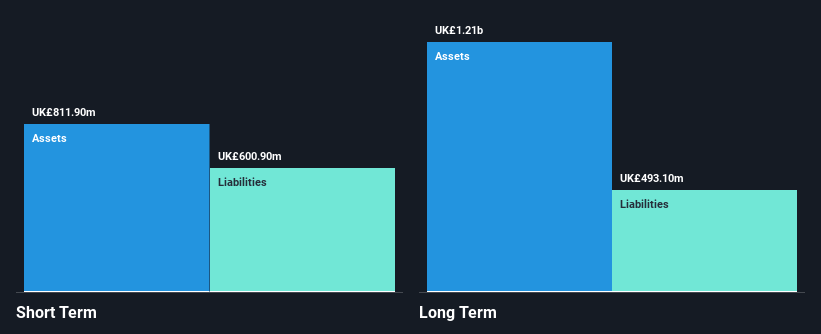

QinetiQ Group plc, with a market cap of £2.22 billion, operates in the defense and technology sectors globally. Recent executive appointments to the QinetiQ SSA Board aim to strengthen leadership amid strategic challenges. Despite reporting a decline in half-year sales to £900.4 million and net income to £38.3 million, the company increased its interim dividend by 7%, reflecting commitment to shareholder returns. While currently unprofitable with losses increasing over five years, its debt is well-covered by operating cash flow and interest payments are adequately managed by EBIT, indicating financial stability despite volatility in earnings growth forecasts at 74.44% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of QinetiQ Group.

- Explore QinetiQ Group's analyst forecasts in our growth report.

Next Steps

- Explore the 306 names from our UK Penny Stocks screener here.

- Contemplating Other Strategies? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QinetiQ Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:QQ.

QinetiQ Group

Provides science and technology solution in the defense, security, and infrastructure markets in the United Kingdom, the United States, Australia, and internationally.

Undervalued with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Silver's Breakout to over $50US will make Magma’s future shine with drill sampling returning 115g/t Silver and 2.3 g/t Gold at its Peru Mine

SEGRO's Revenue to Rise 14.7% Amidst Optimistic Growth Plans

After the AI Party: A Sobering Look at Microsoft's Future

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026