- United Kingdom

- /

- REITS

- /

- LSE:LAND

Land Securities Group (LON:LAND shareholders incur further losses as stock declines 5.6% this week, taking five-year losses to 4.3%

For many, the main point of investing is to generate higher returns than the overall market. But the main game is to find enough winners to more than offset the losers So we wouldn't blame long term Land Securities Group Plc (LON:LAND) shareholders for doubting their decision to hold, with the stock down 25% over a half decade.

If the past week is anything to go by, investor sentiment for Land Securities Group isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

Check out our latest analysis for Land Securities Group

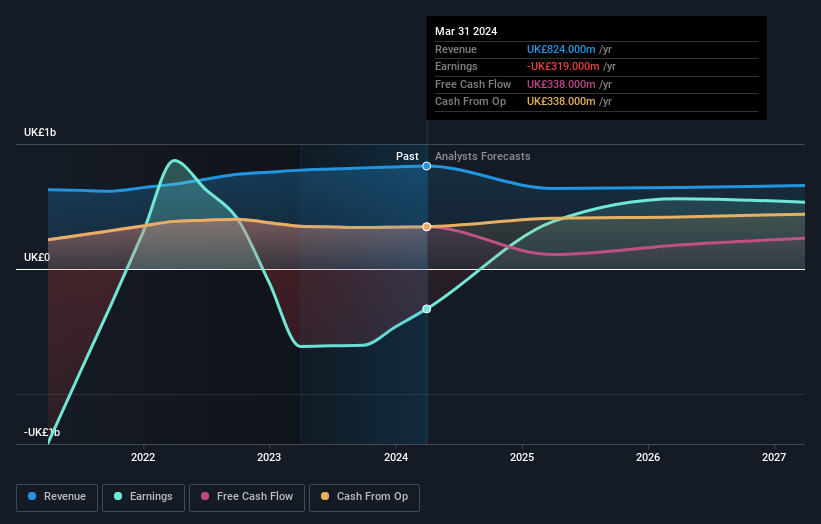

Because Land Securities Group made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

Over five years, Land Securities Group grew its revenue at 2.3% per year. That's far from impressive given all the money it is losing. Given this fairly low revenue growth (and lack of profits), it's not particularly surprising to see the stock down 5% (annualized) in the same time frame. The key question is whether the company can make it to profitability, and beyond, without trouble. Shareholders will want the company to approach profitability if it can't grow revenue any faster.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

If you are thinking of buying or selling Land Securities Group stock, you should check out this FREE detailed report on its balance sheet.

What About Dividends?

As well as measuring the share price return, investors should also consider the total shareholder return (TSR). The TSR incorporates the value of any spin-offs or discounted capital raisings, along with any dividends, based on the assumption that the dividends are reinvested. It's fair to say that the TSR gives a more complete picture for stocks that pay a dividend. In the case of Land Securities Group, it has a TSR of -4.3% for the last 5 years. That exceeds its share price return that we previously mentioned. The dividends paid by the company have thusly boosted the total shareholder return.

A Different Perspective

It's nice to see that Land Securities Group shareholders have received a total shareholder return of 13% over the last year. And that does include the dividend. That certainly beats the loss of about 0.8% per year over the last half decade. This makes us a little wary, but the business might have turned around its fortunes. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Like risks, for instance. Every company has them, and we've spotted 2 warning signs for Land Securities Group (of which 1 is concerning!) you should know about.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on British exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:LAND

Land Securities Group

At Landsec, we build and invest in buildings, spaces and partnerships to create sustainable places, connect communities and realise potential.

Undervalued established dividend payer.