- United Kingdom

- /

- Metals and Mining

- /

- LSE:HOC

UK Stocks That May Be Undervalued In June 2025

Reviewed by Simply Wall St

In recent months, the United Kingdom's FTSE 100 index has faced challenges, notably impacted by weak trade data from China and declining commodity prices. As the market navigates these pressures, investors may find opportunities in stocks that appear undervalued amid broader economic uncertainties. Identifying such stocks often involves looking for companies with strong fundamentals and resilience to external shocks, which can be particularly appealing in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victrex (LSE:VCT) | £7.83 | £15.61 | 49.8% |

| SDI Group (AIM:SDI) | £0.734 | £1.35 | 45.8% |

| Informa (LSE:INF) | £7.922 | £14.45 | 45.2% |

| GlobalData (AIM:DATA) | £1.75 | £3.10 | 43.6% |

| Just Group (LSE:JUST) | £1.48 | £2.95 | 49.9% |

| Duke Capital (AIM:DUKE) | £0.2875 | £0.53 | 46.1% |

| Entain (LSE:ENT) | £7.428 | £13.67 | 45.7% |

| Huddled Group (AIM:HUD) | £0.0325 | £0.06 | 45.7% |

| Deliveroo (LSE:ROO) | £1.754 | £3.13 | 44% |

| Velocity Composites (AIM:VEL) | £0.27 | £0.49 | 44.9% |

We're going to check out a few of the best picks from our screener tool.

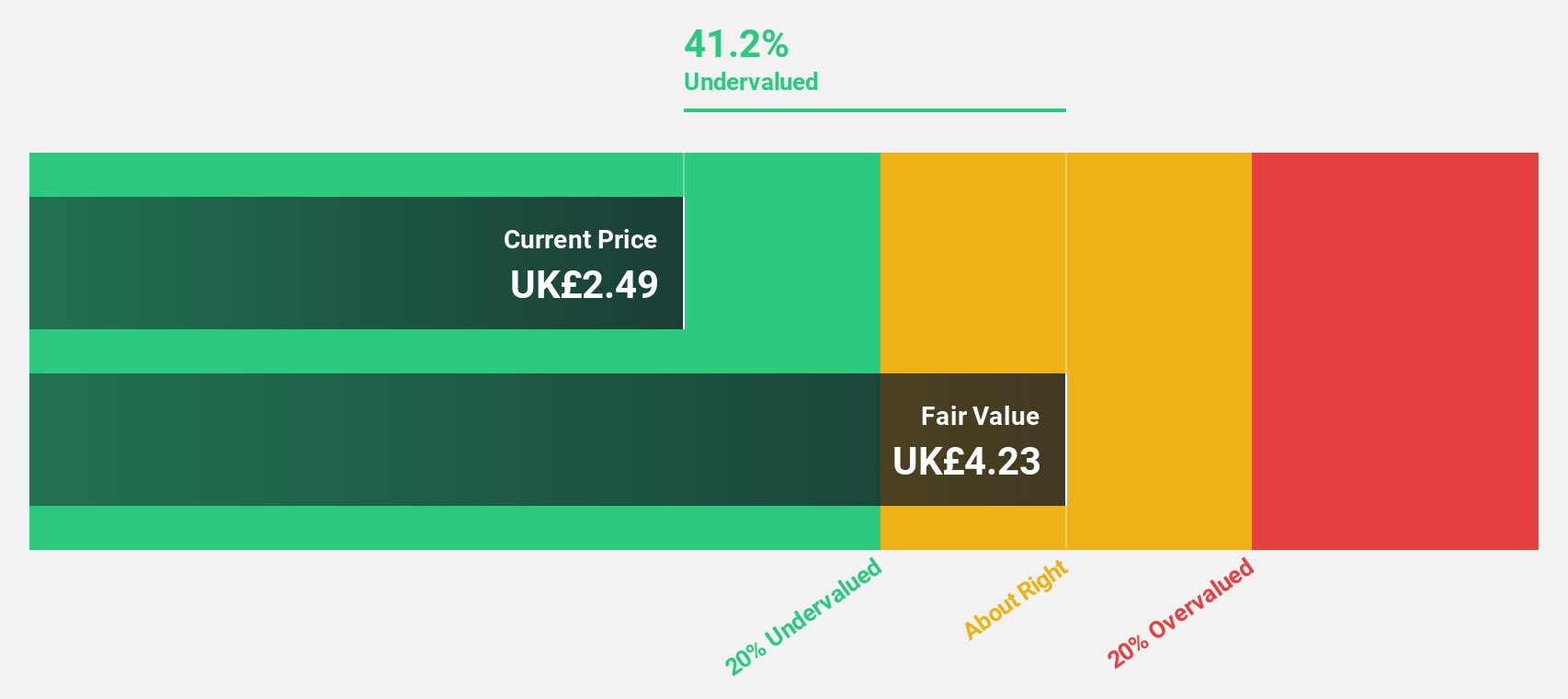

Fintel (AIM:FNTL)

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £284.45 million.

Operations: Fintel Plc's revenue is derived from three main segments: Research & Fintech (£25.40 million), Distribution Channels (£23.80 million), and Intermediary Services (£29.10 million).

Estimated Discount To Fair Value: 32.7%

Fintel appears undervalued based on discounted cash flow analysis, trading at £2.73, below its estimated fair value of £4.05. Despite a decline in net profit margin from 10.9% to 7.5%, earnings are expected to grow significantly at over 30% annually, outpacing the UK market's growth rate of 14.5%. Recent leadership changes and a dividend increase further highlight Fintel's strategic adjustments amid anticipated revenue growth of 5.8% annually, surpassing the broader market's pace.

- The analysis detailed in our Fintel growth report hints at robust future financial performance.

- Navigate through the intricacies of Fintel with our comprehensive financial health report here.

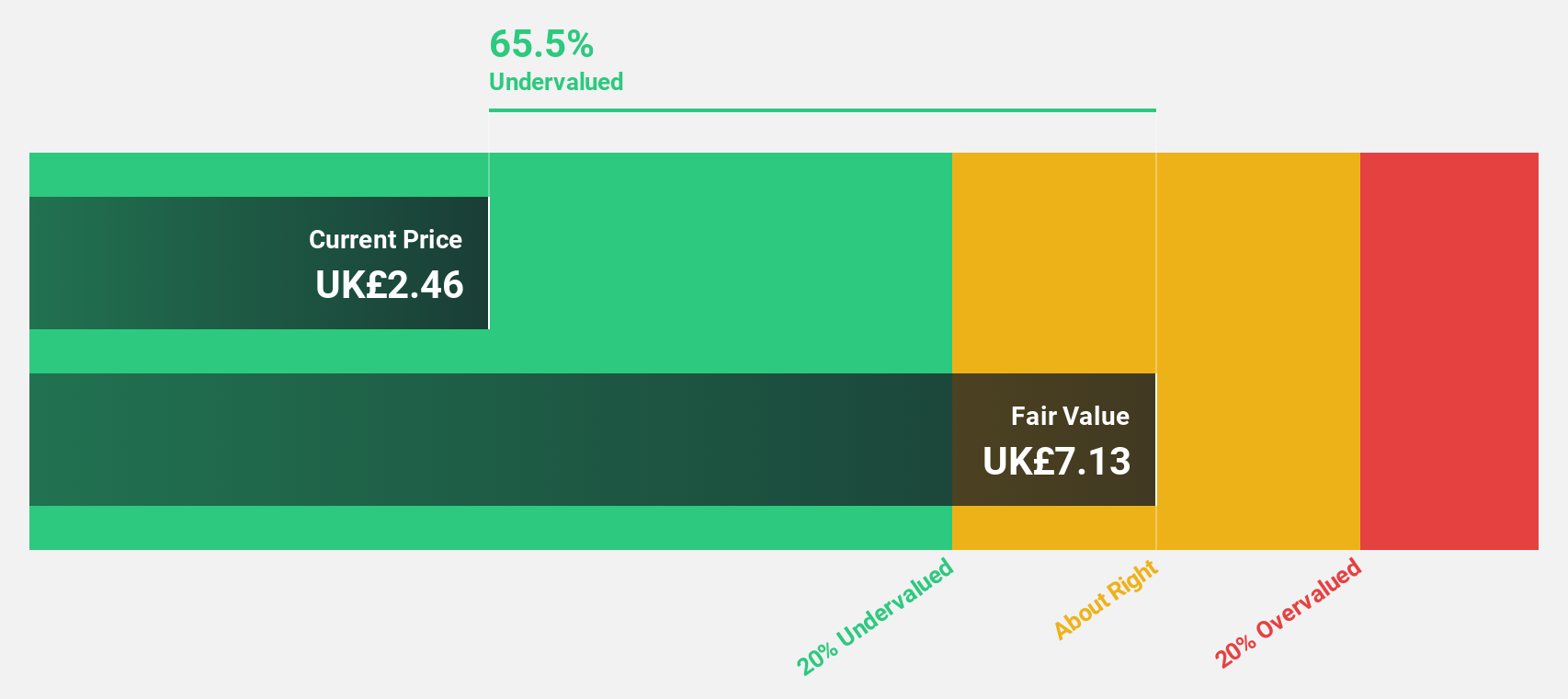

Hochschild Mining (LSE:HOC)

Overview: Hochschild Mining plc is a precious metals company involved in the exploration, mining, processing, and sale of gold and silver deposits across Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile with a market cap of £1.44 billion.

Operations: The company's revenue segments include $293.34 million from San Jose, $149.82 million from Mara Rosa, $504.34 million from Inmaculada, and -$0.26 million from Pallancata.

Estimated Discount To Fair Value: 27.7%

Hochschild Mining is trading at £2.8, significantly below its estimated fair value of £3.88, suggesting it may be undervalued based on discounted cash flow analysis. The company has shown a strong recovery with net income reaching $97.01 million after a previous loss and has introduced a dividend policy linked to free cash flow. Despite share price volatility, earnings are forecast to grow 24.7% annually, outpacing the UK market's growth rate of 14.5%.

- Our earnings growth report unveils the potential for significant increases in Hochschild Mining's future results.

- Get an in-depth perspective on Hochschild Mining's balance sheet by reading our health report here.

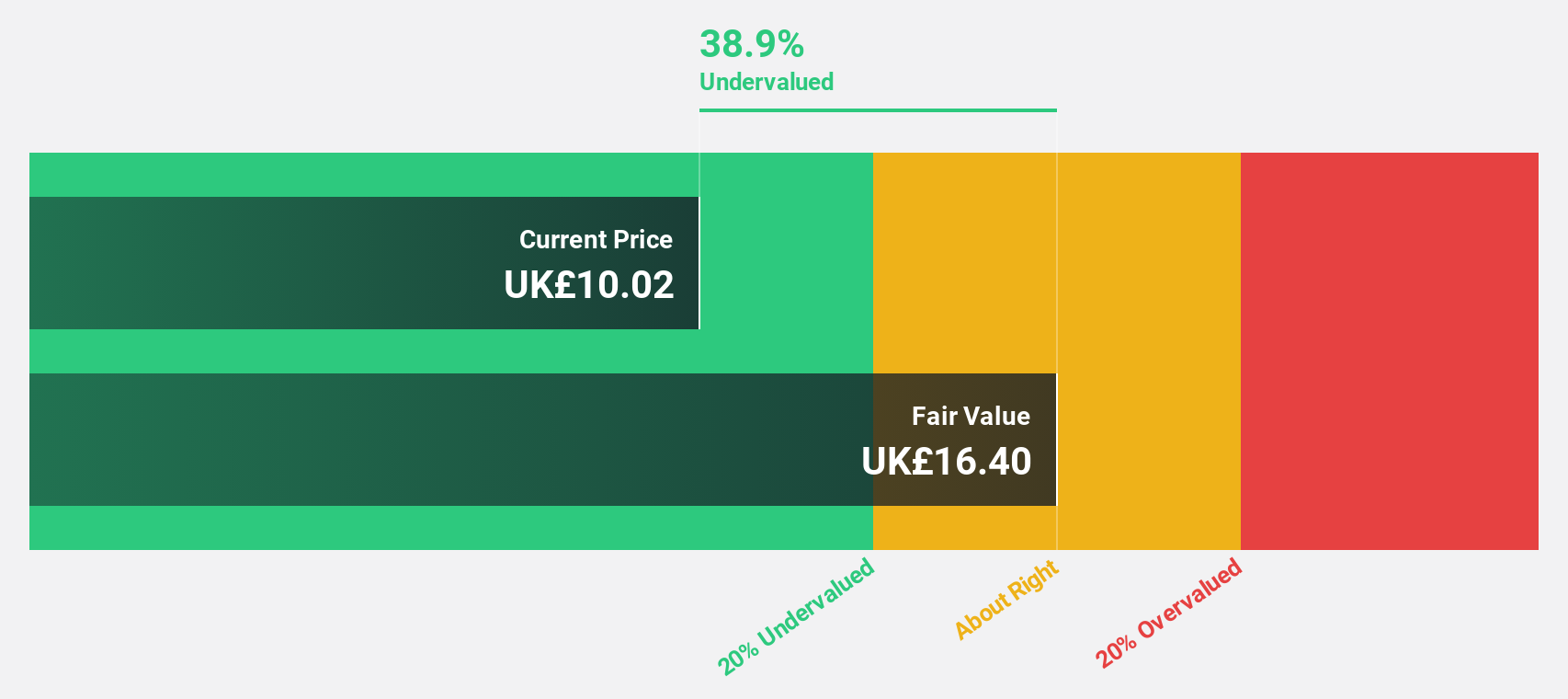

Savills (LSE:SVS)

Overview: Savills plc is a global real estate services provider operating across the UK, Continental Europe, Asia Pacific, Africa, North America, and the Middle East with a market cap of £1.32 billion.

Operations: The company's revenue segments include Consultancy (£495.50 million), Transaction Advisory (£870 million), Investment Management (£94 million), and Property and Facilities Management (£944.50 million).

Estimated Discount To Fair Value: 42.2%

Savills is trading at £9.72, considerably below its estimated fair value of £16.81, highlighting potential undervaluation based on discounted cash flow analysis. Despite a historically unstable dividend track record, recent announcements include a final dividend of 14.5 pence per share. Earnings are projected to grow significantly at 27.8% annually over the next three years, surpassing the UK market's growth rate of 14.5%, though return on equity forecasts remain modest at 13.9%.

- Insights from our recent growth report point to a promising forecast for Savills' business outlook.

- Delve into the full analysis health report here for a deeper understanding of Savills.

Seize The Opportunity

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 50 more companies for you to explore.Click here to unveil our expertly curated list of 53 Undervalued UK Stocks Based On Cash Flows.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Hochschild Mining might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:HOC

Hochschild Mining

A precious metals company, engages in the exploration, mining, processing, and sale of gold and silver deposits in Peru, Argentina, the United Kingdom, Canada, Brazil, and Chile.

Outstanding track record and undervalued.

Similar Companies

Market Insights

Community Narratives