- United Kingdom

- /

- Marine and Shipping

- /

- LSE:ICGC

Exploring Undiscovered Gems in the UK for December 2025

Reviewed by Simply Wall St

As the United Kingdom's FTSE 100 index faces headwinds from weak trade data out of China, impacting major commodity-linked companies and fund managers, investors are increasingly turning their attention to smaller-cap opportunities that might be less exposed to global economic fluctuations. In this environment, identifying stocks with strong fundamentals and growth potential can be particularly rewarding for those seeking undiscovered gems in the UK market.

Top 10 Undiscovered Gems With Strong Fundamentals In The United Kingdom

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| B.P. Marsh & Partners | NA | 42.17% | 45.70% | ★★★★★★ |

| Goodwin | 19.83% | 10.66% | 18.55% | ★★★★★★ |

| Andrews Sykes Group | NA | 2.01% | 5.12% | ★★★★★★ |

| BioPharma Credit | NA | 7.73% | 7.94% | ★★★★★★ |

| Georgia Capital | NA | 2.23% | 16.34% | ★★★★★★ |

| Vectron Systems | NA | 2.48% | 28.82% | ★★★★★★ |

| Nationwide Building Society | 282.42% | 9.69% | 21.24% | ★★★★★☆ |

| Law Debenture | 15.39% | 21.17% | 19.12% | ★★★★★☆ |

| Distribution Finance Capital Holdings | 9.37% | 48.09% | 66.49% | ★★★★★☆ |

| FW Thorpe | 2.12% | 10.94% | 13.25% | ★★★★★☆ |

Let's dive into some prime choices out of from the screener.

BioPharma Credit (LSE:BPCR)

Simply Wall St Value Rating: ★★★★★★

Overview: BioPharma Credit PLC is an investment trust that focuses on investing in interest-bearing debt assets, with a market capitalization of $1.02 billion.

Operations: The primary revenue stream for BioPharma Credit comes from its investments in debt assets secured by royalties, generating $154.66 million.

BioPharma Credit, a notable player in the life sciences sector, has been making waves with its recent addition to the FTSE 250 Index. Over the past year, its earnings surged by 12.6%, outpacing the Capital Markets industry average of 6.5%. The company remains debt-free for over five years and boasts high-quality earnings. With a recent buyback of nearly 7.49% of shares for $1.67 million and trading at 24.3% below estimated fair value, it seems poised for growth despite market fluctuations. Moreover, dividends have reached a total of 73.68 cents since IPO, underscoring its commitment to shareholder returns.

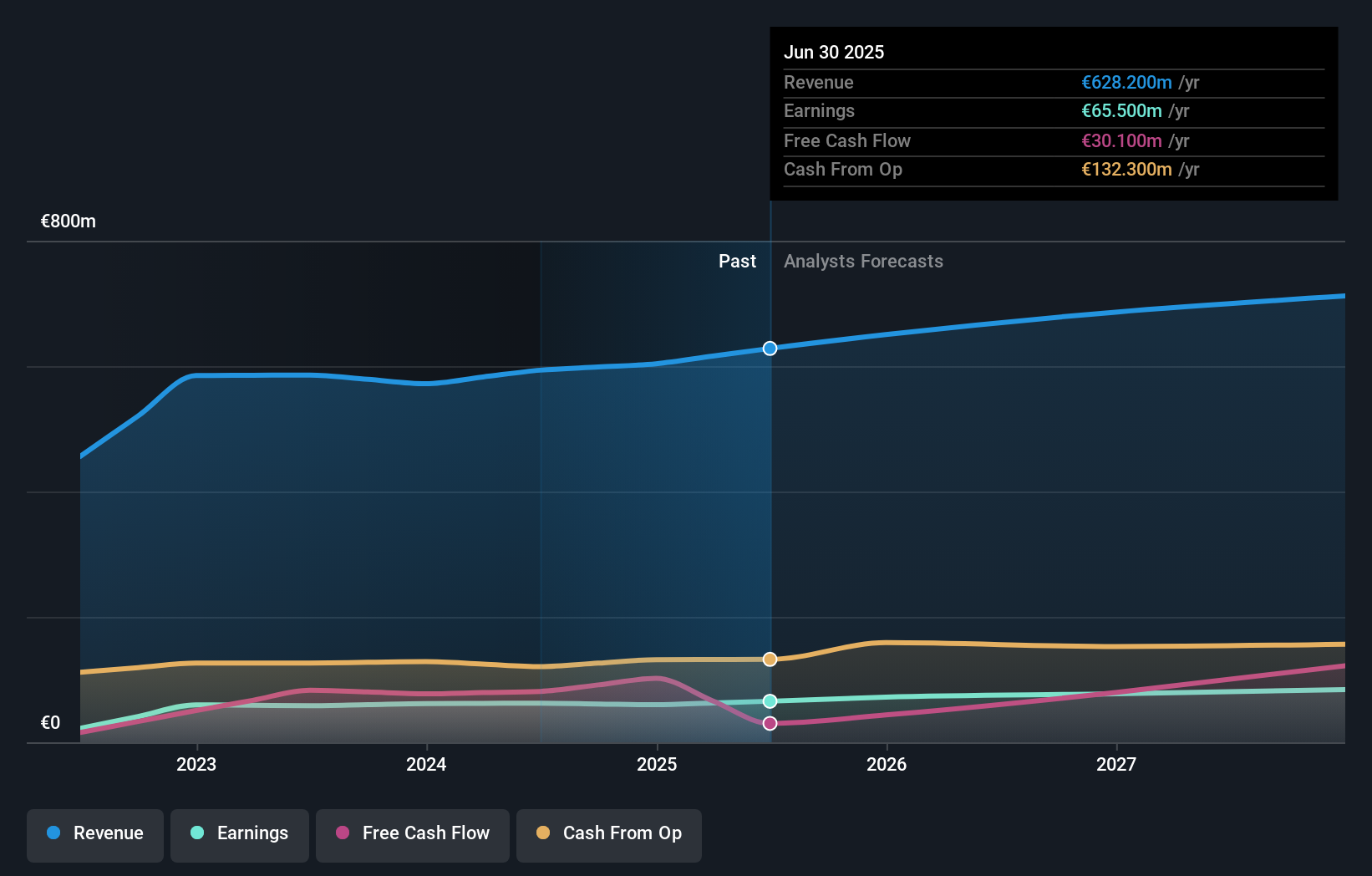

Irish Continental Group (LSE:ICGC)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Irish Continental Group plc is a maritime transport company serving Ireland, the United Kingdom, and Continental Europe with a market cap of £808.43 million.

Operations: The company generates revenue primarily from its Ferries segment, contributing €441.90 million, and its Container and Terminal segment, which adds €219.60 million.

With a satisfactory net debt to equity ratio of 39.8%, Irish Continental Group (ICGC) shows solid financial health, having reduced its debt from 75.6% to 45.7% over five years. The company’s earnings grew by 5% last year, outpacing the shipping industry's -11.6%. Trading at a significant discount of 62.5% below its estimated fair value, ICGC's high-quality earnings are supported by well-covered interest payments with an EBIT coverage of 7.9x. Despite recent insider selling, free cash flow remains positive with €573 million revenue for ten months ending October 2025, up from €521 million in the previous year.

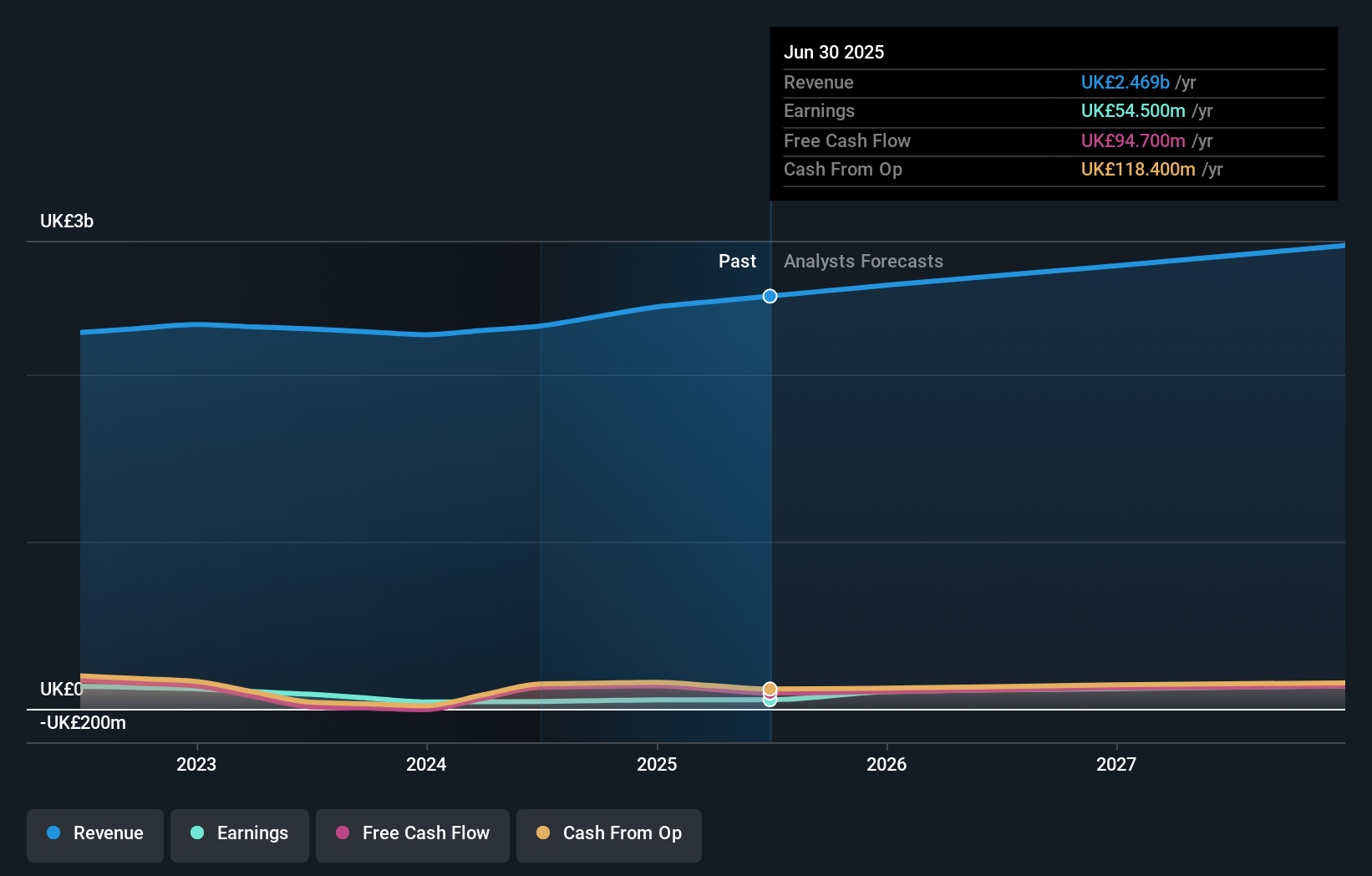

Savills (LSE:SVS)

Simply Wall St Value Rating: ★★★★★☆

Overview: Savills plc is a global real estate services company operating in the UK, Continental Europe, Asia Pacific, Africa, North America, and the Middle East with a market capitalization of approximately £1.38 billion.

Operations: Savills generates revenue primarily from four segments: Property and Facilities Management (£965.20 million), Transaction Advisory (£877.30 million), Consultancy (£534.90 million), and Investment Management (£91.20 million).

Savills, a notable player in the UK real estate sector, is trading at 24.8% below its estimated fair value, presenting potential for investors. The company boasts a satisfactory net debt to equity ratio of 2.3%, indicating sound financial health. Despite earnings growth of 23% not surpassing the industry's 23.4%, Savills remains strong with high-quality past earnings and positive free cash flow. Recent strategic expansions into Asia-Pacific and retail advisory services in the U.S., alongside key executive appointments, aim to leverage market opportunities and enhance global reach amidst macroeconomic challenges and rising costs impacting profit margins.

Seize The Opportunity

- Dive into all 58 of the UK Undiscovered Gems With Strong Fundamentals we have identified here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:ICGC

Irish Continental Group

Operates as a maritime transport company in Ireland, the United Kingdom, and Continental Europe.

Proven track record with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Constellation Energy Dividends and Growth

CoreWeave's Revenue Expected to Rocket 77.88% in 5-Year Forecast

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026