- United Kingdom

- /

- Real Estate

- /

- LSE:IWG

Top UK Growth Companies With High Insider Ownership In July 2025

Reviewed by Simply Wall St

In the wake of recent market fluctuations, driven by weak trade data from China and its ripple effects on the FTSE 100, investors are increasingly seeking stability and growth potential in their portfolios. In such an environment, companies with high insider ownership can be particularly appealing as they often indicate a strong alignment between management and shareholder interests, which can be crucial for navigating uncertain economic landscapes.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Taylor Maritime (LSE:TMI) | 20.7% | 65% |

| SRT Marine Systems (AIM:SRT) | 24.1% | 91.4% |

| QinetiQ Group (LSE:QQ.) | 13.3% | 67.3% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 20.8% |

| Hochschild Mining (LSE:HOC) | 38.4% | 25.6% |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 63.5% |

| Faron Pharmaceuticals Oy (AIM:FARN) | 24.6% | 53.3% |

| ENGAGE XR Holdings (AIM:EXR) | 15.3% | 84.5% |

| B90 Holdings (AIM:B90) | 22.1% | 138.6% |

| ASA International Group (LSE:ASAI) | 18.1% | 23.3% |

Let's review some notable picks from our screened stocks.

Gulf Keystone Petroleum (LSE:GKP)

Simply Wall St Growth Rating: ★★★★★★

Overview: Gulf Keystone Petroleum Limited operates in the exploration, development, and production of oil and gas in the Kurdistan Region of Iraq, with a market cap of approximately £360.06 million.

Operations: The company's revenue is primarily generated from its exploration and production activities in oil and gas, amounting to $151.21 million.

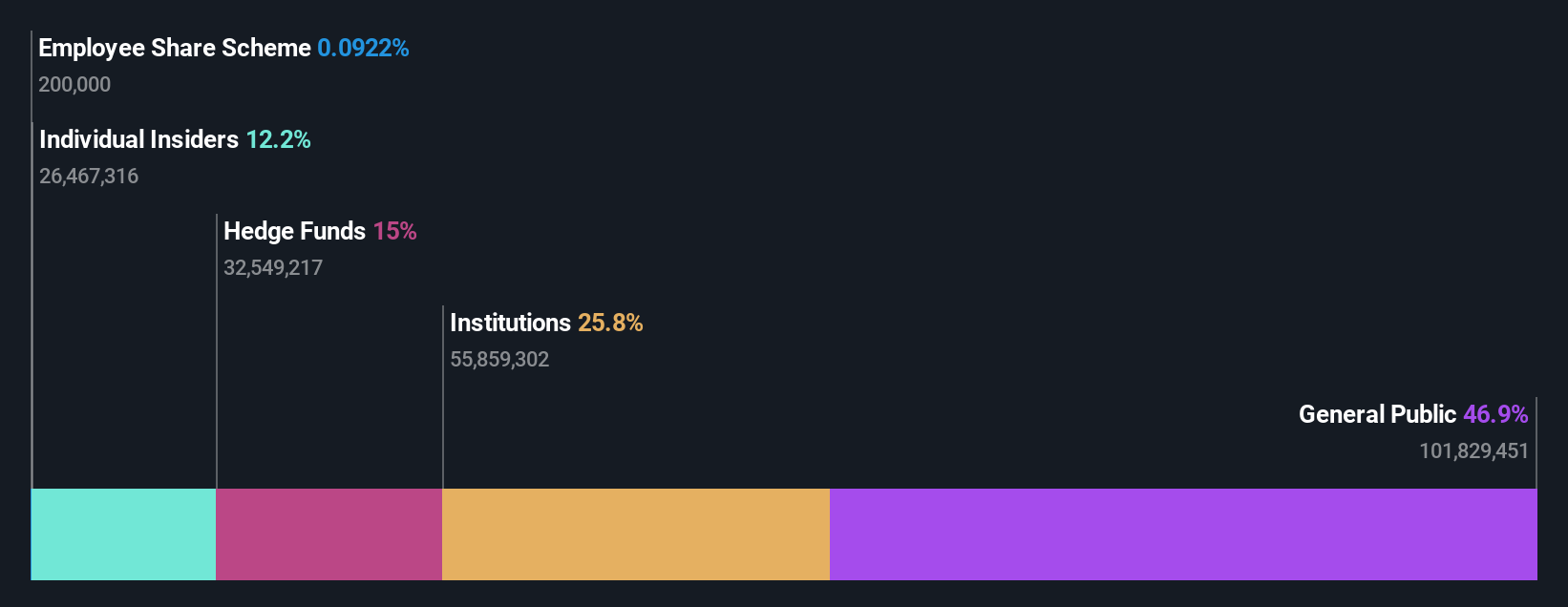

Insider Ownership: 12.2%

Return On Equity Forecast: 25% (2027 estimate)

Gulf Keystone Petroleum's earnings are forecast to grow significantly, outpacing the UK market with a 63.5% annual increase. Revenue is also expected to expand by 21.3% annually, surpassing both market and high growth benchmarks. However, its dividend yield of 10.39% isn't well covered by earnings, posing a potential risk for investors focused on income sustainability. Recent operational disruptions due to safety precautions at Shaikan Field highlight potential volatility despite no asset damage reported.

- Delve into the full analysis future growth report here for a deeper understanding of Gulf Keystone Petroleum.

- Upon reviewing our latest valuation report, Gulf Keystone Petroleum's share price might be too optimistic.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: International Workplace Group plc, along with its subsidiaries, offers workspace solutions across various regions including the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £2.23 billion.

Operations: The company's revenue segments include $1.29 billion from the Americas, $334 million from Asia Pacific, $389 million from Digital and Professional Services, and $1.67 billion from Europe, Middle East, and Africa (EMEA).

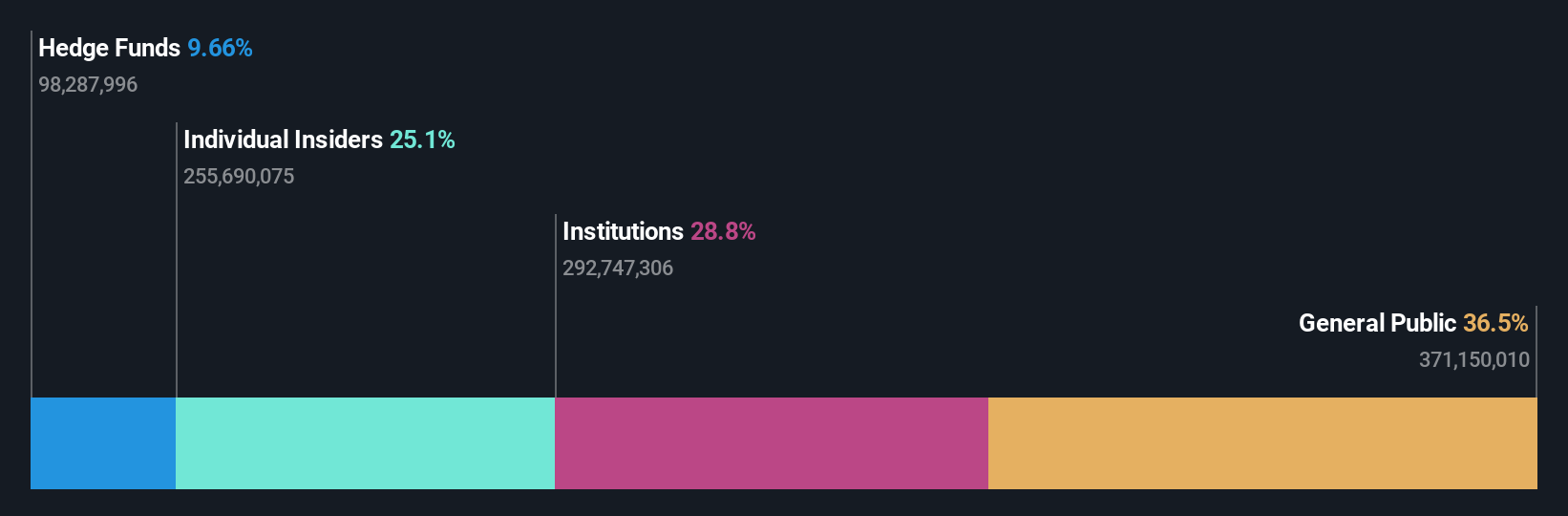

Insider Ownership: 25.2%

Return On Equity Forecast: 36% (2027 estimate)

International Workplace Group is forecast to achieve a significant 53% annual earnings growth, outpacing the UK market, though its revenue growth of 2.7% lags behind. The company recently completed a €300 million fixed-income offering and expanded its share buyback plan by $50 million, totaling $100 million. Despite becoming profitable this year, interest payments remain inadequately covered by earnings, and large one-off items affect financial results.

- Click here to discover the nuances of International Workplace Group with our detailed analytical future growth report.

- Insights from our recent valuation report point to the potential overvaluation of International Workplace Group shares in the market.

Kainos Group (LSE:KNOS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Kainos Group plc provides digital technology services across the United Kingdom, Ireland, America, Central Europe, and internationally with a market cap of £881.85 million.

Operations: The company's revenue is derived from three main segments: Digital Services (£197.17 million), Workday Products (£71.35 million), and Workday Services (£98.72 million).

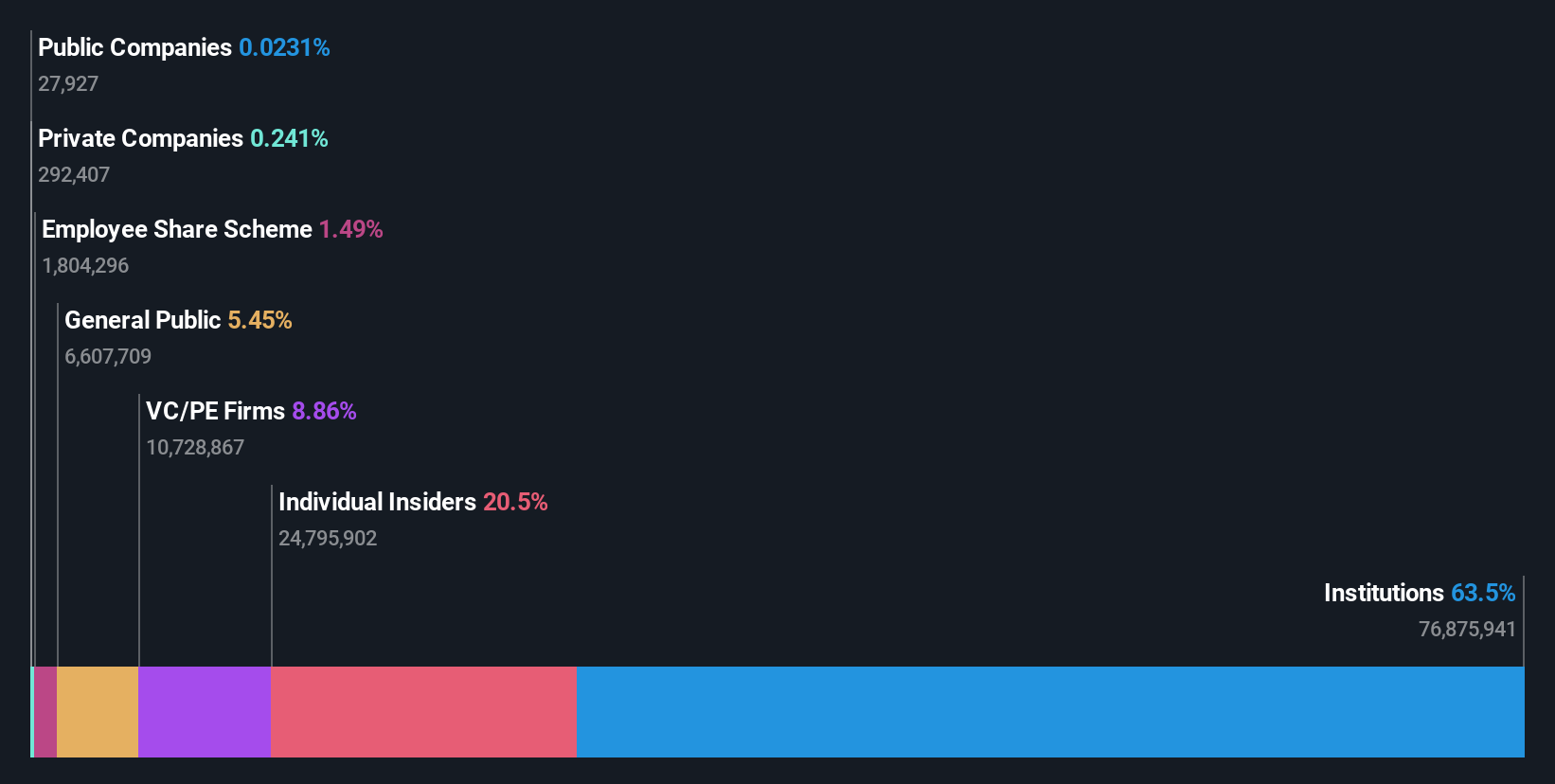

Insider Ownership: 20.5%

Return On Equity Forecast: 38% (2028 estimate)

Kainos Group's earnings are projected to grow at 16.7% annually, surpassing the UK market average, with revenue growth forecasted at 7.1%. The company is trading below estimated fair value and has initiated a £30 million share buyback program to reduce capital. Recent board changes include appointing Shruthi Chindalur as a Non-Executive Director. Despite a decline in sales and net income for the year ending March 2025, Kainos proposed a £23.6 million final dividend pending shareholder approval.

- Navigate through the intricacies of Kainos Group with our comprehensive analyst estimates report here.

- Our valuation report unveils the possibility Kainos Group's shares may be trading at a discount.

Make It Happen

- Delve into our full catalog of 64 Fast Growing UK Companies With High Insider Ownership here.

- Ready For A Different Approach? Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IWG

International Workplace Group

Provides workspace solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

Reasonable growth potential with low risk.

Similar Companies

Market Insights

Community Narratives