- United Kingdom

- /

- Real Estate

- /

- LSE:IWG

3 UK Growth Stocks Insiders Are Eager To Own

Reviewed by Simply Wall St

In the current climate, the UK market is experiencing a downturn, with indices like the FTSE 100 and FTSE 250 closing lower due to weak trade data from China. Amid these challenges, investors often look for growth companies with high insider ownership as they can indicate confidence in a company's potential to navigate uncertain economic conditions.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Gulf Keystone Petroleum (LSE:GKP) | 12.2% | 102.1% |

| Helios Underwriting (AIM:HUW) | 23.8% | 23.1% |

| ASA International Group (LSE:ASAI) | 16.8% | 25.7% |

| LSL Property Services (LSE:LSL) | 10.5% | 26.9% |

| Facilities by ADF (AIM:ADF) | 13.2% | 190% |

| Mortgage Advice Bureau (Holdings) (AIM:MAB1) | 19.8% | 25.4% |

| Judges Scientific (AIM:JDG) | 10.7% | 29.3% |

| B90 Holdings (AIM:B90) | 24.4% | 166.8% |

| Getech Group (AIM:GTC) | 11.8% | 114.5% |

| Anglo Asian Mining (AIM:AAZ) | 40% | 189.1% |

Let's review some notable picks from our screened stocks.

Brickability Group (AIM:BRCK)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Brickability Group Plc, with a market cap of £200.54 million, operates in the United Kingdom by supplying, distributing, and importing building products through its subsidiaries.

Operations: The company's revenue segments include Bricks and Building Materials (£380.56 million), Importing (£90.55 million), Contracting (£88.22 million), and Distribution (£63.21 million).

Insider Ownership: 28.2%

Brickability Group is poised for significant earnings growth, forecasted at 35.2% annually, outpacing the UK market. However, profit margins have declined from last year and insider selling has been significant recently. Despite this, shares are trading below estimated fair value and revenue is expected to grow faster than the UK market rate. Clive Norman's upcoming departure as a non-executive director may impact governance continuity in 2025.

- Take a closer look at Brickability Group's potential here in our earnings growth report.

- The analysis detailed in our Brickability Group valuation report hints at an inflated share price compared to its estimated value.

International Workplace Group (LSE:IWG)

Simply Wall St Growth Rating: ★★★★★☆

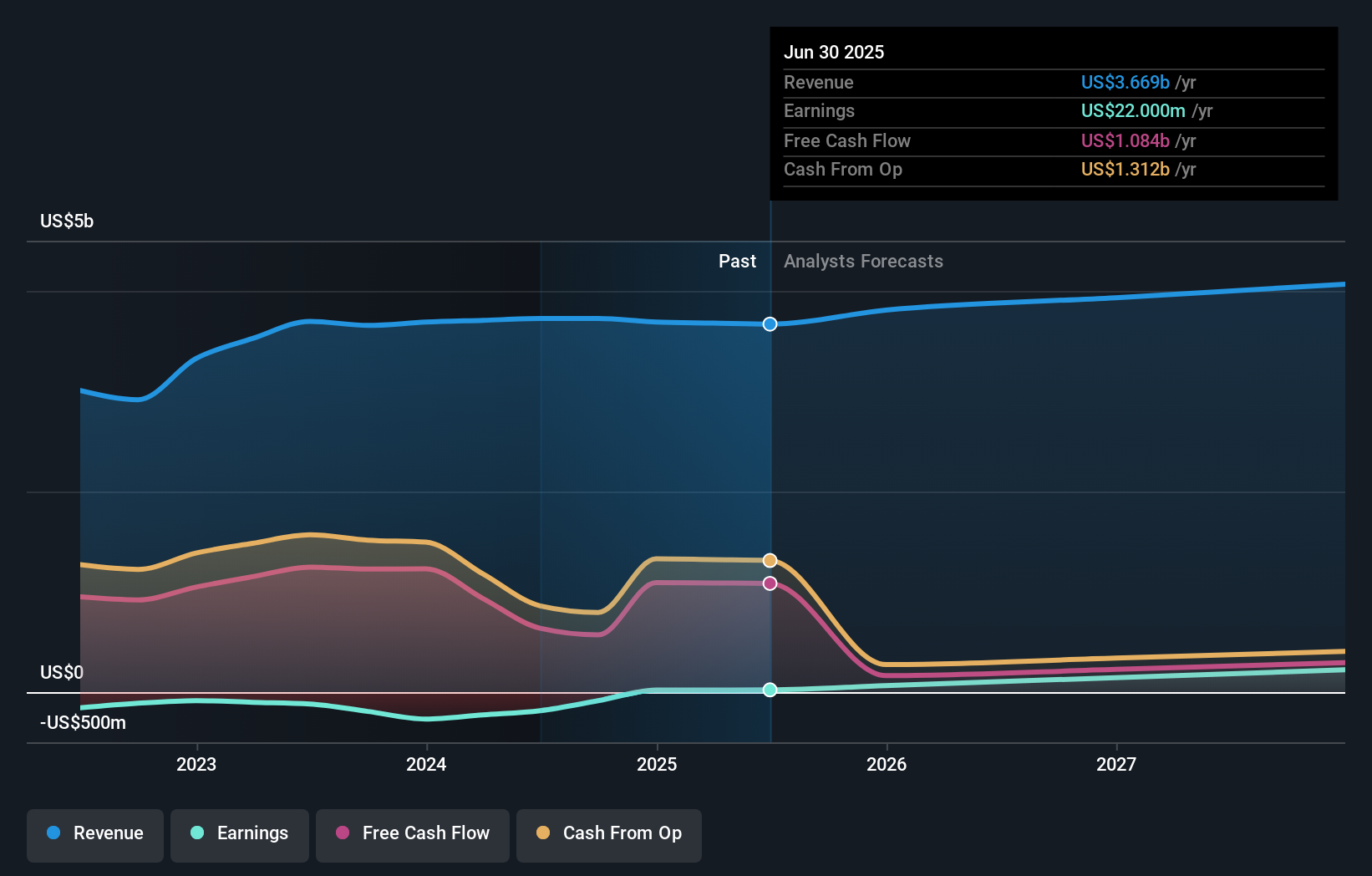

Overview: International Workplace Group plc, with a market cap of £2.01 billion, offers workspace solutions across the Americas, Europe, the Middle East, Africa, and the Asia Pacific through its subsidiaries.

Operations: The company's revenue segments include $402.15 million from Worka, $1.30 billion from the Americas, $343.01 million from Asia Pacific, and $1.69 billion from Europe, the Middle East, and Africa (EMEA).

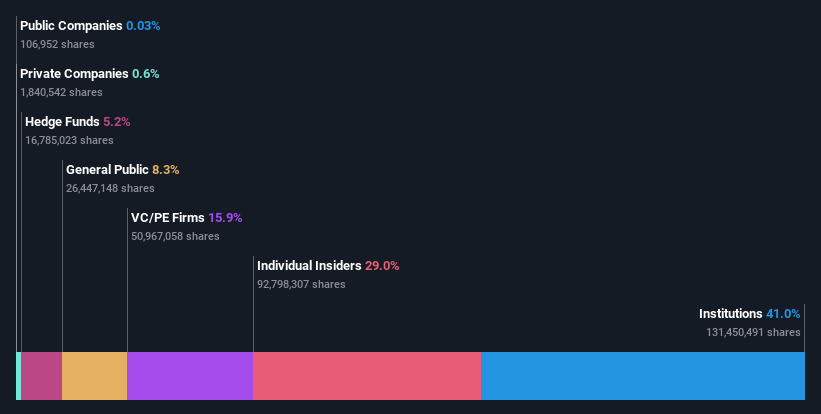

Insider Ownership: 25.2%

International Workplace Group is forecasted to achieve high earnings growth of 118.72% annually, outpacing the UK market and becoming profitable within three years. It trades at a favorable value compared to peers, with analysts predicting a 21.3% price increase. While insider buying has occurred recently, volumes aren't substantial. Revenue growth at 4.3% per year surpasses the UK average but remains under 20%. François Pauly's board departure may influence governance dynamics temporarily.

- Click here to discover the nuances of International Workplace Group with our detailed analytical future growth report.

- Our valuation report unveils the possibility International Workplace Group's shares may be trading at a discount.

TBC Bank Group (LSE:TBCG)

Simply Wall St Growth Rating: ★★★★★☆

Overview: TBC Bank Group PLC operates as a financial services provider offering banking, leasing, insurance, brokerage, and card processing services to corporate and individual customers in Georgia, Azerbaijan, and Uzbekistan with a market cap of £2.44 billion.

Operations: The company's revenue segments include GEL 2.28 billion from Georgian Financial Services and GEL 336.77 million from operations in Uzbekistan.

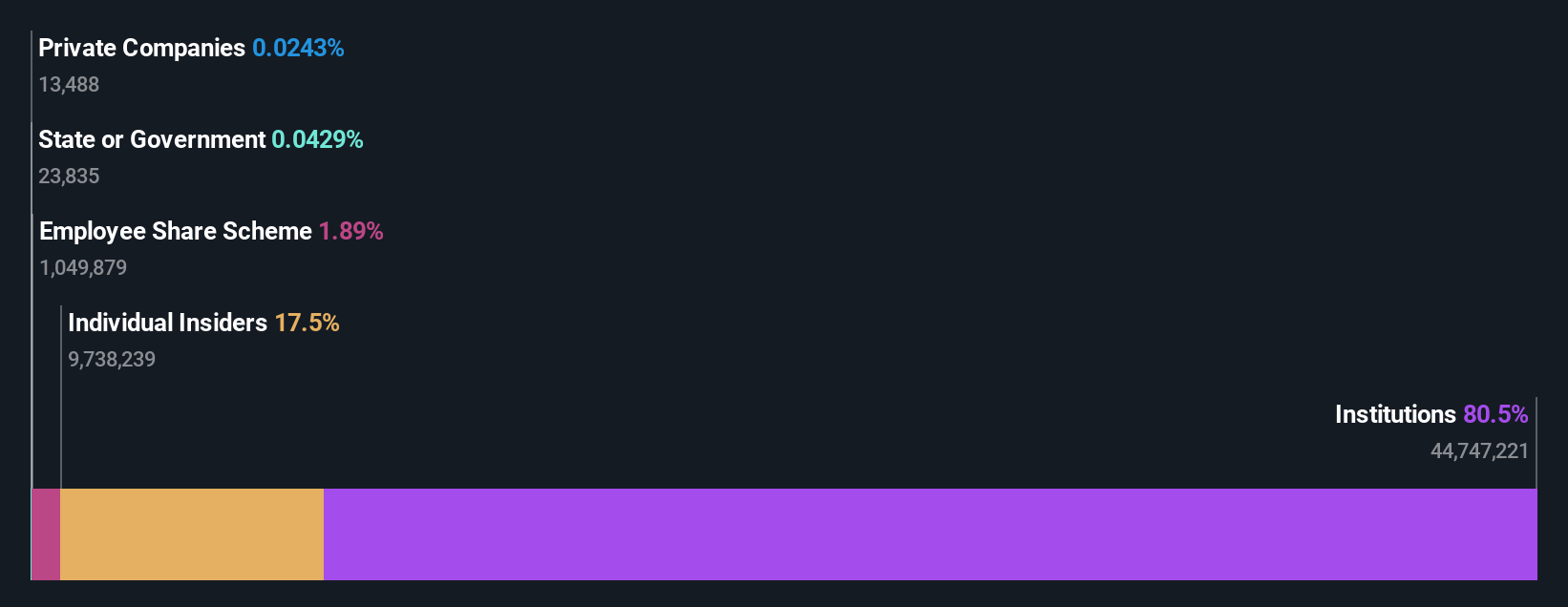

Insider Ownership: 17.6%

TBC Bank Group is forecasted to achieve earnings growth of 16.5% annually, surpassing the UK market average. Revenue is expected to grow over 20% per year, significantly outpacing the market. Despite a high level of bad loans at 2.2%, TBC trades at a substantial discount to its estimated fair value and maintains strong insider ownership with no recent significant insider trading activity. Recent board committee changes may impact governance structure slightly but don't affect growth prospects directly.

- Navigate through the intricacies of TBC Bank Group with our comprehensive analyst estimates report here.

- Upon reviewing our latest valuation report, TBC Bank Group's share price might be too pessimistic.

Taking Advantage

- Click this link to deep-dive into the 61 companies within our Fast Growing UK Companies With High Insider Ownership screener.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:IWG

International Workplace Group

Provides workspace solutions in the Americas, Europe, the Middle East, Africa, and the Asia Pacific.

High growth potential and good value.

Similar Companies

Market Insights

Community Narratives