- United Kingdom

- /

- Biotech

- /

- LSE:GNS

There's No Escaping Genus plc's (LON:GNS) Muted Revenues Despite A 25% Share Price Rise

Despite an already strong run, Genus plc (LON:GNS) shares have been powering on, with a gain of 25% in the last thirty days. The last 30 days bring the annual gain to a very sharp 40%.

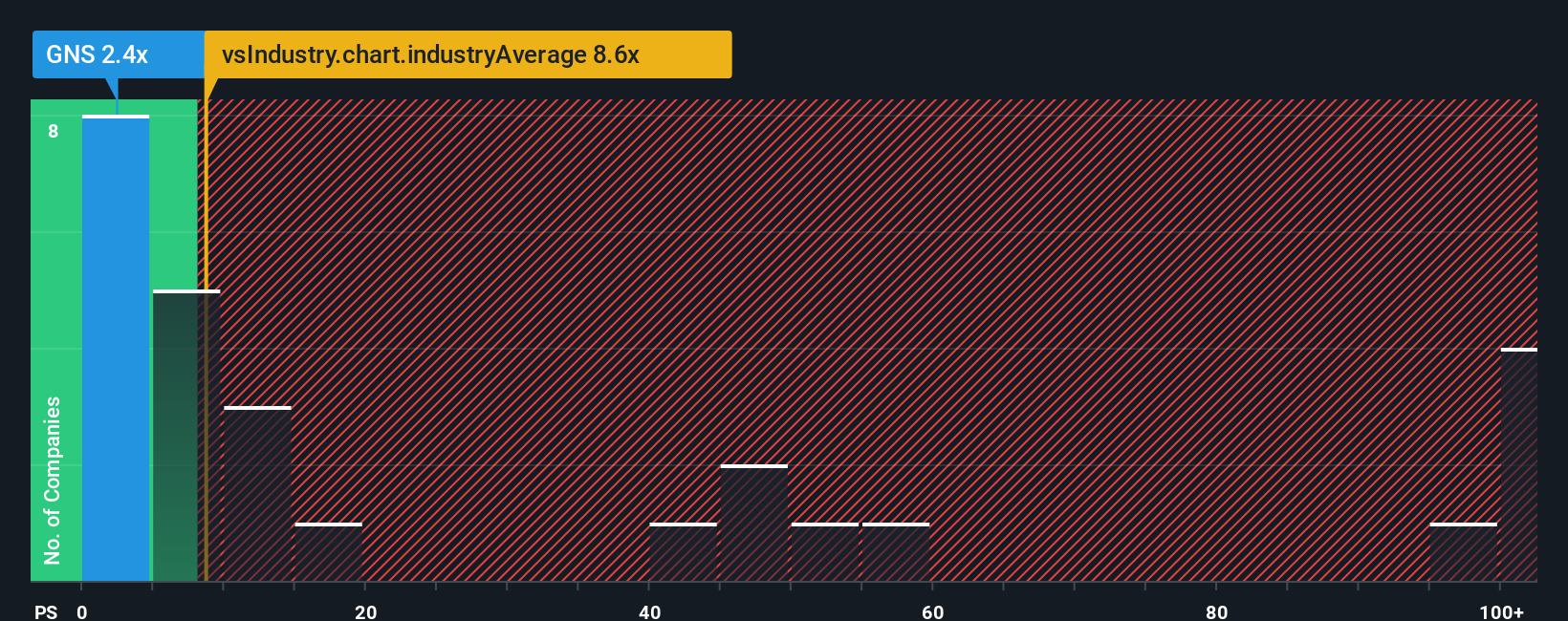

Even after such a large jump in price, Genus may still look like a strong buying opportunity at present with its price-to-sales (or "P/S") ratio of 2.4x, considering almost half of all companies in the Biotechs industry in the United Kingdom have P/S ratios greater than 11.9x and even P/S higher than 58x aren't out of the ordinary. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so limited.

See our latest analysis for Genus

How Genus Has Been Performing

Genus could be doing better as its revenue has been going backwards lately while most other companies have been seeing positive revenue growth. The P/S ratio is probably low because investors think this poor revenue performance isn't going to get any better. If this is the case, then existing shareholders will probably struggle to get excited about the future direction of the share price.

Want the full picture on analyst estimates for the company? Then our free report on Genus will help you uncover what's on the horizon.Is There Any Revenue Growth Forecasted For Genus?

There's an inherent assumption that a company should far underperform the industry for P/S ratios like Genus' to be considered reasonable.

Taking a look back first, we see that there was hardly any revenue growth to speak of for the company over the past year. Fortunately, a few good years before that means that it was still able to grow revenue by 18% in total over the last three years. So it appears to us that the company has had a mixed result in terms of growing revenue over that time.

Looking ahead now, revenue is anticipated to climb by 4.6% per annum during the coming three years according to the eight analysts following the company. With the industry predicted to deliver 27% growth per year, the company is positioned for a weaker revenue result.

With this in consideration, its clear as to why Genus' P/S is falling short industry peers. Apparently many shareholders weren't comfortable holding on while the company is potentially eyeing a less prosperous future.

The Key Takeaway

Shares in Genus have risen appreciably however, its P/S is still subdued. Using the price-to-sales ratio alone to determine if you should sell your stock isn't sensible, however it can be a practical guide to the company's future prospects.

As expected, our analysis of Genus' analyst forecasts confirms that the company's underwhelming revenue outlook is a major contributor to its low P/S. Shareholders' pessimism on the revenue prospects for the company seems to be the main contributor to the depressed P/S. Unless these conditions improve, they will continue to form a barrier for the share price around these levels.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Genus with six simple checks.

If these risks are making you reconsider your opinion on Genus, explore our interactive list of high quality stocks to get an idea of what else is out there.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:GNS

Genus

Produces and sells animal genetics to farmers in North America, Latin America, the United Kingdom, the rest of Europe, the Middle East, Russia, Africa, and Asia.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives