- United Kingdom

- /

- Personal Products

- /

- AIM:W7L

3 Promising UK Penny Stocks With Market Caps Under £300M

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices slipping amid concerns over weak trade data from China, highlighting the interconnected nature of global economies. In such fluctuating markets, investors often seek opportunities beyond established blue-chip stocks. Penny stocks, though an older term, continue to represent a sector where smaller or newer companies can offer potential value and growth opportunities for those looking to explore less conventional investment avenues.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 4 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.615 | £526.31M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.02 | £163.19M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.96 | £14.49M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.13 | £27.03M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.645 | $374.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Michelmersh Brick Holdings (AIM:MBH) | £0.86 | £74.79M | ✅ 4 ⚠️ 3 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.495 | £72.21M | ✅ 3 ⚠️ 3 View Analysis > |

| M.T.I Wireless Edge (AIM:MWE) | £0.505 | £43.53M | ✅ 3 ⚠️ 3 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.95M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 301 stocks from our UK Penny Stocks screener.

Let's review some notable picks from our screened stocks.

M&C Saatchi (AIM:SAA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: M&C Saatchi plc offers advertising and marketing communications services across the UK, Europe, the Middle East, Asia Pacific, and the Americas with a market cap of £150.91 million.

Operations: M&C Saatchi plc has not reported specific revenue segments.

Market Cap: £150.91M

M&C Saatchi has faced recent challenges, including a significant impact from the US Government shutdown, leading to a projected 7% decline in like-for-like net revenue for 2025. Despite this setback, the company maintains strong financial health with more cash than debt and well-covered interest payments. However, its profitability has suffered due to large one-off losses and declining profit margins over the past year. The management team is experienced with an average tenure of 3.3 years, but the board is relatively new. M&C Saatchi's stock trades significantly below estimated fair value, offering potential upside if performance stabilizes.

- Click here to discover the nuances of M&C Saatchi with our detailed analytical financial health report.

- Explore M&C Saatchi's analyst forecasts in our growth report.

Warpaint London (AIM:W7L)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Warpaint London PLC, with a market cap of £163.19 million, produces and sells cosmetics through its subsidiaries.

Operations: The company's revenue is primarily derived from its Own Brand segment, which accounts for £102.66 million, while the Close-Out segment contributes £2.15 million.

Market Cap: £163.19M

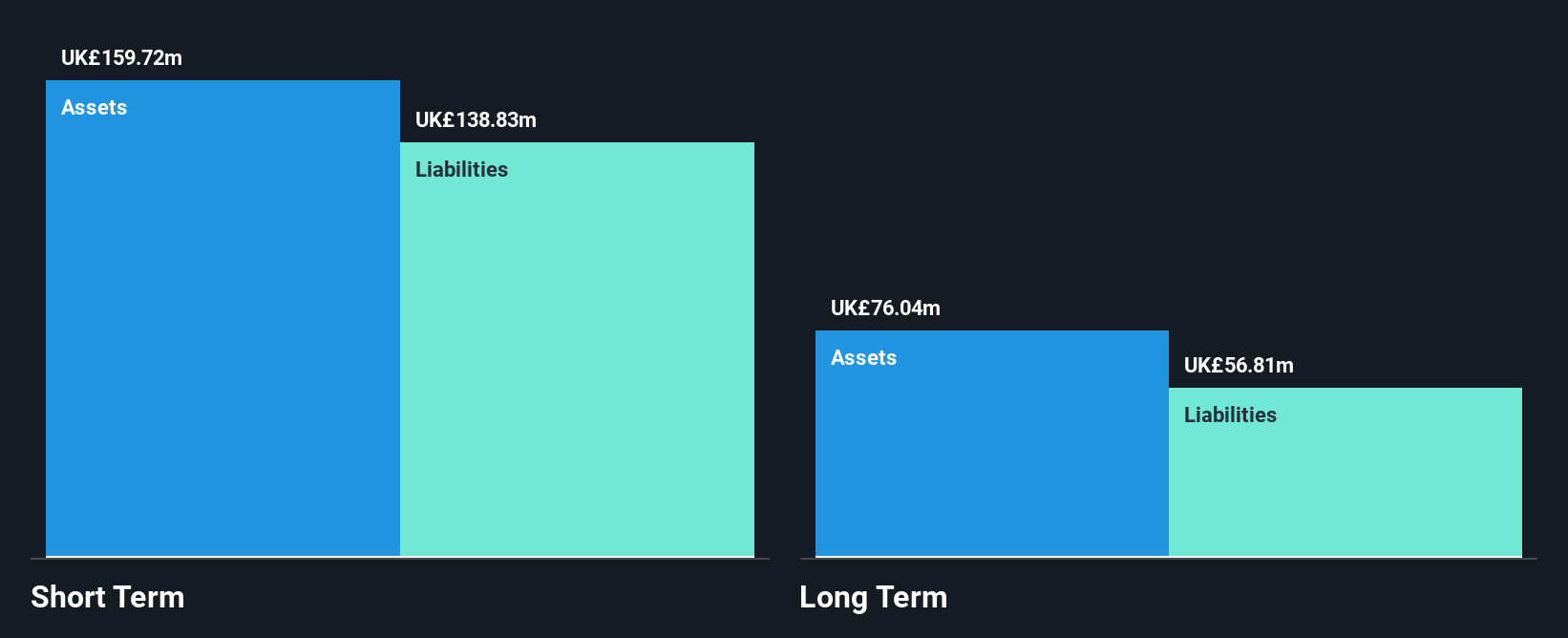

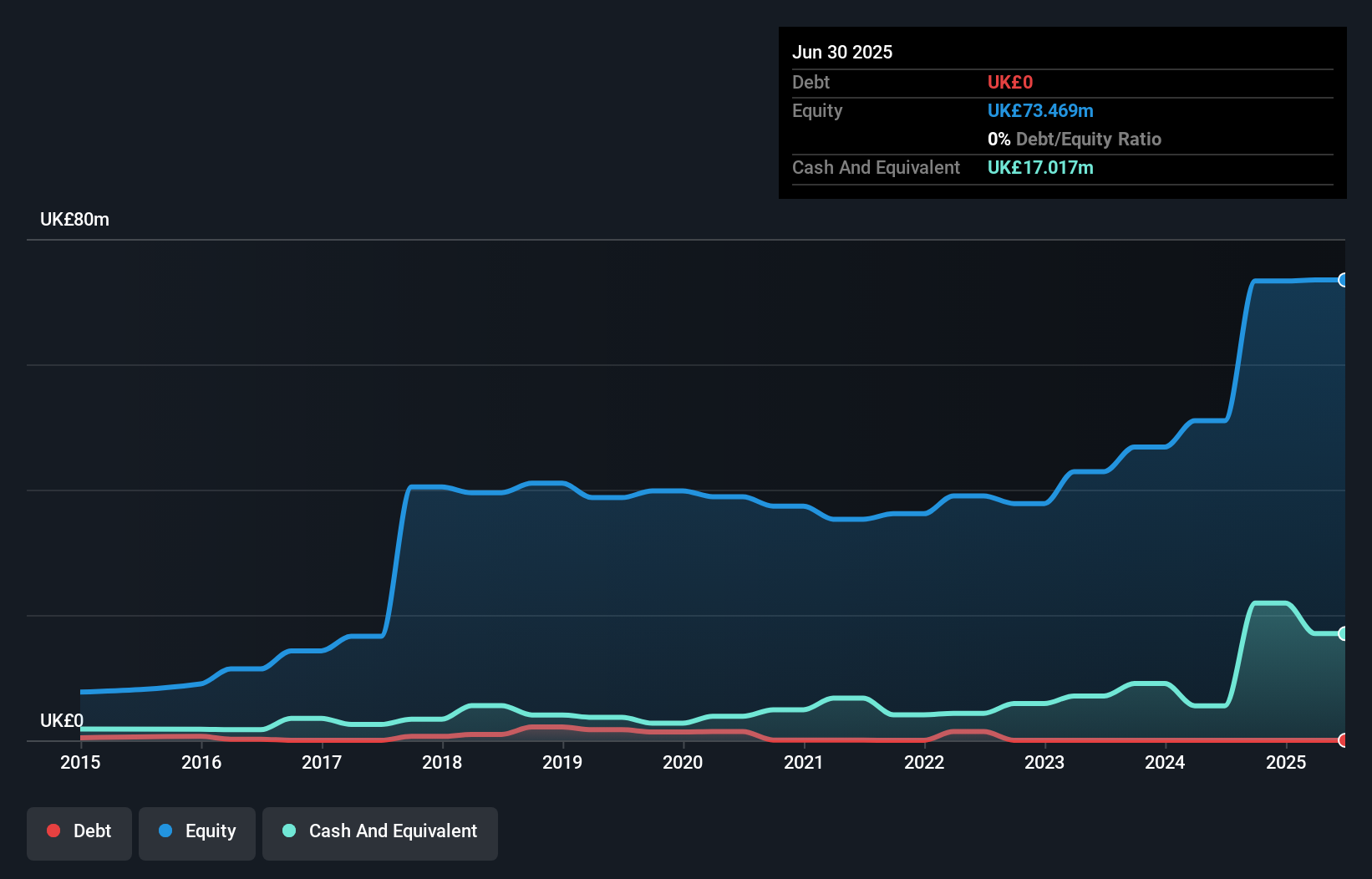

Warpaint London PLC, with a market cap of £163.19 million, has shown mixed financial performance recently. Despite being debt-free and having strong asset coverage for both short- and long-term liabilities, the company reported a decline in net income to £5.43 million for the half year ended June 30, 2025, compared to £8.02 million the previous year. The stock trades at a significant discount to its estimated fair value and has not been meaningfully diluted over the past year. Analysts agree on potential price appreciation of over 100%, but earnings growth remains challenging with recent negative trends.

- Take a closer look at Warpaint London's potential here in our financial health report.

- Examine Warpaint London's earnings growth report to understand how analysts expect it to perform.

Capital (LSE:CAPD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Capital Limited, along with its subsidiaries, offers drilling, mining, mineral assaying, and surveying services and has a market cap of £225.25 million.

Operations: The company generates revenue from its Business Services segment, amounting to $337.77 million.

Market Cap: £225.25M

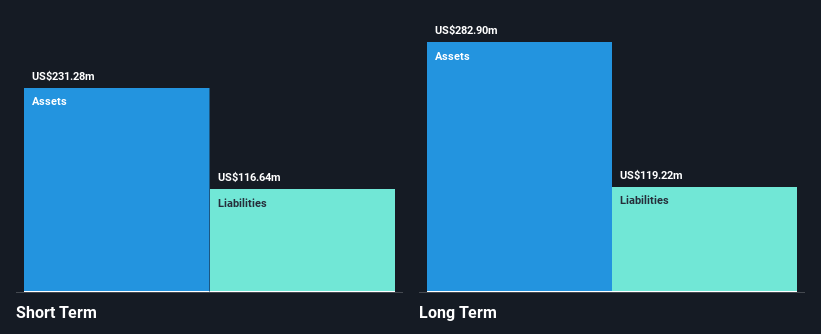

Capital Limited, with a market cap of £225.25 million, is navigating the penny stock landscape amidst financial challenges and opportunities. The company's recent follow-on equity offering raised £30.58 million, indicating strategic capital mobilization despite an increased debt-to-equity ratio over five years. While earnings have declined by 7.1% annually over the past five years and net profit margins have decreased from last year, Capital's short-term assets comfortably cover liabilities. Although interest coverage by EBIT is low at 2.2 times, operating cash flow sufficiently covers its debt obligations at 57.7%. Trading below analyst price targets suggests potential for stock price growth.

- Get an in-depth perspective on Capital's performance by reading our balance sheet health report here.

- Assess Capital's future earnings estimates with our detailed growth reports.

Taking Advantage

- Unlock more gems! Our UK Penny Stocks screener has unearthed 298 more companies for you to explore.Click here to unveil our expertly curated list of 301 UK Penny Stocks.

- Ready For A Different Approach? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Warpaint London might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:W7L

Very undervalued with flawless balance sheet.

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026