- United Kingdom

- /

- Pharma

- /

- AIM:APH

Alliance Pharma And 2 Other UK Penny Stocks With Promising Fundamentals

Reviewed by Simply Wall St

The United Kingdom's stock market has been facing challenges, as evidenced by the recent declines in the FTSE 100 and FTSE 250 indices, partly due to weak trade data from China affecting global economic sentiment. Despite these broader market pressures, investors can still find opportunities by focusing on stocks with strong fundamentals. Penny stocks, although sometimes seen as a relic of past trading days, offer potential for significant returns when they are grounded in solid financials. In this article, we explore three UK penny stocks that stand out for their robust balance sheets and potential for growth.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Financial Health Rating |

| Foresight Group Holdings (LSE:FSG) | £3.91 | £445.66M | ★★★★★★ |

| Warpaint London (AIM:W7L) | £3.58 | £289.22M | ★★★★★★ |

| Next 15 Group (AIM:NFG) | £3.135 | £311.79M | ★★★★☆☆ |

| Begbies Traynor Group (AIM:BEG) | £0.94 | £149.81M | ★★★★★★ |

| Polar Capital Holdings (AIM:POLR) | £4.725 | £455.47M | ★★★★★★ |

| Helios Underwriting (AIM:HUW) | £2.21 | £157.67M | ★★★★★☆ |

| Secure Trust Bank (LSE:STB) | £4.26 | £81.24M | ★★★★☆☆ |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ★★★★★★ |

| Ultimate Products (LSE:ULTP) | £0.805 | £68.33M | ★★★★★★ |

| Luceco (LSE:LUCE) | £1.468 | £226.41M | ★★★★★☆ |

Click here to see the full list of 445 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Alliance Pharma (AIM:APH)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Alliance Pharma plc acquires, markets, and distributes consumer healthcare products and prescription medicines across various regions including Europe, the Middle East, Africa, the Asia Pacific, China, and the Americas with a market cap of £334.07 million.

Operations: The company's revenue is derived from two main segments: Consumer Healthcare, which generated £136.21 million, and Prescription Medicines, contributing £46.93 million.

Market Cap: £334.07M

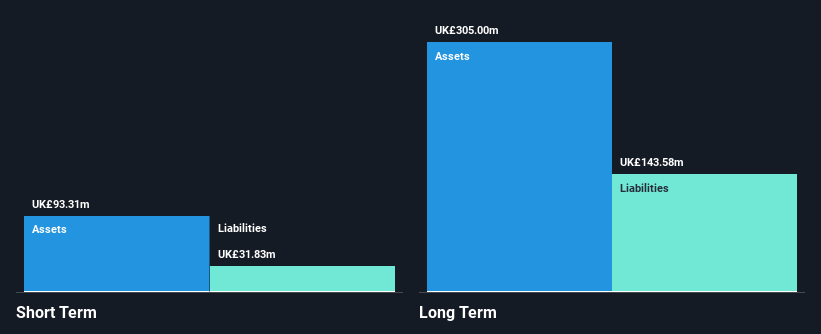

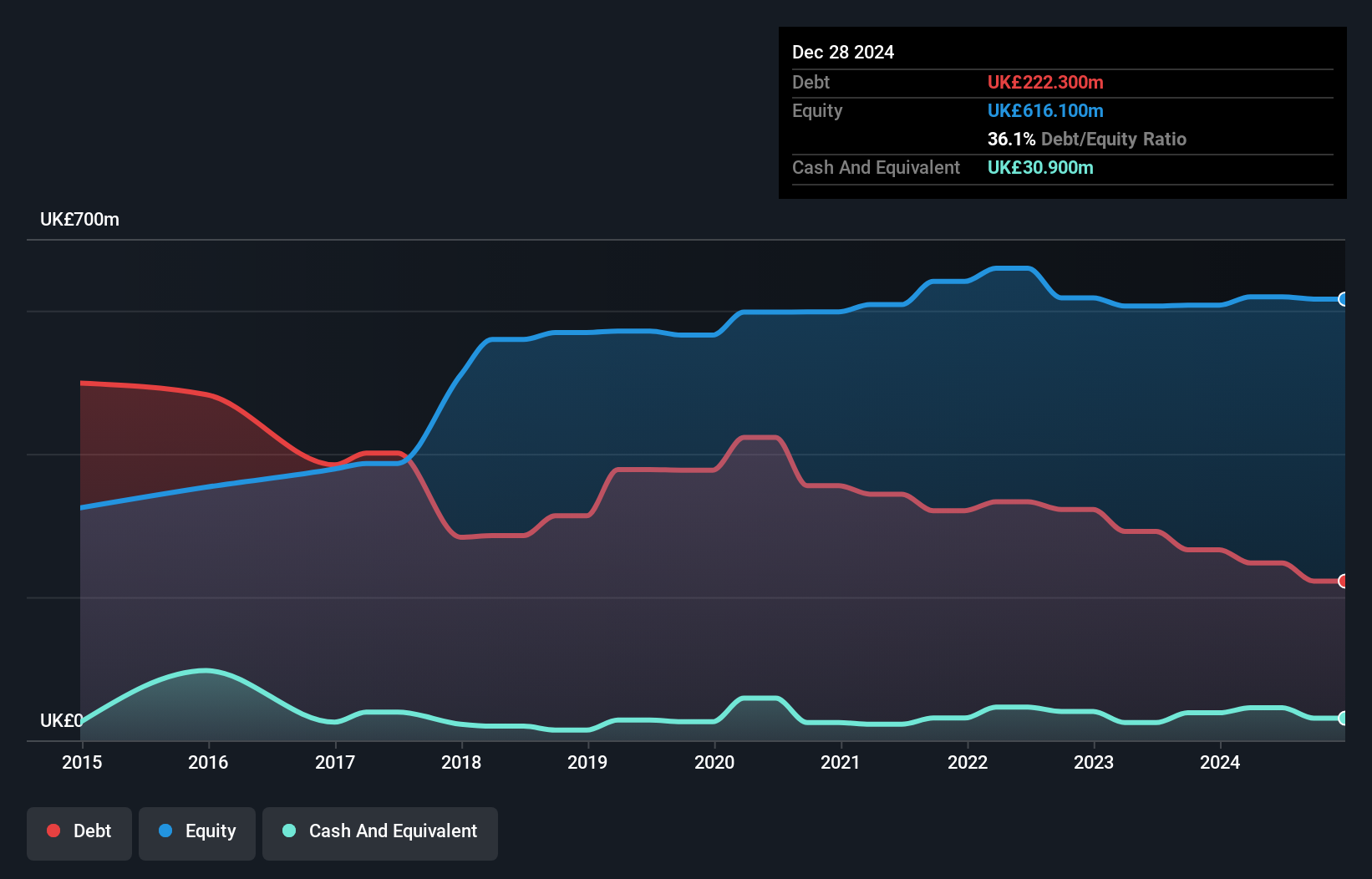

Alliance Pharma plc, with a market cap of £334.07 million, is undergoing significant changes as it faces a takeover by a consortium led by DBAY Advisors. The acquisition will result in its delisting from AIM, expected in the first half of 2025. Despite being unprofitable and experiencing increased losses over five years, Alliance's interest payments are well covered by EBIT and operating cash flow effectively covers debt. Its management team is seasoned with an average tenure of 7.4 years, although the board lacks experience with only 1.3 years on average per member. Short-term assets exceed short-term liabilities but fall short against long-term obligations.

- Get an in-depth perspective on Alliance Pharma's performance by reading our balance sheet health report here.

- Gain insights into Alliance Pharma's future direction by reviewing our growth report.

NAHL Group (AIM:NAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NAHL Group Plc operates in the United Kingdom, offering products and services in consumer legal services and catastrophic injury markets, with a market cap of £35.28 million.

Operations: The company's revenue is derived from two main segments: Critical Care, contributing £15.37 million, and Consumer Legal Services, generating £25.26 million.

Market Cap: £35.28M

NAHL Group Plc, with a £35.28 million market cap, has shown resilience in the penny stock space despite challenges. Its financial stability is supported by short-term assets exceeding both short and long-term liabilities. The company has reduced its debt-to-equity ratio over five years to 19.1%, with operating cash flow covering 46.4% of its debt, indicating sound financial management. Earnings have grown significantly at 172.9% last year, surpassing industry growth rates, although Return on Equity remains low at 4.9%. NAHL's board and management team are experienced, while ongoing M&A discussions for Bush & Co could impact future operations.

- Take a closer look at NAHL Group's potential here in our financial health report.

- Learn about NAHL Group's future growth trajectory here.

Bakkavor Group (LSE:BAKK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Bakkavor Group plc, along with its subsidiaries, specializes in the preparation and marketing of fresh prepared foods across the United Kingdom, the United States, and China, with a market capitalization of £887.77 million.

Operations: The company's revenue is primarily derived from the United Kingdom at £1.90 billion, followed by the United States with £221.2 million, and China contributing £117 million.

Market Cap: £887.77M

Bakkavor Group plc, with a market cap of £887.77 million, has demonstrated strong earnings growth of 428.7% over the past year, significantly outpacing the food industry average. Despite this impressive growth, Return on Equity remains low at 10.3%. The company's net debt to equity ratio is satisfactory at 32.6%, and its debt is well covered by operating cash flow (62.7%). However, short-term assets (£316.6M) do not cover short-term liabilities (£509.4M), indicating potential liquidity concerns. Bakkavor's revenue for the year ending December 2024 was £2.29 billion, highlighting robust operational performance across key markets.

- Jump into the full analysis health report here for a deeper understanding of Bakkavor Group.

- Review our growth performance report to gain insights into Bakkavor Group's future.

Where To Now?

- Unlock our comprehensive list of 445 UK Penny Stocks by clicking here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:APH

Alliance Pharma

Acquires, markets, and distributes consumer healthcare products and prescription medicines in Europe, the Middle East, Africa, the Asia Pacific, China, and the Americas.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives