Nichols And 2 Other UK Stocks That Might Be Priced Below Estimated Value

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid concerns over weak trade data from China, a key trading partner. In this environment of fluctuating global cues, identifying undervalued stocks can be crucial for investors looking to capitalize on potential growth opportunities; companies that are priced below their estimated value often present such prospects despite broader market uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Victorian Plumbing Group (AIM:VIC) | £0.60 | £1.19 | 49.7% |

| SigmaRoc (AIM:SRC) | £1.23 | £2.41 | 49% |

| PageGroup (LSE:PAGE) | £2.246 | £4.43 | 49.3% |

| Knights Group Holdings (AIM:KGH) | £1.71 | £3.29 | 48% |

| Hollywood Bowl Group (LSE:BOWL) | £2.53 | £4.86 | 47.9% |

| Gym Group (LSE:GYM) | £1.496 | £2.90 | 48.5% |

| Gooch & Housego (AIM:GHH) | £5.46 | £10.79 | 49.4% |

| Essentra (LSE:ESNT) | £0.988 | £1.95 | 49.4% |

| Burberry Group (LSE:BRBY) | £11.13 | £21.13 | 47.3% |

| AstraZeneca (LSE:AZN) | £113.96 | £222.15 | 48.7% |

Let's uncover some gems from our specialized screener.

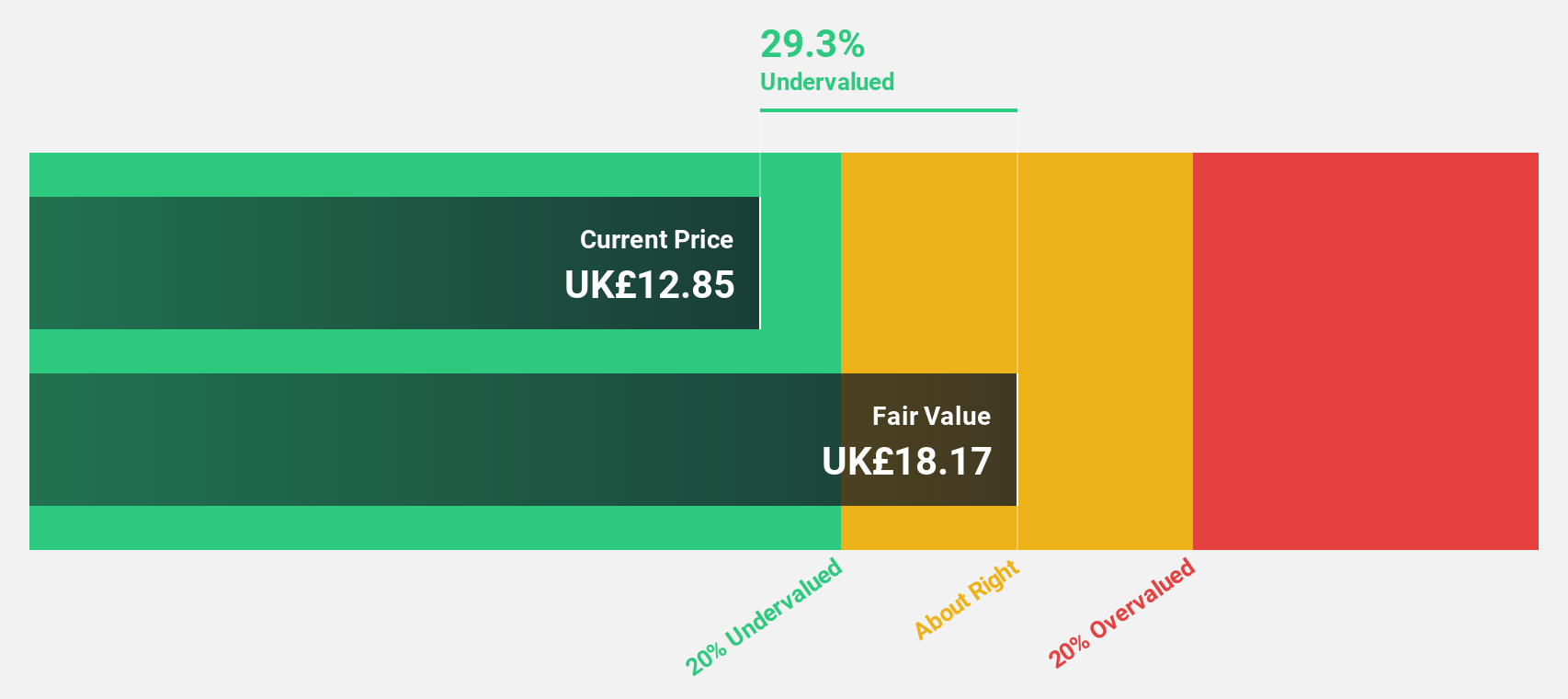

Nichols (AIM:NICL)

Overview: Nichols plc, with a market cap of £442.49 million, is involved in supplying soft drinks to the retail, wholesale, catering, licensed, and leisure industries across the United Kingdom, the Middle East, Africa, and internationally.

Operations: The company's revenue segments consist of £133.97 million from Packaged products and £40.35 million from Out of Home sales.

Estimated Discount To Fair Value: 35.2%

Nichols is trading significantly below its estimated fair value, presenting a potential undervaluation based on discounted cash flow analysis. Despite a slight decrease in net income for the first half of 2025, earnings are forecast to grow faster than the UK market at 16.4% annually. However, revenue growth remains modest at 4.4%. Analysts expect a stock price increase of 20.9%, although the company has an unstable dividend track record and large one-off items affecting earnings quality.

- The growth report we've compiled suggests that Nichols' future prospects could be on the up.

- Click here to discover the nuances of Nichols with our detailed financial health report.

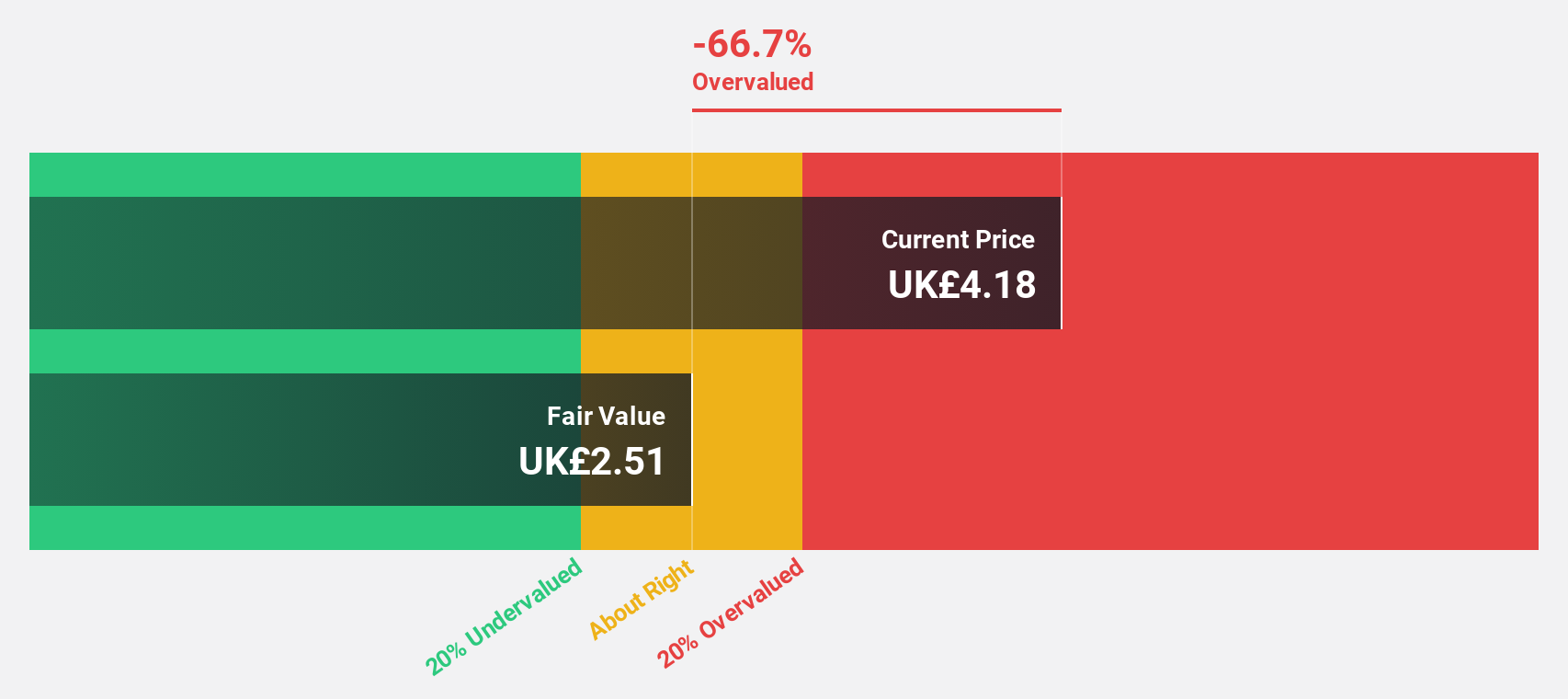

Barratt Redrow (LSE:BTRW)

Overview: Barratt Redrow plc operates in the housebuilding industry within the United Kingdom and has a market capitalization of approximately £5.30 billion.

Operations: The company's revenue is primarily derived from its housebuilding segment, which generated £5.58 billion.

Estimated Discount To Fair Value: 43.8%

Barratt Redrow is trading at £3.73, significantly below its estimated fair value of £6.64, suggesting potential undervaluation based on discounted cash flow analysis. The company's earnings grew by 63.4% last year and are forecast to increase by 25.1% annually, outpacing the UK market average growth rate of 13.9%. Despite a low return on equity forecast and unsustainable dividend coverage, recent earnings results show substantial revenue and net income growth compared to the previous year.

- Our comprehensive growth report raises the possibility that Barratt Redrow is poised for substantial financial growth.

- Navigate through the intricacies of Barratt Redrow with our comprehensive financial health report here.

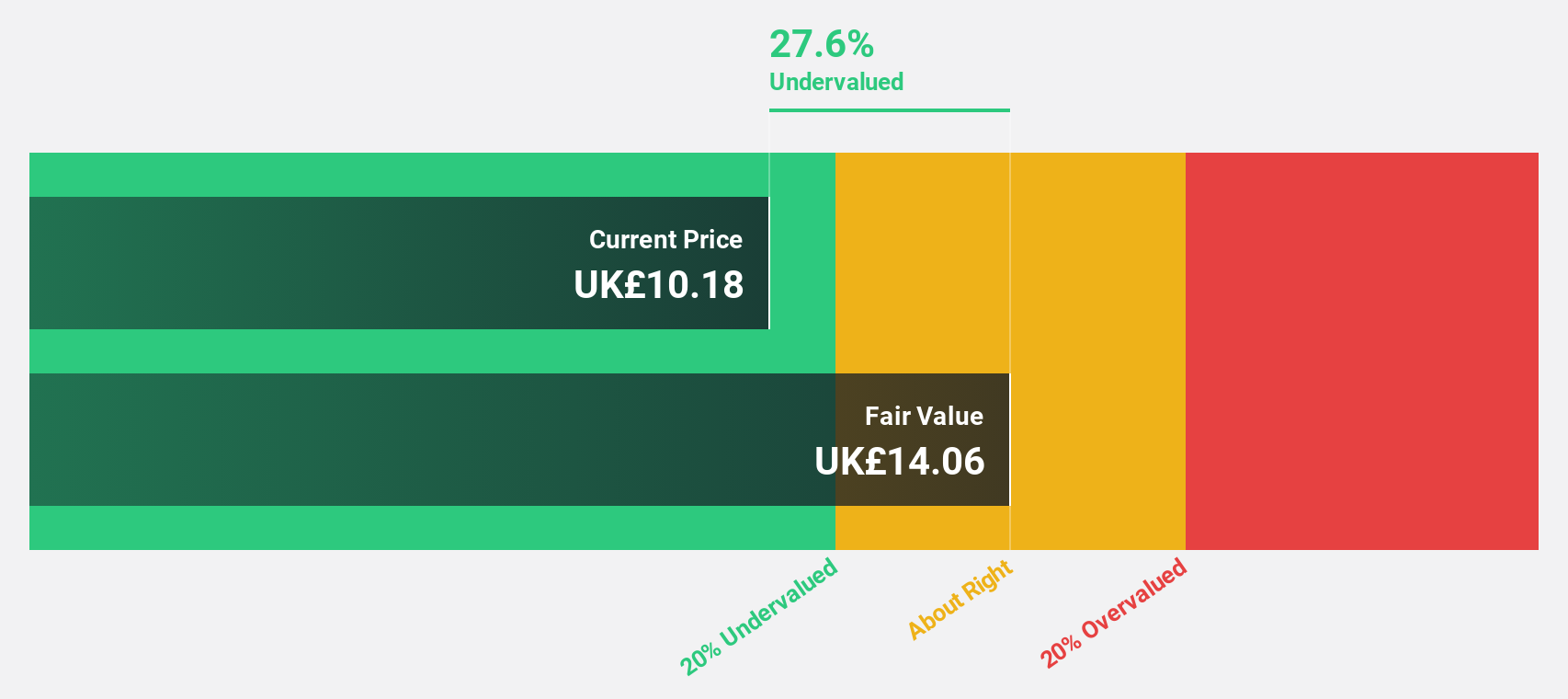

Mondi (LSE:MNDI)

Overview: Mondi plc is a global company involved in the manufacture and sale of packaging and paper solutions across various regions including Africa, Europe, Russia, North America, South America, Asia, and Australia with a market cap of £4.45 billion.

Operations: The company generates revenue from several segments, including Flexible Packaging (€3.98 billion), Corrugated Packaging (€2.45 billion), and Uncoated Fine Paper (€1.27 billion).

Estimated Discount To Fair Value: 32.6%

Mondi is trading at £10.1, significantly below its estimated fair value of £14.99, highlighting potential undervaluation based on discounted cash flow analysis. Despite a high debt level and profit margins decreasing from 5.5% to 2.5%, earnings are forecasted to grow significantly at 22.7% annually, surpassing the UK market average of 13.9%. Recent half-year results show increased sales but lower net income compared to last year, with dividends not well covered by earnings or free cash flows.

- Our earnings growth report unveils the potential for significant increases in Mondi's future results.

- Dive into the specifics of Mondi here with our thorough financial health report.

Next Steps

- Delve into our full catalog of 56 Undervalued UK Stocks Based On Cash Flows here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:MNDI

Mondi

Engages in the manufacture and sale of packaging and paper solutions in Africa, Western Europe, Emerging Europe, Russia, North America, South America, Asia, and Australia.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives