- United Kingdom

- /

- Chemicals

- /

- AIM:ITX

UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index experiencing a downturn due to weak trade data from China, highlighting global economic interconnections. In such fluctuating conditions, identifying stocks with strong financials and growth potential becomes crucial for investors. Penny stocks, though an older term, still hold relevance as they often represent smaller companies that can offer both value and growth opportunities when carefully selected.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| DSW Capital (AIM:DSW) | £0.50 | £12.57M | ✅ 3 ⚠️ 3 View Analysis > |

| Foresight Group Holdings (LSE:FSG) | £4.81 | £549.16M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.24 | £180.96M | ✅ 4 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.92 | £13.89M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.09 | £15M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.30 | £29.18M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.46 | £249.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.665 | £95.83M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £181.95M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

We're going to check out a few of the best picks from our screener tool.

ECO Animal Health Group (AIM:EAH)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: ECO Animal Health Group plc, along with its subsidiaries, manufactures and supplies animal health products internationally and has a market cap of £58.95 million.

Operations: The company generates its revenue from the Pharmaceuticals segment, which accounts for £79.60 million.

Market Cap: £58.95M

ECO Animal Health Group, with a market cap of £58.95 million, has shown significant financial resilience and growth potential within the penny stock category. The company reported a strong first half of 2025, with revenues reaching £33.2 million despite external challenges, and improved gross margins are anticipated. Recent developments include a positive opinion from the EMA for its ECOVAXXIN® MS vaccine, which could enhance future revenue streams when commercialised in 2026. While earnings grew by over 60% last year, past five-year profits have declined annually by 47%, indicating volatility but also potential for recovery as strategic initiatives unfold.

- Click here and access our complete financial health analysis report to understand the dynamics of ECO Animal Health Group.

- Assess ECO Animal Health Group's future earnings estimates with our detailed growth reports.

Itaconix (AIM:ITX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Itaconix plc, along with its subsidiaries, develops plant-based polymers for home and personal care applications across North America, Europe, and internationally, with a market cap of £15.64 million.

Operations: The company's revenue is derived from its Formulation Solutions segment, generating $2.97 million, and its Performance Ingredients segment, contributing $5.58 million.

Market Cap: £15.64M

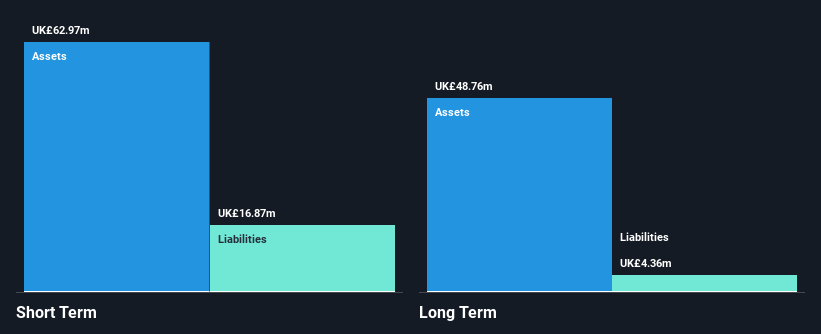

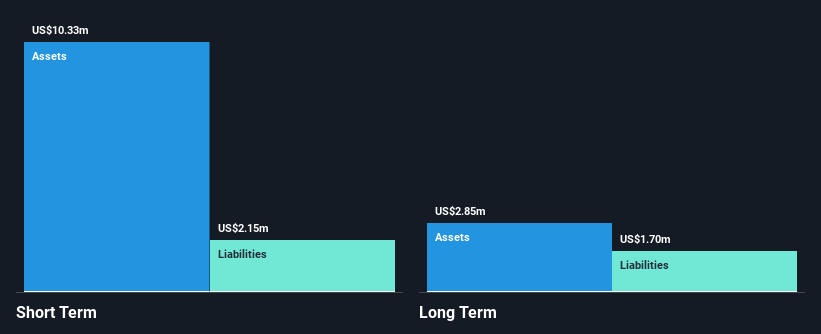

Itaconix plc, with a market cap of £15.64 million, has demonstrated revenue growth with sales reaching US$4.82 million for the first half of 2025 compared to US$2.78 million a year ago, although it remains unprofitable with a net loss of US$0.41 million. The company benefits from having no debt and sufficient short-term assets to cover liabilities, providing financial stability in the penny stock realm. Revenue is projected to grow annually by 24.73%, supported by its cash runway exceeding three years if free cash flow continues its historical growth trend, positioning Itaconix well for future expansion opportunities within its industry niche.

- Navigate through the intricacies of Itaconix with our comprehensive balance sheet health report here.

- Understand Itaconix's earnings outlook by examining our growth report.

Van Elle Holdings (AIM:VANL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Van Elle Holdings plc operates as a geotechnical and ground engineering contractor in the United Kingdom, with a market cap of £37.87 million.

Operations: The company's revenue is generated from three primary segments: General Piling (£46.03 million), Specialist Piling & Rail (£46.10 million), and Ground Engineering Services (£38.14 million).

Market Cap: £37.87M

Van Elle Holdings plc, with a market cap of £37.87 million, shows financial stability in the penny stock sector, supported by short-term assets exceeding both short and long-term liabilities. Despite recent negative earnings growth and a decrease in profit margins from 3.8% to 2.4%, the company maintains high-quality earnings and has become profitable over the past five years with significant annual earnings growth. The management team is experienced, though its debt-to-equity ratio has increased slightly over time; however, debt is well covered by cash flow and interest payments are adequately managed. A dividend of 0.8 per share was recently affirmed at its AGM.

- Unlock comprehensive insights into our analysis of Van Elle Holdings stock in this financial health report.

- Evaluate Van Elle Holdings' prospects by accessing our earnings growth report.

Key Takeaways

- Navigate through the entire inventory of 294 UK Penny Stocks here.

- Want To Explore Some Alternatives? The end of cancer? These 29 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:ITX

Itaconix

Engages in the development of plant-based polymers for home and personal care applications in North America, Europe, and internationally.

Flawless balance sheet with limited growth.

Market Insights

Community Narratives