- United Kingdom

- /

- Metals and Mining

- /

- AIM:GFM

UK Penny Stocks To Watch In June 2025

Reviewed by Simply Wall St

The UK market has been experiencing some turbulence, with the FTSE 100 index recently closing lower due to weak trade data from China, highlighting global economic interdependencies. In such a climate, investors often seek out opportunities that might not be immediately obvious, turning their attention to penny stocks—an investment area that remains relevant despite its somewhat outdated label. These smaller or newer companies can offer unique value propositions and growth potential when supported by strong financials, making them intriguing options for those looking to uncover hidden opportunities in the market.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.025 | £452.99M | ✅ 4 ⚠️ 1 View Analysis > |

| Warpaint London (AIM:W7L) | £4.65 | £375.66M | ✅ 5 ⚠️ 3 View Analysis > |

| Stelrad Group (LSE:SRAD) | £1.46 | £185.93M | ✅ 5 ⚠️ 2 View Analysis > |

| Cairn Homes (LSE:CRN) | £1.82 | £1.13B | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.38 | £41.12M | ✅ 5 ⚠️ 2 View Analysis > |

| Polar Capital Holdings (AIM:POLR) | £4.42 | £426.14M | ✅ 2 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.89 | £298.52M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.04 | £165.92M | ✅ 4 ⚠️ 2 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.86 | £11.84M | ✅ 3 ⚠️ 3 View Analysis > |

| Braemar (LSE:BMS) | £2.33 | £72.9M | ✅ 3 ⚠️ 4 View Analysis > |

Click here to see the full list of 405 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Griffin Mining (AIM:GFM)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Griffin Mining Limited is a mining and investment company focused on the exploration, development, and mining of mineral properties with a market cap of £310.48 million.

Operations: Griffin Mining Limited has not reported any specific revenue segments.

Market Cap: £310.48M

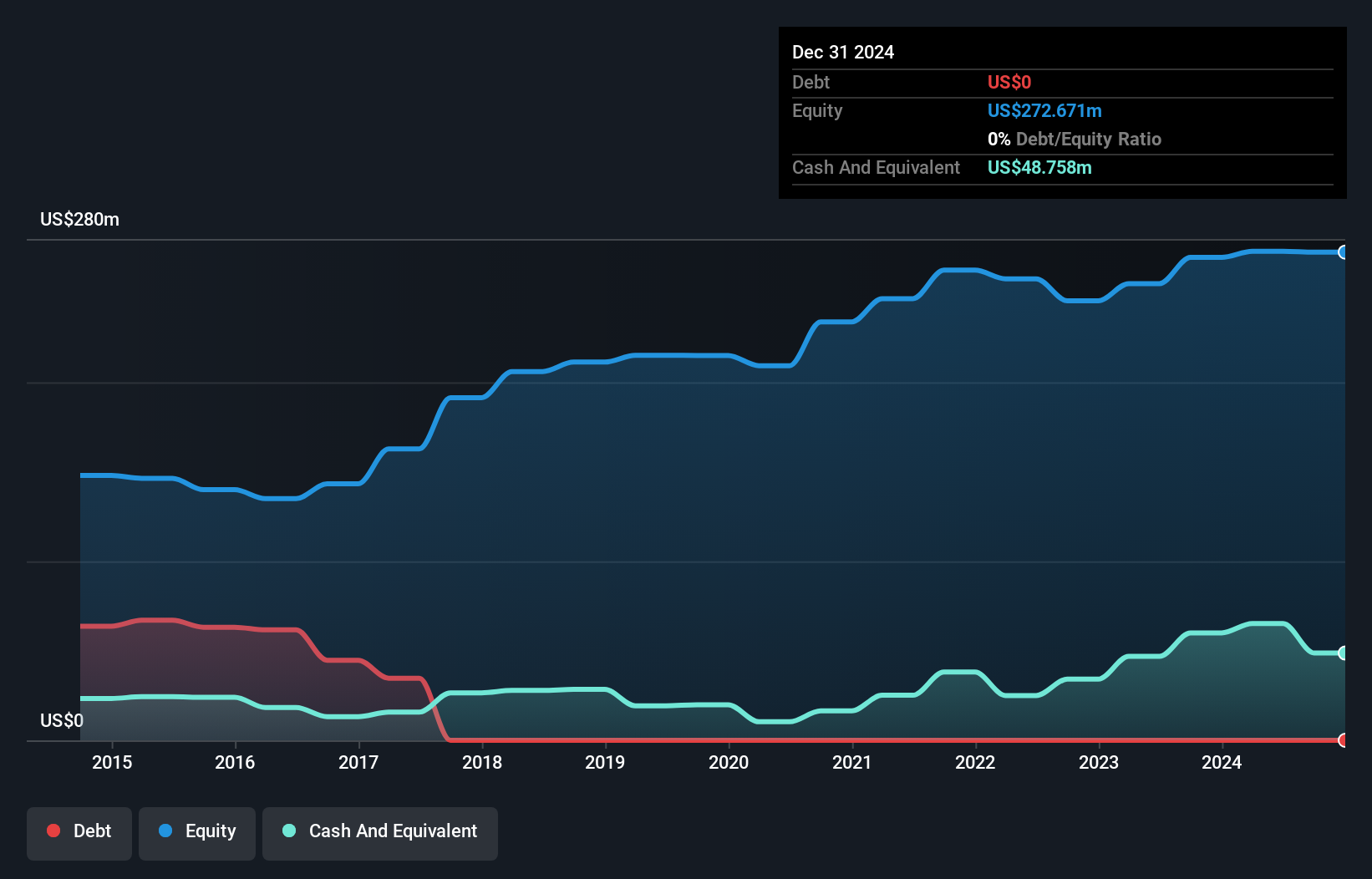

Griffin Mining Limited, with a market cap of £310.48 million, has shown mixed performance typical of penny stocks. The company is debt-free and has strong short-term asset coverage over liabilities, but its recent earnings have declined with net income at US$11.35 million compared to US$15.24 million the previous year. Despite negative earnings growth last year, Griffin's long-term profits have grown by 13.3% annually over five years and are forecasted to grow further by 19.76% per year. Recent drilling results at Caijiaying indicate promising high-grade gold domains that could enhance future resource estimates and mining inventory.

- Jump into the full analysis health report here for a deeper understanding of Griffin Mining.

- Understand Griffin Mining's earnings outlook by examining our growth report.

Aptitude Software Group (LSE:APTD)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Aptitude Software Group plc, with a market cap of £170.17 million, offers financial management software solutions in the United Kingdom and internationally through its subsidiaries.

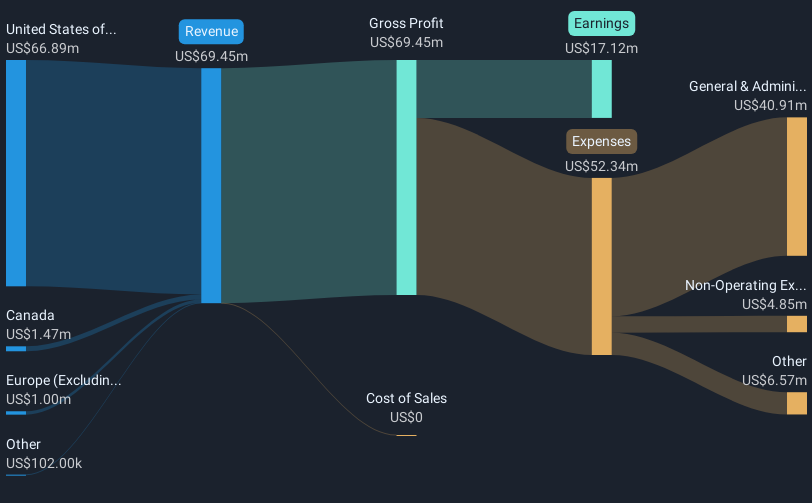

Operations: The company generates revenue of £70.04 million through its financial management software solutions offered both domestically and internationally.

Market Cap: £170.17M

Aptitude Software Group plc, with a market cap of £170.17 million, demonstrates characteristics often seen in penny stocks. The company has stable weekly volatility and improved profit margins, with recent earnings growth of 20.7% surpassing industry averages. Despite a low Return on Equity at 8.6%, its interest payments are well-covered by EBIT, and it trades at good value compared to peers. Recent strategic moves include a new Fynapse contract win worth $1 million and the appointment of Paula Dowdy as Non-Executive Director to enhance leadership strength following board changes at the AGM on May 28, 2025.

- Click here to discover the nuances of Aptitude Software Group with our detailed analytical financial health report.

- Gain insights into Aptitude Software Group's future direction by reviewing our growth report.

City of London Investment Group (LSE:CLIG)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: City of London Investment Group PLC is a publicly owned investment manager with a market cap of £181.85 million.

Operations: The company generates $72.64 million in revenue from its asset management operations.

Market Cap: £181.85M

City of London Investment Group PLC, with a market cap of £181.85 million, exhibits certain features typical of penny stocks. It maintains a debt-free status and strong liquidity, as short-term assets ($38.1M) surpass both long-term ($13.4M) and short-term liabilities ($7.7M). Despite stable earnings growth at 5% annually over five years, its Return on Equity is relatively low at 12.1%. The dividend yield of 8.31% may not be fully sustainable by earnings alone. Recent board changes include the appointment of Benjamin Denys William Stocks as an Independent Non-Executive Director to bolster governance and strategic oversight.

- Get an in-depth perspective on City of London Investment Group's performance by reading our balance sheet health report here.

- Assess City of London Investment Group's future earnings estimates with our detailed growth reports.

Key Takeaways

- Access the full spectrum of 405 UK Penny Stocks by clicking on this link.

- Ready To Venture Into Other Investment Styles? Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:GFM

Griffin Mining

A mining and investment company, engages in the mining, exploration, and development of mineral properties.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives