- United Kingdom

- /

- Entertainment

- /

- AIM:DEVO

3 UK Penny Stocks With Market Caps Over £100M To Watch

Reviewed by Simply Wall St

The UK stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, investors can still find opportunities by focusing on smaller companies that demonstrate strong financial health and potential for growth. Penny stocks, although an older term, continue to represent a viable investment area for those seeking value in less-established firms with promising prospects.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.62 | £517.24M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.30 | £185.81M | ✅ 3 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.39 | £42.2M | ✅ 4 ⚠️ 3 View Analysis > |

| Ingenta (AIM:ING) | £0.675 | £10.19M | ✅ 2 ⚠️ 2 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.575 | $334.26M | ✅ 4 ⚠️ 2 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.45 | £124.06M | ✅ 4 ⚠️ 1 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.225 | £195.02M | ✅ 4 ⚠️ 3 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.75 | £10.33M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.53 | £77.08M | ✅ 3 ⚠️ 3 View Analysis > |

| ME Group International (LSE:MEGP) | £1.904 | £719.19M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

Devolver Digital (AIM:DEVO)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Devolver Digital, Inc. is a video game developer and publisher operating across multiple platforms globally, with a market cap of £123.37 million.

Operations: The company's revenue from the Computer Graphics segment is $104.78 million.

Market Cap: £123.37M

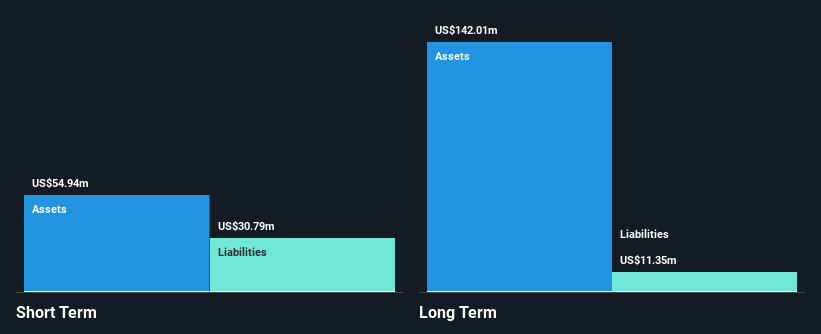

Devolver Digital, Inc. operates with a market cap of £123.37 million and reported revenue of US$104.78 million from its Computer Graphics segment. Despite being debt-free and having sufficient cash runway for over three years, the company is currently unprofitable, with losses increasing at 22.3% annually over the past five years. Short-term assets of US$61 million comfortably cover both short-term (US$24.5 million) and long-term liabilities (US$11.4 million). While earnings are forecast to grow significantly at 91.91% per year, current negative return on equity reflects ongoing profitability challenges amidst stable weekly volatility.

- Click to explore a detailed breakdown of our findings in Devolver Digital's financial health report.

- Assess Devolver Digital's future earnings estimates with our detailed growth reports.

Eurasia Mining (AIM:EUA)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Eurasia Mining Plc is a mining and mineral exploration company focused on the exploration, development, and production of palladium, platinum, rhodium, iridium, copper, nickel, gold, and other minerals in Russia with a market cap of £105.10 million.

Operations: The company's revenue is derived entirely from the exploration and development of platinum group metals, gold, and other minerals, amounting to £6.64 million.

Market Cap: £105.1M

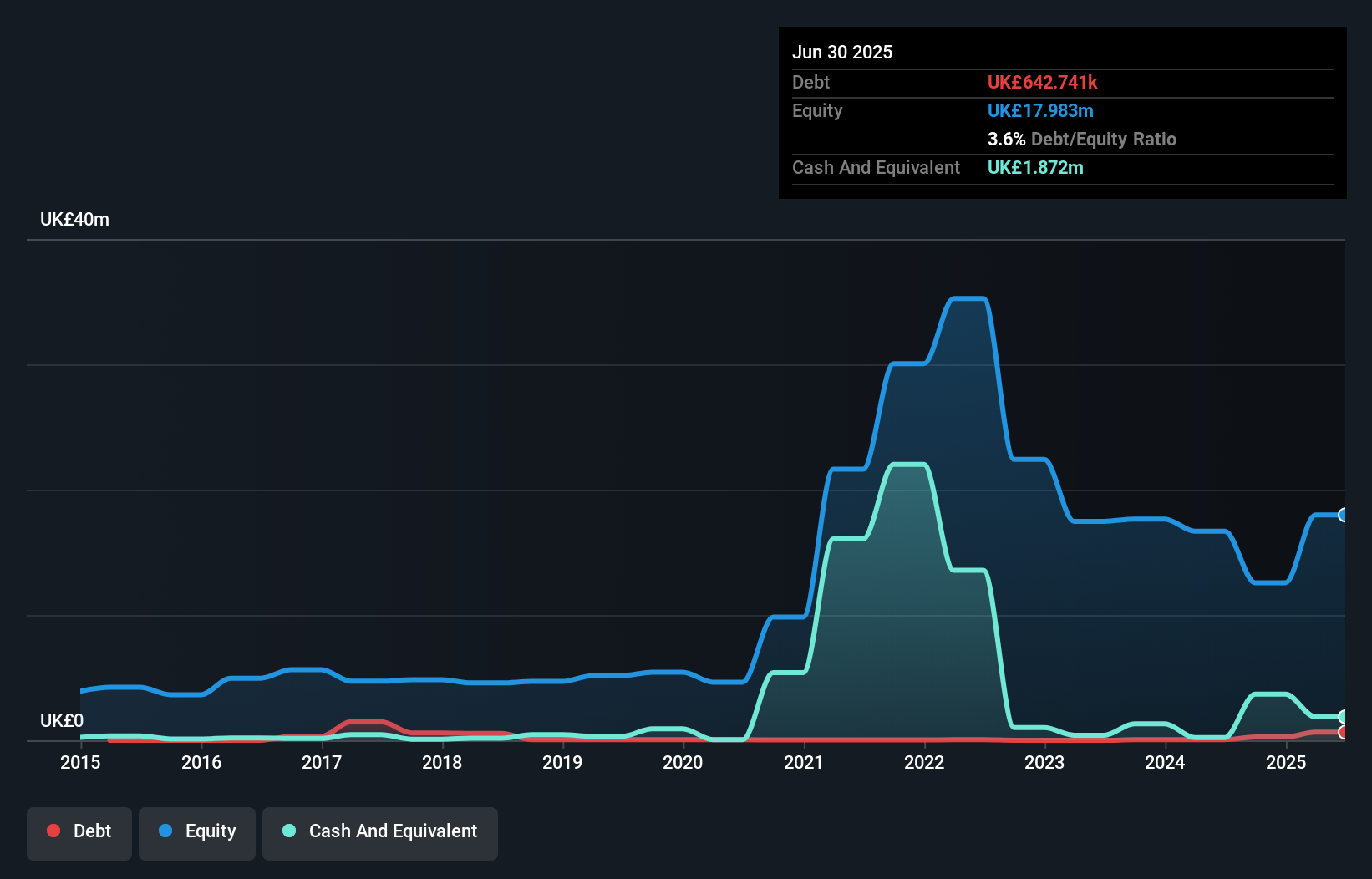

Eurasia Mining, with a market cap of £105.10 million, focuses on platinum group metals and gold exploration in Russia. Despite being unprofitable and experiencing increasing losses over the past five years, the company maintains a sufficient cash runway exceeding three years. Recent developments include a licence extension for its NKT project, which boasts significant nickel and copper reserves and existing infrastructure that could reduce capital expenditure by up to 80%. The company's West Kytlim mine is operational at low costs due to efficient open-pit mining techniques. Eurasia's strategic asset management may offer potential liquidity events in the future.

- Click here to discover the nuances of Eurasia Mining with our detailed analytical financial health report.

- Assess Eurasia Mining's previous results with our detailed historical performance reports.

NCC Group (LSE:NCC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe with a market cap of £448.63 million.

Operations: The company's revenue is derived from two primary segments: Cyber Security, generating £246.18 million, and Escode, contributing £65.95 million.

Market Cap: £448.63M

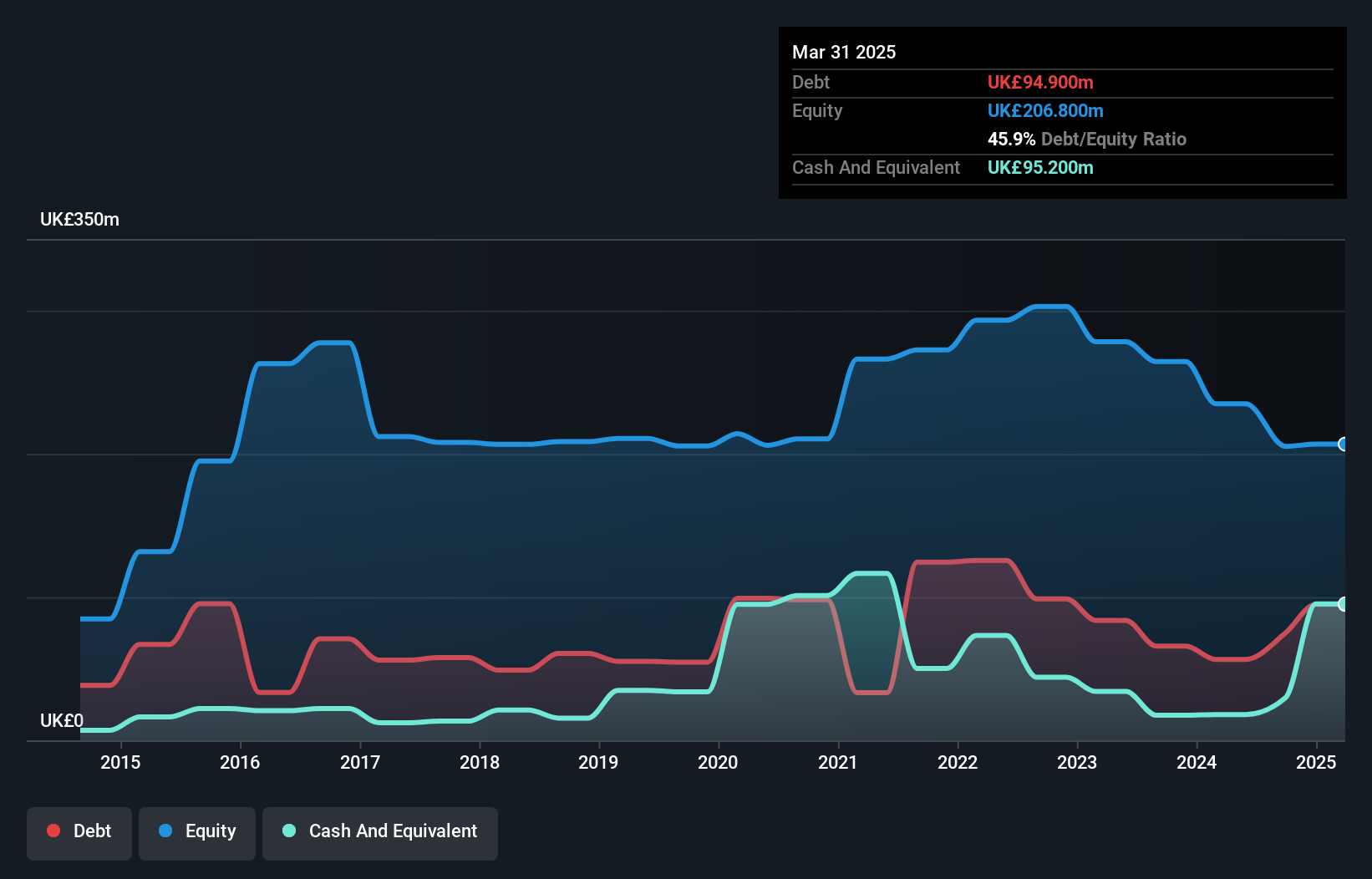

NCC Group, with a market cap of £448.63 million, operates in the cyber and software resilience sector, generating significant revenue from Cyber Security (£246.18M) and Escode (£65.95M). Despite recent earnings improvement—net income rose to £16 million for the half-year ending March 31, 2025—the company remains unprofitable overall. Its debt level is manageable with more cash than total debt and reduced debt-to-equity ratio over five years. However, interest payments are not well covered by EBIT (2.1x), and dividends remain unsustainable due to insufficient earnings coverage. The stock trades at 8% below estimated fair value amidst strategic pivots in its Cyber Security division.

- Dive into the specifics of NCC Group here with our thorough balance sheet health report.

- Review our growth performance report to gain insights into NCC Group's future.

Seize The Opportunity

- Embark on your investment journey to our 295 UK Penny Stocks selection here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:DEVO

Devolver Digital

Develops and publishes digital video games for PC, console, and mobile platforms in Europe, North America, the Asia Pacific, Latin America, the United Kingdom, the Middle East, and North Africa.

Reasonable growth potential with adequate balance sheet.

Market Insights

Community Narratives