- United Kingdom

- /

- Insurance

- /

- LSE:CRE

Top UK Dividend Stocks To Consider In June 2025

Reviewed by Simply Wall St

As the FTSE 100 and FTSE 250 indices experience downward pressure due to weak trade data from China, investors are closely monitoring the impact on London markets and global economic conditions. In such uncertain times, dividend stocks can offer a measure of stability, providing regular income streams that may help offset market volatility.

Top 10 Dividend Stocks In The United Kingdom

| Name | Dividend Yield | Dividend Rating |

| WPP (LSE:WPP) | 7.07% | ★★★★★★ |

| Pets at Home Group (LSE:PETS) | 4.94% | ★★★★★☆ |

| OSB Group (LSE:OSB) | 6.80% | ★★★★★☆ |

| NWF Group (AIM:NWF) | 4.71% | ★★★★★☆ |

| Man Group (LSE:EMG) | 7.18% | ★★★★★☆ |

| Keller Group (LSE:KLR) | 3.26% | ★★★★★☆ |

| James Latham (AIM:LTHM) | 7.02% | ★★★★★☆ |

| Grafton Group (LSE:GFTU) | 3.68% | ★★★★★☆ |

| Dunelm Group (LSE:DNLM) | 6.51% | ★★★★★☆ |

| 4imprint Group (LSE:FOUR) | 5.10% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top UK Dividend Stocks screener.

Below we spotlight a couple of our favorites from our exclusive screener.

James Halstead (AIM:JHD)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: James Halstead plc manufactures and supplies flooring products for commercial and domestic uses across various regions including the United Kingdom, Europe, Scandinavia, Australasia, Asia, and internationally, with a market cap of £671.03 million.

Operations: James Halstead plc generates revenue of £268.52 million from its flooring products manufacturing and distribution operations across multiple global markets.

Dividend Yield: 5.3%

James Halstead has maintained stable and reliable dividends over the past decade, with a recent 10% interim dividend increase to 2.75 pence per share. Despite a high payout ratio of 86%, dividends are covered by earnings but not by free cash flows, which poses sustainability concerns. The dividend yield of 5.28% is slightly below the top tier in the UK market, while its price-to-earnings ratio of 15.8x remains competitive against the market average.

- Take a closer look at James Halstead's potential here in our dividend report.

- Our valuation report here indicates James Halstead may be overvalued.

Conduit Holdings (LSE:CRE)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Conduit Holdings Limited, with a market cap of £604.52 million, operates globally through its subsidiary to offer reinsurance products and services.

Operations: Conduit Holdings Limited generates revenue through its reinsurance operations, with segments including Casualty at $190.60 million, Property at $344.20 million, and Specialty at $154.40 million.

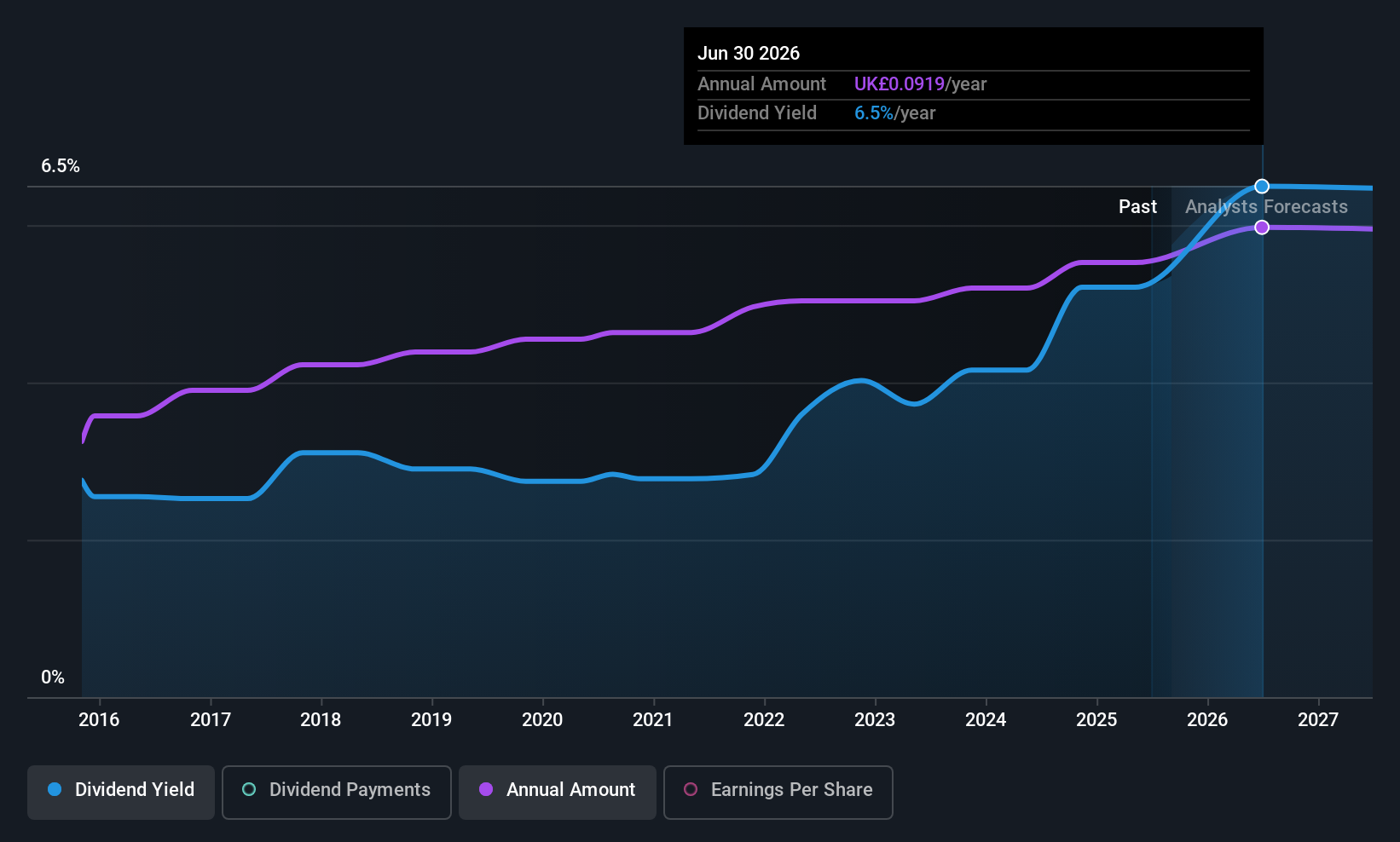

Dividend Yield: 6.9%

Conduit Holdings' dividend yield of 6.87% ranks in the top 25% of UK payers, supported by a low cash payout ratio of 13.9% and a reasonable earnings payout ratio of 45.1%. However, its dividend history is less reliable, with payments being volatile over its four-year record and no growth observed. Recent strategic moves include a $50 million share buyback program funded from existing cash resources, potentially impacting future dividend sustainability or growth prospects.

- Delve into the full analysis dividend report here for a deeper understanding of Conduit Holdings.

- Our valuation report unveils the possibility Conduit Holdings' shares may be trading at a discount.

Inchcape (LSE:INCH)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Inchcape plc is an automotive distributor and retailer with a market capitalization of approximately £2.53 billion.

Operations: Inchcape plc generates its revenue from three primary segments: APAC (£2.99 billion), Americas (£3.27 billion), and Europe & Africa (£3.00 billion).

Dividend Yield: 4.2%

Inchcape's dividend yield of 4.18% is below the top 25% of UK dividend payers, but its payouts are well-covered by earnings and cash flows, with payout ratios at 42.9% and 20.9%, respectively. Despite past volatility in dividends, there has been growth over the last decade. Recent strategic initiatives include seeking bolt-on acquisitions, which could influence future financial performance and dividend stability amidst a high debt level and recent board changes affecting governance dynamics.

- Dive into the specifics of Inchcape here with our thorough dividend report.

- Our valuation report here indicates Inchcape may be undervalued.

Summing It All Up

- Get an in-depth perspective on all 58 Top UK Dividend Stocks by using our screener here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CRE

Conduit Holdings

Through its subsidiary, provides reinsurance products and services worldwide.

Excellent balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives