- United Kingdom

- /

- Insurance

- /

- LSE:AV.

Aviva (LSE:AV.)—A Fresh Look at Value After Recent Returns and Analyst Debate

Reviewed by Simply Wall St

See our latest analysis for Aviva.

Aviva’s shares have powered higher over the past year, with a 58.56% total shareholder return and strong year-to-date momentum. This signals improving sentiment and renewed confidence in its growth story after recent headline events. While day-to-day price shifts remain modest, the company’s longer-term performance clearly stands out from the pack.

If you’re looking for your next opportunity, now’s an ideal moment to broaden your investing horizons and discover fast growing stocks with high insider ownership

Yet with shares hovering just shy of analyst targets and posting robust long-term returns, the key question remains: is Aviva undervalued, or has the market already factored in all its future growth potential?

Most Popular Narrative: 90% Undervalued

Compared to Aviva’s last close at £6.76, the prevailing narrative sees a fair value all the way up at £11.02, a major gap pointing toward significant upside. This sets the stage for a debate on whether recent strategic changes and industry tailwinds truly justify such a bullish stance.

Aviva's exposure to the UK's ageing population, persistent demand for retirement solutions, and growing assets in workplace pensions and wealth mean that the company stands to benefit structurally from increasing premium inflows and strong long-term growth in Assets Under Management (AUM) and fee income, driving future revenues and operating profit.

What bold forecasts push Aviva’s fair value into the stratosphere? The narrative hinges on explosive revenue growth, margin jumps, and a future profit multiple rarely seen in its sector. Think analyst estimates that would raise eyebrows. See what’s behind the headline number.

Result: Fair Value of £11.02 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent dependence on the mature UK insurance market and challenges integrating recent acquisitions could limit Aviva’s ability to deliver sustained and outsized growth.

Find out about the key risks to this Aviva narrative.

Another View: Market Multiples Send a Different Signal

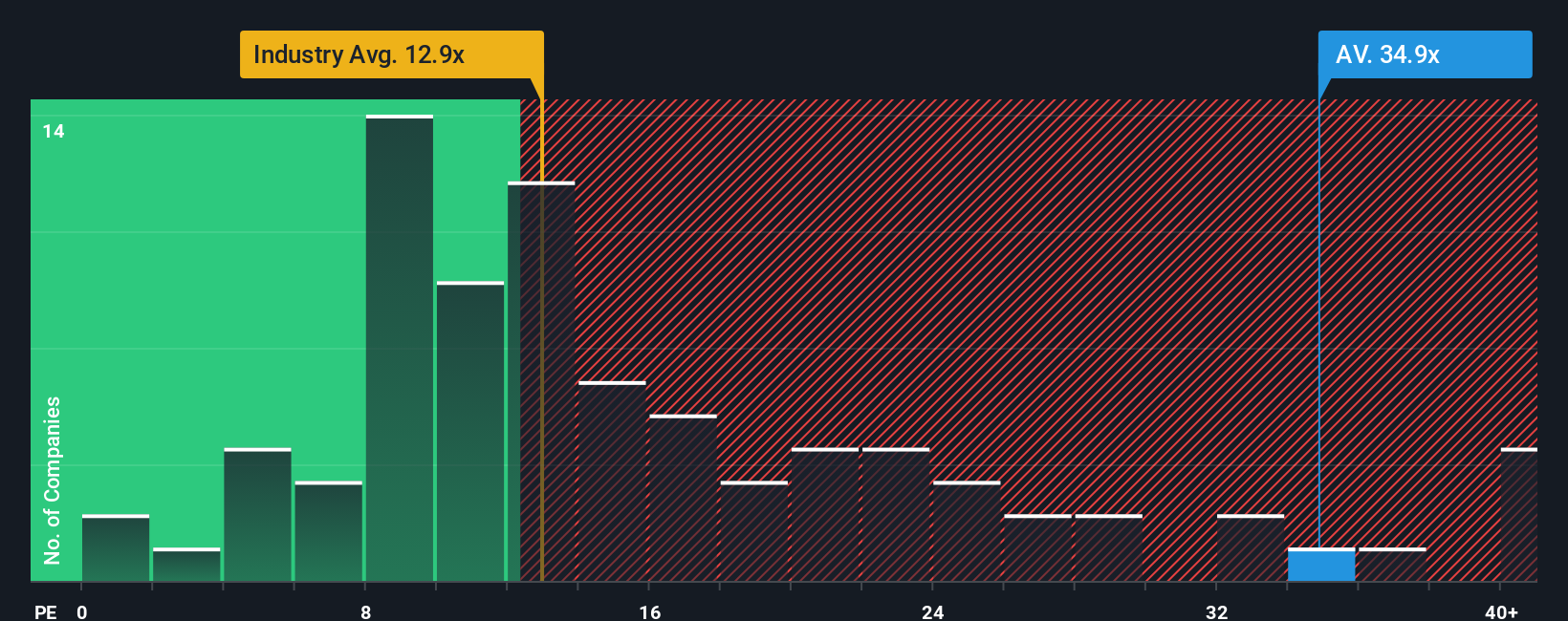

While the discounted cash flow approach points to Aviva being undervalued, the company's price-to-earnings ratio tells a different story. Aviva trades at 34.6 times earnings, which is notably higher than the industry average of 12.7 and a peer average of 20.4. Even compared to the fair ratio of 21.6, it appears expensive. This suggests the market may be pricing in more optimism than fundamentals justify. Does this signal a valuation risk, or is the premium truly warranted?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Aviva Narrative

If you’d rather dig into the numbers and reach your own conclusions, it takes just a few minutes to develop a completely personalized view. Do it your way.

A great starting point for your Aviva research is our analysis highlighting 2 key rewards and 2 important warning signs that could impact your investment decision.

Looking for More Smart Investment Ideas?

Expand your portfolio’s potential by tapping unique themes and growth stories that most investors overlook. The right stock could transform your outcomes, but only if you act before the crowd catches on.

- Discover future potential with these 870 undervalued stocks based on cash flows featuring established names trading at deep discounts based on solid cash flow analysis.

- Explore the AI boom by checking out these 24 AI penny stocks, where companies are using machine intelligence to redefine industries and drive growth.

- Increase your income by targeting these 16 dividend stocks with yields > 3% that deliver market-beating yields and reliable cash payouts for steady wealth building.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AV.

Aviva

Provides various insurance, retirement, and wealth products in the United Kingdom, Ireland, Canada, and internationally.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives