- United Kingdom

- /

- Specialty Stores

- /

- LSE:CURY

UK's Promising Penny Stocks For November 2025

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. Despite these broader market pressures, there remains a niche within the investment landscape that continues to intrigue investors: penny stocks. While the term might seem outdated, these smaller or newer companies can offer a mix of affordability and growth potential when backed by strong financials, making them an interesting area for those seeking under-the-radar opportunities.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.89 | £558.3M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.20 | £177.73M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.53 | £127.37M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.895 | £13.51M | ✅ 2 ⚠️ 3 View Analysis > |

| Northern Bear (AIM:NTBR) | £1.135 | £15.62M | ✅ 4 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £2.25 | £28.55M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.56 | $325.54M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.48 | £251.33M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.425 | £68.83M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.135 | £181.15M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Let's explore several standout options from the results in the screener.

NIOX Group (AIM:NIOX)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: NIOX Group Plc is involved in the design, development, and commercialization of medical devices for asthma diagnosis, monitoring, and management globally, with a market cap of £296.69 million.

Operations: The company generates revenue primarily from its NIOX® segment, which accounted for £46 million.

Market Cap: £296.69M

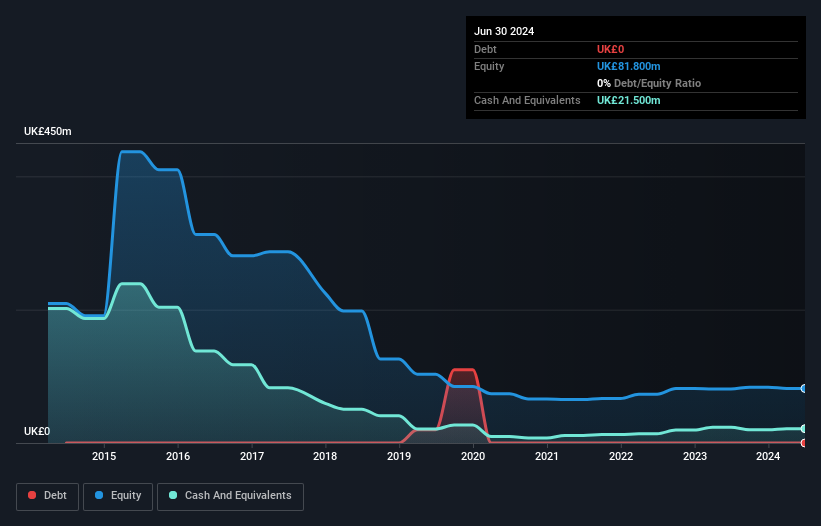

NIOX Group Plc, with a market cap of £296.69 million, has shown promising financial performance in recent periods, reporting half-year sales of £25.2 million and net income of £5.9 million as of June 2025. Despite negative earnings growth over the past year and reduced profit margins from 28.2% to 10.7%, the company remains debt-free with short-term assets exceeding liabilities significantly (£22.4M vs £6M). Trading at a discount to its estimated fair value and boasting high-quality earnings, NIOX's profitability has grown substantially over the past five years despite recent volatility in returns and lower-than-desired return on equity (7.6%).

- Unlock comprehensive insights into our analysis of NIOX Group stock in this financial health report.

- Evaluate NIOX Group's prospects by accessing our earnings growth report.

Currys (LSE:CURY)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Currys plc is an omnichannel retailer of technology products and services across the UK, Ireland, and several Nordic countries, with a market cap of £1.41 billion.

Operations: The company generates revenue from two main geographical segments: £5.35 billion from the UK & Ireland and £3.42 billion from the Nordics.

Market Cap: £1.41B

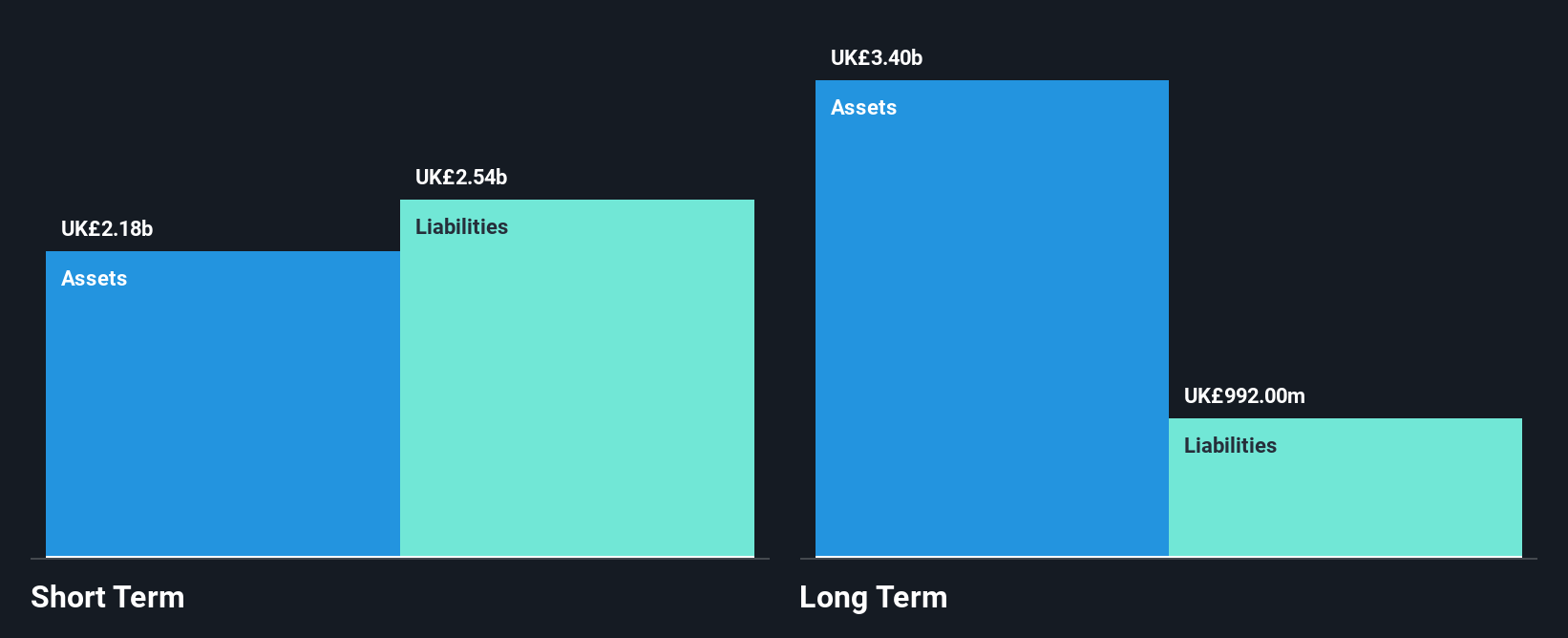

Currys plc, with a market cap of £1.41 billion, demonstrates several strengths as a potential investment in the realm of penny stocks. The company has shown robust earnings growth over the past year, significantly outpacing its industry peers. Its debt is well covered by operating cash flow and it holds more cash than total debt, indicating strong financial health. Trading at a price-to-earnings ratio below the UK market average suggests good relative value. However, its return on equity remains low and short-term liabilities exceed short-term assets slightly. Recent board changes reflect an evolving governance structure focusing on sustainability goals.

- Click to explore a detailed breakdown of our findings in Currys' financial health report.

- Review our growth performance report to gain insights into Currys' future.

Luceco (LSE:LUCE)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Luceco plc is a company that manufactures and distributes wiring accessories, LED lighting, and portable power products across various regions including the United Kingdom, the Americas, Europe, the Middle East, Africa, and the Asia Pacific with a market cap of £216.55 million.

Operations: The company generates revenue from three main segments: Wiring Accessories (£121 million), LED Lighting (£78.8 million), and Portable Power (£58.8 million).

Market Cap: £216.55M

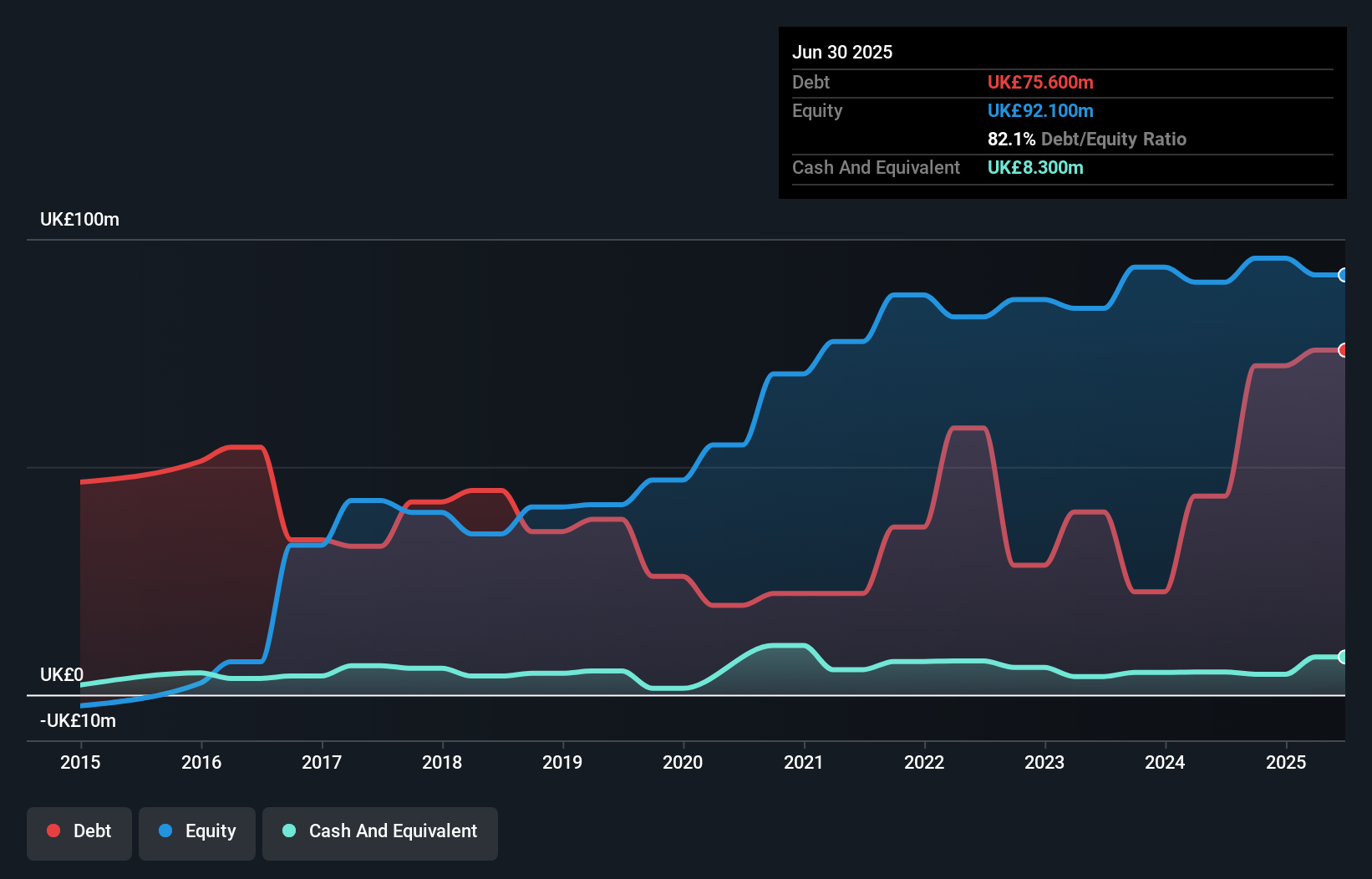

Luceco plc, with a market cap of £216.55 million, presents a mixed picture for investors in the penny stock segment. The company is actively exploring mergers and acquisitions to bolster growth, particularly in the energy transition space. Despite stable weekly volatility and manageable debt covered by operating cash flow, Luceco's net profit margins have declined from last year. The company's interim dividend has increased slightly but remains unstable historically. While short-term assets exceed liabilities comfortably, its high net debt to equity ratio suggests financial caution is warranted. Earnings growth forecasts are positive but past earnings have seen declines.

- Navigate through the intricacies of Luceco with our comprehensive balance sheet health report here.

- Examine Luceco's earnings growth report to understand how analysts expect it to perform.

Seize The Opportunity

- Gain an insight into the universe of 295 UK Penny Stocks by clicking here.

- Interested In Other Possibilities? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:CURY

Currys

Operates as a omnichannel retailer of technology products and services in the United Kingdom, Ireland, Norway, Sweden, Finland, Denmark, Iceland, Greenland, and the Faroe Islands.

Solid track record and good value.

Similar Companies

Market Insights

Community Narratives