- United Kingdom

- /

- Beverage

- /

- LSE:DGE

Here's Why We Think Diageo (LON:DGE) Might Deserve Your Attention Today

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' Loss making companies can act like a sponge for capital - so investors should be cautious that they're not throwing good money after bad.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Diageo (LON:DGE). While this doesn't necessarily speak to whether it's undervalued, the profitability of the business is enough to warrant some appreciation - especially if its growing.

View our latest analysis for Diageo

Diageo's Improving Profits

Even when EPS earnings per share (EPS) growth is unexceptional, company value can be created if this rate is sustained each year. So it's easy to see why many investors focus in on EPS growth. Diageo's EPS skyrocketed from UK£1.14 to UK£1.43, in just one year; a result that's bound to bring a smile to shareholders. That's a impressive gain of 26%.

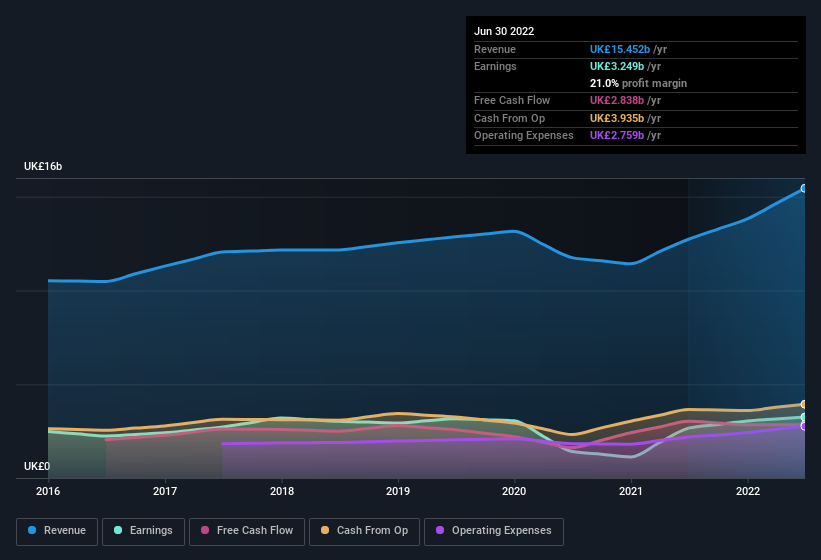

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. While we note Diageo achieved similar EBIT margins to last year, revenue grew by a solid 21% to UK£15b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

Of course the knack is to find stocks that have their best days in the future, not in the past. You could base your opinion on past performance, of course, but you may also want to check this interactive graph of professional analyst EPS forecasts for Diageo.

Are Diageo Insiders Aligned With All Shareholders?

Investors are always searching for a vote of confidence in the companies they hold and insider buying is one of the key indicators for optimism on the market. This view is based on the possibility that stock purchases signal bullishness on behalf of the buyer. However, insiders are sometimes wrong, and we don't know the exact thinking behind their acquisitions.

It's pleasing to note that insiders spent UK£1.1m buying Diageo shares, over the last year, without reporting any share sales whatsoever. The shareholders within the general public should find themselves expectant and certainly hopeful, that this large outlay signals prescient optimism for the business. It is also worth noting that it was Non-Executive Chairman Francisco Javier Larraz who made the biggest single purchase, worth UK£916k, paying UK£36.65 per share.

The good news, alongside the insider buying, for Diageo bulls is that insiders (collectively) have a meaningful investment in the stock. With a whopping UK£67m worth of shares as a group, insiders have plenty riding on the company's success. This should keep them focused on creating long term value for shareholders.

Is Diageo Worth Keeping An Eye On?

You can't deny that Diageo has grown its earnings per share at a very impressive rate. That's attractive. On top of that, insiders own a significant stake in the company and have been buying more shares. So it's fair to say that this stock may well deserve a spot on your watchlist. It's still necessary to consider the ever-present spectre of investment risk. We've identified 1 warning sign with Diageo , and understanding this should be part of your investment process.

Keen growth investors love to see insider buying. Thankfully, Diageo isn't the only one. You can see a a free list of them here.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About LSE:DGE

Diageo

Engages in the production, marketing, and sale of alcoholic beverages.

Established dividend payer and good value.