- United Kingdom

- /

- Beverage

- /

- LSE:DGE

Diageo (LSE:DGE): Exploring Valuation After Recent Share Price Decline

Reviewed by Simply Wall St

Diageo (LSE:DGE) stock has struggled to gain ground over the past year, with the share price down more than 23%. This performance prompts a closer look at where the business stands today.

See our latest analysis for Diageo.

With Diageo’s share price retreating over 32% year-to-date, market sentiment seems to be cooling after a stretch of strong growth in previous years. The one-year total shareholder return of -23.5% underscores that momentum has faded, even with Diageo’s leadership in global spirits.

If you’re weighing new opportunities, now is a smart time to expand your search and discover fast growing stocks with high insider ownership

But after such a sharp drop, are investors overlooking a hidden value, or are expectations for a rebound already reflected in today’s price? Could this be a real buying opportunity, or is future growth already accounted for?

Most Popular Narrative: 21.8% Undervalued

Despite Diageo’s last closing price of £17.25, the most popular narrative pegs fair value at £22.05, a notable gap worth investigating. The narrative is shaped by analyst expectations for revenue momentum, margins, and the ongoing tension between premiumization strategies and sluggish market conditions.

Diageo is intensifying its focus on premiumization and category expansion, particularly in tequila and ready-to-drink beverages, to capture rising consumer affluence and elevated brand preferences in both emerging and developed markets. These efforts are aimed at supporting future revenue growth and gross margin expansion. The company is undertaking a multiyear overhaul to deepen locally tailored, occasion-led marketing and distribution strategies across key regions including Europe, Asia-Pacific, and Africa. This positions Diageo to take advantage of demographic shifts such as urbanization and a growing legal drinking-age population, factors that are expected to influence volume and sales momentum over the long term.

Want the real drivers behind this value gap? There is a bold thesis here rooted in new market playbooks and major category shifts. The forecast numbers at the center of this story could surprise even seasoned investors. Don’t miss what could shake up market expectations.

Result: Fair Value of £22.05 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent trends toward moderation and tighter regulations could limit Diageo’s growth trajectory. This may make a swift recovery less certain for investors.

Find out about the key risks to this Diageo narrative.

Another View: Market Ratios Raise Questions

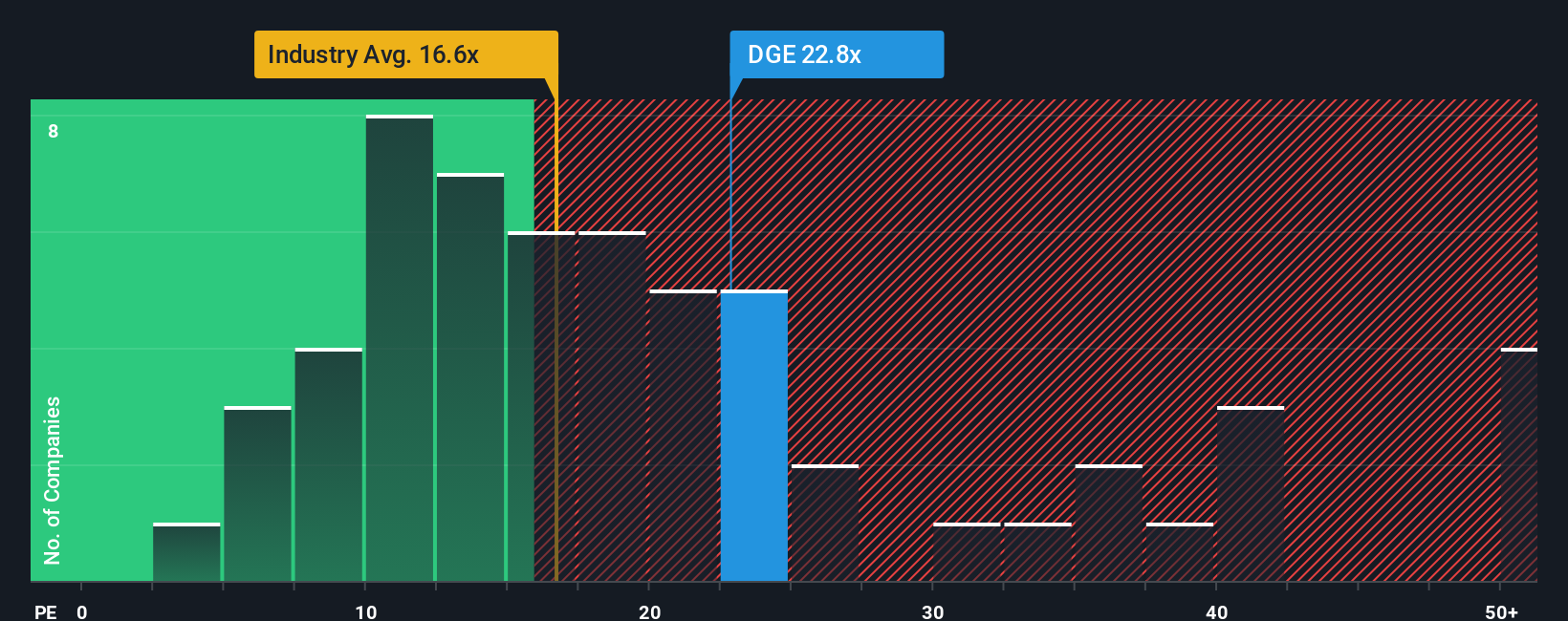

Examining Diageo’s share price through the lens of earnings multiples brings a different perspective. The company trades at a price-to-earnings ratio of 21.9x, slightly above peer averages (21.7x) and well above the European Beverage industry (17.3x). Interestingly, it still sits below its fair ratio of 26.3x, a level the market could eventually approach. This suggests the shares may not be a bargain based on today’s market sentiment, but do investors see opportunity where the market is more cautious?

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Diageo Narrative

If you see the story differently or prefer digging into the data on your own terms, you can build your own perspective in under three minutes. Do it your way.

A great starting point for your Diageo research is our analysis highlighting 3 key rewards and 4 important warning signs that could impact your investment decision.

Looking for more investment ideas?

Don’t let the best opportunities pass you by. Expand your horizons beyond Diageo and find unique stocks tailored to your strategy with these clever approaches from Simply Wall Street:

- Spot unrecognized growth potential and tap into upside with these 932 undervalued stocks based on cash flows that show strong fundamentals and attractive valuations others might overlook.

- Generate income and beat savings rates as you benefit from these 14 dividend stocks with yields > 3% boasting yields comfortably above 3%.

- Jump ahead of industry trends by investigating these 25 AI penny stocks positioned to benefit from artificial intelligence breakthroughs in real-world sectors.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:DGE

Diageo

Engages in the production, marketing, and distribution of alcoholic beverages in North America, Europe, the Asia Pacific, Latin America and Caribbean, and Africa.

Good value average dividend payer.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026