- United Kingdom

- /

- Oil and Gas

- /

- LSE:SHEL

Is Shell’s Stock Opportunity Growing After Recent Energy Transition News?

Reviewed by Bailey Pemberton

- Ever wondered whether Shell stock is genuinely great value or if there is more beneath the surface? Let’s explore what investors like you should know before making the next move.

- Shell shares have climbed a solid 10.3% so far this year and are up an impressive 13.6% over the past twelve months, hinting at both growth potential and fresh market optimism.

- Recent headlines have focused on Shell’s pivot towards energy transition strategies and continued share buybacks, which has kept investor attention high. Strategic decisions in renewables and cost management have shaped views on both long-term prospects and nearer-term volatility.

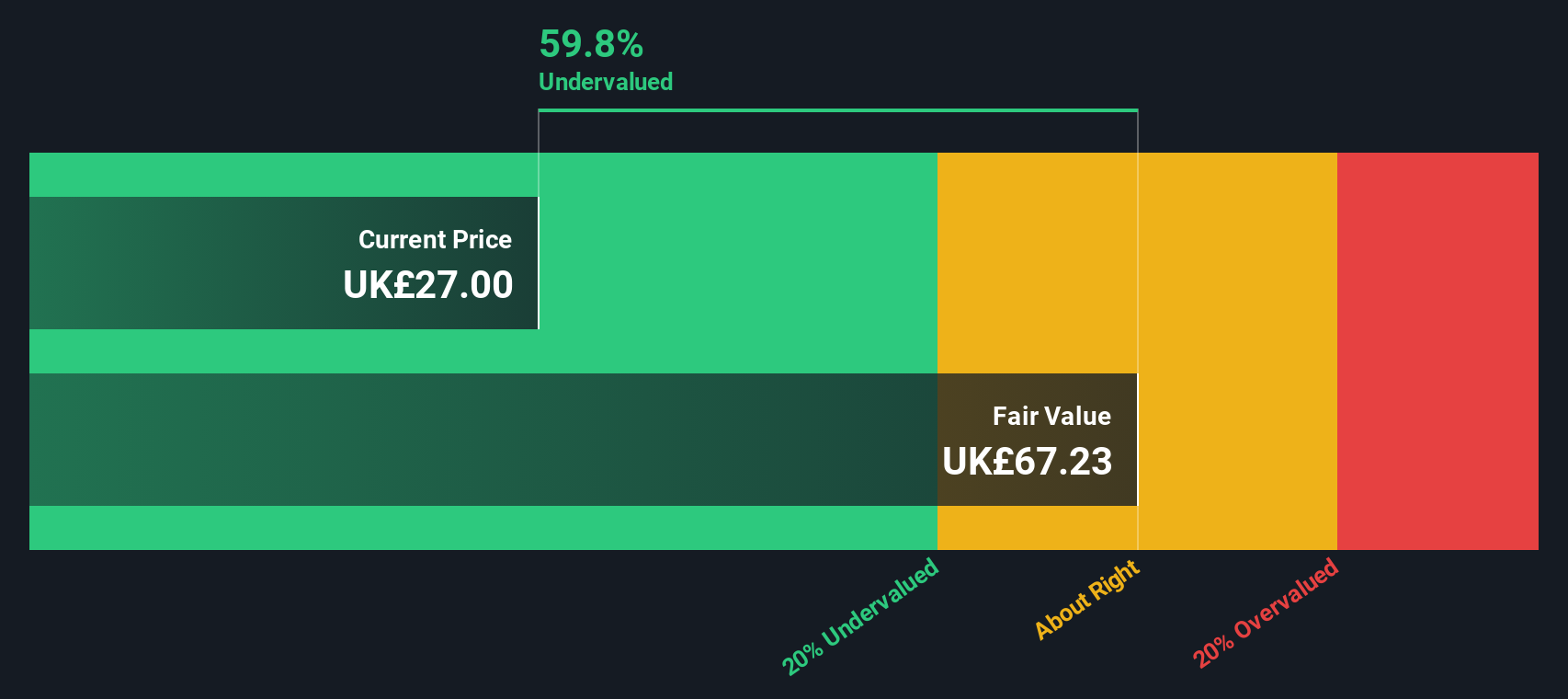

- Shell currently scores 4 out of 6 on our valuation checks. This means it’s considered undervalued in most key ways. As we break down the different valuation approaches, keep in mind there may be an even more insightful way to navigate the numbers. Stay tuned for that at the end.

Find out why Shell's 13.6% return over the last year is lagging behind its peers.

Approach 1: Shell Discounted Cash Flow (DCF) Analysis

The Discounted Cash Flow (DCF) model estimates what a company is truly worth today by projecting its future free cash flows and then discounting them back to present value. This gives investors a way to see past market price volatility and focus on the core numbers driving long-term value.

For Shell, analysts estimate that last year’s Free Cash Flow was $27.9 billion, and forecasts suggest cash flows will remain strong. Over the next several years, projections anticipate growth to $26.2 billion by 2029. It is important to note that analysts provide direct estimates only for the next few years, so the farther out these projections go, the more they rely on extrapolation by Simply Wall St models.

Using the 2 Stage Free Cash Flow to Equity method, the DCF model suggests Shell’s intrinsic value is $58.77 per share. Compared to its current market price, this points to a significant 52.6% discount, meaning the shares appear very undervalued from a cash flow perspective.

Result: UNDERVALUED

Our Discounted Cash Flow (DCF) analysis suggests Shell is undervalued by 52.6%. Track this in your watchlist or portfolio, or discover 928 more undervalued stocks based on cash flows.

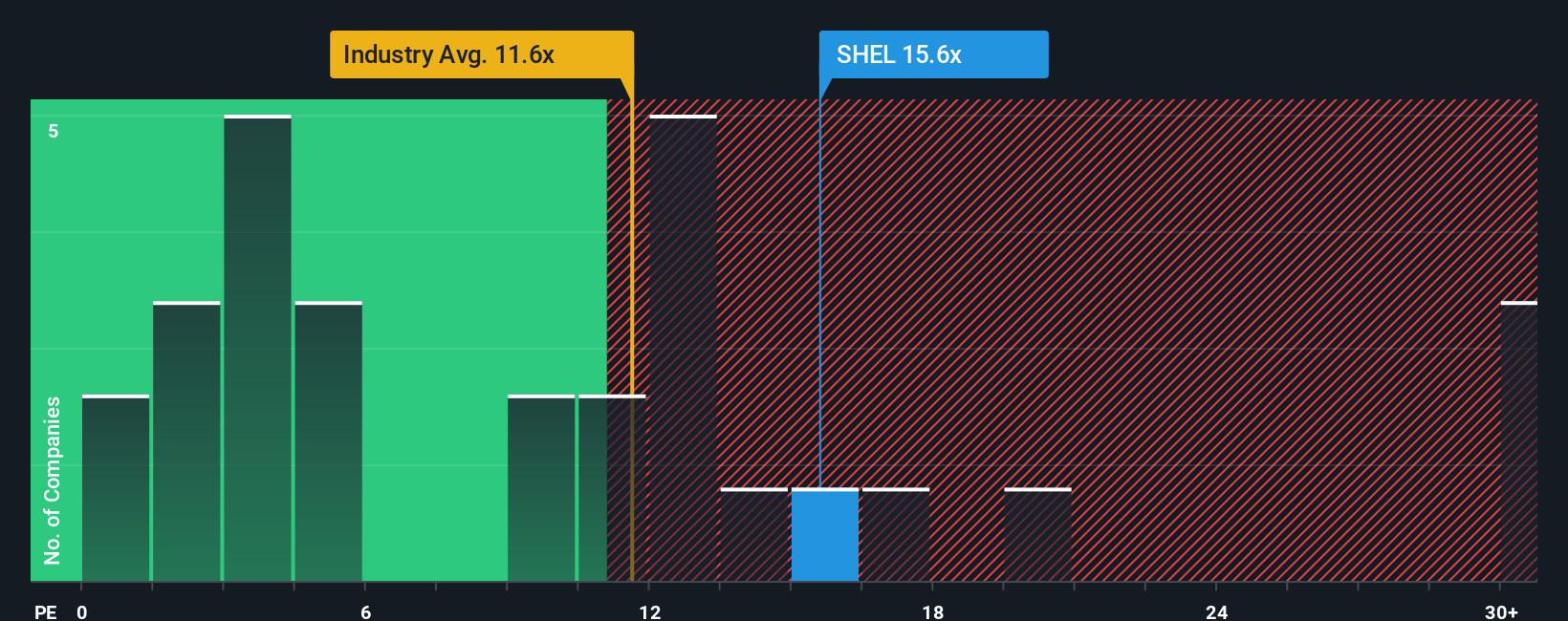

Approach 2: Shell Price vs Earnings (PE)

The Price-to-Earnings (PE) ratio is a widely used valuation metric for established, profitable companies like Shell because it tells investors how much they are paying for each unit of reported earnings. Since Shell generates substantial profits and maintains relatively stable earnings, PE provides a quick snapshot of how the market is currently valuing those profits.

Market expectations for growth and risk drive what is considered a "normal" or "fair" PE ratio. In general, the higher the anticipated earnings growth and the lower the risk, the more investors are willing to pay, resulting in a higher PE multiple.

Shell's current PE ratio is 14.5x, which compares favorably to both the Oil and Gas industry average of 10.4x and the peer average of 15.5x. While these benchmarks offer useful context, they do not account for Shell's unique combination of scale, profitability, and growth prospects.

This is where Simply Wall St's proprietary Fair Ratio comes in. Calculated at 18.5x for Shell, the Fair Ratio incorporates not only industry data and peer comparisons, but also factors such as Shell's earnings growth, margin profile, market cap, and risk level. This approach allows for a much more tailored view of fair value, rather than relying solely on broad averages.

Comparing Shell’s actual PE of 14.5x to the Fair Ratio of 18.5x suggests the stock is trading well below its estimated fair value. For investors, this is a strong signal that Shell may be undervalued by the market based on its earnings power and fundamentals.

Result: UNDERVALUED

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover 1441 companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Shell Narrative

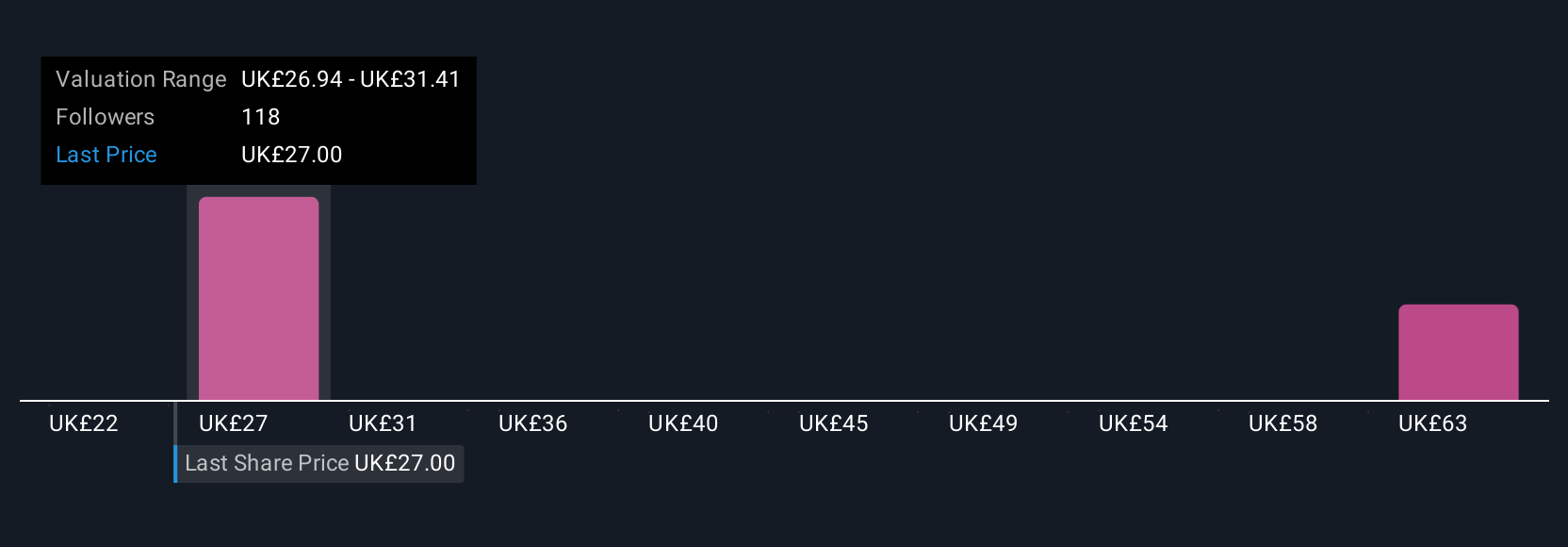

Earlier we mentioned that there is an even better way to understand valuation. Let's introduce you to Narratives. A Narrative is simply your story for a company, connecting the dots between what you believe about its future and what that means for its financials, such as revenue, earnings, margins, and ultimately, its true fair value.

Instead of just relying on numbers, Narratives empower you to express your view on Shell’s outlook, link that story to future forecasts, and see how it translates into a fair value estimate. This approach is available to everyone on Simply Wall St’s Community page, where millions of investors share and refine their perspectives interactively.

With Narratives, you can easily decide when to consider buying or selling shares by comparing your fair value to the current price, and your key calculations update dynamically when new news or results are released. This helps keep your outlook as current as possible.

For example, different investors have recently set their Shell fair value as high as £39.36 or as low as £27.06, depending on whether they envision upbeat earnings growth and strong energy demand, or expect continued sector risks and margin pressure.

Do you think there's more to the story for Shell? Head over to our Community to see what others are saying!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:SHEL

Shell

Operates as an energy and petrochemical company Europe, Asia, Oceania, Africa, the United States, and other Americas.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026