- United Kingdom

- /

- Capital Markets

- /

- LSE:EMG

UK Stocks Estimated To Be Trading Below Their Intrinsic Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 index declining amid weak trade data from China, highlighting concerns about global economic recovery and its impact on UK companies. As investors navigate these uncertain times, identifying stocks that are trading below their intrinsic value can offer potential opportunities for those looking to capitalize on undervalued assets in a fluctuating market environment.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Pinewood Technologies Group (LSE:PINE) | £3.65 | £7.18 | 49.1% |

| PageGroup (LSE:PAGE) | £2.37 | £4.52 | 47.6% |

| Norcros (LSE:NXR) | £2.93 | £5.29 | 44.6% |

| Nichols (AIM:NICL) | £10.10 | £18.53 | 45.5% |

| Motorpoint Group (LSE:MOTR) | £1.40 | £2.77 | 49.5% |

| Forterra (LSE:FORT) | £1.824 | £3.29 | 44.6% |

| Fintel (AIM:FNTL) | £2.13 | £3.80 | 44% |

| Begbies Traynor Group (AIM:BEG) | £1.14 | £2.20 | 48.1% |

| Airtel Africa (LSE:AAF) | £3.12 | £5.87 | 46.8% |

| Advanced Medical Solutions Group (AIM:AMS) | £2.115 | £4.15 | 49.1% |

Let's take a closer look at a couple of our picks from the screened companies.

Man Group (LSE:EMG)

Overview: Man Group Limited is a publicly owned investment manager with a market cap of approximately £2.30 billion, specializing in diverse asset management strategies.

Operations: The company's revenue from its Investment Management Business segment is $1.31 billion.

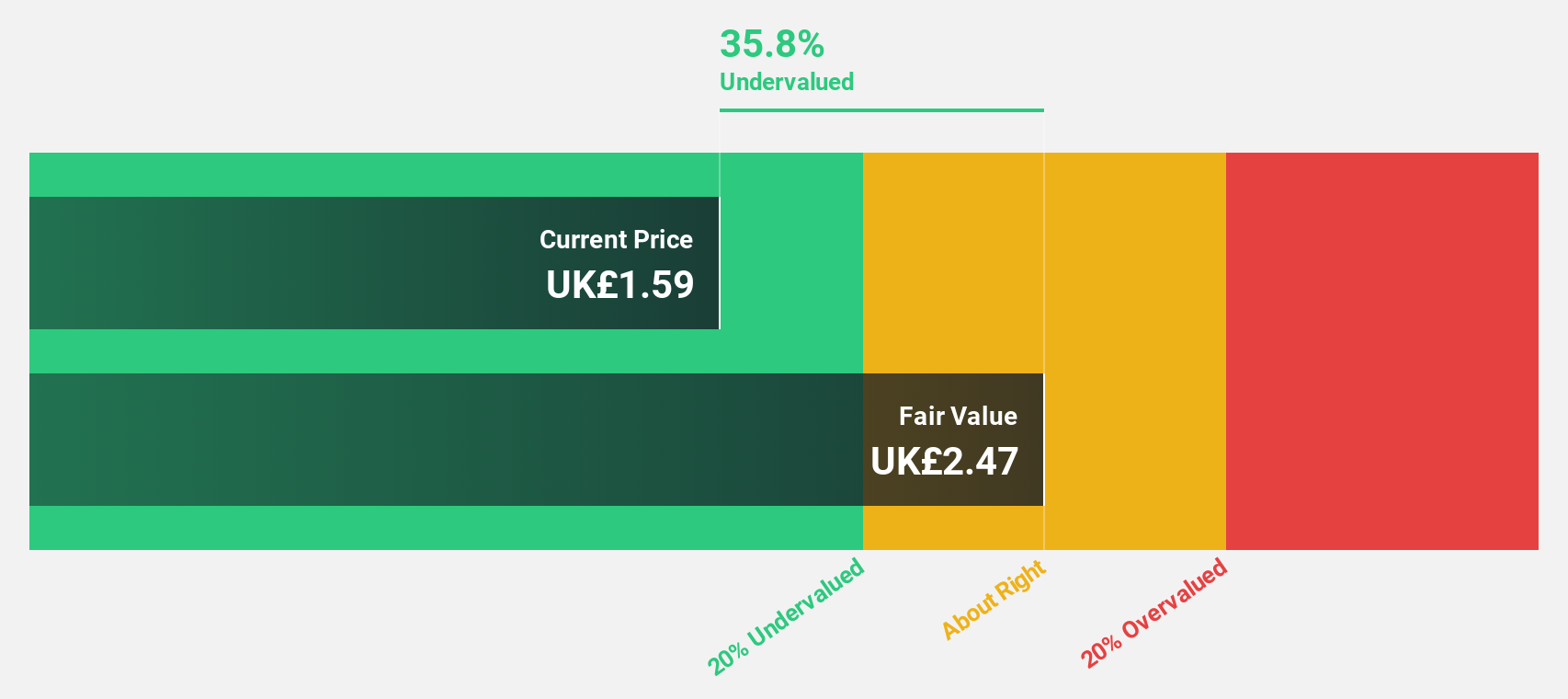

Estimated Discount To Fair Value: 41%

Man Group is trading at £2.06, significantly below its estimated fair value of £3.5, making it highly undervalued based on cash flows. Despite a recent decline in profit margins from 22.6% to 14.2%, earnings are expected to grow substantially at 36.13% annually over the next three years, outpacing the UK market's growth rate of 14.4%. However, its dividend yield of 6.31% is not well covered by earnings, which may concern income-focused investors.

- The growth report we've compiled suggests that Man Group's future prospects could be on the up.

- Click here and access our complete balance sheet health report to understand the dynamics of Man Group.

PageGroup (LSE:PAGE)

Overview: PageGroup plc, with a market cap of £739.50 million, operates as a recruitment consultancy offering services across the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Operations: The company generates revenue of £1.64 billion from its recruitment services across various regions including the United Kingdom, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

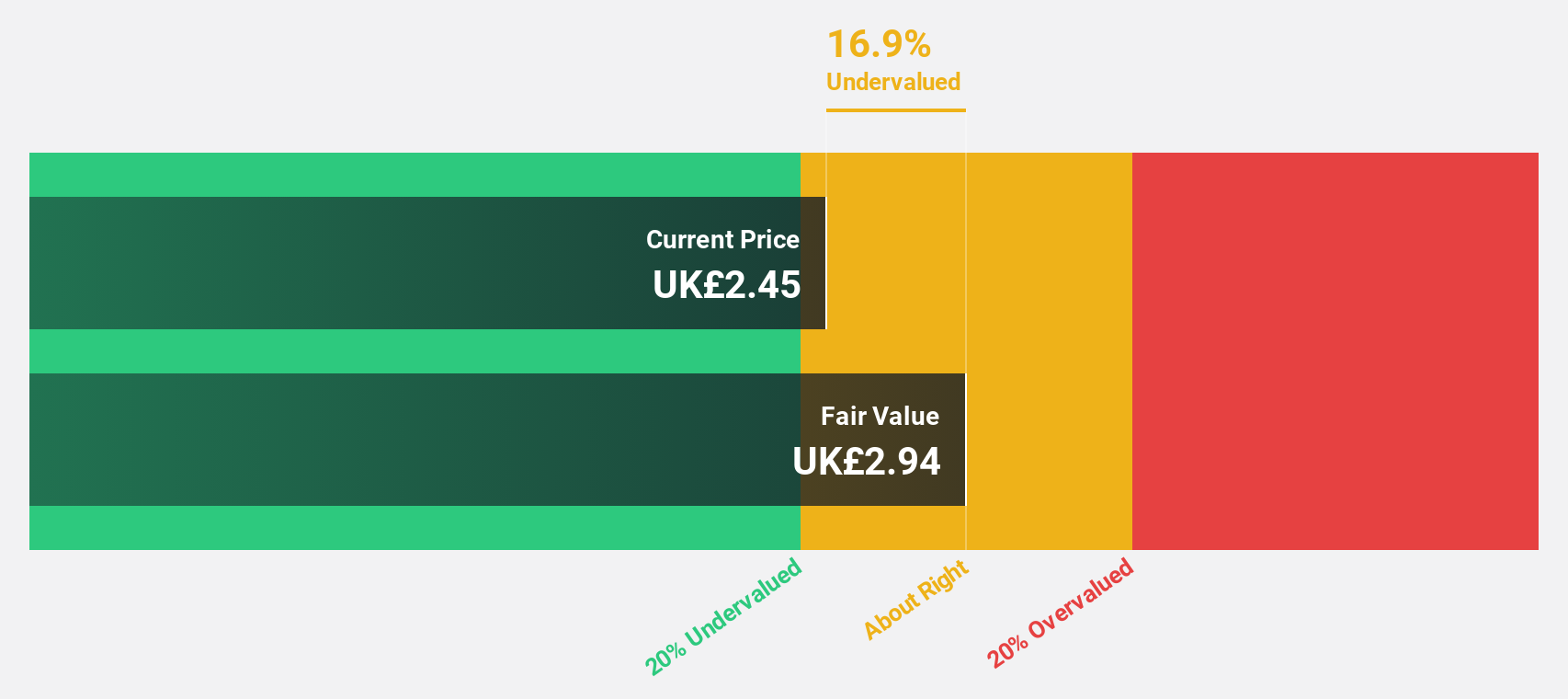

Estimated Discount To Fair Value: 47.6%

PageGroup is trading at £2.37, significantly below its estimated fair value of £4.52, indicating it is highly undervalued based on cash flows. Despite a reduction in profit margins from 2.7% to 0.7%, earnings are forecast to grow substantially at 67.31% annually over the next three years, surpassing the UK market's growth rate of 14.4%. However, recent guidance lowering operating profit expectations and an unsustainable dividend yield of 7.22% may pose concerns for investors.

- Insights from our recent growth report point to a promising forecast for PageGroup's business outlook.

- Click here to discover the nuances of PageGroup with our detailed financial health report.

Pinewood Technologies Group (LSE:PINE)

Overview: Pinewood Technologies Group PLC is a cloud-based dealer management software provider operating in the UK, Europe, Africa, Asia, and the Middle East with a market cap of £366.96 million.

Operations: Pinewood Technologies Group generates its revenue from providing cloud-based dealer management software across the UK, Europe, Africa, Asia, and the Middle East.

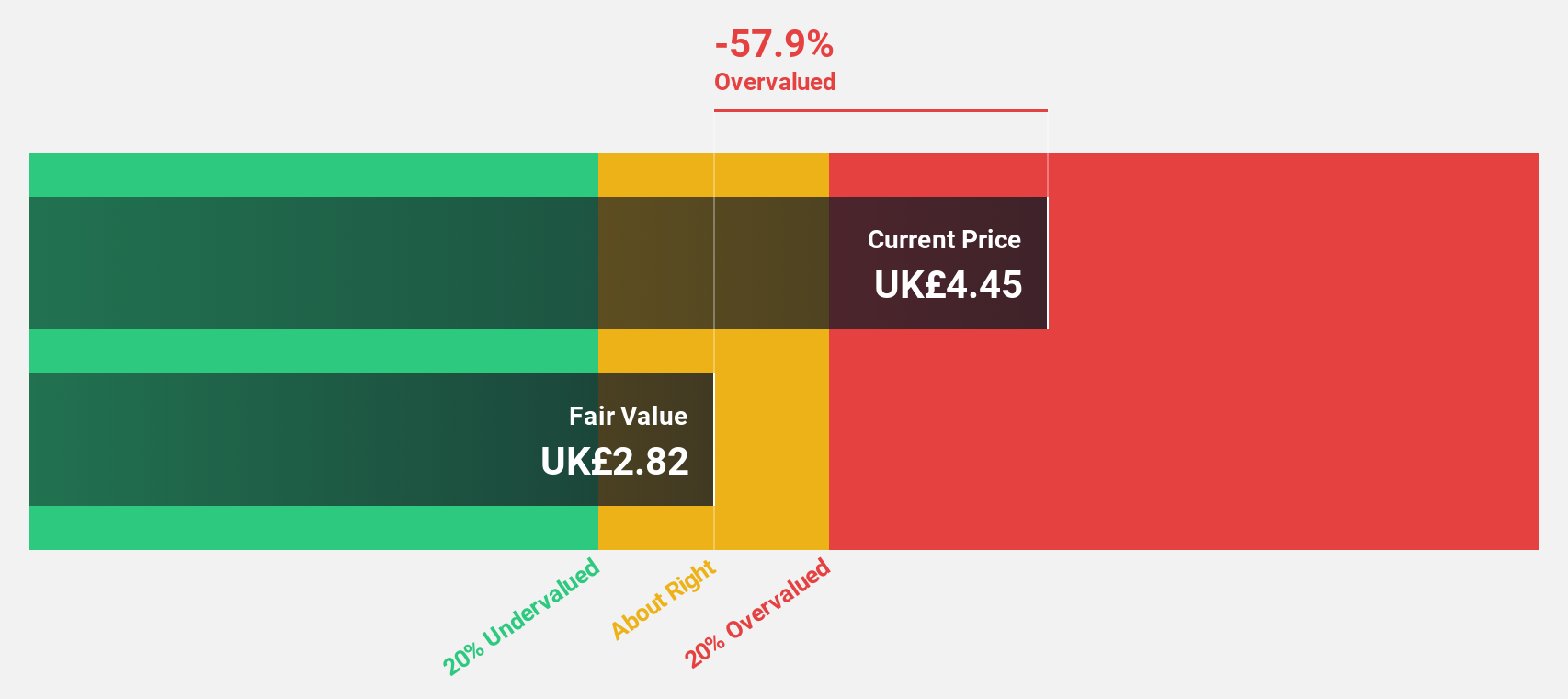

Estimated Discount To Fair Value: 49.1%

Pinewood Technologies Group, trading at £3.65, is significantly undervalued with an estimated fair value of £7.18. Despite a recent net loss of £0.7 million and shareholder dilution, its earnings are projected to grow by 49.21% annually, outpacing the UK market's growth rate of 14.4%. Recent board appointments bring strategic expertise as Pinewood expands in AI technology sectors, enhancing its potential for future profitability and market positioning within the FTSE indices.

- Our comprehensive growth report raises the possibility that Pinewood Technologies Group is poised for substantial financial growth.

- Navigate through the intricacies of Pinewood Technologies Group with our comprehensive financial health report here.

Next Steps

- Dive into all 53 of the Undervalued UK Stocks Based On Cash Flows we have identified here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:EMG

High growth potential with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Perdana Petroleum Berhad is a Zombie Business with a 27.34% Profit Margin and inflation adjusted revenue Business

Many trends acting at the same time

Engineered for Stability. Positioned for Growth.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026