We'd be surprised if TMT Investments PLC (LON:TMT) shareholders haven't noticed that the Head of Strategy & Director for Strategic Development, German Kaplun, recently sold US$131k worth of stock at US$2.62 per share. However, the silver lining is that the sale only reduced their total holding by 0.7%, so we're hesitant to read anything much into it, on its own.

The Last 12 Months Of Insider Transactions At TMT Investments

Over the last year, we can see that the biggest insider purchase was by Head of Business Development Alexander Morgulchik for US$155k worth of shares, at about US$2.75 per share. So it's clear an insider wanted to buy, at around the current price, which is US$2.79. While their view may have changed since the purchase was made, this does at least suggest they have had confidence in the company's future. If someone buys shares at well below current prices, it's a good sign on balance, but keep in mind they may no longer see value. Happily, the TMT Investments insiders decided to buy shares at close to current prices.

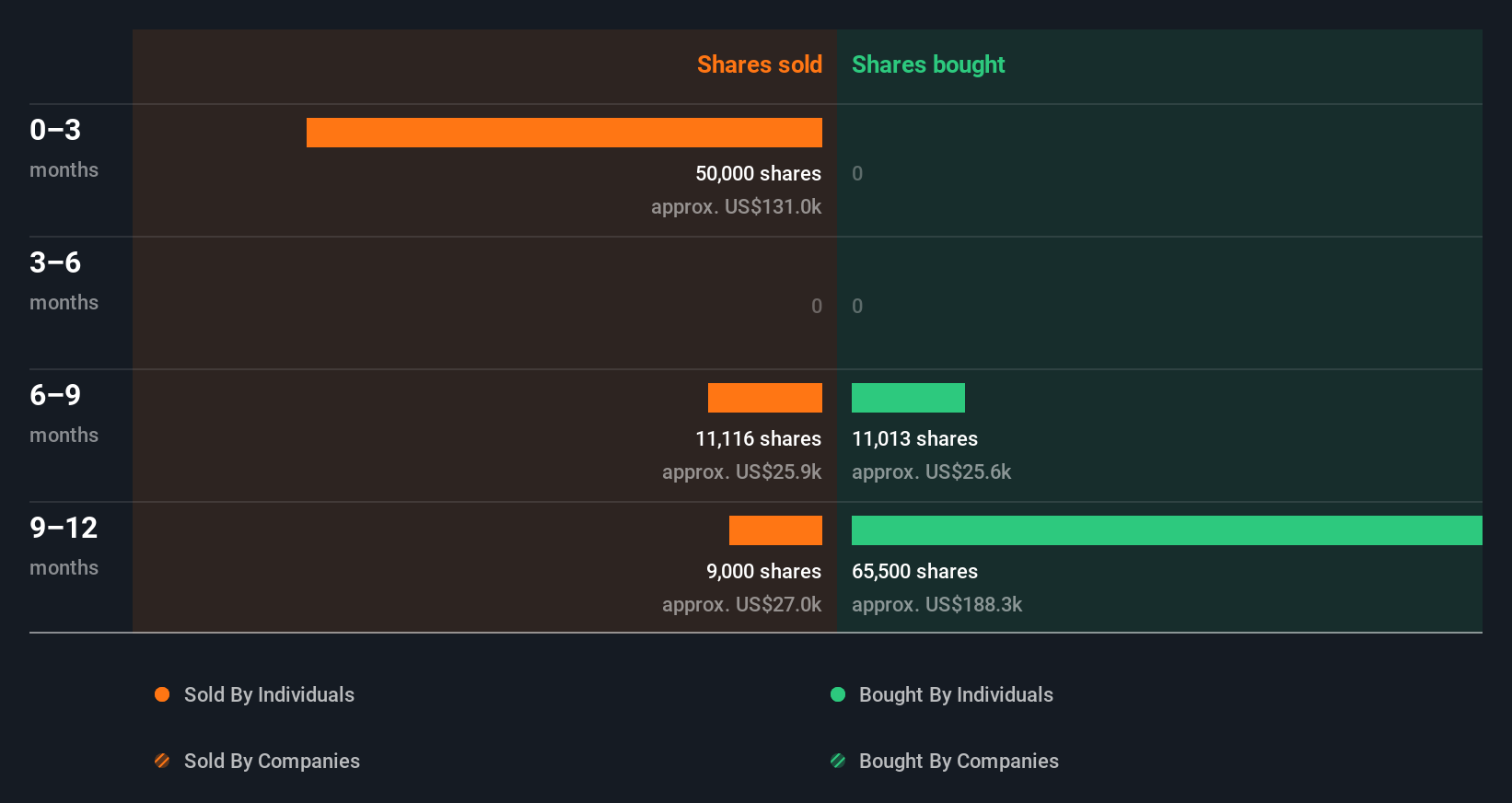

In the last twelve months insiders purchased 76.51k shares for US$208k. But they sold 70.12k shares for US$184k. In total, TMT Investments insiders bought more than they sold over the last year. The chart below shows insider transactions (by companies and individuals) over the last year. If you want to know exactly who sold, for how much, and when, simply click on the graph below!

See our latest analysis for TMT Investments

TMT Investments is not the only stock insiders are buying. So take a peek at this free list of under-the-radar companies with insider buying.

Insider Ownership Of TMT Investments

Many investors like to check how much of a company is owned by insiders. A high insider ownership often makes company leadership more mindful of shareholder interests. TMT Investments insiders own 49% of the company, currently worth about US$43m based on the recent share price. Most shareholders would be happy to see this sort of insider ownership, since it suggests that management incentives are well aligned with other shareholders.

So What Does This Data Suggest About TMT Investments Insiders?

An insider hasn't bought TMT Investments stock in the last three months, but there was some selling. In contrast, they appear keener if you look at the last twelve months. We are also comforted by the high levels of insider ownership. So the recent selling doesn't worry us. While it's good to be aware of what's going on with the insider's ownership and transactions, we make sure to also consider what risks are facing a stock before making any investment decision. To that end, you should learn about the 3 warning signs we've spotted with TMT Investments (including 1 which makes us a bit uncomfortable).

But note: TMT Investments may not be the best stock to buy. So take a peek at this free list of interesting companies with high ROE and low debt.

For the purposes of this article, insiders are those individuals who report their transactions to the relevant regulatory body. We currently account for open market transactions and private dispositions of direct interests only, but not derivative transactions or indirect interests.

Valuation is complex, but we're here to simplify it.

Discover if TMT Investments might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About AIM:TMT

TMT Investments

A venture capital and private equity firm specializing in startups, early-stage, small, and mid-sized companies.

Flawless balance sheet with low risk.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026