- United Kingdom

- /

- Capital Markets

- /

- AIM:FRP

European Undervalued Small Caps With Insider Buying To Consider

Reviewed by Simply Wall St

The European market has recently faced challenges, with the pan-European STOXX Europe 600 Index declining by 0.75% amid new tariff threats from the U.S., disrupting a five-week streak of gains. Despite these headwinds, small-cap stocks in Europe may present opportunities for investors who focus on companies with solid fundamentals and potential for growth, particularly in sectors resilient to trade tensions and economic fluctuations.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Morgan Advanced Materials | 11.7x | 0.5x | 35.53% | ★★★★★☆ |

| FRP Advisory Group | 11.6x | 2.1x | 20.69% | ★★★★★☆ |

| Savills | 24.1x | 0.5x | 41.95% | ★★★★☆☆ |

| Tristel | 29.9x | 4.2x | 4.17% | ★★★★☆☆ |

| AKVA group | 15.5x | 0.7x | 46.73% | ★★★★☆☆ |

| Cloetta | 16.0x | 1.2x | 44.11% | ★★★☆☆☆ |

| Absolent Air Care Group | 23.1x | 1.8x | 47.79% | ★★★☆☆☆ |

| Italmobiliare | 11.8x | 1.6x | -215.06% | ★★★☆☆☆ |

| Close Brothers Group | NA | 0.5x | 1.24% | ★★★☆☆☆ |

| Seeing Machines | NA | 2.2x | 47.75% | ★★★☆☆☆ |

Let's dive into some prime choices out of from the screener.

B.P. Marsh & Partners (AIM:BPM)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: B.P. Marsh & Partners is a specialist private equity investor focused on providing consultancy services and trading investments in the financial services sector, with a market cap of £150.77 million.

Operations: The company generates revenue primarily from consultancy services and trading investments in financial services, with recent figures reaching £64.99 million. The gross profit margin has shown an upward trend, peaking at 85.00% in recent periods. Operating expenses are consistently reported as zero, while non-operating expenses have varied over time. Net income margins have also experienced growth, with a recent high of 83.12%.

PE: 4.6x

B.P. Marsh & Partners, a small-cap entity in Europe, recently completed a £12.2 million follow-on equity offering with Panmure Liberum Limited as the new lead underwriter, highlighting strategic shifts. The company has also initiated a share repurchase program up to £2 million to reduce share capital, reflecting insider confidence in its valuation. Despite relying on external borrowing for funding, which carries higher risk than customer deposits, these activities suggest potential for growth and value realization in the future.

- Dive into the specifics of B.P. Marsh & Partners here with our thorough valuation report.

Evaluate B.P. Marsh & Partners' historical performance by accessing our past performance report.

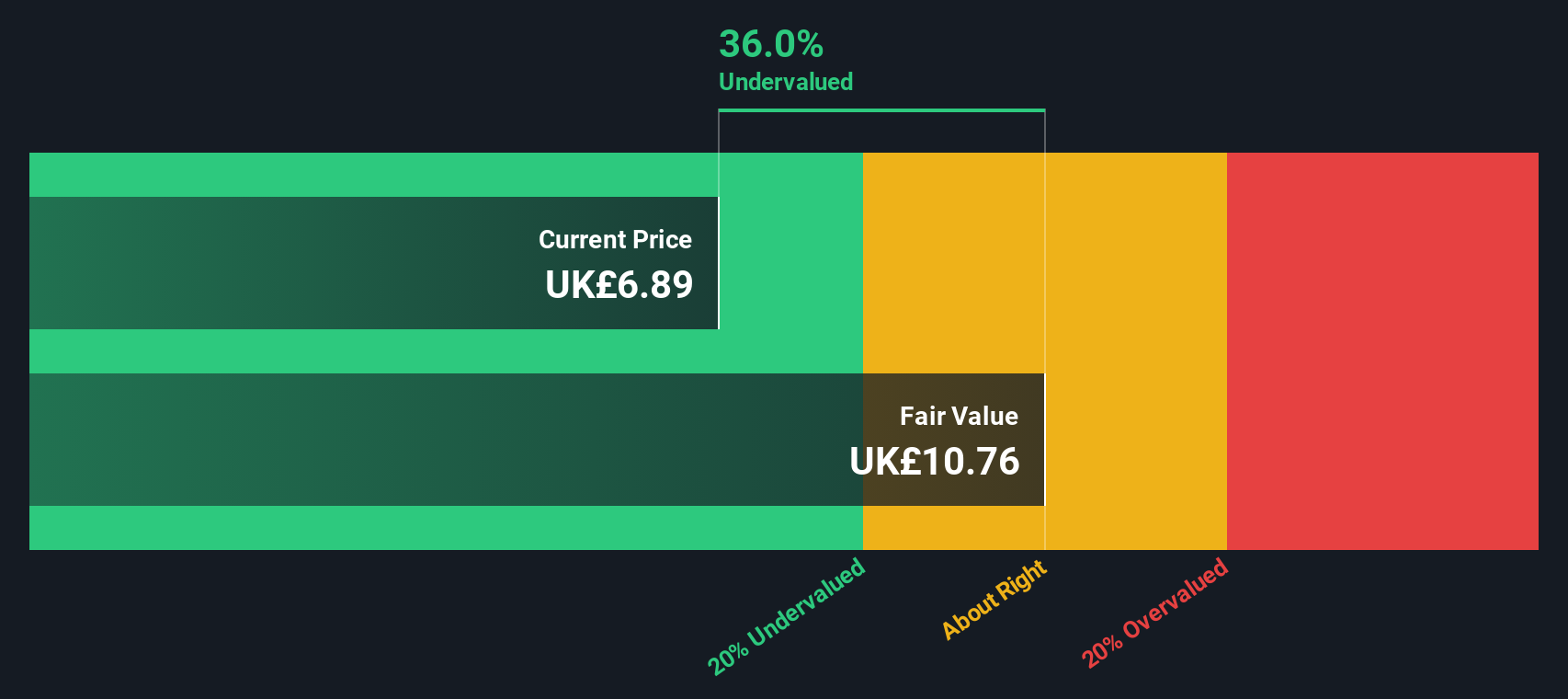

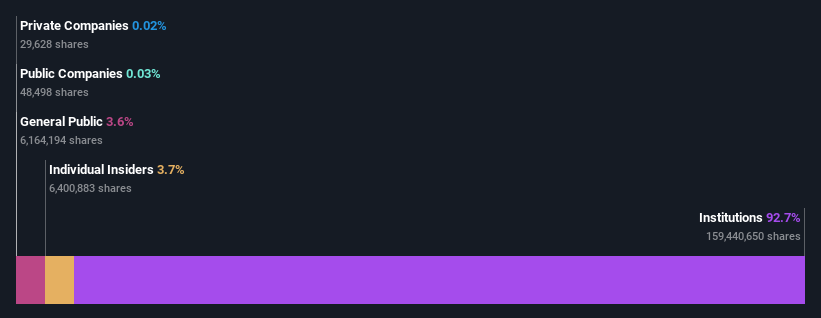

FRP Advisory Group (AIM:FRP)

Simply Wall St Value Rating: ★★★★★☆

Overview: FRP Advisory Group provides specialist business advisory services and has a market capitalization of approximately £0.32 billion.

Operations: The company generates revenue primarily from its specialist business advisory services, with recent figures showing a gross profit margin of 45.96%. Over time, operating expenses have been a significant part of the cost structure, impacting net income margins, which recently stood at 17.88%.

PE: 11.6x

FRP Advisory Group, a European small-cap firm, is drawing attention with its projected Fiscal Year 2025 revenue of £152 million, marking a 19% increase from the previous year. Despite relying solely on external borrowing for funding, which carries higher risk than customer deposits, the company shows promising growth prospects with earnings expected to rise annually by 4.8%. Notably, insider confidence is evident from recent share purchases in April and May 2025.

- Click here to discover the nuances of FRP Advisory Group with our detailed analytical valuation report.

Gain insights into FRP Advisory Group's past trends and performance with our Past report.

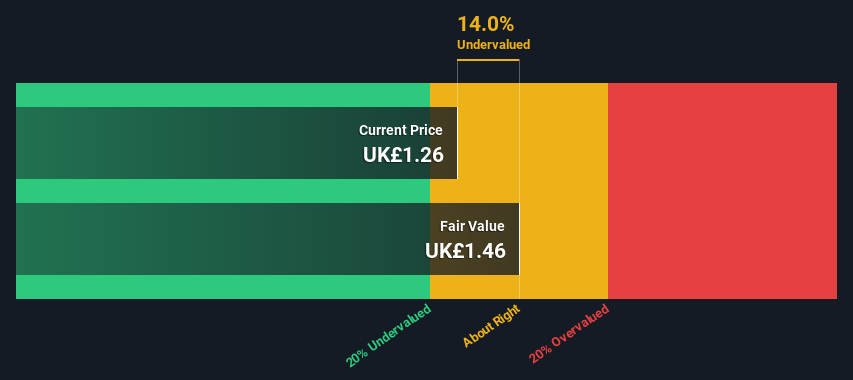

Hollywood Bowl Group (LSE:BOWL)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Hollywood Bowl Group operates a network of bowling centers across the UK, focusing on providing family-friendly entertainment, with a market capitalization of approximately £0.56 billion.

Operations: The company generates revenue primarily from recreational activities, with a recent figure of £230.40 million. The gross profit margin has seen fluctuations, most notably decreasing to 63.15% as of September 2024, after peaking at 87.66% in March 2017. Operating expenses and cost of goods sold are significant components impacting profitability, with notable increases over time contributing to margin changes.

PE: 16.9x

Hollywood Bowl Group, a key player in the leisure industry, recently reported a 8.4% increase in first-half revenue to £129.2 million for the period ending March 2025, with notable growth in Canada. The company faces higher risk due to reliance on external borrowing but shows promise with projected earnings growth of 11.58% annually. Insider confidence is evident as Peter Boddy purchased 100,000 shares worth approximately £320,000 in early 2025, indicating potential value recognition within this smaller market segment.

Key Takeaways

- Delve into our full catalog of 76 Undervalued European Small Caps With Insider Buying here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:FRP

FRP Advisory Group

Provides business advisory services to companies, lenders, investors, individuals, and other stakeholders in the United Kingdom.

Excellent balance sheet and good value.

Market Insights

Community Narratives