- United Kingdom

- /

- Consumer Durables

- /

- LSE:BWY

UK Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

The United Kingdom's stock market has recently faced challenges, with the FTSE 100 and FTSE 250 indices experiencing declines amid weak trade data from China, highlighting global economic uncertainties. As these broader market conditions unfold, investors may find opportunities in stocks that are trading below their estimated value, offering potential for growth when fundamentals align with favorable entry points.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Foresight Group Holdings (LSE:FSG) | £3.41 | £6.32 | 46% |

| Aptitude Software Group (LSE:APTD) | £2.62 | £5.19 | 49.5% |

| Gooch & Housego (AIM:GHH) | £3.75 | £7.17 | 47.7% |

| NIOX Group (AIM:NIOX) | £0.592 | £1.09 | 45.6% |

| Franchise Brands (AIM:FRAN) | £1.31 | £2.45 | 46.5% |

| Trainline (LSE:TRN) | £2.862 | £5.21 | 45.1% |

| Deliveroo (LSE:ROO) | £1.344 | £2.69 | 49.9% |

| Kromek Group (AIM:KMK) | £0.052 | £0.10 | 48.9% |

| Ibstock (LSE:IBST) | £1.772 | £3.28 | 46% |

| CVS Group (AIM:CVSG) | £10.12 | £18.62 | 45.7% |

Let's explore several standout options from the results in the screener.

Bellway (LSE:BWY)

Overview: Bellway p.l.c., with a market cap of £2.95 billion, operates in the United Kingdom as a homebuilding company through its subsidiaries.

Operations: The company's revenue is primarily generated from UK House Building, amounting to £2.54 billion.

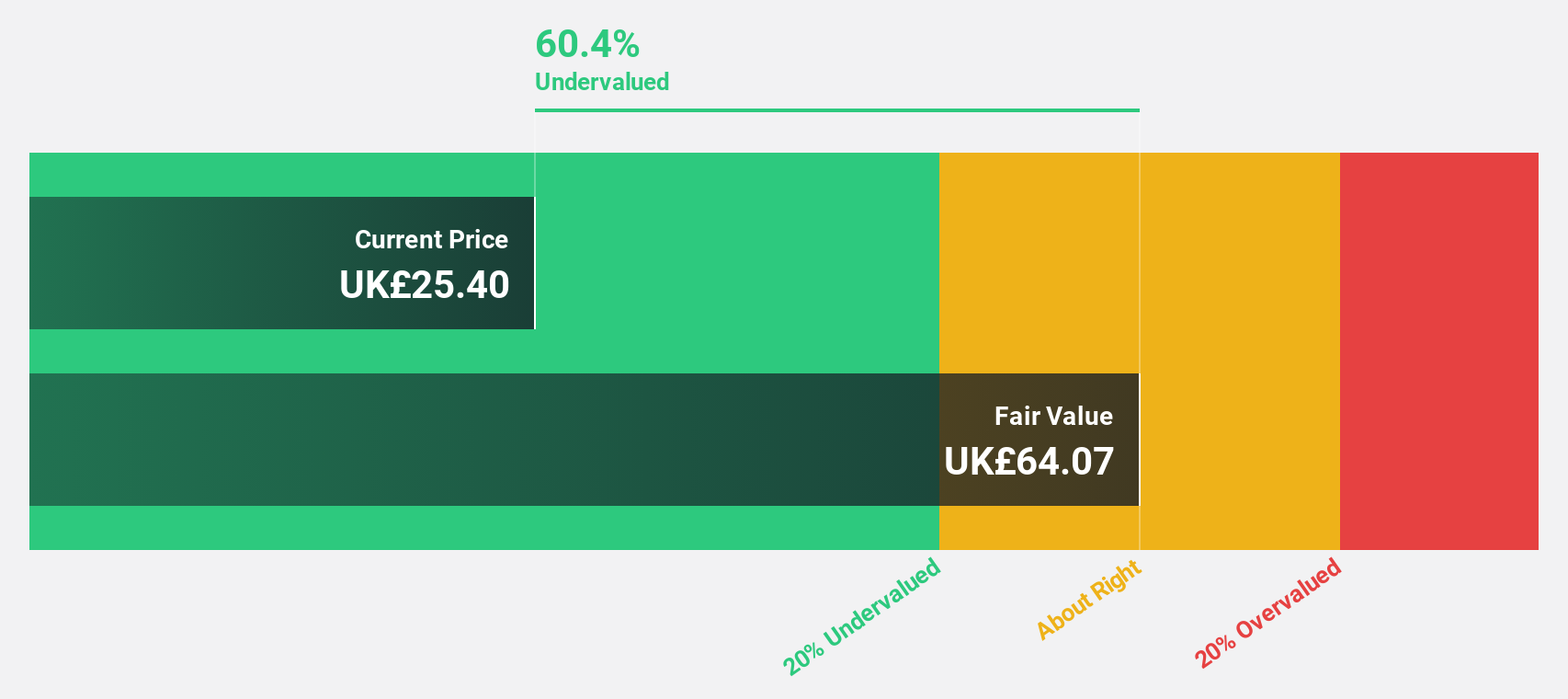

Estimated Discount To Fair Value: 21.8%

Bellway p.l.c. appears undervalued based on cash flows, trading at £24.88, below the estimated fair value of £31.81. Recent earnings for the half year show sales of £1.43 billion and net income of £100.4 million, reflecting solid growth compared to the previous year. Analysts anticipate significant annual profit growth of over 20%, outpacing both revenue forecasts and market averages in the UK, despite a low future return on equity forecast at 8%.

- Our expertly prepared growth report on Bellway implies its future financial outlook may be stronger than recent results.

- Delve into the full analysis health report here for a deeper understanding of Bellway.

Phoenix Group Holdings (LSE:PHNX)

Overview: Phoenix Group Holdings plc operates in the long-term savings and retirement business in Europe with a market cap of £5.78 billion.

Operations: The company's revenue segments include Retirement Solutions generating £4.46 billion, while With-profits, Europe and Other, and Pensions & Savings segments reported negative revenues of -£711 million, -£785 million, and -£562 million respectively.

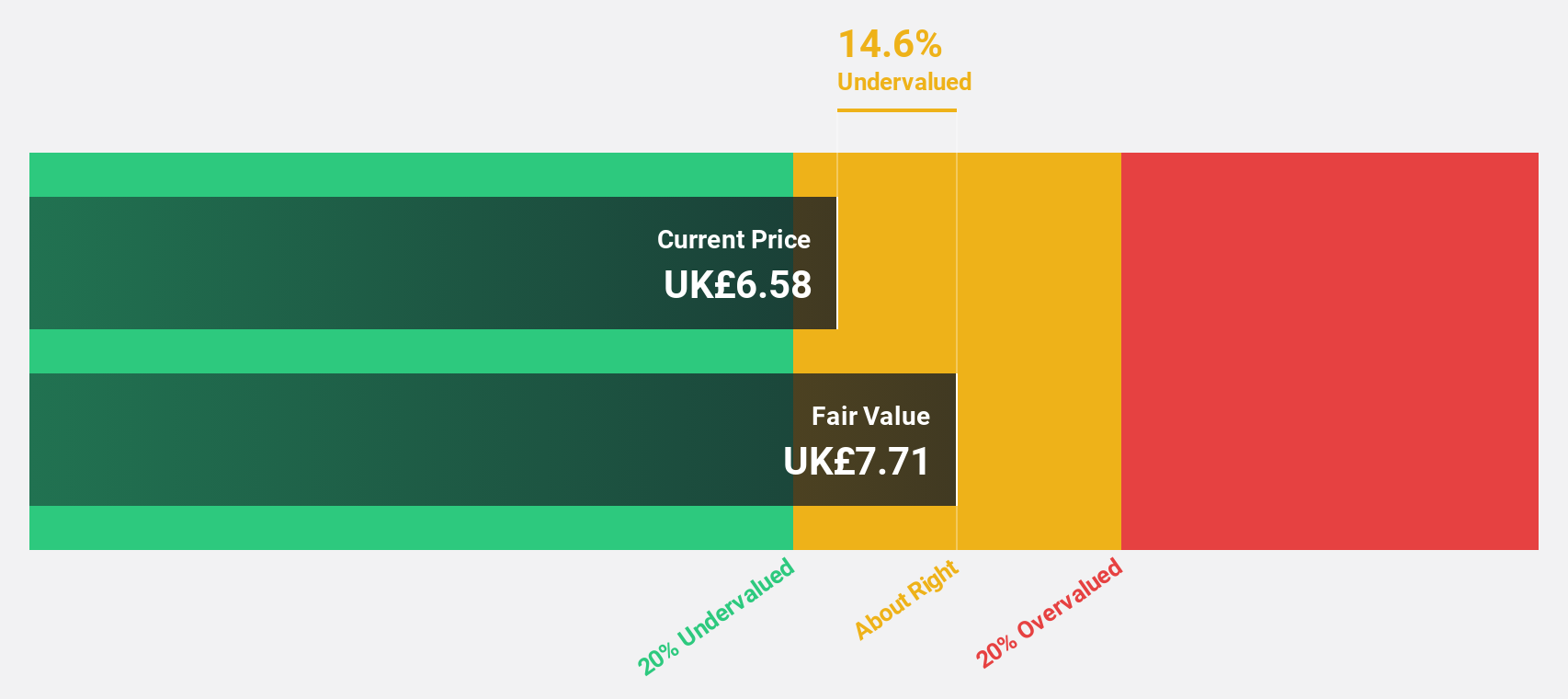

Estimated Discount To Fair Value: 29.9%

Phoenix Group Holdings is trading at £5.79, significantly below its estimated fair value of £8.25, suggesting undervaluation based on cash flows. Despite a net loss of £1.09 billion reported for 2024, the company is forecast to become profitable within three years and achieve high return on equity (79.6%). However, revenue is expected to decline annually by 23.9%, and its dividend yield of 9.46% remains unsustainable against current earnings levels despite a recent increase in payout.

- Our comprehensive growth report raises the possibility that Phoenix Group Holdings is poised for substantial financial growth.

- Navigate through the intricacies of Phoenix Group Holdings with our comprehensive financial health report here.

Deliveroo (LSE:ROO)

Overview: Deliveroo plc operates an online food delivery platform across various countries, including the UK and several others in Europe, Asia, and the Middle East, with a market cap of approximately £1.95 billion.

Operations: The company's revenue primarily comes from its on-demand food delivery platform, generating £2.07 billion.

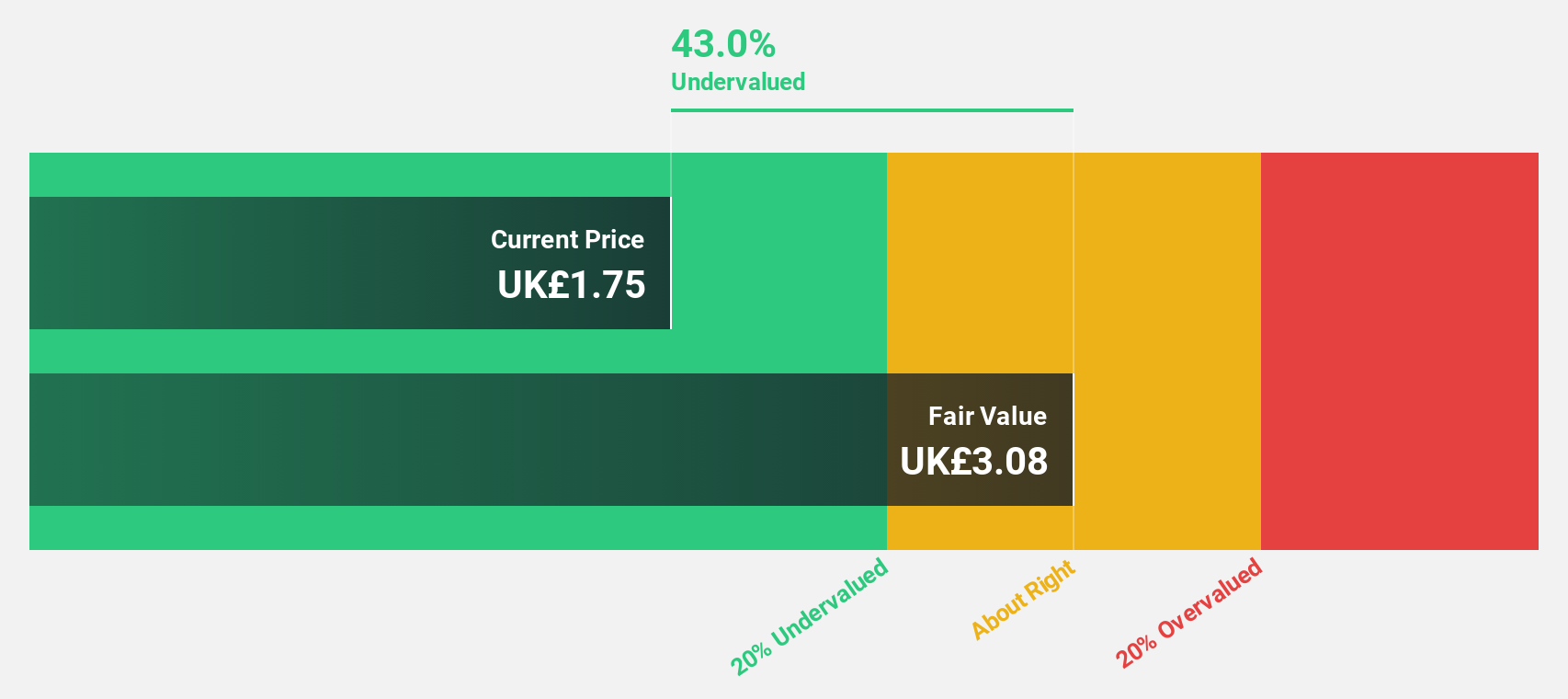

Estimated Discount To Fair Value: 49.9%

Deliveroo, trading at £1.34, is considerably below its estimated fair value of £2.69, indicating potential undervaluation based on cash flows. The company reported Q1 2025 revenue of £518 million and has increased its buyback plan by £100 million to a total of £250 million. Earnings have grown 41.5% annually over five years, with profits forecasted to grow 67.13% per year and become profitable within three years, surpassing average market growth expectations.

- The growth report we've compiled suggests that Deliveroo's future prospects could be on the up.

- Click here to discover the nuances of Deliveroo with our detailed financial health report.

Make It Happen

- Embark on your investment journey to our 51 Undervalued UK Stocks Based On Cash Flows selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Bellway might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:BWY

Excellent balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives