- United Kingdom

- /

- Insurance

- /

- LSE:PHNX

UK Stocks Priced Below Estimated Fair Value In July 2025

Reviewed by Simply Wall St

As the UK market grapples with global economic challenges, notably the sluggish recovery in China impacting commodity prices and investor sentiment, the FTSE 100 has experienced declines, reflecting broader concerns about international trade dynamics. In this environment of uncertainty, investors might find opportunities by identifying stocks that are currently priced below their estimated fair value, potentially offering a margin of safety amidst market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United Kingdom

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Van Elle Holdings (AIM:VANL) | £0.395 | £0.73 | 45.9% |

| Topps Tiles (LSE:TPT) | £0.36 | £0.69 | 47.7% |

| TBC Bank Group (LSE:TBCG) | £49.45 | £95.93 | 48.4% |

| Marlowe (AIM:MRL) | £4.40 | £8.38 | 47.5% |

| LSL Property Services (LSE:LSL) | £3.05 | £5.92 | 48.5% |

| Hostelworld Group (LSE:HSW) | £1.295 | £2.56 | 49.4% |

| Burberry Group (LSE:BRBY) | £12.48 | £23.86 | 47.7% |

| Begbies Traynor Group (AIM:BEG) | £1.21 | £2.25 | 46.3% |

| AstraZeneca (LSE:AZN) | £103.12 | £194.37 | 46.9% |

| Aptitude Software Group (LSE:APTD) | £2.87 | £5.39 | 46.7% |

Let's explore several standout options from the results in the screener.

AO World (LSE:AO.)

Overview: AO World plc operates as an online retailer of domestic appliances and ancillary services in the United Kingdom and Germany, with a market cap of £549.22 million.

Operations: The company generates revenue of £1.14 billion from its online retailing of domestic appliances and ancillary services in the UK and Germany.

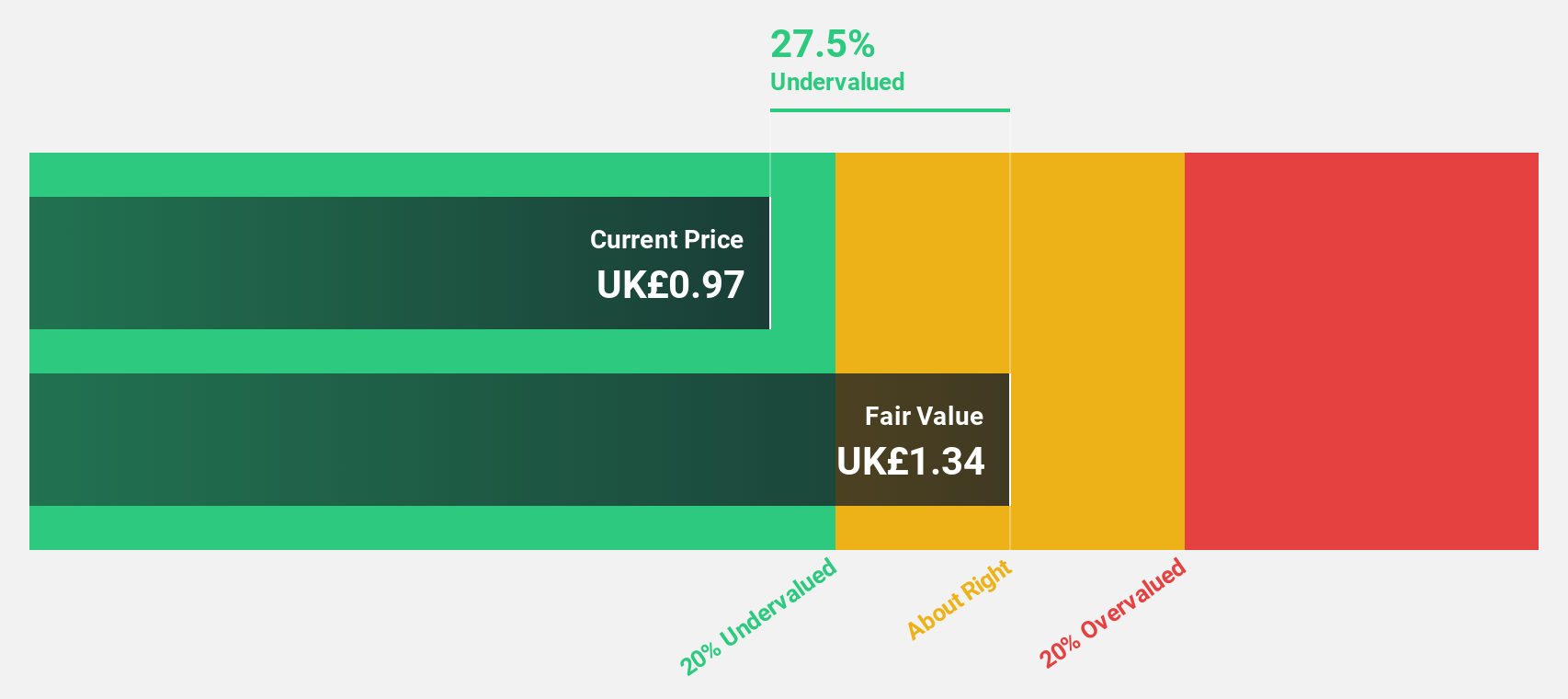

Estimated Discount To Fair Value: 26.3%

AO World appears undervalued, trading at £0.97, below its estimated fair value of £1.31 by over 20%. Despite a decline in net income to £10.5 million for the year ending March 31, 2025, and significant insider selling recently, analysts forecast strong earnings growth of 37.8% annually over the next three years, outpacing the UK market's average. Revenue is also expected to grow faster than the broader market at 8.5% per year.

- Our earnings growth report unveils the potential for significant increases in AO World's future results.

- Delve into the full analysis health report here for a deeper understanding of AO World.

Phoenix Group Holdings (LSE:PHNX)

Overview: Phoenix Group Holdings plc operates in the long-term savings and retirement business in Europe, with a market cap of £6.43 billion.

Operations: The company's revenue segments include Retirement Solutions generating £4.46 billion, while With-profits, Europe & Other, and Pensions & Savings contribute negative revenues of -£711 million, -£785 million, and -£562 million respectively.

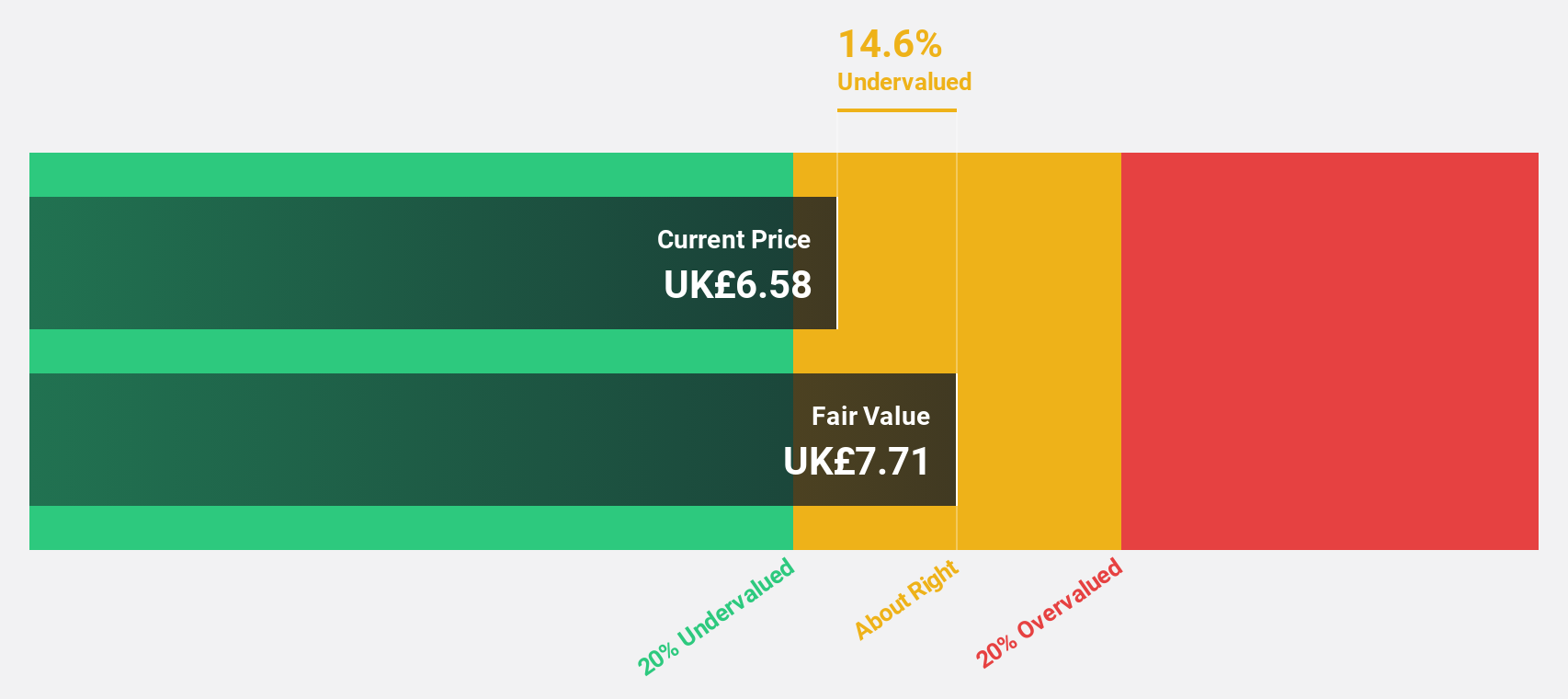

Estimated Discount To Fair Value: 16.9%

Phoenix Group Holdings trades at £6.44, slightly below its fair value of £7.75, offering a 16.9% discount. Despite expected revenue declines of 23.9% annually over the next three years, the company is projected to become profitable during this period with earnings growth above market averages and a very high forecasted return on equity in three years (71.7%). Recent board changes include Sherry Coutu becoming Chair of the Remuneration Committee from July 2025.

- In light of our recent growth report, it seems possible that Phoenix Group Holdings' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Phoenix Group Holdings.

Deliveroo (LSE:ROO)

Overview: Deliveroo plc operates an online on-demand food and non-food delivery platform across several countries, including the UK, Ireland, and others, with a market cap of £2.65 billion.

Operations: The company's revenue is primarily derived from its on-demand food delivery platform, generating £2.07 billion.

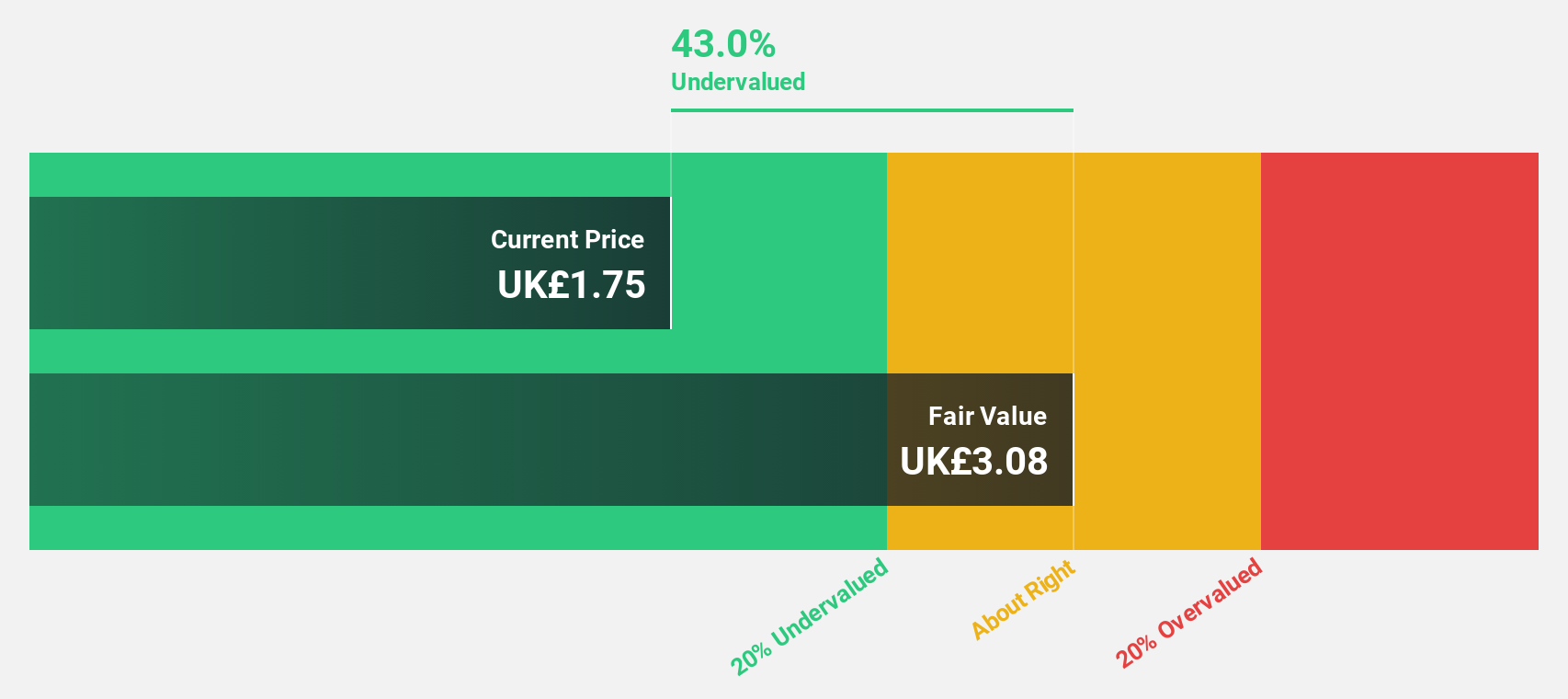

Estimated Discount To Fair Value: 42.6%

Deliveroo is trading at £1.77, significantly below its estimated fair value of £3.09, presenting a potential opportunity for investors focused on cash flow valuation. Earnings are expected to grow 67.39% annually, outpacing the UK market's revenue growth forecast of 3.5%. Recent developments include DoorDash's acquisition proposal valued at approximately £2.7 billion, with shareholder approval already secured and completion anticipated by the end of 2025 pending regulatory consent.

- Our comprehensive growth report raises the possibility that Deliveroo is poised for substantial financial growth.

- Click here to discover the nuances of Deliveroo with our detailed financial health report.

Next Steps

- Unlock more gems! Our Undervalued UK Stocks Based On Cash Flows screener has unearthed 55 more companies for you to explore.Click here to unveil our expertly curated list of 58 Undervalued UK Stocks Based On Cash Flows.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PHNX

Phoenix Group Holdings

Operates in the long-term savings and retirement business in Europe.

Established dividend payer with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives