- United Kingdom

- /

- Consumer Services

- /

- AIM:TRB

Top UK Penny Stocks To Watch In November 2025

Reviewed by Simply Wall St

The UK stock market has recently experienced a downturn, with the FTSE 100 and FTSE 250 indices both closing lower amid concerns over China's economic recovery and its impact on global trade. Despite these challenges, certain investment opportunities remain attractive, particularly in areas that offer potential for growth at a lower entry cost. Penny stocks—though an older term—still hold relevance as they often represent smaller or newer companies that can provide significant upside when backed by strong financial health.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| Foresight Group Holdings (LSE:FSG) | £4.825 | £550.88M | ✅ 4 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £2.10 | £169.65M | ✅ 4 ⚠️ 2 View Analysis > |

| Quartix Technologies (AIM:QTX) | £2.62 | £126.89M | ✅ 5 ⚠️ 2 View Analysis > |

| Ingenta (AIM:ING) | £0.90 | £13.59M | ✅ 2 ⚠️ 3 View Analysis > |

| System1 Group (AIM:SYS1) | £2.18 | £27.66M | ✅ 3 ⚠️ 3 View Analysis > |

| Integrated Diagnostics Holdings (LSE:IDHC) | $0.665 | $386.58M | ✅ 4 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £2.46 | £249.3M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £2.625 | £94.39M | ✅ 4 ⚠️ 1 View Analysis > |

| Spectra Systems (AIM:SPSY) | £1.385 | £66.9M | ✅ 3 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.10 | £175.56M | ✅ 4 ⚠️ 2 View Analysis > |

Click here to see the full list of 295 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

Tribal Group (AIM:TRB)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Tribal Group plc, with a market cap of £136 million, provides software and services to education institutions globally through its subsidiaries.

Operations: The company generates revenue primarily from its Student Information Systems (SIS) segment, contributing £73.59 million, and its Etio segment, which adds £16.76 million.

Market Cap: £136M

Tribal Group plc, with a market cap of £136 million, presents an intriguing profile for penny stock investors. The company has demonstrated significant earnings growth over the past year, with net income rising to £3.91 million from £1.35 million and basic earnings per share increasing to £0.018 from £0.006. Despite its short-term liabilities (£40.4M) exceeding short-term assets (£20.5M), the company's debt is well covered by operating cash flow (165.3%), and its net debt to equity ratio is satisfactory at 6.6%. However, future earnings are forecasted to decline slightly by 2% annually over the next three years.

- Click here and access our complete financial health analysis report to understand the dynamics of Tribal Group.

- Gain insights into Tribal Group's future direction by reviewing our growth report.

Braemar (LSE:BMS)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Braemar Plc offers shipbroking services across various international markets, including the UK, Singapore, and the US, with a market cap of £73.98 million.

Operations: The company's revenue is derived from three segments: Chartering (£77.11 million), Risk Advisory (£23.42 million), and Investment Advisory (£29.24 million).

Market Cap: £73.98M

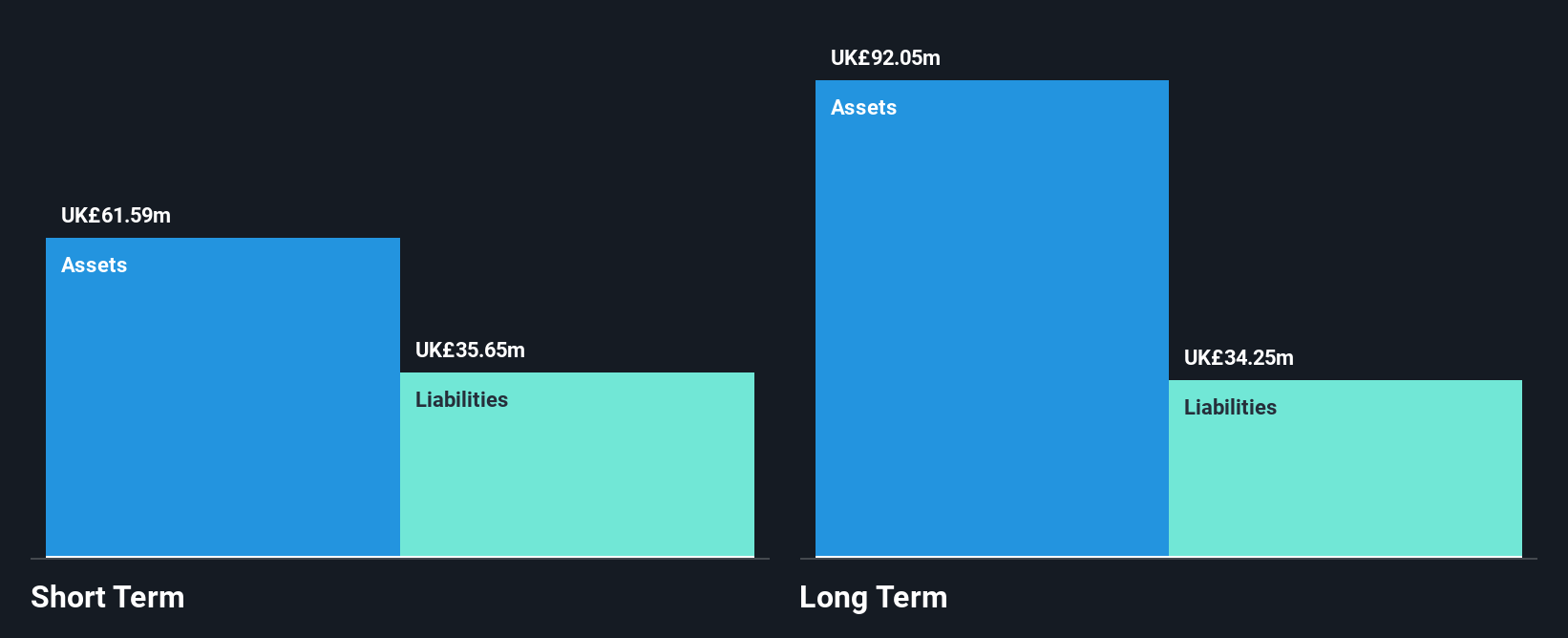

Braemar Plc, with a market cap of £73.98 million, has faced challenges recently, reporting a decline in half-year sales to £63.89 million from £75.99 million and net income dropping to £0.214 million from £2.15 million year-on-year. Despite this downturn, the company maintains satisfactory debt levels with a net debt to equity ratio of 18.5% and covers short-term liabilities (£35.6M) with short-term assets (£61.6M). While earnings growth has been negative recently (-19.9%), future projections indicate potential growth at 32.9% annually, offering some optimism for investors in penny stocks seeking recovery opportunities.

- Click to explore a detailed breakdown of our findings in Braemar's financial health report.

- Learn about Braemar's future growth trajectory here.

Taylor Maritime (LSE:TMI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Taylor Maritime Limited is an investment company focused on acquiring, managing, and operating dry bulk ships, with a market cap of $279.81 million.

Operations: The company's revenue segment involves generating investment returns through the operation of shipping vessels, with a reported figure of -$66.35 million.

Market Cap: $279.81M

Taylor Maritime Limited, with a market cap of $279.81 million, operates in the dry bulk shipping sector but is currently pre-revenue and unprofitable. Trading significantly below its estimated fair value, it offers potential for value-seeking investors despite lacking meaningful revenue. The company remains debt-free and has stable weekly volatility at 1%. However, its board is relatively inexperienced with an average tenure of 1.1 years. Recently, Taylor Maritime declared an interim dividend of 2 US cents per share payable on November 28, 2025. Leadership changes include Rebecca Brosnan succeeding Sandra Platts as Chair of the Remuneration Committee.

- Get an in-depth perspective on Taylor Maritime's performance by reading our balance sheet health report here.

- Explore Taylor Maritime's analyst forecasts in our growth report.

Key Takeaways

- Click this link to deep-dive into the 295 companies within our UK Penny Stocks screener.

- Want To Explore Some Alternatives? Trump has pledged to "unleash" American oil and gas and these 22 US stocks have developments that are poised to benefit.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Tribal Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:TRB

Tribal Group

Through its subsidiaries, provides software and services to education institutions worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives