- United Kingdom

- /

- Beverage

- /

- AIM:NICL

Exploring 3 Undervalued European Small Caps With Insider Buying

Reviewed by Simply Wall St

Amidst concerns about global growth and a stronger euro, the pan-European STOXX Europe 600 Index recently ended slightly lower, reflecting mixed performances across major stock indexes in the region. With inflation remaining close to target and unemployment easing in the eurozone, investors are increasingly focused on small-cap stocks that may offer potential opportunities in this complex economic landscape. In such an environment, identifying companies with strong fundamentals and insider buying can be particularly appealing for those looking to navigate these uncertain market conditions.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Boozt | 15.1x | 0.7x | 45.74% | ★★★★★☆ |

| Hoist Finance | 9.7x | 2.0x | 21.24% | ★★★★★☆ |

| Bytes Technology Group | 18.7x | 4.7x | 5.89% | ★★★★☆☆ |

| Sabre Insurance Group | 8.4x | 1.5x | -2.56% | ★★★★☆☆ |

| Instabank | 11.1x | 3.0x | 20.06% | ★★★★☆☆ |

| Cairn Homes | 13.3x | 1.7x | 19.78% | ★★★★☆☆ |

| CVS Group | 44.7x | 1.3x | 38.57% | ★★★★☆☆ |

| Oxford Instruments | 40.2x | 2.1x | 16.89% | ★★★☆☆☆ |

| Nyab | 21.9x | 1.0x | 36.72% | ★★★☆☆☆ |

| FastPartner | 16.4x | 4.2x | -27.63% | ★★★☆☆☆ |

We'll examine a selection from our screener results.

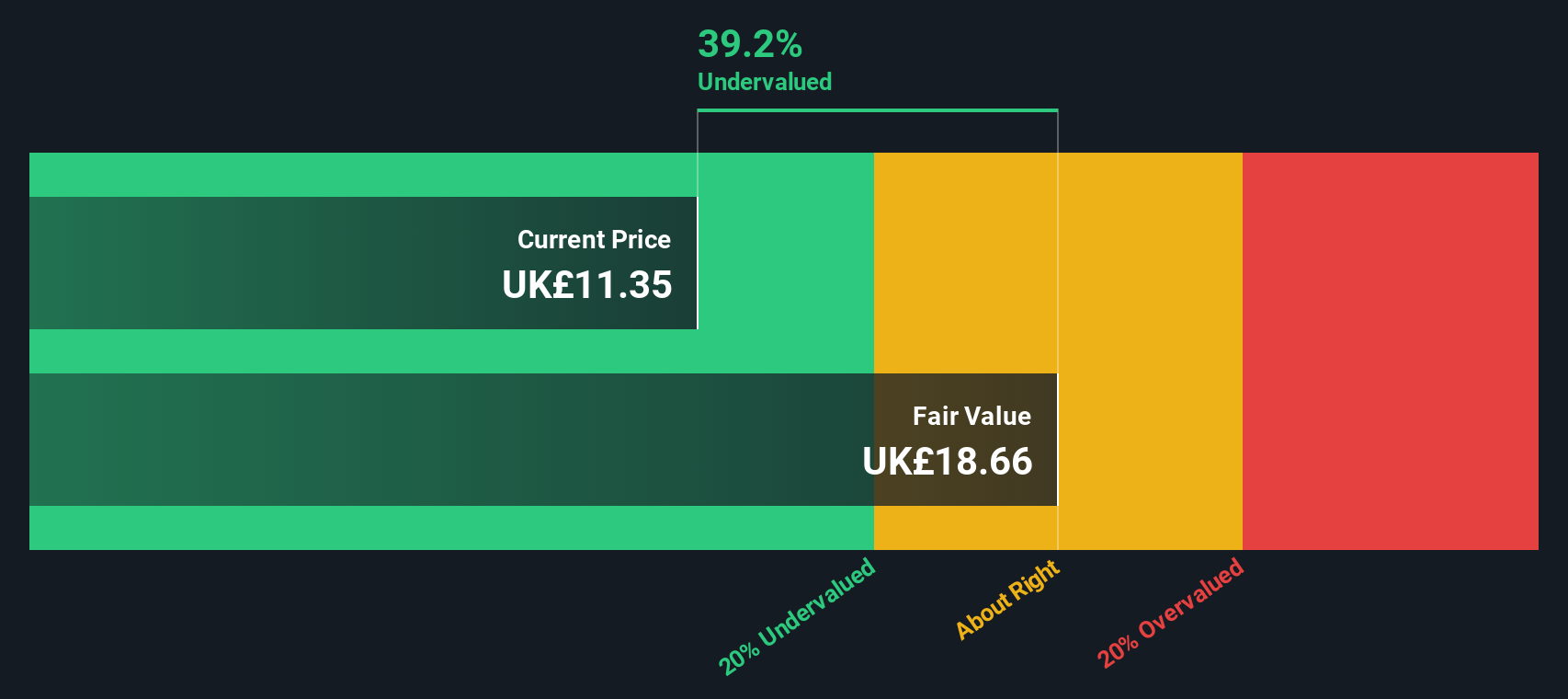

Nichols (AIM:NICL)

Simply Wall St Value Rating: ★★★★☆☆

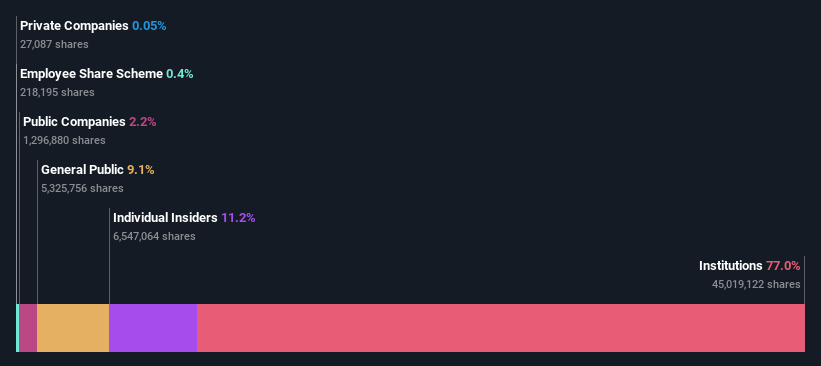

Overview: Nichols is a company engaged in the production and distribution of beverages, with operations segmented into packaged goods and out-of-home sales, and it has a market cap of £0.45 billion.

Operations: The company's revenue streams are primarily derived from its Packaged and Out of Home segments, totaling £133.97 million and £40.35 million, respectively. The gross profit margin has shown variability over the periods analyzed, with a notable low of 21.63% in June 2019 and a high of 53.16% in June 2017 before settling at around 45.72% by September 2025. Operating expenses have consistently included significant allocations to sales & marketing as well as general & administrative functions, impacting overall profitability trends throughout the years observed.

PE: 23.8x

Nichols, a smaller player in the European market, has shown insider confidence with recent share purchases. For the half year ending June 2025, sales increased to £85.49 million from £83.98 million the previous year, though net income slightly decreased to £8.53 million from £8.88 million. Despite external borrowing being its sole funding source, Nichols maintains quality earnings and is projected to grow earnings by 16% annually. The interim dividend rose to 15 pence per share for September 2025 payment.

- Delve into the full analysis valuation report here for a deeper understanding of Nichols.

Understand Nichols' track record by examining our Past report.

Cairn Homes (LSE:CRN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Cairn Homes is a leading Irish homebuilder focused on building and property development, with a market cap of €0.56 billion.

Operations: The company's primary revenue stream is from building and property development, with recent revenue reported at €778.20 million. Cost of goods sold (COGS) for the same period was €608.51 million, resulting in a gross profit of €169.70 million. The gross profit margin has shown an upward trend reaching 22.31% in mid-2024 before slightly decreasing to 21.81% by September 2025 due to variations in COGS and operating expenses over time.

PE: 13.3x

Cairn Homes, a European housing developer, is experiencing a mix of challenges and opportunities. Sales for the first half of 2025 were €284.46 million, down from €366.13 million in 2024, with net income also declining to €31.69 million from €46.89 million last year. Despite this dip, the company has increased its interim dividend by 8%, demonstrating confidence in future earnings growth projected at over 10% for the year. Insider confidence is evident through recent share purchases by executives earlier this year, suggesting optimism about Cairn's long-term prospects despite current funding risks associated with external borrowing rather than customer deposits.

- Click here and access our complete valuation analysis report to understand the dynamics of Cairn Homes.

Evaluate Cairn Homes' historical performance by accessing our past performance report.

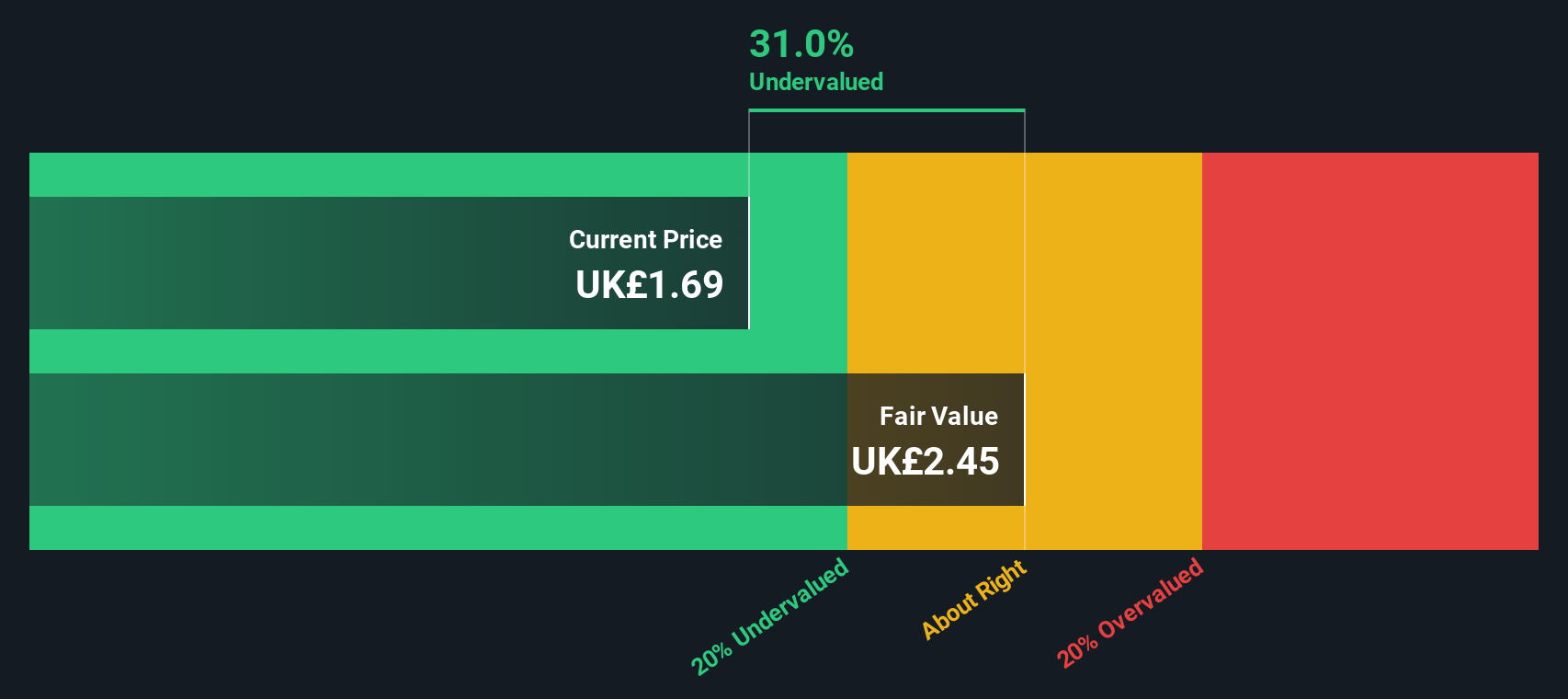

MJ Gleeson (LSE:GLE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MJ Gleeson is a UK-based company focused on urban regeneration and affordable housing development through its two main divisions, Gleeson Homes and Gleeson Land, with a market cap of approximately £0.41 billion.

Operations: Gleeson generates revenue primarily from its Gleeson Homes division, with a smaller contribution from Gleeson Land. The company's gross profit margin has seen a decline, reaching 22.32% in the latest period ending December 2024. Operating expenses have consistently impacted net income, as evidenced by the recent net income margin of 4.70%.

PE: 11.3x

MJ Gleeson, a smaller player in the European market, is drawing attention due to its potential for growth. Despite relying on external borrowing for funding, which carries higher risk, earnings are forecasted to increase by 16% annually. Recent guidance suggests profits before tax for fiscal year 2025 are anticipated between £21 million and £22.5 million. Insider confidence is evident as insiders have been purchasing shares over the past six months, indicating belief in future prospects amidst board changes and new leadership appointments.

- Navigate through the intricacies of MJ Gleeson with our comprehensive valuation report here.

Review our historical performance report to gain insights into MJ Gleeson's's past performance.

Summing It All Up

- Discover the full array of 48 Undervalued European Small Caps With Insider Buying right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nichols might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:NICL

Nichols

Engages in supply of soft drinks to the retail, wholesale, catering, licensed, and leisure industries in the United Kingdom, the Middle East, Africa, and internationally.

Flawless balance sheet, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives