- United Kingdom

- /

- REITS

- /

- LSE:PCTN

3 Undervalued European Small Caps With Insider Buying To Enhance Your Portfolio

Reviewed by Simply Wall St

The European market has shown resilience, with the STOXX Europe 600 Index rising by 2.11% amid strong corporate earnings and optimism surrounding geopolitical tensions. As the Bank of England lowers interest rates due to labor market concerns, small-cap stocks in Europe present intriguing opportunities for investors looking to navigate these evolving economic conditions. Identifying stocks with strong fundamentals and potential insider confidence can be a valuable strategy in such a dynamic environment.

Top 10 Undervalued Small Caps With Insider Buying In Europe

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Foxtons Group | 10.8x | 1.0x | 40.46% | ★★★★★☆ |

| Renold | 10.6x | 0.7x | 3.27% | ★★★★☆☆ |

| NCC Group | NA | 1.4x | 11.15% | ★★★★☆☆ |

| CVS Group | 46.1x | 1.3x | 36.75% | ★★★★☆☆ |

| Yubico | 34.2x | 4.9x | -36.19% | ★★★☆☆☆ |

| A.G. BARR | 19.3x | 1.8x | 46.55% | ★★★☆☆☆ |

| Nyab | 25.5x | 1.1x | 26.42% | ★★★☆☆☆ |

| SmartCraft | 44.7x | 8.0x | 31.78% | ★★★☆☆☆ |

| Oxford Instruments | 40.6x | 2.1x | 17.31% | ★★★☆☆☆ |

| Karnov Group | 220.4x | 4.7x | 33.90% | ★★★☆☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

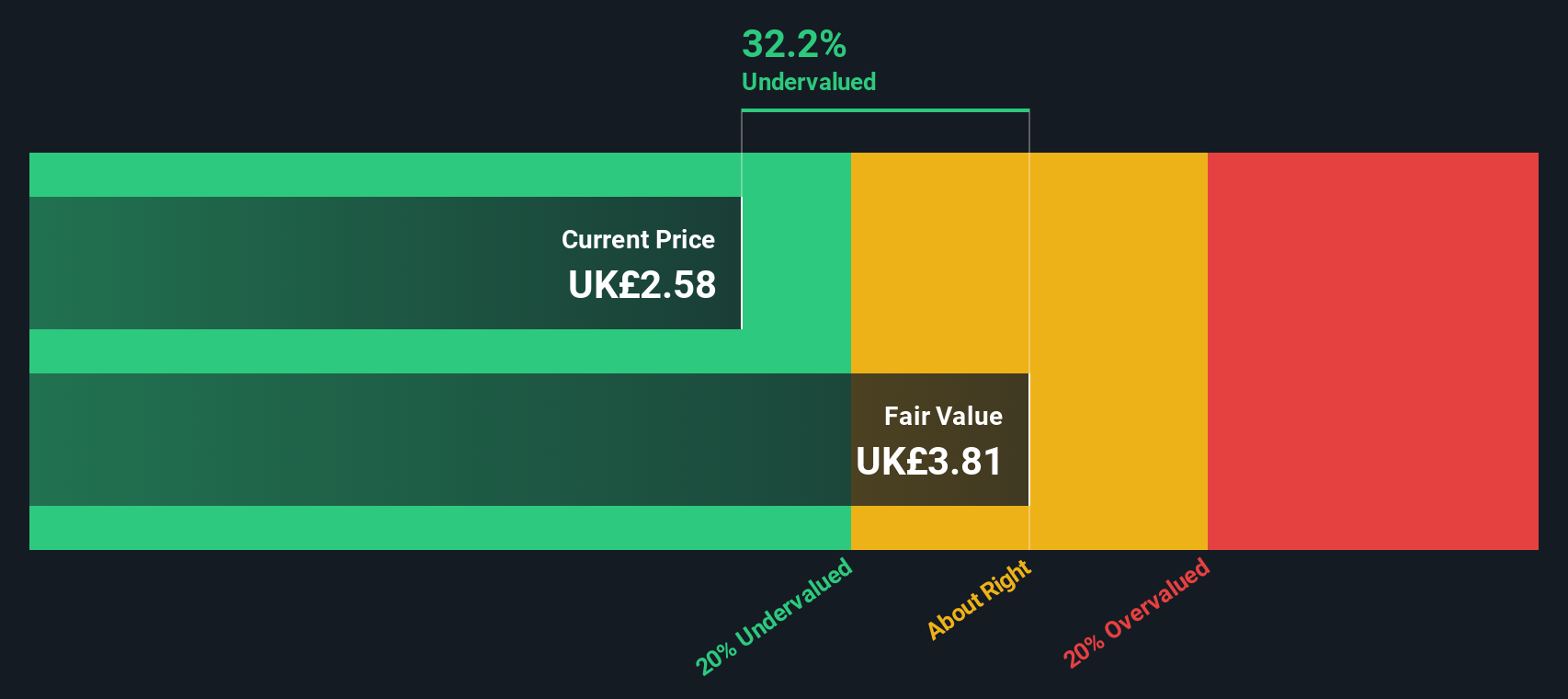

Domino's Pizza Group (LSE:DOM)

Simply Wall St Value Rating: ★★★★★☆

Overview: Domino's Pizza Group operates as a leading pizza delivery company, primarily generating income through sales to franchisees, corporate stores, and national advertising and ecommerce activities, with a market capitalization of approximately £1.25 billion.

Operations: The company's revenue is primarily derived from sales to franchisees, corporate stores income, and national advertising and e-commerce income. Over recent periods, the gross profit margin has shown an upward trend, reaching 47.18% in June 2025. Operating expenses are significant, with general and administrative expenses being a major component.

PE: 10.4x

Domino's Pizza Group, a smaller player in the European market, is navigating financial challenges with its reliance on external borrowing. Despite this, insider confidence has been evident with recent share purchases. For H1 2025, sales rose slightly to £331.5 million from £326.8 million last year; however, net income decreased to £29.8 million from £42.3 million previously reported. The company plans mid-twenties new store openings in fiscal 2025 and declared a dividend increase of 2.9% for shareholders registered by August 15th.

- Click here and access our complete valuation analysis report to understand the dynamics of Domino's Pizza Group.

Understand Domino's Pizza Group's track record by examining our Past report.

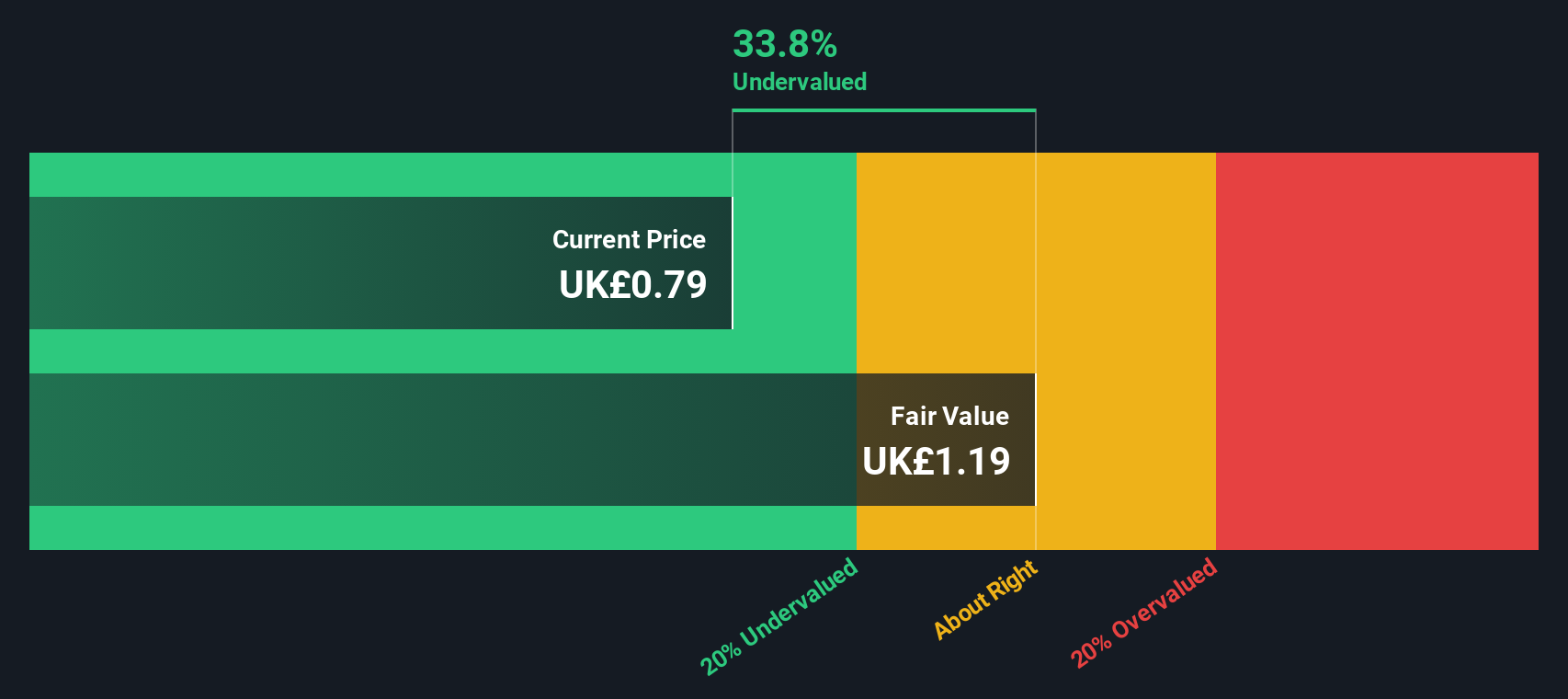

MJ Gleeson (LSE:GLE)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: MJ Gleeson is a UK-based company primarily engaged in land development and low-cost homebuilding, with operations divided into Gleeson Land and Gleeson Homes segments, boasting a market cap of approximately £0.42 billion.

Operations: The company's revenue is primarily derived from Gleeson Homes (£343.33 million) and Gleeson Land (£8.40 million). Over recent periods, the gross profit margin has shown a downward trend, reaching 22.32% by the end of 2024. Operating expenses have consistently been a significant portion of costs, with general and administrative expenses forming a substantial part of these outlays.

PE: 12.6x

MJ Gleeson, a smaller player in the European market, shows potential for growth with earnings forecasted to rise 16.41% annually. Despite recent share price volatility, insider confidence is evident through significant share purchases in early 2025. The company anticipates a profit before tax of £21 million to £22.5 million for fiscal year 2025 and around £24.5 million for 2026, aligning with market expectations. Recent leadership changes could steer strategic growth amid its reliance on external borrowing over customer deposits.

- Take a closer look at MJ Gleeson's potential here in our valuation report.

Explore historical data to track MJ Gleeson's performance over time in our Past section.

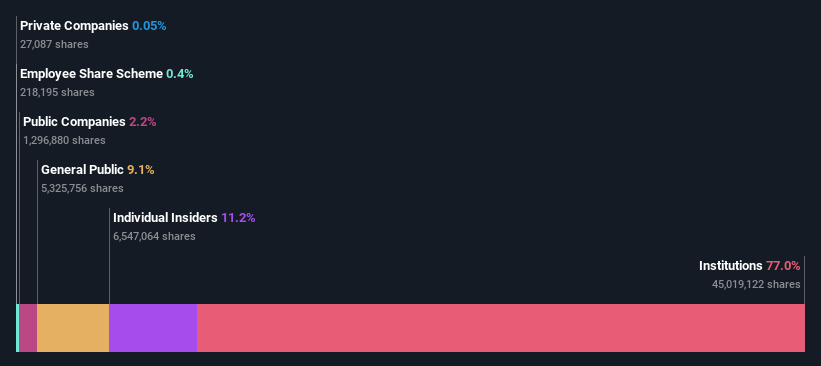

Picton Property Income (LSE:PCTN)

Simply Wall St Value Rating: ★★★★★☆

Overview: Picton Property Income is a UK-based real estate investment trust focusing on commercial property investments with a market cap of approximately £0.48 billion.

Operations: The company generates revenue primarily from real estate investments, with recent figures reaching £54.02 million. A significant portion of its cost structure is attributed to COGS, which was £16.34 million in the latest period. Operating expenses are relatively stable, recorded at £6.78 million for the same period. The gross profit margin has shown a slight decline over time, standing at 69.75% in the most recent data point provided.

PE: 10.4x

Picton Property Income shows potential as an undervalued small company in Europe, with insider confidence highlighted by the Non-Executive Chair's purchase of 295,371 shares for £218,574. Despite a slight drop in sales to £54.02 million for the year ending March 2025, net income soared to £37.32 million from a previous loss. The company's earnings are set to grow by nearly 6% annually. A maintained interim dividend of 0.95 pence per share further underscores its financial stability amidst higher-risk external funding sources and one-off items affecting results.

Key Takeaways

- Unlock our comprehensive list of 48 Undervalued European Small Caps With Insider Buying by clicking here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:PCTN

Picton Property Income

Established in 2005, Picton is listed on the main market of the London Stock Exchange and is a constituent of a number of EPRA indices including the FTSE EPRA Nareit Global Index.

Undervalued average dividend payer.

Market Insights

Community Narratives