Want to participate in a short research study? Help shape the future of investing tools and you could win a $250 gift card!

Kiran Shah became the CEO of The Character Group plc (LON:CCT) in 2005. This report will, first, examine the CEO compensation levels in comparison to CEO compensation at companies of similar size. After that, we will consider the growth in the business. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Character Group

How Does Kiran Shah's Compensation Compare With Similar Sized Companies?

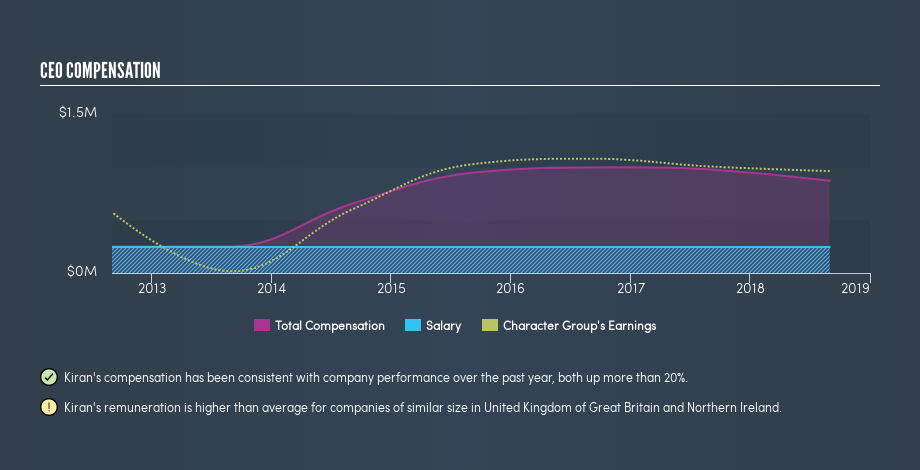

At the time of writing our data says that The Character Group plc has a market cap of UK£118m, and is paying total annual CEO compensation of UK£870k. (This is based on the year to August 2018). While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at UK£246k. We took a group of companies with market capitalizations below UK£157m, and calculated the median CEO total compensation to be UK£253k.

Thus we can conclude that Kiran Shah receives more in total compensation than the median of a group of companies in the same market, and of similar size to The Character Group plc. However, this doesn't necessarily mean the pay is too high. A closer look at the performance of the underlying business will give us a better idea about whether the pay is particularly generous.

You can see a visual representation of the CEO compensation at Character Group, below.

Is The Character Group plc Growing?

Over the last three years The Character Group plc has grown its earnings per share (EPS) by an average of 1.8% per year (using a line of best fit). Its revenue is up 9.9% over last year.

I would argue that the improvement in revenue isn't particularly impressive, but the modest improvement in EPS is good. Considering these factors I'd say performance has been pretty decent, though not amazing. You might want to check this free visual report on analyst forecasts for future earnings.

Has The Character Group plc Been A Good Investment?

The Character Group plc has generated a total shareholder return of 31% over three years, so most shareholders would be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

We compared the total CEO remuneration paid by The Character Group plc, and compared it to remuneration at a group of similar sized companies. Our data suggests that it pays above the median CEO pay within that group.

We generally prefer to see stronger EPS growth, and we're not particularly impressed with the total shareholder return, over the last three years. Considering this, we wouldn't want to see any big pay rises, although we'd stop short of calling the CEO compensation unfair. Whatever your view on compensation, you might want to check if insiders are buying or selling Character Group shares (free trial).

Arguably, business quality is much more important than CEO compensation levels. So check out this free list of interesting companies, that have HIGH return on equity and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About AIM:CCT

Character Group

A holding company, designs, develops, manufactures, and distributes toys, games, and giftware products in the United Kingdom, Scandinavia, the Far East, and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

The "Molecular Pencil": Why Beam's Technology is Built to Win

ADNOC Gas future shines with a 21.4% revenue surge

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026