- United Kingdom

- /

- Hospitality

- /

- AIM:LGRS

Three UK Growth Stocks With Insider Ownership Up To 26%

Reviewed by Simply Wall St

Over the past year, the United Kingdom's stock market has experienced a modest rise of 4.5%, despite a recent weekly drop of 1.2%. In this context, growth companies with high insider ownership can be particularly appealing, as they often reflect a strong alignment between company management and shareholder interests.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| Plant Health Care (AIM:PHC) | 26.4% | 121.3% |

| Petrofac (LSE:PFC) | 16.6% | 124.5% |

| Getech Group (AIM:GTC) | 17.3% | 86.1% |

| Gulf Keystone Petroleum (LSE:GKP) | 10.7% | 47.6% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 26.7% | 25.5% |

| Velocity Composites (AIM:VEL) | 28.5% | 143.4% |

| TEAM (AIM:TEAM) | 25.8% | 58.6% |

| B90 Holdings (AIM:B90) | 24.4% | 142.7% |

| Afentra (AIM:AET) | 38.3% | 64.4% |

| Mothercare (AIM:MTC) | 15.1% | 41.2% |

We'll examine a selection from our screener results.

Loungers (AIM:LGRS)

Simply Wall St Growth Rating: ★★★★☆☆

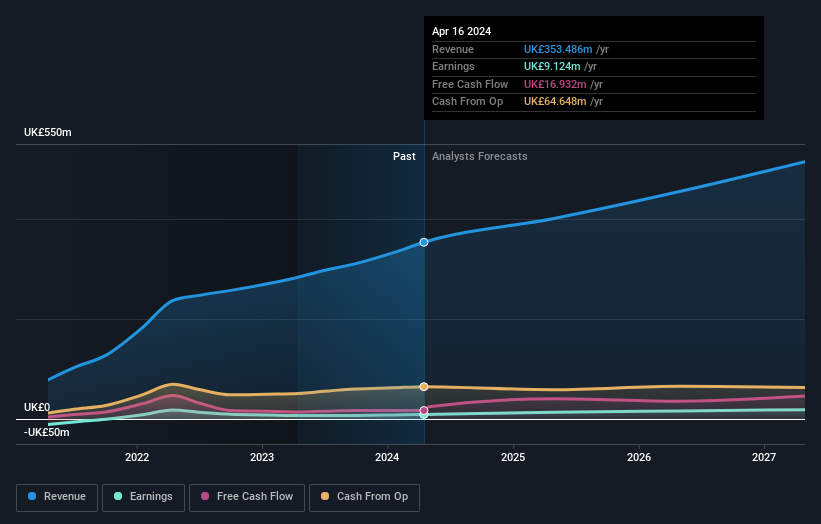

Overview: Loungers plc operates cafes, bars, and restaurants under the Lounge and Cosy Club brands in England and Wales, with a market capitalization of approximately £293.83 million.

Operations: The company generates its revenue primarily from operating café bars and restaurants, totaling £310.80 million.

Insider Ownership: 13.9%

Loungers plc, a UK-based company, is trading significantly below its estimated fair value and analysts expect a notable price increase. Despite lower profit margins compared to last year, its earnings are forecasted to grow robustly over the next three years. Recent leadership changes aim to bolster this growth trajectory, as evidenced by record revenues of £353.5 million reported for FY 2024, marking a substantial increase from the previous year. These factors position Loungers interestingly for investors focused on insider-owned growth companies.

- Delve into the full analysis future growth report here for a deeper understanding of Loungers.

- Insights from our recent valuation report point to the potential undervaluation of Loungers shares in the market.

RWS Holdings (AIM:RWS)

Simply Wall St Growth Rating: ★★★★☆☆

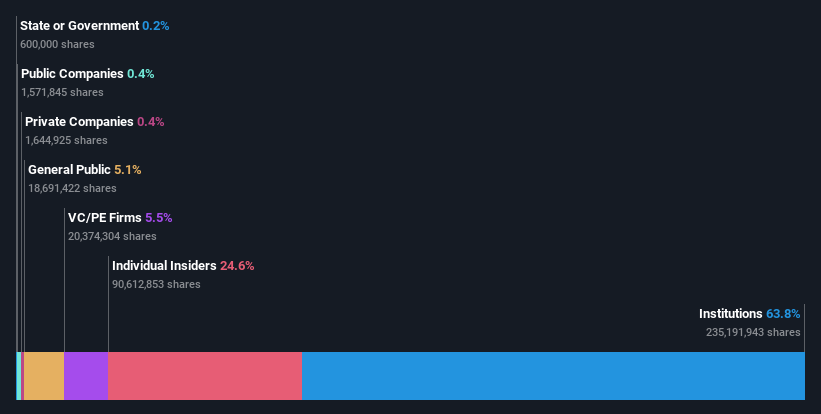

Overview: RWS Holdings plc specializes in technology-enabled language, content, and intellectual property services with a market capitalization of approximately £0.72 billion.

Operations: The company operates primarily in the sectors of technology-enabled language, content management, and intellectual property services.

Insider Ownership: 24.6%

RWS Holdings, a UK firm, is trading at 60.5% below its fair value with expectations of significant price recovery. While its dividend increase reflects strong financial health and confidence in future prospects, recent earnings have declined. The company's revenue growth is modest but exceeds the UK market average. RWS is set to become profitable within three years, with earnings forecasted to grow substantially annually. Insider ownership remains high, aligning interests with shareholders despite a volatile share price and upcoming CEO transition.

- Unlock comprehensive insights into our analysis of RWS Holdings stock in this growth report.

- Our expertly prepared valuation report RWS Holdings implies its share price may be lower than expected.

Volex (AIM:VLX)

Simply Wall St Growth Rating: ★★★★☆☆

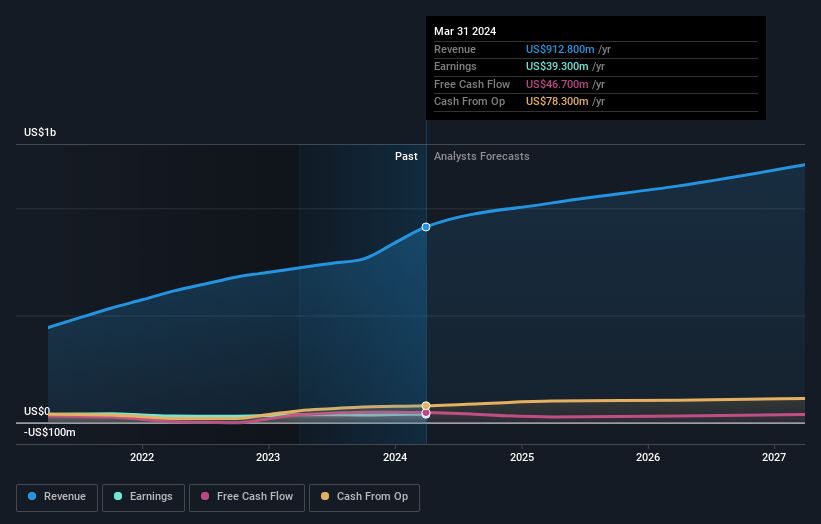

Overview: Volex plc is a manufacturer and supplier of power products and cable assemblies, operating across North America, Europe, and Asia, with a market capitalization of approximately £0.62 billion.

Operations: The company generates revenue through the manufacture and supply of power products and cable assemblies across three key regions: North America, Europe, and Asia.

Insider Ownership: 26.9%

Volex, a UK-based company, is experiencing substantial growth with earnings increasing by 20.7% last year and expected to grow by 20.16% annually over the next three years. Despite a high level of debt, Volex's revenue growth is outpacing the UK market average at 13.3% per year, bolstered by strategic acquisitions such as Murat Ticaret which significantly contributed to a forecasted annual revenue of at least US$900 million. However, shareholder dilution has occurred in the past year and Return on Equity is projected to be low at 15.6%. Analysts predict a stock price increase of 24.9%.

- Get an in-depth perspective on Volex's performance by reading our analyst estimates report here.

- Our valuation report unveils the possibility Volex's shares may be trading at a discount.

Where To Now?

- Click here to access our complete index of 64 Fast Growing UK Companies With High Insider Ownership.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About AIM:LGRS

Loungers

Operates cafés, bars, and restaurants under the Lounge and Cosy Club brand names in England and Wales.

Reasonable growth potential with proven track record.