- United Kingdom

- /

- Semiconductors

- /

- LSE:AWE

UK Growth Companies With High Insider Ownership In November 2025

Reviewed by Simply Wall St

In November 2025, the United Kingdom's stock market is experiencing a challenging period, with the FTSE 100 and FTSE 250 indices reflecting concerns over weak global cues and faltering trade data from China. In such an environment, growth companies with high insider ownership can be particularly appealing as they often indicate strong confidence from those closest to the business, potentially offering resilience amid broader market uncertainties.

Top 10 Growth Companies With High Insider Ownership In The United Kingdom

| Name | Insider Ownership | Earnings Growth |

| SRT Marine Systems (AIM:SRT) | 16.3% | 57.8% |

| QinetiQ Group (LSE:QQ.) | 13.3% | 67.7% |

| Metals Exploration (AIM:MTL) | 10.4% | 85.9% |

| Manolete Partners (AIM:MANO) | 38.1% | 29.5% |

| LSL Property Services (LSE:LSL) | 10.4% | 21.2% |

| Integrated Diagnostics Holdings (LSE:IDHC) | 27.9% | 21% |

| Foresight Group Holdings (LSE:FSG) | 34.7% | 20.1% |

| Evoke (LSE:EVOK) | 20.6% | 81.9% |

| B90 Holdings (AIM:B90) | 22.1% | 157.2% |

| Anglo Asian Mining (AIM:AAZ) | 39.7% | 134.7% |

Below we spotlight a couple of our favorites from our exclusive screener.

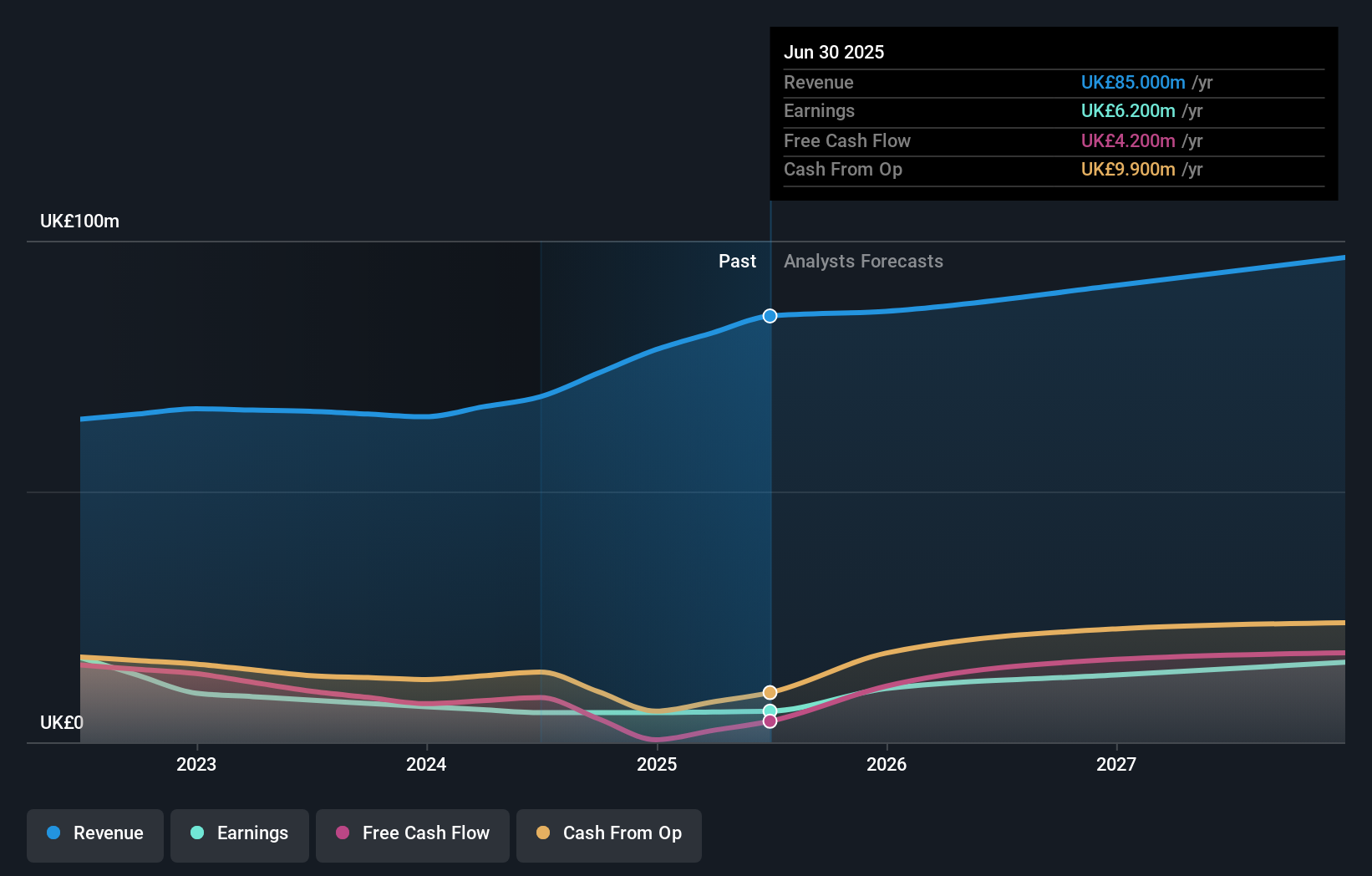

Fintel (AIM:FNTL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Fintel Plc provides intermediary services and distribution channels to the retail financial services sector in the United Kingdom, with a market cap of £224.02 million.

Operations: Fintel Plc's revenue segments focus on offering intermediary services and distribution channels within the UK's retail financial services industry.

Insider Ownership: 26.8%

Fintel Plc demonstrates substantial growth potential with earnings expected to grow significantly at 31.2% annually, outpacing the UK market. Despite trading at a notable discount below its estimated fair value, the company shows consistent revenue and profit growth, as evidenced by recent sales of £42.4 million for H1 2025 and increased net income. The interim dividend increase reflects financial strength, although insider trading activity remains quiet over the past three months.

- Navigate through the intricacies of Fintel with our comprehensive analyst estimates report here.

- Insights from our recent valuation report point to the potential undervaluation of Fintel shares in the market.

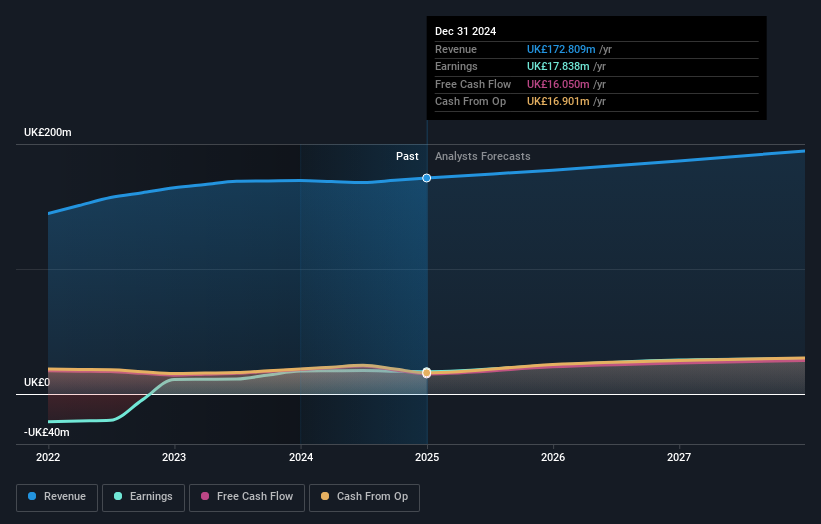

Nichols (AIM:NICL)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Nichols plc, with a market cap of £374.84 million, supplies soft drinks to the retail, wholesale, catering, licensed, and leisure industries across the United Kingdom and internationally including regions like the Middle East and Africa.

Operations: The company's revenue is primarily generated from its Packaged segment, which accounts for £133.97 million, and its Out of Home segment, contributing £40.35 million.

Insider Ownership: 24.7%

Nichols is trading 42.8% below its estimated fair value, with earnings forecast to grow at 16.38% annually, surpassing the UK market growth rate. Despite high-quality earnings being impacted by large one-off items and an unstable dividend track record, analysts agree on a potential 38% stock price increase. Recent executive changes include appointing Matthew Rothwell as CFO, expected to bolster strategic growth efforts given his extensive experience in UK consumer-facing businesses.

- Get an in-depth perspective on Nichols' performance by reading our analyst estimates report here.

- Our comprehensive valuation report raises the possibility that Nichols is priced lower than what may be justified by its financials.

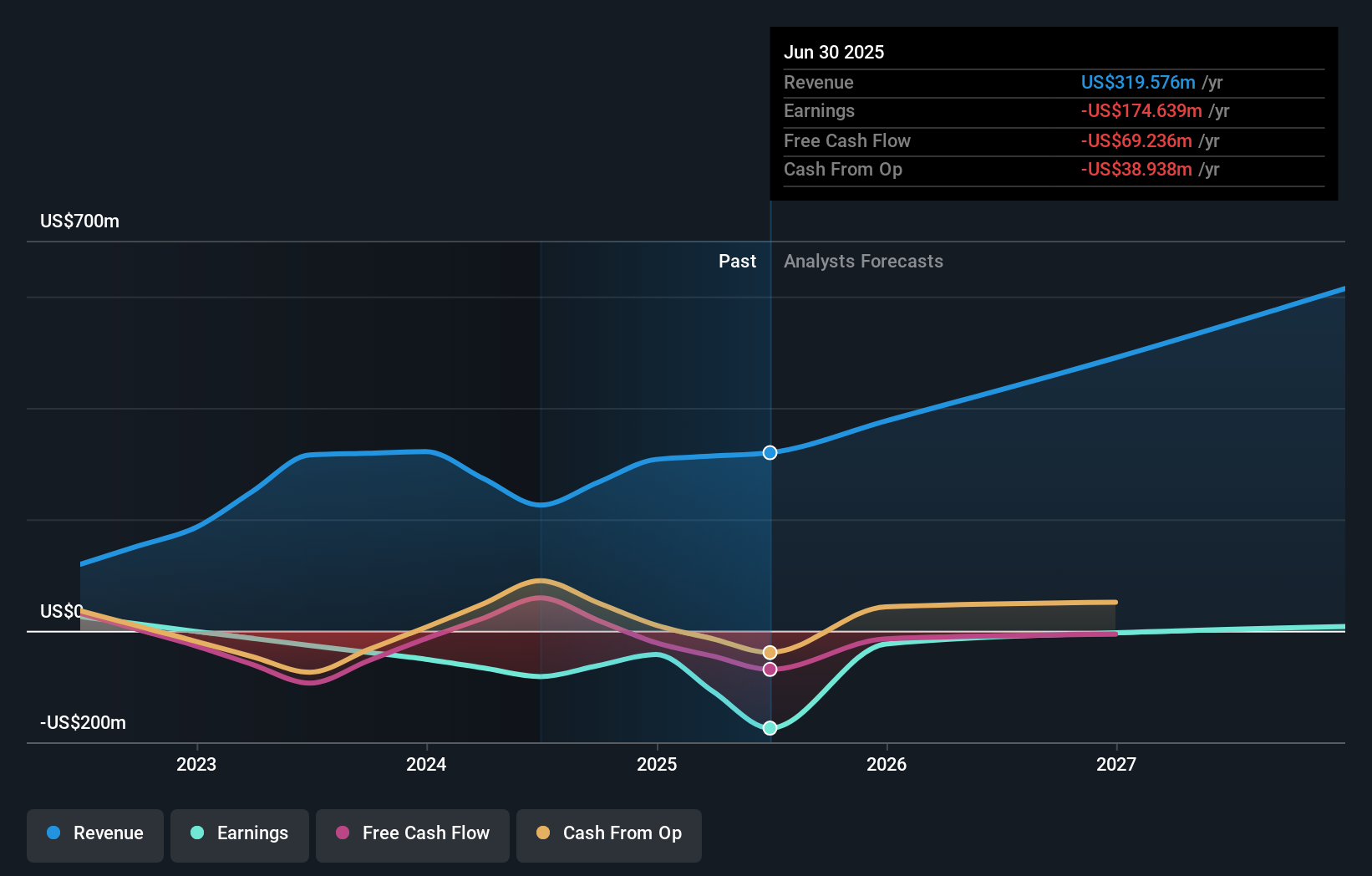

Alphawave IP Group (LSE:AWE)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Alphawave IP Group plc develops and sells wired connectivity solutions across various regions including North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom with a market cap of £1.44 billion.

Operations: The company's revenue primarily comes from its Communications Equipment segment, which generated $319.58 million.

Insider Ownership: 34%

Alphawave IP Group is experiencing significant revenue growth, forecasted at 26.1% annually, outpacing the UK market's 4.2%. Despite current unprofitability, it is expected to achieve profitability within three years. Recent advancements include successful tape-outs of cutting-edge UCIe™ 3D IP on TSMC's SoIC® technology and showcasing high-performance connectivity solutions at ECOC 2025. However, substantial insider trading activity hasn't been reported recently, which might be a consideration for potential investors.

- Unlock comprehensive insights into our analysis of Alphawave IP Group stock in this growth report.

- Our valuation report here indicates Alphawave IP Group may be overvalued.

Key Takeaways

- Take a closer look at our Fast Growing UK Companies With High Insider Ownership list of 58 companies by clicking here.

- Interested In Other Possibilities? These 13 companies survived and thrived after COVID and have the right ingredients to survive Trump's tariffs. Discover why before your portfolio feels the trade war pinch.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:AWE

Alphawave IP Group

Develops and sells wired connectivity solutions in North America, China, the Asia Pacific, Europe, the Middle East, Africa, and the United Kingdom.

High growth potential with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives